The COVID-19 pandemic has significantly impacted the CAR T-cell therapy market. As per an article published in November 2021 in PubMed, CAR T-cell therapy recipients were believed to be at high risk of poor outcomes from COVID-19 due to their severely immunocompromised state caused by prior lymphodepletion immunochemotherapy and CAR-T-cell therapy-related side effects such as B-cell depletion, hypogammaglobulinemia, and cytopenias. Such studies reflect that the onset of the COVID-19 pandemic reduced the number of patients undergoing CAR-T cell therapy, significantly impacting the demand for CAR-T-cell therapy. However, with the introduction of vaccines and uplifting lockdown restrictions, research and development activities have been resumed, and patient visits increased, reflecting that the market is expected to grow significantly in the coming period.

The market's growth can be attributed to the factors such as the increasing burden of cancer and the rise in research and development to develop CAR T-cell therapy. For instance, according to the Macmillan Cancer Support statistics updated in October 2022, the estimated number of people currently living with cancer in the UK are likely to rise to 3.5 million by 2025, 4 million by 2030, and 5.3 million by 2040. This estimation includes 1,010,310 number of males and 948,000 cases of females. Furthermore, as per a June 2021 update by the American Society of Clinical Oncology (ASCO), cancer cells are known to hide from the normal immune system, but through CAR T-cell therapy, scientists can make T cells better equipped to find and kill some cancer cells. Thus, the anticipated increase in cancer cases will drive the demand for CAR T-cell therapy in the coming period. Additionally, increasing research and development are contributing to market growth. For instance, in December 2021, Novartis reported the introduction of T-Charge, the company’s next-generation CAR-T platform that will serve as the foundation for various new investigational CAR-T cell therapies in the Novartis pipeline. Furthermore, in January 2022, Bristol-Myers Squibb Company reported that Japan’s Ministry of Health, Labour and Welfare approved Abecma (idecabtagene violence), a B-cell maturation antigen (BCMA)-directed chimeric antigen receptor (CAR) T cell immunotherapy, for the treatment of adult patients with relapsed or refractory (R/R) multiple myeloma. Such developments drive the demand for CAR T-cell therapies, thereby contributing to market growth.

Hence, due to the rise in cancer cases, and the increase in research and development in CAR T- cell therapy, the studied market is expected to witness growth over the forecast period. However, the high cost of developing CAR T-cell therapy is a major factor hindering market growth.

CAR T-Cell Therapy Market Trends

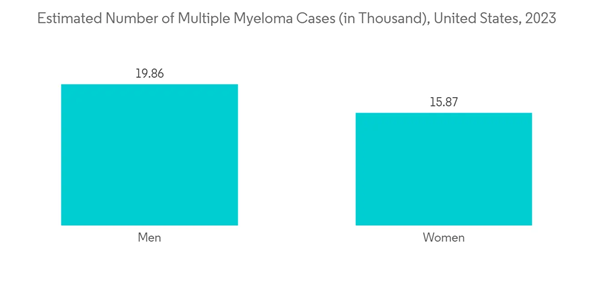

Multiple Myeloma is Expected to Observe a Significant Growth Over the Forecast Period

Multiple myeloma is cancer that forms in a type of white blood cell called a plasma cell. It is also known as Kahler's disease. The major factors fueling the market growth are the increasing burden of multiple myeloma, increasing research and development, and the implementation of strategic initiatives by the market players. For instance, as per Cancer Australia, In 2022, it is estimated that 2,625 new cases of multiple myeloma were diagnosed in Australia (1,540 males and 1,085 females). According to the same source, in 2022, it is estimated that a person has a 1 in 111 (or 0.90%) risk of being diagnosed with multiple myeloma by the age of 85 (1 in 94 or 1.1% for males and 1 in 135 or 0.74% for females).The increasing number of approvals is also contributing to the market growth. For instance, in February 2022, the Janssen Pharmaceutical Companies of Johnson & Johnson reported the United States Food and Drug Administration (FDA) approved CARVYKTI (ciltacabtagene autoleucel; cilta-cel) for the treatment of adults with relapsed or refractory multiple myeloma (RRMM) after four or more prior lines of therapy, including a proteasome inhibitor, an immunomodulatory agent, and an anti-CD38 monoclonal antibody. Similarly, in October 2022, the FDA granted accelerated approval to teclistamab-cqyv (Tecvayli, Janssen Biotech, Inc.), the first bispecific B-cell maturation antigen (BCMA)-directed CD3 T-cell engager, for adult patients with relapsed or refractory multiple myeloma who have received at least four prior lines of therapy, including a proteasome inhibitor, an immunomodulatory agent, and an anti-CD38 monoclonal antibody. Thus, the market is expected to witness significant growth over the forecast period due to the above developments.

Hence, due to the rise in multiple myeloma cases, and the increase in product launches, the studied segment is expected to witness growth over the forecast period.

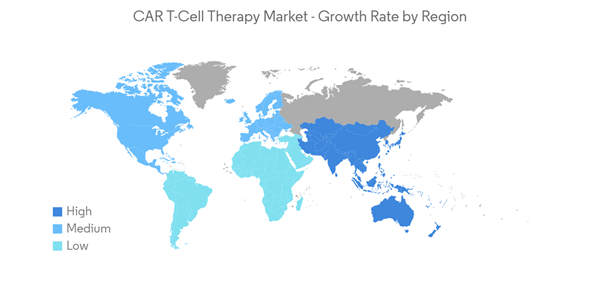

North America is Expected to Hold a Significant Share in the Market and Expected to do Same Over the Forecast Period

North America is expected to witness growth in the studied market owing to the increasing burden of chronic disorders such as cancer and autoimmune disorders, growth in research and development activities, and strong and established market players.For instance, according to the American Cancer Society 2023 Cancer Statistics, the new number of cancer cases is estimated to be 1,958,310 in the United States in 2023. This estimation includes 1,010,310 number of males and 948,000 cases of females. Such a high number of cancer cases indicates the rising demand for CAR T-cell therapy in the country, thereby contributing to market growth. Additionally, several strategic initiatives the players implement contribute to market growth. For instance, in April 2022, Kite, a Gilead Company, reported the FDA-approved commercial production at the company's new CAR T-cell therapy manufacturing facility in Frederick, Maryland. The site will produce Kite’s FDA-approved CAR T-cell therapy to treat blood cancer. Furthermore, clinical studies showing promising results in CAR T-cell therapies across the region are anticipated to increase the market demand. For instance, as per the June 2022 update from uOttawa, one of the first made-in-Canada CAR-T cell therapy for cancer showed promising results in the clinical trial. The trial is called Canadian-Led Immunotherapies in Cancer-01 (CLIC-01). It uses a different kind of cell manufacturing that opens the door to less expensive and more equitable treatment.

Moreover, the growing number of investments contributes to market growth. For instance, in June 2021, Blackstone reported that funds managed by Blackstone Life Sciences had committed USD 250 million towards the launch of a new autologous and allogeneic universal chimeric antigen receptor (CAR) T-cell therapy company, along with Intellia Therapeutics, Inc. and Cellex Cell Professionals GmbH, the parent company of GEMoaB GmbH, a clinical-stage cell therapy company.

Hence, due to the rise in cancer cases and the increase in clinical studies in CAR T -Cell therapies, North America is expected to witness growth over the forecast period.

CAR T-Cell Therapy Industry Overview

The CAR T-Cell therapy market is moderately competitive with several global and international players. The key players are adopting different growth strategies to enhance their market presence, such as partnerships, agreements, collaborations, new product launches, geographical expansions, mergers, and acquisitions. Some of the key players in the market are Novartis AG, Bristol-Myers Squibb Company, Gilead Sciences, Inc. (Kite Pharma), Johnson & Johnson, and Sorrento Therapeutics, Inc., among other players.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Novartis AG

- Bristol-Myers Squibb Company

- Gilead Sciences, Inc. (Kite Pharma)

- Johnson & Johnson

- Eli Lilly and Company

- Sorrento Therapeutics, Inc.

- ACROBiosystems

- Celyad Oncology

- Sangamo Therapeutics, Inc.

- Servier Laboratories

- Noile-Immune Biotech, Inc.

- Miltenyi Biotec