Key Highlights

- The surgical lights market's growth was impacted due to a decline in the number of surgeries and procedures amid the COVID-19 pandemic in its initial phases. Elective and other routine operations were canceled or postponed, allowing critical care units to use the operating and recovery rooms for COVID-19 patients.

- For instance, an article published in Patients Safety in Surgery Journal in June 2022 stated that the total number of primary and secondary surgical patients decreased by 22.7% and 11.7%, respectively, in Germany during the first year of the pandemic as compared to the previous year. Thus, the growing need for hospitalization for severely impacted COVID-19 patients worldwide increased the demand for surgical or operating lights in the later phase of the pandemic.

- Hence, owing to the factors mentioned above, the market studied had a significant impact on the market studied. However, with the COVID-19 cases in control, the market is re-gaining its pre-pandemic nature regarding the demand for surgical lights in ICUs and operating theaters. Furthermore, the factors such as the significant rise in surgical treatments and technological advancements in the field of surgical lighting systems, the studied market is expected to boost the growth during the forecast period.

- According to National Health Service (NHS) Digital's National Obesity Audit published in August 2022, a total of 4,035 people underwent primary bariatric procedures in England in 2021-2022. The bariatric procedures in England in 2021-2022 showed an increase of roughly 60% compared to the previous year. Therefore, the high burden of the population affected by obesity and the rising number of bariatric surgical procedures will boost the utilization of surgical lights during the procedure, which is expected to augment the market growth during the forecast period.

- Similarly, the rising technological enhancements in surgical lights and launches are likely to bolster the growth of the surgical lights market in the upcoming years. For instance, in October 2021, Getinge launched a new feature called Volista VisioNIR in Maquet Volista StandOP. The new feature allows the surgical staff to keep the surgical light on when performing open surgeries using NIR fluorescence imaging systems. Additionally, in July 2021, MezLight LLC launched its revolutionary surgical lighting system to provide surgeons with a bright, sterile, and reusable solution for focused light.

- Therefore, owing to the aforementioned factors, such as the rising number of surgical procedures and technological advancements, the studied market is projected to grow during the forecast period. However, the higher cost associated with surgical lights is one of the major factors restraining the market's growth over the analysis period.

Surgical Lights Market Trends

LED Lights Segment is Expected to Witness a Healthy Growth during the Forecast Period

- For open surgery, LED lighting is the most commonly used light source. They help reduce shadows in open surgery. Due to its long-term cost savings, quantity and quality of illumination, and sufficient illumination intensity, the LED lights segment is projected to grow significantly.

- Moreover, LED lighting is most widely accepted in surgical settings with several advantages such as shadow dilution, correlated color temperature, homogeneity, and color rendering index over traditional lighting. Also, other surgical lights, such as halogen or gas discharge bulbs, use more power than those LEDs, making them less preferable. Such factors will likely propel the segment's growth over the forecast period.

- Furthermore, rising strategic initiatives such as launches and technological advancements by key market players are boosting the segment's growth over the analysis period. For instance, in August 2021, Fujifilm launched the Eluxeo 7000X system imaging tool with five LED lights for a real-time picture during an endoscopic operation. Also, in March 2021, the DASSL (Diffuse Asymmetric Symmetric Surgery Lens) was launched by A.L.P. for recessed or surface-mounted luminaires in operating rooms. The novel biased diffuse microstructure lens improves L.E.D. hiding power, smooth distribution, and lighting distributions that are both symmetrical (along the axis) and asymmetrical (cross-axis).

- Additionally, in November 2021, Vivo Surgical's launched Klaro in vivo lighting device that is designed to improve surgical illumination and provide a clearer view of surgical cavities. The light is developed in partnership with SingHealth and Panasonic Lighting (Europe). Numerous issues with conventional operating room lighting and personal headlights are resolved by this LED light.

- Thus, owing to the advantages of LED surgical lights and increasing launches by market players, the LED light segment is expected to witness healthy growth during the forecast period.

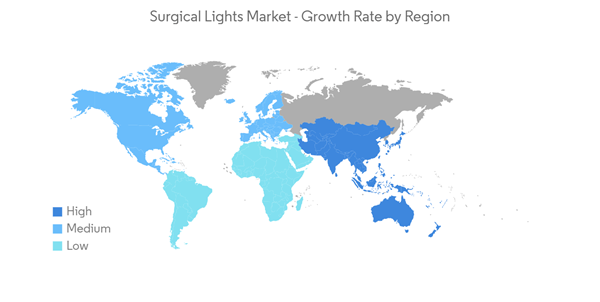

North America is Expected to Hold a Major Share of the Surgical Lights Market

- North America is expected to register a significant market share in the surgical lights market due to the rising number of hospital admissions and investments to expand operating room devices.

- The increasing healthcare expenditure, along with investment in new hospitals and clinics along with the expansion of existing ones, are expected to boost growth in the studied segment over the forecast period. For instance, in February 2022, the Definitive Healthcare's Hospitals & IDN database stated that there are 8,214 hospitals in the United States. Texas, California, and Florida rank among the top three, with 915, 553, and 372 hospitals, respectively. Thus, the increase in the number of hospitals is expected to increase the operating rooms, which in turn promotes the studied market growth in the region.

- Also, in March 2021, the Ontario government, a Canadian province, invested up to USD 41.8 million in the new Grey Bruce Health Services Markdale Hospital for expansion and other activities like the purchase of instruments, which is expected to have a positive impact on the growth of the segment. Thus, an increasing number of hospitals would increase the demand for the adoption of surgical lights, which is expected to increase market growth over the forecast period.

- The rising launches by market players also contribute significantly to the market growth. For instance, in March 2022, Leviton Lighting brand Viscor launched a new Certolux MSU-DFX luminaire featuring 365DisInFx UVA technology designed to promote cleaner surgical suites.

- Thus, the abovementioned factors are expected to expand the studied market within the region during the forecast period.

Surgical Lights Industry Overview

The surgical lights market is moderately competitive, with several players across the globe. In terms of market share, various major players currently dominate the market. With the rising hospital infrastructure and high prevalence of surgeries, many regional players are expected to be part of the surgical light market over the forecast period. The key players in the market for surgical lights are Hill-Rom Services, Steris, SIMEON Medical, Getinge AB, and Stryker Corporation.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Hill-Rom Services

- Getinge AB

- STRYKER

- SIMEON Medical

- STERIS

- A-dec

- Integra Life Sciences

- SKYTRON

- EPMD Group

- Koninklijke Philips