The market is driven by the demand for luxury residents from the GCC as well as other foreign countries. Furthermore, there is also demand for rental real estate, which is driving the market.

The Kingdom of Bahrain is an archipelago between Saudi Arabia and Qatar. It is made up of the main island of Bahrain and dozens of smaller islands. It has become more popular with foreign retirees and investors because it is safe and quiet, has low living costs, and has a diverse population. Bahrain, for example, allows women to work and drive, which is considered more liberal than neighboring Gulf Cooperation Council countries such as Saudi Arabia and Qatar. While Arabic is the official language, English is widely understood. Despite increasing population growth and an influx of foreign residents, Bahrain's residential market has softened in recent years due to an oversupply of housing.

During January–March 2022, Bahrain's residential capital values remained stable. Across the country, demand for rental properties such as villas and townhouses remained strong in Q1 2022. According to a real estate services provider, capital values in Bahrain's residential real estate segment have remained largely stable every quarter. When compared year on year, the capital value index for apartments and villas in the country has dropped by an average of 1.2% and 2.6%, respectively, according to Savill's Q1 2022 Bahrain Market in Minutes report.

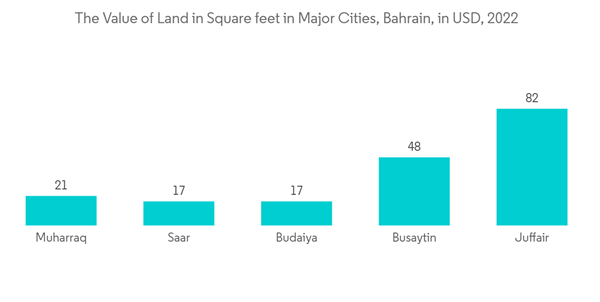

Foreigners in Bahrain are limited to buying in freehold areas, which include Durrat Al Bahrain, Seef, Reef Island, Juffair, Amwaj Islands, Dilmunia Island, Diyar Al Muharraq, and Riffa Views, according to brokers. New construction continues in Bahrain, with approximately 9,000 new units expected by 2026 in Diyar Al Muharraq, a complex of seven artificial islands near Manama, likely further depressing rents. At the moment, average residential prices in Bahrain are roughly half those of comparable properties in Dubai, United Arab Emirates. People from countries in the Gulf Cooperation Council, primarily Bahrain and Saudi Arabia, account for 75–80% of all sales transactions in Bahrain. Several of the remaining buyers are British, Indian, and Pakistani.

Bahrain Luxury Residential Real Estate Market Trends

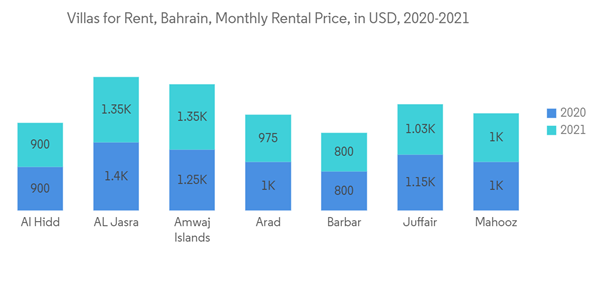

Increase in demand for rental villas driving the market

Bahrain is now on the map of places to invest because its economy is getting better, it has more tourists, and it is known as one of the safest places in the GCC for international trade. And real estate is a hot sector. According to a CBRE analysis, the total number of real estate transactions in Bahrain in the third quarter of this year was 5,482. While the figure is down slightly from the previous quarter's total of 5,532, August alone saw 2,431 transactions, making it the second most successful month since 2018. Rates in both the sales and rental markets changed only slightly in the last two quarters of 2022.It's important to note that the average quoted sales prices of newly released prime properties, like those in Diyar Al Muharraq, have gone up. Between Q4 and Q1, average mid-to-high-end apartment rental prices in Bahrain fell by up to 12% QoQ for two-bedroom apartments, with three-bedroom apartment configurations seeing the smallest change. With slow population growth and more apartments being built in the Kingdom, rents will likely continue to go down.

Increase in sale of luxury residences to foreign buyers driving the market

According to one of Bahrain's leading Proptech firms, there has been a recent increase in the number of leads and impressions in the residential sales market. Between May and June 2022, overall impressions for both apartments and villas for sale increased by approximately 34%, indicating strong demand for these types of units. Villas and apartments for sale in Bahrain are becoming more popular as more people become interested in real estate investment and property ownership. When comparing May 2022 to June 2022, leads for villas for sale increased by more than 76%, according to data collected by a Proptech firm. In terms of apartments for sale, there was a 59% lead when comparing the same time frame.As a result, Bahrain has become a popular international real estate destination. Investors, primarily from the Gulf region but also from Europe and Asia, are expected. The Bahraini government is encouraging real estate popularity through economic initiatives aimed at increasing investment from both within and outside the country. It seems like many of its neighbors have implemented an economic diversification strategy to diversify their economies away from hydrocarbons. The National Economic Recovery Plan, which was launched in the aftermath of the COVID-19 pandemic, aimed to grow Bahrain's economy by investing more than USD 30 billion in five main pillars: infrastructure, industrial development, housing, tourism, and healthcare.

In addition, in 2021, the government was expected to unveil a four-year National Real Estate Plan to encourage real estate investment. This five-pillar plan, developed by the Real Estate Regulatory Authority, aims to implement international practices, protect stakeholders' rights, and develop a regulatory framework based on the key themes of sustainability, innovation, transparency, and cohesion. Bahrain is seeing a surge in luxury developments across the country. Over the next few years, major projects such as the Golden Gate Towers, Oryx Bahrain Bay, Paramount Tower, Harbour Row, and Amwaj Gateway are expected to deliver 4,322 luxury units.

Bahrain Luxury Residential Real Estate Industry Overview

The Bahrain luxury residential real estate market is fragmented, with many local, regional, and a few global players. Some of the major players in the market are Diyar Al Muharraq, Naseej, Durrat Khaleej Al Bahrain, Durrat Marina, and Ithmaar Development Company. The merger and acquisition activity in Bahrain is also expected to increase in the coming years, likely increasing luxury residential real estate development and thereby encouraging more companies to enter the market.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Diyar Al Muharraq

- Naseej

- Durrat Khaleej Al Bahrain

- Durrat Marina

- Ithmaar Development Company

- Manara Developments

- Seef properties

- Carlton Real Estate

- ASK Real Estate

- Arabian Homes Properties

- House Me

- Pegasus Real Estate*