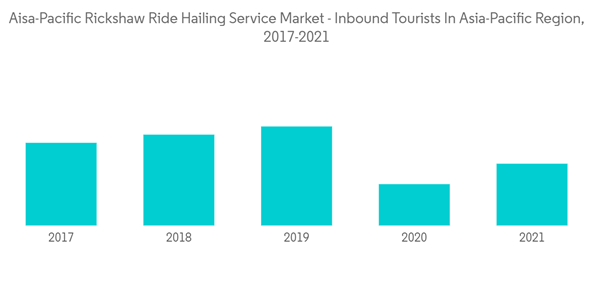

Owing to the global pandemic and the subsequent lockdowns, the Asia-pacific rikshaw ride-hailing service market witnessed a downfall. Due to the restrictions and the halted tourism, the studied market declined. But owing to the ease in the restrictions and life coming to normalcy, the Rickshaw Ride Hailing market is expected to grow during the Forecasts period.

Tourism has grown dramatically over the decades, diversifying more and becoming one of the world's fastest-growing economic sectors. Modern tourism is inextricably tied to economic growth and includes an increasing number of new locations. Tourism has been a crucial engine of socioeconomic advancement as a result of these processes. Tourism is a large sector, thus car rentals are in high demand all around the world.

An increase in ride-hailing services has mostly resulted from increased concern and understanding about reduced emissions. Furthermore, ride-hailing allows for enhanced mobility without the worry of incurring the fees connected with owning a car. These services are available on websites and other online platforms, which has aided the tourism car rental market's expansion.

Majour players operating in the Asia-Pacific Rickshaw Ride Hailing Service Market include, Uber Technologies Inc., Ola Cabs, Gojek Tech, Grab, and DiDi Chuxing.

Key Market Trends

Rising Tourism, Leisure Traveling and Logistics Sector

Because of the COVID-19, international travel was banned that resulting in the haunting of the Tourism industry worldwide. But with the situation easing and people resuming international travel and pleasure traveling, the tourism industry is expected to grow to aid the Asia-Pacific Rickshaw Ride-Hailing Service Market.

In 2020, the share of the total gross domestic product (GDP) generated by travel and tourism worldwide dipped drastically to below 6% when compared to 2019 which was more than 10%. Now with tourism back on the rise, in 2021, the share of the tourism industry claimed back to more than 6% and is expected to even grow in the upcoming years.

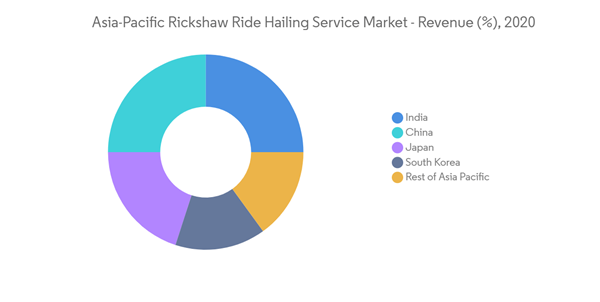

China led the total contribution of travel and tourism to GDP in the Aisa-Pacific market in 2020, followed by Japan and India. China contributed more than USD 600 billion which is the highest among any other country in the region. It is expected that the number of inbound travelers in the North East Aisa-Pacific to increase by more than 300% and in south Asia-Pacific by 100%.

Additionally, in 2020 Aisa-Pacific regionon has the largest share of the global logistics market of about USD 4,000 billion, which is also expected to grow significantly in the Forecasts period. Consinderin the overall growing travel, tourism and logistics industry, the Asic-Pacific Rickshaw Ride Hailing Service Market Is expected to witness significant growth in the Forecasts period.

India To Witness Significant Growth

The logistics industry in India has traditionally embraced the commercial use of electric vehicles. Many logistics companies are actively working to create a green supply chain in the next five to ten years. An increasing number of firms are adding electric vehicles to reduce transportation pollution. The logistics industry would be at the forefront of adopting electric rickshaw ride-hailing services.

Moreover, growth in the e-commerce sector in India is also studied as the opportunity pocket for the growth of the market studied. Ride-hailing service companies maintain constructive alliances with key e-commerce brands to supply their utility to end markets, significantly boosting the overall market.

With that, the Indian government is also putting pressure on reducing carbon emissions caused by diesel fuel combustion and tackling greenhouse gas emissions, thereby pushing investments in developing electric vehicles. Meanwhile, low-emission zones are driving fleets to replace diesel vehicles with cleaner options.

For instance, Ola Cabs has also started to incorporate 10,000 electric rickshaws. The company announced to bring one million electric vehicles on roads under its “Mission Electric” sustainable mobility vision.

As a result of the electrification and the governments incentives of buying an electric vehicle in the country, India is expected to witness derastic growth in the upcoming years.

Competitive Landscape

The Asia-Pacific Rickshaw Ride-Hailing Service Market has several players operating at the international as well as country levels. However, the internal players own a significant share of the market making the market fairly concentrated.

The top five major players operating in the studied market are, Uber Technologies Inc., Ola Cabs, DiDi Chixing, Gojek Tech and Grab.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Uber Technologies Inc.

- Ola Cabs (ANI Technologies Pvt. Ltd)

- DiDi Chuxing (Beijing Xiaoju Technology Co, Ltd.)

- Gojek tech

- Grab

- Mauto Electric Mobility Pvt. Ltd

- Euler Motors Private Limited

- Jugnoo (Socomo Technologies Pvt Ltd.)

- SmartShift Logistics Solutions Pvt. Ltd (Porter)

- e-Yana