The US Household Coffee Machine Market size is estimated at USD 3.06 billion in 2024, and is expected to reach USD 4.18 billion by 2029, growing at a CAGR of 6.38% during the forecast period (2024-2029).

The top five countries generating revenue from the coffee machine market in descending order are the United States, Germany, France, Italy, and Brazil. With the US generating 3521 Mn USD in 2022. With the advent of the online sales platform, sales of coffee machines in offline mode had seen a continuous decline and a surge in online sales, signifying a change in consumer behavior and how the market had to change its selling strategy online. A continuous increase in the price of coffee machines is observed because of the continuous increase in the inflation rate and price of raw materials (metal industry). The price of a coffee machine was USD 106.6 in 2014, increasing to $119.3 in 2021. In 2020 there was maximum revenue generation for the coffee machine market. After the advent of COVID 19, it saw a decline of 16.3% in 2022.

Covid had caused a disruption in the coffee machine market, leading to decreased revenue generation. A continuous disruption in supply chain logistics occurs, causing inflationary pressure for coffee and the coffee machine market because firms could not meet surging global demand.

As covid restrictions are relaxed in various parts of the world and lockdowns are relaxed, more economic activity is taking place. With an increase in economic activity and normalization of the supply chain, consumption of coffee is increasing, creating space for the coffee machine market in the US. With 64% of US consumers drinking coffee daily of an average of 3.5 cups, consumer spread is expected to increase.

US Household Coffee Machine Market Trends

Coffee consumption driving coffee machine market towards making more investment,

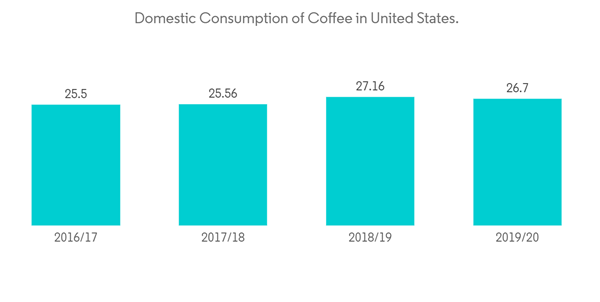

During the Pre-pandemic level of January 2020, home coffee consumption remained at around 80%, which saw an increase after the pandemic to 84%, showing an increase in household coffee consumption after covid. In a survey among the US sample population, it was observed almost 43% of coffee drinkers chose specialty coffee in the past day, an increase of 20% since January 2021. From 2018-19 to 2019-20, coffee consumption observed a setback with 27.16 mn(60 kgs bags) consumed in 2018-19 and declined to 26.7 mn(60 kg bags) in 2019-20 with covid having a setback on consumption as well as production capacity, These changes in coffee consumption affected sales of coffee machine market.

Almost 58% of the population in the US drink coffee daily, and most of the consumed coffee is Traditional (specialty), after which comes Espresso-based beverage creating a market for the coffee machine. The maximum share of coffee drinking in the United States by age group is held by above 60 and youth from 18-24 years as the least coffee consuming. It gives a direction to the coffee market, as well as the coffee machine market, a direction towards which age to work on.

Automation leading to transformation and increase in revenue from coffee machine market.

The coffee shop market has seen no shortage of automation; this has been part of a push to improve consistency and minimize the number of time baristas spend on manual tasks. The automated coffee market is observing an increasing penetration in rising café chains, restaurants, and hangout places, creating an environment for growth in coffee and the coffee machine market. The semi-automated coffee machine market is also observing an increasing trend of offering consumers to create a brew per their preference. Integration of smart technology with domestic appliances creates automated coffee machines with Bluetooth and Wi-fi technology available. This ease in communication is likely to propel the coffee machine market.

They have automated coffee machine during 2021 that are valued at $5.34 bn USD and is expected to reach $6.95 bn USD by 2027 and give an excellent coffee without hassle. A completely automatic coffee machine allows users to save time and effort, which is especially beneficial for people who are short on time. This coffee machine market is expected to reach new heights by adopting household and commercial usage automation. The coffee machine market in the US is expected to grow at the highest pace in North America with automation.

Among Machinery, Steam coffee machines dominate the market with 69.5% share, with another segment of capsule coffee machines holding 22.4% share and drip coffee machines holding 8.1 % share, with all of them expected to grow at a CAGR greater than 4.5%.

US Household Coffee Machine Industry Overview

With the competitive environment in the coffee machine market in the United States, Coffee machine makers enter the market to reap the benefit of the available profit opportunity. The US and Europe have observed continuous competition in the coffee market, but with the dollarization of the global market, the US will always be taking a leading role in the Coffee machine market as well as the coffee market.

In descending order, the countries generating the maximum profit from the coffee market are the United States, France, Germany, and Brazil. The global automated coffee machine market is consolidated, and competition within the automated coffee market is increasing with time. As a result, players are focusing on launching products with advanced features besides adopting an expansion strategy for US households in the coffee machine market. The share of the coffee machine market in the US is continuously increasing. Of the total production of automated coffee machines in the market, 50% of the demand comes from the US, of which the United States originates almost 70%.

Coffee is the most consumed beverage in the United States. It touches communities worldwide in an amazing way generating tax dollars to create jobs, from the supermarket to dairy farms. The total economic impact of the coffee industry in 2015 was '$225.2 bn USD'. US coffee consumption has continuously increased since 2013/14 with 23.8 million 60 kg bags consumed in 2019/20 and 27.16 million 60 kg bags. This data shows a continuously increasing coffee market in the United States. Markets competing for space in the US coffee market are Starbucks, Espresso Supply, and National Presto Industry. Inc, Dynamo Aviation US, S&D coffee makers.INC, etc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- S&D coffee makers.Inc

- National Presto Industry.Inc

- Lavazza

- Regal Ware

- Quench

- Dynamo Avaition US

- Lancaster Commercial Product

- Espresso Supply

- Simpli Press

- Starbucks