Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The growth of the textile industry, both for domestic use and export, significantly drives the demand for PTA, as polyester fibers are essential for apparel, home textiles, and industrial fabrics. Additionally, increased infrastructure and construction activities fuel the need for polyester products in applications such as geo-textiles and reinforcement materials.

India is a major player in the PTA market, with leading companies such as Reliance Industries and Indian Oil Corporation investing in advanced facilities to cater to both domestic and export demands. PTA production relies on paraxylene (PX), a petroleum-derived feedstock, and fluctuations in PX availability and global crude oil prices can impact production costs and market dynamics.

India imports a large portion of its PTA, primarily from China, the Middle East, and Southeast Asia, to supplement domestic production and meet high demand from various end-use industries. Stringent environmental regulations on emissions and waste management require investments in cleaner technologies and compliance measures. Technological advancements aim to improve production efficiency, reduce costs, and lessen environmental impact. There is also a growing focus on sustainability, with efforts towards recycling and developing bio-based PTA alternatives to minimize ecological impact. The Indian PTA market offers significant growth potential driven by robust domestic industrial demand. Future advancements in technology and sustainability will be pivotal in shaping the market’s development.

Key Market Drivers

Infrastructure Development

Purified Terephthalic Acid (PTA) is integral to the production of polyester resins, which are crucial for manufacturing construction materials such as composites, adhesives, and coatings. These materials play a key role in various infrastructure projects, including building construction, road repairs, and bridges. Polyester-based coatings, derived from PTA, are applied to construction materials to protect against weathering and corrosion, thus enhancing the durability of infrastructure.Foreign Direct Investment (FDI) in construction development, including townships, housing, and built-up infrastructure projects, totaled USD 26.54 billion, while FDI in the construction (infrastructure) sector reached USD 33.52 billion between April 2000 and December 2023. Government efforts to develop and modernize urban infrastructure - encompassing both residential and commercial buildings - drive the demand for polyester-based products, thereby increasing the need for PTA. Additionally, large-scale public works projects, such as highways, railways, and airports, rely on polyester resins and other PTA-derived materials, further boosting PTA consumption.

The recent Interim Budget for 2024-25 has increased the capital investment outlay for infrastructure by 11.1% to USD 133.86 billion, representing 3.4% of GDP. Such increased government expenditure on infrastructure typically stimulates demand for various construction materials, including those containing PTA, particularly during periods of economic growth or recovery. As India continues to invest in and expand its infrastructure, the demand for PTA and its derivatives is expected to rise, reflecting the broader trends in infrastructure development and modernization.

Growth of Textile Industry

Purified Terephthalic Acid (PTA) is a key raw material for producing polyester fibers, which are widely used in the textile industry. As demand for polyester textiles increases, so does the need for PTA. Shifts in fashion trends and a growing consumer preference for affordable, durable, and low-maintenance clothing are driving up the consumption of polyester fabrics, thereby boosting PTA demand. Rapid urbanization in India has led to a heightened need for a variety of textile products for both residential and commercial purposes, including apparel and home furnishings, which heavily rely on polyester.Economic growth and rising disposable incomes are also contributing to increased consumer spending on textile products, further driving the demand for polyester-based materials and PTA. Government initiatives and incentives aimed at revitalizing the textile industry, such as subsidies and modernization support, indirectly benefit the PTA market by promoting growth in textile production. For example, the government allocated USD 109.99 million to the Amended Technology Upgradation Fund Scheme (ATUFS) in the 2023-24 budget to stimulate private investment and job creation in the sector.

Investment in new textile manufacturing facilities, including mills and production lines, increases PTA demand, as these operations require large quantities of polyester. According to IBEF, textiles, handicrafts, and apparel represented 10.6% of India's total exports in FY22. Despite a dip in FY20 and FY21, exports have consistently risen since FY16, with textile and apparel exports reaching a record USD 44.4 billion in FY22, a 41% increase from FY21. As India's textile industry grows and meets both domestic and international demands, the need for PTA remains strong, especially given the increasing trend towards sustainable textiles and recycled polyester. This ongoing evolution in consumer preferences and technological advancements ensures a continued rise in PTA demand as a vital component in polyester production.

Key Market Challenges

Regulatory and Trade Barriers

High import tariffs can drive up the cost of PTA and its derivatives for domestic manufacturers, making raw material sourcing more expensive and challenging competition with imported products. Export tariffs or restrictions from other countries can also restrict market access for PTA producers, limiting their ability to enter international markets. For instance, in 2023, Indian manufacturers in plastics, packaging, textiles, and automotive sectors are banned from sourcing purified terephthalic acid from mainland Chinese producers due to a decision by Indian authorities. This prohibition is part of India's updated list of Bureau of Indian Standards-certified global PTA suppliers, which excludes Chinese producers.Different markets impose specific product standards and certifications for PTA and its derivatives. Securing these certifications can be both time-consuming and costly, impacting market access. Additionally, adhering to health and safety regulations related to the handling and transportation of PTA can add operational costs and complexities. Changes or deficiencies in trade agreements can affect PTA trade flows, influencing both imports and exports. Complex customs procedures and documentation requirements can result in delays and higher costs for importing PTA, while increased border inspections may lead to longer lead times and potential supply chain disruptions. Effectively navigating these regulatory and trade barriers is essential for PTA producers to remain competitive and ensure stable operations.

Volatility in Raw Material Prices

PTA production depends on para-xylene, which is derived from crude oil. Variations in crude oil prices can lead to fluctuations in para-xylene costs, which in turn affect PTA production expenses. Unpredictable changes in crude oil prices can cause PTA costs to vary, impacting profit margins and complicating financial planning for manufacturers. Disruptions in the supply chain for raw materials like para-xylene can result in shortages or delays, affecting PTA production continuity and increasing costs. Market speculation can drive up raw material prices, impacting both PTA production costs and market prices.Manufacturers must frequently adjust their pricing strategies in response to raw material price changes, which can affect their competitiveness and customer relationships. Fluctuating raw material costs also complicate investment decisions and financial planning, making it difficult to budget for capital expenditures and operational costs. Long-term supply contracts can help stabilize prices but may present challenges if raw material prices fall significantly. Securing a reliable supply of raw materials at predictable prices can be particularly difficult in a volatile market, affecting production stability and cost management.

Key Market Trends

Rise of Innovative Packaging

There is a notable shift towards sustainable packaging solutions that utilize recycled or biodegradable materials. PTA, a crucial raw material for polyester-based packaging, is seeing increased demand for eco-friendly packaging options. In April 2024, UFlex, India’s leading multinational in flexible packaging solutions, began producing poly-condensed polyester chips at its Panipat facility. This plant, with an annual capacity of 168,000 metric tons, focuses on manufacturing polyester chips essential for Biaxially Oriented Polyethylene Terephthalate (BOPET) packaging films. The movement towards reducing plastic waste has boosted the use of recycled PET (rPET) in packaging, which in turn drives PTA demand since PTA is used in creating new polyester products.In June 2024, Germany’s Coperion and Herbold Meckesheim, known for recycling technology, partnered with India’s Magpet Polymer Pvt. Ltd. to establish a PET bottle-to-bottle recycling facility. Also in June, Coca-Cola India introduced 100% recycled polyethylene terephthalate (rPET) bottles in a 250ml Affordable Small Sparkling Package (ASSP) format in Odisha, India, advancing plastic circularity efforts. Advancements in packaging technologies, including barrier coatings and sophisticated film structures, require specialized PTA formulations to enhance material performance and functionality. The rise of smart packaging solutions, featuring elements like temperature indicators and QR codes, is also driving demand for high-quality PTA to ensure the durability and reliability of these advanced packages.

Customization in packaging to address specific industry needs such as improved protection, extended shelf life, and enhanced aesthetics is on the rise. PTA is used to produce tailored polyester films and coatings that meet these demands. Additionally, the growth of e-commerce has increased the need for durable packaging solutions that protect products during transit, further boosting PTA demand. Emerging markets are experiencing a surge in demand for innovative packaging due to rapid economic development and rising consumer spending. This trend opens new opportunities for PTA producers to broaden their market presence.

Segmental Insights

Sales Channel Insights

Based on Sales Channel, the Direct Sales Channel emerged as the dominating segment in the Indian market for Purified Terephthalic Acid in 2024. PTA is required in substantial volumes for industrial uses like textile production and packaging. Direct sales are more effective for managing these large orders, allowing for efficient delivery of substantial quantities directly from producers to major clients. This approach helps PTA producers build and sustain long-term relationships with significant customers, such as textile mills and packaging firms, fostering trust and encouraging repeat business. By cutting out intermediaries, direct sales reduce extra costs associated with distributors or agents, benefiting both producers, who can offer competitive prices, and buyers, who can save on expenses. Direct sales also provide producers with better control over pricing strategies and quality assurance, ensuring that PTA meets the specific needs of large buyers. Additionally, this method simplifies the supply chain by minimizing intermediary steps, which leads to quicker order fulfillment and more reliable supply management. Large buyers often prefer direct dealings with producers to strengthen brand loyalty and guarantee consistent delivery of high-quality products.End User Insights

Based on End User, Polyester Fiber and Yarn emerged as the dominating segment in the Indian market for Purified Terephthalic Acid in 2024. Polyester fibers are widely utilized across the textile industry, spanning products such as clothing, home furnishings, and industrial textiles. This extensive use significantly drives the demand for PTA. Polyester is highly regarded for its durability, affordability, and versatility, with its resistance to wrinkles, shrinking, and abrasion making it a popular choice for both everyday apparel and specialized textiles. As one of the largest consumers of PTA, the polyester fiber market reflects the high volume of fibers produced and used globally, further solidifying its dominance in PTA consumption.Polyester’s cost-effectiveness, particularly when compared to natural fibers like cotton or wool, contributes to its widespread adoption and, consequently, increased PTA demand. The efficient and scalable production processes for polyester allow for large quantities of fiber and yarn to be produced at relatively low costs, thereby reinforcing the reliance on PTA. Additionally, ongoing innovations in fiber technology such as enhancements in strength, texture, and performance drive the creation of new polyester products, many of which require specialized PTA formulations. The development of diverse polyester fiber types, including high-performance and specialty variants, further stimulates the need for PTA.

Regional Insights

Based on Region, West India emerged as the dominant region in the Indian market for Purified Terephthalic Acid in 2024. The Western region of India, especially in states like Gujarat and Maharashtra, is a key industrial and manufacturing hub. Cities such as Mumbai, Pune, and Surat are prominent centers for the textile and packaging industries, which are major consumers of PTA. PTA is essential for polyester production, and the high volume of textile manufacturing in this region drives substantial demand for PTA. In 2023, a Memorandum of Understanding (MoU) was signed between the State and Central governments to establish the PM MITRA Park on 1,141 acres in Vansi Borsi, Navsari, Gujarat. This initiative, part of the PM MITRA (Mega Integrated Textile Region and Apparel) Park, reflects the region's commitment to bolstering its textile and manufacturing sectors. The Western region benefits from advanced infrastructure, including well-developed ports, transport networks, and industrial facilities, which facilitate the efficient distribution and consumption of PTA. The region’s robust economic activity, with a strong industrial base, further contributes to high PTA demand. Additionally, its proximity to major ports supports significant export and trade activities, enhancing its market position in PTA.Significant investments have been made in the Western region’s industrial facilities and technology. For example, in 2024, TCG invested USD 149.25 million in expanding its FDY Yarn production, aiming to revive Garden Silk Mills with a state-of-the-art plant in Jolwa that produces high-quality polyester chips, POY, FDY, and specialty yarns. TCG’s expansion reflects the region’s growing role in the PTA-polyester downstream segment. The Western region's high concentration of PTA-consuming industries, coupled with substantial investments and advanced infrastructure, results in a higher demand for PTA compared to other regions in India.

Key Market Players

- Reliance Industries Limited

- Moradia Brothers Chem Pvt. Ltd.

- Sigma Aldrich Chemicals Private Limited

- Eastman Chemical India Private Limited

- RX CHEMICAL RXSOL RX MARINE

- MCPI Private Limited

- Indorama Ventures Public Company Limited

- Indian Oil Corporation Ltd

- BP India Services Private Ltd.

- GAIL (India) Limited

Report Scope:

In this report, the India Purified Terephthalic Acid Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Purified Terephthalic Acid Market, By Sales Channel:

- Direct Sales Channel

- Indirect Sales Channel

India Purified Terephthalic Acid Market, By End User:

- Polyester Fiber and Yarn

- PET Resin

- Polyester Film

- Others

India Purified Terephthalic Acid Market, By Region:

- West India

- North India

- South India

- East India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies presents in the India Purified Terephthalic Acid Market.Available Customizations:

India Purified Terephthalic Acid Market report with the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report:Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Reliance Industries Limited

- Moradia Brothers Chem Pvt. Ltd.

- Sigma Aldrich Chemicals Private Limited

- Eastman Chemical India Private Limited

- RX CHEMICAL RXSOL RX MARINE

- MCPI Private Limited

- Indorama Ventures Public Company Limited

- Indian Oil Corporation Ltd

- BP India Services Private Ltd.

- GAIL (India) Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | August 2024 |

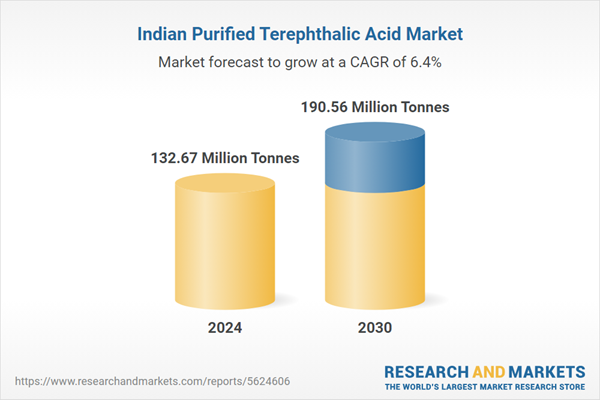

| Forecast Period | 2024 - 2030 |

| Estimated Market Value in 2024 | 132.67 Million Tonnes |

| Forecasted Market Value by 2030 | 190.56 Million Tonnes |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |