The global market is experiencing significant momentum due to the expansion of e-commerce and the consequent rise in demand for efficient packaging solutions that minimize environmental impact. For instance, according to industry reports, the eco-friendly packaging market is projected to increase from USD 257.73 Billion in 2025 to USD 498.29 Billion by 2034, with a compound annual growth rate (CAGR) of 7.6% between 2025 and 2034. Increased awareness regarding microplastic pollution has also accelerated the shift toward water-soluble alternatives in food-grade and personal care applications. Furthermore, the growing trend of single-dose product packaging across various sectors, including agrochemicals and industrial cleaners, enhances the appeal of these films. Strategic collaborations between film manufacturers and chemical companies are fostering innovation, enabling films with higher tensile strength and controlled solubility rates. Additionally, advancements in cold-water soluble formulations are opening new avenues in temperature-sensitive applications, further supporting water soluble film market growth.

In the United States, the water soluble film market is primarily driven by the increasing emphasis on industrial automation and the need for pre-measured, mess-free packaging in manufacturing processes. The country's robust pharmaceutical sector has adopted water-soluble films for precise drug delivery systems, contributing significantly to market growth. Strong federal initiatives promoting sustainability and plastic reduction are also encouraging adoption across consumer and institutional segments. Furthermore, the growth of environmentally conscious start-ups and rising venture capital investment in green packaging technologies have accelerated innovation and market penetration. The expansion of industrial and institutional cleaning services, coupled with stringent occupational safety standards, further strengthens the demand for dissolvable, low-contact packaging solutions.

Water Soluble Film Market Trends:

Rising Demand in Sustainable Packaging Applications

Water-soluble films are increasingly utilized in the packaging of disinfectants and detergents due to their eco-friendly, non-toxic, and biodegradable nature. This shift aligns with global sustainability goals and consumer preferences for environmentally responsible products. In the United States alone, the Packaging & Labeling Services industry consists of over 15,309 businesses and has grown at a compound annual growth rate (CAGR) of 7.1% from 2020 to 2025. The robust expansion of this industry highlights the growing demand for innovative packaging solutions. Water-soluble films also provide effective barriers against odors, gases, bacteria, and moisture, making them suitable for a range of hygiene and cleaning applications. This trend is expected to continue as sustainability becomes central to corporate packaging strategies.Shift Toward Circular Economy and Innovation

As industries increasingly pivot toward circular economy models, water-soluble films are emerging as a key component of sustainable packaging strategies. By 2025, over 40% of companies are expected to adopt innovative and eco-friendly packaging technologies, a shift that is driving substantial interest in dissolvable films. These films not only reduce environmental impact but also improve product safety by limiting human exposure to harsh chemicals. In response, companies are investing in R&D to develop next-generation water-soluble materials with enhanced strength, solubility control, and barrier properties. Advanced polymer chemistry, synthetic materials, and carbon-based technologies are being explored to meet growing demands. This trend reflects a broader market move toward high-performance, sustainable alternatives that support both environmental goals and functional efficiency, further creating a positive water soluble film market outlook.Expanding Industrial and Food & Beverage Applications

Water-soluble films are gaining significant traction in the chemical industry due to their ability to protect workers from direct contact with hazardous substances. Pre-measured, single-use packaging using water-soluble films minimizes risk and enhances safety in industrial settings. Simultaneously, the food and beverage (F&B) sector is adopting these films for their excellent air-, oil-, and moisture-resistant properties, ensuring longer shelf life and improved product integrity. These advantages are offering lucrative opportunities for manufacturers to diversify applications and meet evolving industry requirements. Additionally, regulatory pressures regarding environmental compliance are compelling companies to replace traditional plastic with dissolvable alternatives. This adoption, combined with rising investment in technological innovations, is shaping the market’s expansion into previously untapped verticals, solidifying water-soluble films as a versatile solution. For instance, in October 2024, Arrow Greentech showcased its Watersol™ water-soluble packaging at PMFAI ICSCE 2024, focusing on sustainability and safety in agriculture. The technology dissolves quickly in water, reducing pollution, health risks, and waste. It ensures precise mono-dosing and eliminates plastic contamination, aligning with global environmental goals. Arrow’s eco-friendly solutions are gaining recognition for enhancing efficiency and promoting sustainable agricultural practices, while the company expands its global presence and partnerships in the agrochemical market.Water Soluble Film Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global water soluble film market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on material, application, and end-use industry.Analysis by Material:

- PVA/PVOH

- Xylan

Analysis by Application:

- Detergent Packaging

- Agrochemical Packaging

- Water Treatment Chemical Packaging

- Pharmaceutical Packaging

- Others

Analysis by End-Use Industry:

- Textile

- Agriculture

- Consumer Goods

- Healthcare

- Others

Regional Analysis:

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Key Regional Takeaways:

United States Water Soluble Film Market Analysis

In 2024, the United States held a market share of around 86.80% in North America. United States is experiencing increased water soluble film adoption driven by the growing demand for sustainable packaging. According to industry reports, about half of US consumers are willing to pay more for sustainable packaging: across different end-use areas, about 50% of consumers are willing to pay 1 to 3% more, 25% are willing to pay 4 to 7% more, and about 12% are willing to pay 7 to 10% more. As environmental concerns escalate, industries across food, agriculture, and personal care are turning to sustainable packaging alternatives that reduce plastic waste. Water soluble film, being biodegradable and dissolvable in water, is gaining traction as an ideal solution for single-use and unit-dose packaging formats. This shift is further supported by consumer awareness and preference for environmentally friendly products, encouraging businesses to invest in sustainable packaging innovations. Regulatory focus on reducing plastic consumption is also contributing to the rapid adoption of water soluble film across multiple sectors. The sustainable packaging movement continues to redefine material usage patterns in the region, fueling long-term growth prospects for water soluble film applications.Asia Pacific Water Soluble Film Market Analysis

Asia-Pacific is witnessing notable water soluble film adoption supported by the increasing number of packaging units. Approximately 85% of the more than 22,000 packaging units in India are Small and Medium Enterprises (SMEs). Rapid industrialization, urban population growth, and rising consumption patterns have significantly expanded packaging operations across sectors such as food, agriculture, and consumer goods. The surge in packaging units is creating a robust demand for efficient and eco-friendly materials, positioning water soluble film as a viable packaging solution. Its ability to meet diverse application requirements while minimizing environmental footprint makes it favorable in this high-volume region. Local manufacturers are actively exploring water soluble film technologies to align with evolving sustainability goals and regulatory directions. As packaging operations scale up to meet growing consumer demand, water soluble film stands out for its adaptability and environmental compliance, enhancing its role in the regional packaging landscape.Europe Water Soluble Film Market Analysis

Europe is advancing in water soluble film adoption fueled by growing pharmaceutical packaging requirements. The Germany pharmaceutical packaging market size reached USD 6.0 Billion in 2024. Looking forward, the publisher expects the market to reach USD 12.5 Billion by 2033, exhibiting a growth rate (CAGR) of 7.8% during 2025-2033. With increased healthcare awareness and the rising demand for precise medication delivery formats, pharmaceutical companies are leveraging water soluble film for unit-dose and dissolvable applications. Its compatibility with sensitive compounds and hygienic benefits positions it as a preferred choice in pharmaceutical packaging. The strict regulatory environment regarding material safety and environmental impact further drives this transition. Innovations in drug delivery and packaging mechanisms are amplifying interest in water soluble film across European pharmaceutical supply chains. Sustainability remains a core priority, and water soluble film aligns with these objectives by reducing material waste and enhancing compliance with eco-design mandates. This regional demand reflects a broader trend toward functional, sustainable solutions in healthcare packaging.Latin America Water Soluble Film Market Analysis

Latin America is seeing increased water soluble film adoption due to growing demand for flexible packaging. Latin America flexible packaging market size reached USD 8.74 Billion in 2024. Looking forward, the publisher expects the market to reach USD 12.21 Billion by 2033, exhibiting a growth rate (CAGR) of 3.5% during 2025-2033. As industries seek more adaptable and efficient packaging options, flexible packaging formats are gaining popularity for their convenience and reduced material usage. Water soluble film complements these needs by offering dissolution properties and environmental benefits. The shift toward lightweight and sustainable materials is reinforcing the use of water soluble film in diverse sectors. Its integration in flexible packaging supports regional goals for waste reduction and packaging efficiency.Middle East and Africa Water Soluble Film Market Analysis

Middle East and Africa are experiencing higher water soluble film adoption driven by growing textile industries. According to reports, in 2022, the UAE textile market was valued at more than USD10 Billion and is now expected to expand by more than 5% a year over the medium term. As textile production expands, the need for efficient and eco-friendly packaging of dyes and detergents has increased. Water soluble film meets these industrial needs with its dissolvable and non-contaminating properties. Its application enhances workflow efficiency and aligns with cleaner production initiatives. The regional textile sector’s focus on sustainability and chemical handling efficiency is accelerating the shift toward water soluble film usage in operational processes.Competitive Landscape:

The water soluble film market forecast indicates a competitive landscape marked by moderate to high fragmentation, with a mix of global and regional players vying for market share through product quality, innovation, and pricing strategies. The market is driven by rising demand in sectors such as agriculture, pharmaceuticals, home care, and food packaging due to the film’s eco-friendly and biodegradable properties. Key competitive factors include technological advancements, custom formulations, and strong distribution networks. Companies often invest in R&D to enhance film solubility, strength, and compatibility with various substances. Strategic partnerships, capacity expansions, and sustainability initiatives are common approaches to gain market share. Additionally, regulatory support for green packaging and increased environmental awareness are compelling firms to innovate while meeting stringent safety and performance standards. For instance, in May 2024, Ecopol announced that its Hydrolene® LTF/LJ film received the prestigious "OK biodegradable WATER®" certification from TÜV AUSTRIA, demonstrating its ability to decompose effectively in freshwater environments. This certification follows the success of Hydrolene® LTF/TB, highlighting Ecopol's commitment to sustainability. The achievement reinforces their mission to reduce environmental impact and mitigate waste in rivers, lakes, and freshwater ecosystems, marking a significant step toward a greener, more sustainable future.The report provides a comprehensive analysis of the competitive landscape in the water soluble film market with detailed profiles of all major companies, including:

- Kuraray Co. Ltd.

- Nippon Synthetic Chemical Industry Co. Ltd.

- Sekisui Chemical Co., Ltd.

- Aicello Corporation

- Arrow GreenTech Ltd.

- Cortec Corporation

- Changzhou Kelin PVA Water Soluble Films Co., Ltd.

- Jiangmen Proudly Water-soluble Plastic Co., Ltd.

- AMC (UK) Ltd.

- 3M Company

- Mitsubishi Chemical Corporation

- DuPont de Nemours, Inc.

- Fujian Zhongsu Biodegradable Films Co., Ltd.

- Dezhou Huamao Textile Co. Ltd.

- Neptun Technologies GmbH

Key Questions Answered in This Report

1. How big is the water soluble film market?2. What is the future outlook of the water soluble film market?

3. What are the key factors driving the water soluble film market?

4. Which region accounts for the largest water soluble film market share?

5. Which are the leading companies in the global water soluble film market?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global Water Soluble Film Market

5.1 Market Overview

5.2 Market Performance

5.3 Impact of COVID-19

5.4 Market Breakup by Material

5.5 Market Breakup by Application

5.6 Market Breakup by End-Use Industry

5.7 Market Breakup by Region

5.8 Market Forecast

6 Market Breakup by Material

6.1 PVA/PVOH

6.1.1 Market Trends

6.1.2 Market Forecast

6.2 Xylan

6.2.1 Market Trends

6.2.2 Market Forecast

7 Market Breakup by Application

7.1 Detergent Packaging

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 Agrochemical Packaging

7.2.1 Market Trends

7.2.2 Market Forecast

7.3 Water Treatment Chemical Packaging

7.3.1 Market Trends

7.3.2 Market Forecast

7.4 Pharmaceutical Packaging

7.4.1 Market Trends

7.4.2 Market Forecast

7.5 Others

7.5.1 Market Trends

7.5.2 Market Forecast

8 Market Breakup by End-Use Industry

8.1 Textile

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 Agriculture

8.2.1 Market Trends

8.2.2 Market Forecast

8.3 Consumer Goods

8.3.1 Market Trends

8.3.2 Market Forecast

8.4 Healthcare

8.4.1 Market Trends

8.4.2 Market Forecast

8.5 Others

8.5.1 Market Trends

8.5.2 Market Forecast

9 Market Breakup by Region

9.1 North America

9.1.1 Market Trends

9.1.2 Market Forecast

9.2 Europe

9.2.1 Market Trends

9.2.2 Market Forecast

9.3 Asia Pacific

9.3.1 Market Trends

9.3.2 Market Forecast

9.4 Middle East and Africa

9.4.1 Market Trends

9.4.2 Market Forecast

9.5 Latin America

9.5.1 Market Trends

9.5.2 Market Forecast

10 SWOT Analysis

10.1 Overview

10.2 Strengths

10.3 Weaknesses

10.4 Opportunities

10.5 Threats

11 Value Chain Analysis

12 Porter’s Five Forces Analysis

12.1 Overview

12.2 Bargaining Power of Buyers

12.3 Bargaining Power of Suppliers

12.4 Degree of Competition

12.5 Threat of New Entrants

12.6 Threat of Substitutes

13 Price Analysis

13.1 Price Indicators

13.2 Price Structure

13.3 Margin Analysis

14 Competitive Landscape

14.1 Market Structure

14.2 Key Players

14.3 Profiles of Key Players

14.3.1 Kuraray Co. Ltd.

14.3.2 Nippon Synthetic Chemical Industry Co. Ltd.

14.3.3 Sekisui Chemical Co., Ltd.

14.3.4 Aicello Corporation

14.3.5 Arrow GreenTech Ltd.

14.3.6 Cortec Corporation

14.3.7 Changzhou Kelin PVA Water Soluble Films Co., Ltd.

14.3.8 Jiangmen Proudly Water-soluble Plastic Co., Ltd.

14.3.9 AMC (UK) Ltd.

14.3.10 3M Company

14.3.11 Mitsubishi Chemical Corporation

14.3.12 DuPont de Nemours, Inc.

14.3.13 Fujian Zhongsu Biodegradable Films Co., Ltd.

14.3.14 Dezhou Huamao Textile Co. Ltd.

14.3.15 Neptun Technologies GmbH

List of Figures

Figure 1: Global: Water Soluble Film Market: Major Drivers and Challenges

Figure 2: Global: Water Soluble Film Market: Sales Value (in Million USD), 2019-2024

Figure 3: Global: Water Soluble Film Market: Breakup by Material (in %), 2024

Figure 4: Global: Water Soluble Film Market: Breakup by Application (in %), 2024

Figure 5: Global: Water Soluble Film Market: Breakup by End-Use Industry (in %), 2024

Figure 6: Global: Water Soluble Film Market: Breakup by Region (in %), 2024

Figure 7: Global: Water Soluble Film Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 8: Global: Water Soluble Film Industry: SWOT Analysis

Figure 9: Global: Water Soluble Film Industry: Value Chain Analysis

Figure 10: Global: Water Soluble Film Industry: Porter’s Five Forces Analysis

Figure 11: Global: Water Soluble Film (PVA/PVOH) Market: Sales Value (in Million USD), 2019 & 2024

Figure 12: Global: Water Soluble Film (PVA/PVOH) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 13: Global: Water Soluble Film (Xylan) Market: Sales Value (in Million USD), 2019 & 2024

Figure 14: Global: Water Soluble Film (Xylan) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 15: Global: Water Soluble Film (Detergent Packaging) Market: Sales Value (in Million USD), 2019 & 2024

Figure 16: Global: Water Soluble Film (Detergent Packaging) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 17: Global: Water Soluble Film (Agrochemical Packaging) Market: Sales Value (in Million USD), 2019 & 2024

Figure 18: Global: Water Soluble Film (Agrochemical Packaging) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 19: Global: Water Soluble Film (Water Treatment Chemical Packaging) Market: Sales Value (in Million USD), 2019 & 2024

Figure 20: Global: Water Soluble Film (Water Treatment Chemical Packaging) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 21: Global: Water Soluble Film (Pharmaceutical Packaging) Market: Sales Value (in Million USD), 2019 & 2024

Figure 22: Global: Water Soluble Film (Pharmaceutical Packaging) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 23: Global: Water Soluble Film (Other Applications) Market: Sales Value (in Million USD), 2019 & 2024

Figure 24: Global: Water Soluble Film (Other Applications) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 25: Global: Water Soluble Film (Textile) Market: Sales Value (in Million USD), 2019 & 2024

Figure 26: Global: Water Soluble Film (Textile) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 27: Global: Water Soluble Film (Agriculture) Market: Sales Value (in Million USD), 2019 & 2024

Figure 28: Global: Water Soluble Film (Agriculture) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 29: Global: Water Soluble Film (Consumer Goods) Market: Sales Value (in Million USD), 2019 & 2024

Figure 30: Global: Water Soluble Film (Consumer Goods) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 31: Global: Water Soluble Film (Healthcare) Market: Sales Value (in Million USD), 2019 & 2024

Figure 32: Global: Water Soluble Film (Healthcare) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 33: Global: Water Soluble Film (Other End-Use Industries) Market: Sales Value (in Million USD), 2019 & 2024

Figure 34: Global: Water Soluble Film (Other End-Use Industries) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 35: North America: Water Soluble Film Market: Sales Value (in Million USD), 2019 & 2024

Figure 36: North America: Water Soluble Film Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 37: Europe: Water Soluble Film Market: Sales Value (in Million USD), 2019 & 2024

Figure 38: Europe: Water Soluble Film Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 39: Asia Pacific: Water Soluble Film Market: Sales Value (in Million USD), 2019 & 2024

Figure 40: Asia Pacific: Water Soluble Film Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 41: Middle East and Africa: Water Soluble Film Market: Sales Value (in Million USD), 2019 & 2024

Figure 42: Middle East and Africa: Water Soluble Film Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 43: Latin America: Water Soluble Film Market: Sales Value (in Million USD), 2019 & 2024

Figure 44: Latin America: Water Soluble Film Market Forecast: Sales Value (in Million USD), 2025-2033

List of Tables

Table 1: Global: Water Soluble Film Market: Key Industry Highlights, 2024 and 2033

Table 2: Global: Water Soluble Film Market Forecast: Breakup by Material (in Million USD), 2025-2033

Table 3: Global: Water Soluble Film Market Forecast: Breakup by Application (in Million USD), 2025-2033

Table 4: Global: Water Soluble Film Market Forecast: Breakup by End-Use Industry (in Million USD), 2025-2033

Table 5: Global: Water Soluble Film Market Forecast: Breakup by Region (in Million USD), 2025-2033

Table 6: Global: Water Soluble Film Market: Competitive Structure

Table 7: Global: Water Soluble Film Market: Key Players

Companies Mentioned

- Kuraray Co. Ltd.

- Nippon Synthetic Chemical Industry Co. Ltd.

- Sekisui Chemical Co. Ltd.

- Aicello Corporation

- Arrow GreenTech Ltd.

- Cortec Corporation

- Changzhou Kelin PVA Water Soluble Films Co. Ltd.

- Jiangmen Proudly Water-soluble Plastic Co. Ltd.

- AMC (UK) Ltd.

- 3M Company

- Mitsubishi Chemical Corporation

- DuPont de Nemours Inc.

- Fujian Zhongsu Biodegradable Films Co. Ltd.

- Dezhou Huamao Textile Co. Ltd.

- Neptun Technologies GmbH

Table Information

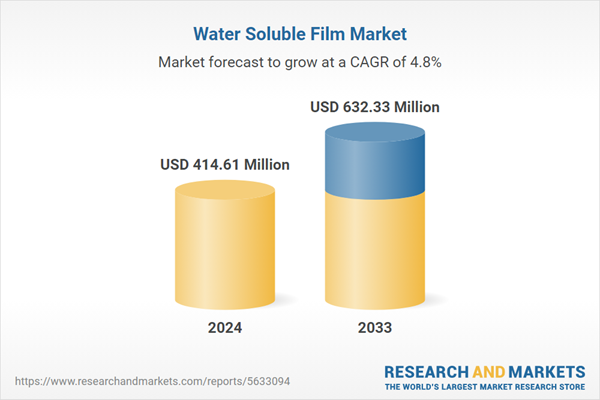

| Report Attribute | Details |

|---|---|

| No. of Pages | 137 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 414.61 Million |

| Forecasted Market Value ( USD | $ 632.33 Million |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |