An automotive switch is an electrical component designed specifically for use in vehicles to control various functions and systems. It acts as a mechanism that allows the driver or passengers to operate different functions within the vehicle, such as turning lights on and off, adjusting the wipers, controlling the windows, activating the air conditioning or heating, or engaging other electronic systems. Automotive switches are typically designed for durability, with the ability to withstand the demanding conditions of the automotive environment, including temperature fluctuations, vibrations, and exposure to moisture and dust. They are often positioned within easy reach of the driver or passengers, ensuring convenient and intuitive operation.

These switches can be activated through a variety of mechanisms, including push buttons, rocker switches, toggle switches, rotary switches, or touch-sensitive panels. Overall, automotive switches play a vital role in providing convenient and reliable control over the various electrical functions and systems within a vehicle, enhancing safety, comfort, and convenience for the occupants.

The market is driven by the increasing focus on vehicle interior aesthetics. This has led to the demand for visually appealing and ergonomic switch designs that enhance the overall appearance and user experience within the vehicle cabin. Additionally, the growing adoption of Advanced Driver Assistance Systems (ADAS) and connected car features fuels the demand for automotive switches that control these functionalities, providing enhanced safety and connectivity for consumers.

The development of autonomous vehicles also presents new opportunities for manufacturers as switches play a vital role in controlling various autonomous driving modes and passenger comfort settings. Moreover, the increasing demand for customization and personalization in vehicles drives the market growth, allowing consumers to select switches that align with their individual preferences.

Automotive Switch Market Trends/Drivers:

Continual Technological Advancements

Technological advancements in the automotive industry are bolstering the growth of the market. The integration of advanced electronic systems and features in vehicles, such as infotainment systems, navigation systems, and ADAS, requires a wide range of switches for control and activation. Touch-sensitive panels or capacitive switches are increasingly being used to provide a sleek and modern interface for controlling various vehicle functions. Moreover, the development of smart switches with features like backlighting, haptic feedback, and gesture recognition further enhances the user experience. As automotive technology continues to evolve, the demand for innovative and sophisticated automotive switches is expected to increase.Increasing Vehicle Production

The steady growth in global vehicle production is a key driver for the market. Emerging economies, such as China, India, and Brazil, have witnessed significant expansion in their automotive manufacturing sectors, leading to higher production volumes. With each vehicle requiring multiple switches for functions like lighting, HVAC controls, power windows, and more, the rise in vehicle production directly contributes to the product demand. Additionally, as automotive manufacturers strive to differentiate their products through advanced features and customization options, the demand for specialized switches tailored to specific vehicle models also increases.Growing Demand for Electric Vehicles (EVs)

The increasing popularity of electric vehicles (EVs) is another significant factor contributing to the global market. The shift towards EVs is driven by environmental concerns, government regulations promoting clean energy, and advancements in battery technology. EVs require specific switches for managing battery systems, power distribution, and charging functionalities.

Additionally, EVs often incorporate advanced driver assistance features, infotainment systems, and sophisticated interior controls, all of which require dedicated switches. The rapid growth of the EV market, along with the expanding charging infrastructure, is expected to propel the demand for products designed specifically for electric vehicles. As the adoption of EVs continues to rise globally, the market will experience a substantial boost in demand from this segment.

Automotive Switch Industry Segmentation:

The research provides an analysis of the key trends in each segment of the global automotive switch market report, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on type, design, vehicle type and sales channel.Breakup by Type:

- Ignition Switches

- HVAC Switches

- Steering Wheel Switches

- Window Switches

- Overhead Console Switches

- Seat Control Switches

- Door Switches

- Hazard Switches

- Multi-Purpose Switches

- Other.

HVAC switches represents the largest market segment

The report has provided a detailed breakup and analysis of the market based on the type. This includes ignition switches, HVAC switches, steering wheel switches, window switches, overhead console switches, seat control switches, door switches, hazard switches, multi-purpose switches, and others. According to the report, HVAC switches represented the largest segment.HVAC switches play a crucial role in controlling the climate control functions within vehicles, including temperature regulation, fan speed adjustment, and air distribution. These switches enable occupants to customize the interior environment of the vehicle according to their comfort preferences. Additionally, with the increasing demand for advanced automotive features and luxury vehicles, the complexity and sophistication of HVAC systems have also grown. This, in turn, drives the demand for more advanced and multifunctional HVAC switches that can control a wide range of climate control settings accurately.

Furthermore, regulations regarding energy efficiency and environmental concerns have led to the development of innovative HVAC systems with improved performance and reduced energy consumption. The integration of advanced HVAC switches with features like eco-mode, intelligent temperature control, and energy-saving algorithms has become crucial in meeting these requirements.

Breakup by Design:

- Rocker Switches

- Rotary Switches

- Toggle Switches

- Push Switches

- Other.

Push switches accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the design. This includes rocker switches, rotary switches, toggle switches, push switches and others. According to the report, push switches represented the largest segment.Push switches are widely used in various applications within vehicles due to their simplicity, reliability, and ease of use. These switches are typically designed with a push-button mechanism that is engaged by pressing the button, which makes them suitable for a range of functions requiring on/off or momentary control. These switches offer a straightforward and intuitive operation, making them user-friendly for drivers and passengers. Their design allows for quick and easy activation or deactivation of functions such as lighting, window control, door locks, and hazard warning systems. They are also known for their robustness and durability. They are designed to withstand mechanical stresses, vibrations, temperature fluctuations, and exposure to moisture and dust.

Breakup by Vehicle Type:

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicle.

Passenger cars represents the largest market segment

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger cars, light commercial vehicles, heavy commercial vehicles. According to the report, passenger cars represented the largest segment.Passenger cars are in high demand due to their versatility, convenience, and suitability for daily commuting, family transportation, and personal use. Additionally, these cars typically require a larger number and variety of switches compared to other vehicle types since they offer a wide range of features and functionalities that necessitate multiple switches for controlling various systems.

These systems include lighting, HVAC, audio and entertainment, power windows and mirrors, wipers, and many other functions. Moreover, passenger cars are often equipped with advanced features and technology-driven systems, such as infotainment systems, driver assistance systems, and comfort-enhancing features. These sophisticated systems rely on a multitude of switches for operation, further driving the demand for automotive switches in the passenger car segment.

Breakup by Sales Channel:

- Original Equipment Manufacturers

- Aftermarke.

Original Equipment Manufacturers accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the sales channel. This includes original equipment manufacturers and aftermarket. According to the report, original equipment manufacturers represented the largest segment.Original Equipment Manufacturers (OEMs) refer to the companies that design and manufacture vehicles or vehicle components directly for the original equipment installation during the production process. OEMs have direct partnerships with vehicle manufacturers, supplying them with automotive switches as original equipment for new vehicle production. These switches are integrated into the vehicle's interior or control panels during the manufacturing process.

The high volume of vehicle production by OEMs contributes to their significant market share in terms of sales. Besides, OEMs have in-depth knowledge of the specific vehicle models, their specifications, and the required switch designs. They work closely with automakers to develop switches that meet the vehicle's functional and design requirements. This close collaboration ensures seamless integration and compatibility with the overall vehicle system.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Afric.

Asia Pacific exhibits a clear dominance, accounting for the largest automotive switch market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa.Asia Pacific, including China, Japan, South Korea, and India, have a robust automotive industry with significant production capabilities. The high volume of vehicle production in Asia Pacific directly drives the demand for automotive switches, as each vehicle requires multiple switches for various functions. In addition to this, the region's growing population and rising disposable incomes have led to increased vehicle ownership and demand for automobiles. The expanding middle class and urbanization have fueled the need for personal transportation, driving the sales of passenger cars and other vehicle types.

This significant increase in vehicle sales, especially in emerging economies, has contributed to the growth of the market in Asia Pacific. Additionally, the region's focus on electric and hybrid vehicles to address environmental concerns and reduce dependence on fossil fuels has led to an increased adoption of automotive switches for alternative powertrain vehicles.

Competitive Landscape:

Top manufacturers in the market heavily invest in research and development activities to enhance their product offerings. They strive to develop innovative switch designs that align with emerging automotive technologies, such as advanced driver assistance systems (ADAS), vehicle connectivity features, and electric vehicle applications. R&D efforts also focus on improving switch performance, durability, and customization options. Numerous automotive switch manufacturers conduct rigorous quality assurance processes to ensure their switches meet strict industry standards and customer expectations.This involves conducting various tests and inspections to validate the switches' durability, electrical performance, resistance to environmental factors, and compliance with safety regulations. Moreover, companies in the market work closely with automotive OEMs and other customers to understand their specific requirements. This collaboration includes customizing switch designs, providing technical support, and offering tailored solutions. Manufacturers strive to build strong partnerships and provide excellent customer service to maintain long-term relationships.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Alps Alpine Co. Ltd.

- C&K

- Eaton Corporation PLC

- HELLA GmbH & Co. KGaA (Faurecia SE)

- INENSY

- Johnson Electric Holdings Limited

- Marquardt Group

- Omron Corporation

- Panasonic Holdings Corporation

- Preh GmbH

- TokaiRika Co. Ltd

- Valeo

- ZF Friedrichshafen AG (Zeppelin-Stiftung.

Key Questions Answered in This Report

- How big is the automotive switch market?

- What is the future outlook of automotive switch market?

- What are the key factors driving the automotive switch market?

- Which region accounts for the largest automotive switch market share?

- Which are the leading companies in the global automotive switch market?

Table of Contents

Companies Mentioned

- Alps Alpine Co. Ltd.

- C&K

- Eaton Corporation PLC

- HELLA GmbH & Co. KGaA (Faurecia SE)

- INENSY

- Johnson Electric Holdings Limited

- Marquardt Group

- Omron Corporation

- Panasonic Holdings Corporation

- Preh GmbH

- TokaiRika Co. Ltd

- Valeo

- ZF Friedrichshafen AG (Zeppelin-Stiftung)

Table Information

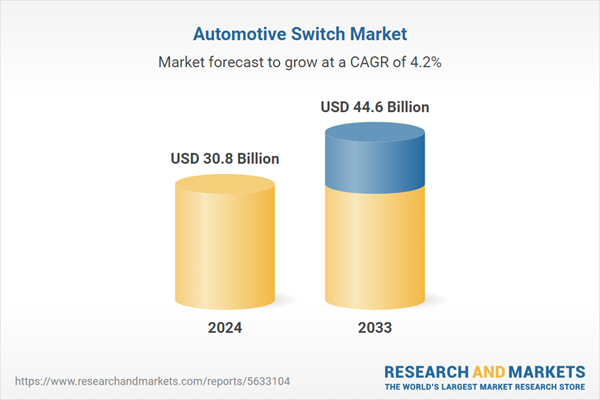

| Report Attribute | Details |

|---|---|

| No. of Pages | 140 |

| Published | June 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 30.8 Billion |

| Forecasted Market Value ( USD | $ 44.6 Billion |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |