Global Mechanical Ventilators Market Analysis:

- Major Market Drivers: The growing prevalence of several respiratory disorders, including COPD, asthma, and pneumonia and the rising geriatric population are catalyzing the mechanical ventilators market growth. Besides this, the ongoing innovations, such as the development of improved ventilator portability, modes, and user interfaces are further stimulating the market expansion.

- Key Market Trends: The inflating healthcare expenditure, mainly in developing economies, and the escalating demand for user-friendly and portable devices in homecare settings, on account of the emerging trend of home-based medical care, are propelling the medical ventilators market demand. Moreover, the market is continuing to grow as a result of the widespread use of intelligent variations with automated functions and cutting-edge monitoring capabilities.

- Competitive Landscape: Some of the major market players in the mechanical ventilators market share include Allied Healthcare Products, Air Liquide, Asahi Kasei, GE Healthcare Company, Hamilton Medical AG, Maquet GmbH & Co. KG (Gatenge), Medtronic Plc, Mindray Medical International Ltd., Philips Healthcare, ResMed, Smiths Group Plc, and Vyaire Medical Inc., among others.

- Geographical Trends: North America represents a significant driver of the mechanical ventilators market forecast, owing to its advanced healthcare infrastructure and the inflating medical expenditures of individuals. Besides this, the increasing focus of Europe on healthcare quality and patient safety is further catalyzing the market forward. Moreover, in the Asia Pacific region, the rising aging population is positively influencing the market growth. Moreover, the inflating medical care spending by individuals in Latin America and Middle East and Africa and the increasing awareness towards respiratory diseases are augmenting the market expansion.

- Challenges and Opportunities: One of the major challenges of the mechanical ventilators market trends include the shortage of essential medical equipment and regular maintenance and servicing of devices, which is costly and time-consuming. However, the continuous advances in technology, including AI and remote monitoring, and the emerging trend of home-healthcare are presenting significant growth opportunities for the market.

Global Mechanical Ventilators Market Trends:

Increasing Cases of Chronic Respiratory Conditions

The rising cases of chronic respiratory conditions, including asthma, acute obstructive pulmonary disease, and pneumonia are primarily driving the mechanical ventilators market statistics. Moreover, the outbreak of the COVID-19 pandemic across the globe had increased mortality, morbidity, and healthcare costs, which is propelling the market growth forward. Therefore, various medical facilities are focusing highly on control measures and infection prevention to minimize the cases of such respiratory diseases. For instance, the National Council on Aging data indicated that Obstructive Sleep Apnea (OSA), characterized by irregular breathing and reduced oxygen supply to the brain, affected about 39 million adults in the U.S. and an estimated 936 million globally. Additionally, as per the American Lung Association, chronic obstructive pulmonary disease (COPD) is the third leading cause of death by disease in the United States. More than 16.4 million people have been diagnosed with chronic obstructive pulmonary disease.Technological Advancements

The ongoing technological advances, such as improved ventilator portability, modes, and user interfaces, are augmenting the mechanical ventilators market. Moreover, the growing popularity of portable and user-friendly devices in home settings, on account of the emerging trend of home-based medical care, is catalyzing the global market. Besides this, the introduction of smart mechanical ventilator variants with automated features and advanced monitoring capabilities is also positively influencing the market growth. For example, Max Ventilator introduced non-invasive ventilators featuring humidifiers and oxygen therapy capabilities, demonstrating versatility in applications for adult and neonatal care. Additionally, Nihon Kohden OrangeMed, Inc. received U.S. FDA clearance for the NKV-330 Ventilator System, which is non-invasive and provides respiratory support in emergencies.Launch of Government Initiatives

The launch of several policies and initiatives by government bodies across countries, including public health campaigns to raise awareness about respiratory illnesses and the importance of early detection and treatment is positively influencing the mechanical ventilators market outlook. In addition to this, the inflating investments by regulatory authorities in research and development efforts for the introduction of the latest and improved mechanical ventilators are also propelling the market expansion. Moreover, the advancing healthcare infrastructures, along with the increasing number of training programs and seminars for medical professionals are further catalyzing the mechanical ventilators market revenue. For instance, CAIRE Inc.’s FreeStyle Comfort portable oxygen concentrator was authorized for reimbursement in France and Germany, enhancing patient access. The company extended its oxygen therapy modalities product portfolio through this launch. Furthermore, CorVent Medical received CE Mark approval and launched commercial use of its RESPOND-19 Ventilator in Europe. The novel system is designed for easy-to-use, flexible expansion of critical care ventilation capacity to allow hospitals to improve the treatment of critically ill patients suffering from acute respiratory distress syndrome (ARDS).Global Mechanical Ventilators Market Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on product type, interface, age group, mode of ventilation and end-use.Breakup by Product Type:

- Intensive Care Ventilators

- Portable/Ambulatory Ventilators

- Others

Intensive care ventilators are developed for usage in critical care settings, such as intensive care units (ICUs) and emergency departments. They are capable of offering an advanced respiratory support to patients with severe respiratory failure or other critical conditions. On the other hand, portable/ambulatory ventilators are designed for use outside of traditional hospital settings, including in-home care, ambulances, or other transport settings. They are smaller, lighter, and more portable than intensive care variants, making them suitable for use in various places.

Breakup by Interface:

- Invasive Ventilation

- Non-Invasive Ventilation

Invasive ventilation typically comprises the insertion of a tube into the patient's airway, usually through the mouth or nose (endotracheal tube) or via a surgical opening in the neck (tracheostomy tube). This allows the ventilator to deliver air or oxygen directly into the lungs. Invasive ventilation is generally utilized for patients with severe respiratory failure or who are unable to breathe on their own. Moreover, non-invasive ventilation does not need the insertion of a tube into the airway of the individual. Instead, it uses a mask or similar device to deliver air or oxygen to the patient's lungs. Non-invasive ventilation is often used for patients with less severe respiratory failure or for patients who are able to breathe on their own but require the additional support.

Breakup by Age Group:

- Pediatric

- Adult

- Geriatric

Pediatric ventilators are specifically created for infants and children. They are smaller in size and have features that cater to the unique respiratory needs of pediatric patients. These devices often include specialized modes and settings to deliver the appropriate level of support for smaller lungs and airways. Besides this, adult ventilators are designed for use in adult patients. They are larger and more robust than pediatric derivatives and are capable of providing the higher tidal volumes and pressures demanded for adult respiratory support. On the other hand, geriatric patients, who are typically older adults, may require ventilator support, owing to age-related respiratory conditions or complications.

Breakup by Mode of Ventilation:

- Combined Mode of Ventilation

- Volume Mode of Ventilation

- Pressure Mode of Ventilation

- Other Mode of Ventilation

Combined mode of ventilation, also referred to as dual or hybrid mode, combines the aspects of volume and pressure ventilation. It allows the ventilator to adjust the inspiratory pressure to maintain a set tidal volume, providing a more flexible and adaptable ventilation. Moreover, in volume mode of ventilation, the ventilator supplies a set tidal volume to the patient with each breath. This mode is commonly used in patients with normal lung compliance or when precise control over tidal volume is required, such as in acute respiratory distress syndrome (ARDS). Besides this, in pressure mode of ventilation, the ventilator delivers a set inspiratory pressure to the individual, allowing for a more variable tidal volume based on the lung compliance and resistance of the patient.

Breakup by End-Use:

- Hospitals and Clinics

- Home Care

- Ambulatory Care Centers

- Others

In hospitals and clinics, mechanical ventilators are utilized in intensive care units (ICUs), emergency departments, operating rooms, and general wards to support patients with acute respiratory failure, respiratory distress, or other conditions that require assisted ventilation. Additionally, these devices are increasingly being used in homecare settings to provide long-term respiratory support to patients with chronic respiratory conditions, such as chronic obstructive pulmonary disease (COPD), neuromuscular disorders, or spinal cord injuries. Furthermore, ambulatory care centers, also known as outpatient clinics or day surgery centers, may utilize mechanical ventilators for patients undergoing procedures that require sedation or anesthesia, including endoscopic procedures or minor surgeries.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America represents a significant region of the mechanical ventilators market overview, owing to its advanced healthcare infrastructure and the inflating medical expenditures of individuals. Besides this, the increasing focus of Europe on healthcare quality and patient safety is further catalyzing the market forward. Moreover, in the Asia Pacific region, the rising aging population is positively influencing the market growth. Besides this, the inflating medical care spending by individuals in Latin America and Middle East and Africa and the increasing awareness towards respiratory diseases are augmenting the market expansion. For instance, according to a report published by the Centers for Disease Control and Prevention (CDC), out of all the hospitalizations caused by COVID-19, over 53% of patients were admitted to the intensive care unit. Additionally, based on a research study by Silvio A. Ñamendys-Silva et al., published in Critical Care, in Mexico, about 15.3% of hospitalized patients require invasive mechanical ventilation (IMV), and 70.8% of patients receive invasive mechanical ventilation (IMV) outside the ICU.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the major market players in the Mechanical Ventilators industry include:- Allied Healthcare Products

- Air Liquide

- Asahi Kasei

- GE Healthcare Company

- Hamilton Medical AG

- Maquet GmbH & Co. KG (Gatenge)

- Medtronic Plc

- Mindray Medical International Ltd.

- Philips Healthcare

- ResMed

- Smiths Group Plc

- Vyaire Medical Inc.

Key Questions Answered in This Report

1. How big is the mechanical ventilators market?2. What is the future outlook of mechanical ventilators market?

3. What are the key factors driving the mechanical ventilators market?

4. Which region accounts for the largest mechanical ventilators market share?

5. Which are the leading companies in the global mechanical ventilators market?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 COVID-19 Impact on the Industry

6 Global Mechanical Ventilators Market

6.1 Market Overview

6.2 Market Performance

6.3 Market Forecast

7 Market Breakup by Product Type

7.1 Intensive Care Ventilators

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 Portable/Ambulatory Ventilators

7.2.1 Market Trends

7.2.2 Market Forecast

7.3 Others

7.3.1 Market Trends

7.3.2 Market Forecast

8 Market Breakup by Interface

8.1 Invasive Ventilation

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 Non-Invasive Ventilation

8.2.1 Market Trends

8.2.2 Market Forecast

9 Market Breakup by Age Group

9.1 Pediatric

9.1.1 Market Trends

9.1.2 Market Forecast

9.2 Adult

9.2.1 Market Trends

9.2.2 Market Forecast

9.3 Geriatric

9.3.1 Market Trends

9.3.2 Market Forecast

10 Market Breakup by Mode of Ventilation

10.1 Combined Mode of Ventilation

10.1.1 Market Trends

10.1.2 Market Forecast

10.2 Volume Mode of Ventilation

10.2.1 Market Trends

10.2.2 Market Forecast

10.3 Pressure Mode of Ventilation

10.3.1 Market Trends

10.3.2 Market Forecast

10.4 Other Mode of Ventilation

10.4.1 Market Trends

10.4.2 Market Forecast

11 Market Breakup by End-Use

11.1 Hospitals and Clinics

11.1.1 Market Trends

11.1.2 Market Forecast

11.2 Home Care

11.2.1 Market Trends

11.2.2 Market Forecast

11.3 Ambulatory Care Centers

11.3.1 Market Trends

11.3.2 Market Forecast

11.4 Others

11.4.1 Market Trends

11.4.2 Market Forecast

12 Market Breakup by Region

12.1 North America

12.1.1 United States

12.1.1.1 Market Trends

12.1.1.2 Market Forecast

12.1.2 Canada

12.1.2.1 Market Trends

12.1.2.2 Market Forecast

12.2 Asia Pacific

12.2.1 China

12.2.1.1 Market Trends

12.2.1.2 Market Forecast

12.2.2 Japan

12.2.2.1 Market Trends

12.2.2.2 Market Forecast

12.2.3 India

12.2.3.1 Market Trends

12.2.3.2 Market Forecast

12.2.4 South Korea

12.2.4.1 Market Trends

12.2.4.2 Market Forecast

12.2.5 Australia

12.2.5.1 Market Trends

12.2.5.2 Market Forecast

12.2.6 Indonesia

12.2.6.1 Market Trends

12.2.6.2 Market Forecast

12.2.7 Others

12.2.7.1 Market Trends

12.2.7.2 Market Forecast

12.3 Europe

12.3.1 Germany

12.3.1.1 Market Trends

12.3.1.2 Market Forecast

12.3.2 France

12.3.2.1 Market Trends

12.3.2.2 Market Forecast

12.3.3 United Kingdom

12.3.3.1 Market Trends

12.3.3.2 Market Forecast

12.3.4 Italy

12.3.4.1 Market Trends

12.3.4.2 Market Forecast

12.3.5 Spain

12.3.5.1 Market Trends

12.3.5.2 Market Forecast

12.3.6 Russia

12.3.6.1 Market Trends

12.3.6.2 Market Forecast

12.3.7 Others

12.3.7.1 Market Trends

12.3.7.2 Market Forecast

12.4 Latin America

12.4.1 Brazil

12.4.1.1 Market Trends

12.4.1.2 Market Forecast

12.4.2 Mexico

12.4.2.1 Market Trends

12.4.2.2 Market Forecast

12.4.3 Others

12.4.3.1 Market Trends

12.4.3.2 Market Forecast

12.5 Middle East and Africa

12.5.1 Market Trends

12.5.2 Market Breakup by Country

12.5.3 Market Forecast

13 SWOT Analysis

13.1 Overview

13.2 Strengths

13.3 Weaknesses

13.4 Opportunities

13.5 Threats

14 Value Chain Analysis

15 Porters Five Forces Analysis

15.1 Overview

15.2 Bargaining Power of Buyers

15.3 Bargaining Power of Suppliers

15.4 Degree of Competition

15.5 Threat of New Entrants

15.6 Threat of Substitutes

16 Competitive Landscape

16.1 Market Structure

16.2 Key Players

16.3 Profiles of Key Players

16.3.1 Allied Healthcare Products

16.3.1.1 Company Overview

16.3.1.2 Product Portfolio

16.3.1.3 Financials

16.3.1.4 SWOT Analysis

16.3.2 Air Liquide

16.3.2.1 Company Overview

16.3.2.2 Product Portfolio

16.3.3 Asahi Kasei

16.3.3.1 Company Overview

16.3.3.2 Product Portfolio

16.3.3.3 Financials

16.3.3.4 SWOT Analysis

16.3.4 GE Healthcare Company

16.3.4.1 Company Overview

16.3.4.2 Product Portfolio

16.3.5 Hamilton Medical AG

16.3.5.1 Company Overview

16.3.5.2 Product Portfolio

16.3.6 Maquet GmbH & Co. KG (Gatenge)

16.3.6.1 Company Overview

16.3.6.2 Product Portfolio

16.3.6.3 Financials

16.3.6.4 SWOT Analysis

16.3.7 Medtronic Plc

16.3.7.1 Company Overview

16.3.7.2 Product Portfolio

16.3.8 Mindray Medical International Ltd.

16.3.8.1 Company Overview

16.3.8.2 Product Portfolio

16.3.9 Philips Healthcare

16.3.9.1 Company Overview

16.3.9.2 Product Portfolio

16.3.10 ResMed

16.3.10.1 Company Overview

16.3.10.2 Product Portfolio

16.3.10.3 Financials

16.3.10.4 SWOT Analysis

16.3.11 Smiths Group Plc

16.3.11.1 Company Overview

16.3.11.2 Product Portfolio

16.3.12 Vyaire Medical Inc.

16.3.12.1 Company Overview

16.3.12.2 Product Portfolio

List of Figures

Figure 1: Global: Mechanical Ventilators Market: Major Drivers and Challenges

Figure 2: Global: Mechanical Ventilators Market: Sales Value (in Billion USD), 2019-2024

Figure 3: Global: Mechanical Ventilators Market: Breakup by Product Type (in %), 2024

Figure 4: Global: Mechanical Ventilators Market: Breakup by Interface (in %), 2024

Figure 5: Global: Mechanical Ventilators Market: Breakup by Age Group (in %), 2024

Figure 6: Global: Mechanical Ventilators Market: Breakup by Mode of Ventilation (in %), 2024

Figure 7: Global: Mechanical Ventilators Market: Breakup by End-Use (in %), 2024

Figure 8: Global: Mechanical Ventilators Market: Breakup by Region (in %), 2024

Figure 9: Global: Mechanical Ventilators Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 10: Global: Mechanical Ventilators (Intensive Care Ventilators) Market: Sales Value (in Million USD), 2019 & 2024

Figure 11: Global: Mechanical Ventilators (Intensive Care Ventilators) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 12: Global: Mechanical Ventilators (Portable/Ambulatory Ventilators) Market: Sales Value (in Million USD), 2019 & 2024

Figure 13: Global: Mechanical Ventilators (Portable/Ambulatory Ventilators) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 14: Global: Mechanical Ventilators (Others) Market: Sales Value (in Million USD), 2019 & 2024

Figure 15: Global: Mechanical Ventilators (Others) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 16: Global: Mechanical Ventilators (Invasive Ventilation) Market: Sales Value (in Million USD), 2019 & 2024

Figure 17: Global: Mechanical Ventilators (Invasive Ventilation) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 18: Global: Mechanical Ventilators (Non-Invasive Ventilation) Market: Sales Value (in Million USD), 2019 & 2024

Figure 19: Global: Mechanical Ventilators (Non-Invasive Ventilation) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 20: Global: Mechanical Ventilators (Pediatric) Market: Sales Value (in Million USD), 2019 & 2024

Figure 21: Global: Mechanical Ventilators (Pediatric) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 22: Global: Mechanical Ventilators (Adult) Market: Sales Value (in Million USD), 2019 & 2024

Figure 23: Global: Mechanical Ventilators (Adult) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 24: Global: Mechanical Ventilators (Geriatric) Market: Sales Value (in Million USD), 2019 & 2024

Figure 25: Global: Mechanical Ventilators (Geriatric) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 26: Global: Mechanical Ventilators (Combined Mode of Ventilation) Market: Sales Value (in Million USD), 2019 & 2024

Figure 27: Global: Mechanical Ventilators (Combined Mode of Ventilation) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 28: Global: Mechanical Ventilators (Volume Mode of Ventilation) Market: Sales Value (in Million USD), 2019 & 2024

Figure 29: Global: Mechanical Ventilators (Volume Mode of Ventilation) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 30: Global: Mechanical Ventilators (Pressure Mode of Ventilation) Market: Sales Value (in Million USD), 2019 & 2024

Figure 31: Global: Mechanical Ventilators (Pressure Mode of Ventilation) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 32: Global: Mechanical Ventilators (Other Mode of Ventilation) Market: Sales Value (in Million USD), 2019 & 2024

Figure 33: Global: Mechanical Ventilators (Other Mode of Ventilation) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 34: Global: Mechanical Ventilators (Hospitals and Clinics) Market: Sales Value (in Million USD), 2019 & 2024

Figure 35: Global: Mechanical Ventilators (Hospitals and Clinics) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 36: Global: Mechanical Ventilators (Home Care) Market: Sales Value (in Million USD), 2019 & 2024

Figure 37: Global: Mechanical Ventilators (Home Care) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 38: Global: Mechanical Ventilators (Ambulatory Care Centers) Market: Sales Value (in Million USD), 2019 & 2024

Figure 39: Global: Mechanical Ventilators (Ambulatory Care Centers) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 40: Global: Mechanical Ventilators (Others) Market: Sales Value (in Million USD), 2019 & 2024

Figure 41: Global: Mechanical Ventilators (Others) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 42: North America: Mechanical Ventilators Market: Sales Value (in Million USD), 2019 & 2024

Figure 43: North America: Mechanical Ventilators Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 44: United States: Mechanical Ventilators Market: Sales Value (in Million USD), 2019 & 2024

Figure 45: United States: Mechanical Ventilators Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 46: Canada: Mechanical Ventilators Market: Sales Value (in Million USD), 2019 & 2024

Figure 47: Canada: Mechanical Ventilators Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 48: Asia Pacific: Mechanical Ventilators Market: Sales Value (in Million USD), 2019 & 2024

Figure 49: Asia Pacific: Mechanical Ventilators Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 50: China: Mechanical Ventilators Market: Sales Value (in Million USD), 2019 & 2024

Figure 51: China: Mechanical Ventilators Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 52: Japan: Mechanical Ventilators Market: Sales Value (in Million USD), 2019 & 2024

Figure 53: Japan: Mechanical Ventilators Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 54: India: Mechanical Ventilators Market: Sales Value (in Million USD), 2019 & 2024

Figure 55: India: Mechanical Ventilators Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 56: South Korea: Mechanical Ventilators Market: Sales Value (in Million USD), 2019 & 2024

Figure 57: South Korea: Mechanical Ventilators Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 58: Australia: Mechanical Ventilators Market: Sales Value (in Million USD), 2019 & 2024

Figure 59: Australia: Mechanical Ventilators Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 60: Indonesia: Mechanical Ventilators Market: Sales Value (in Million USD), 2019 & 2024

Figure 61: Indonesia: Mechanical Ventilators Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 62: Others: Mechanical Ventilators Market: Sales Value (in Million USD), 2019 & 2024

Figure 63: Others: Mechanical Ventilators Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 64: Europe: Mechanical Ventilators Market: Sales Value (in Million USD), 2019 & 2024

Figure 65: Europe: Mechanical Ventilators Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 66: Germany: Mechanical Ventilators Market: Sales Value (in Million USD), 2019 & 2024

Figure 67: Germany: Mechanical Ventilators Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 68: France: Mechanical Ventilators Market: Sales Value (in Million USD), 2019 & 2024

Figure 69: France: Mechanical Ventilators Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 70: United Kingdom: Mechanical Ventilators Market: Sales Value (in Million USD), 2019 & 2024

Figure 71: United Kingdom: Mechanical Ventilators Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 72: Italy: Mechanical Ventilators Market: Sales Value (in Million USD), 2019 & 2024

Figure 73: Italy: Mechanical Ventilators Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 74: Spain: Mechanical Ventilators Market: Sales Value (in Million USD), 2019 & 2024

Figure 75: Spain: Mechanical Ventilators Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 76: Russia: Mechanical Ventilators Market: Sales Value (in Million USD), 2019 & 2024

Figure 77: Russia: Mechanical Ventilators Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 78: Others: Mechanical Ventilators Market: Sales Value (in Million USD), 2019 & 2024

Figure 79: Others: Mechanical Ventilators Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 80: Latin America: Mechanical Ventilators Market: Sales Value (in Million USD), 2019 & 2024

Figure 81: Latin America: Mechanical Ventilators Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 82: Brazil: Mechanical Ventilators Market: Sales Value (in Million USD), 2019 & 2024

Figure 83: Brazil: Mechanical Ventilators Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 84: Mexico: Mechanical Ventilators Market: Sales Value (in Million USD), 2019 & 2024

Figure 85: Mexico: Mechanical Ventilators Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 86: Others: Mechanical Ventilators Market: Sales Value (in Million USD), 2019 & 2024

Figure 87: Others: Mechanical Ventilators Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 88: Middle East and Africa: Mechanical Ventilators Market: Sales Value (in Million USD), 2019 & 2024

Figure 89: Middle East and Africa: Mechanical Ventilators Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 90: Global: Mechanical Ventilators Industry: SWOT Analysis

Figure 91: Global: Mechanical Ventilators Industry: Value Chain Analysis

Figure 92: Global: Mechanical Ventilators Industry: Porter’s Five Forces Analysis

List of Tables

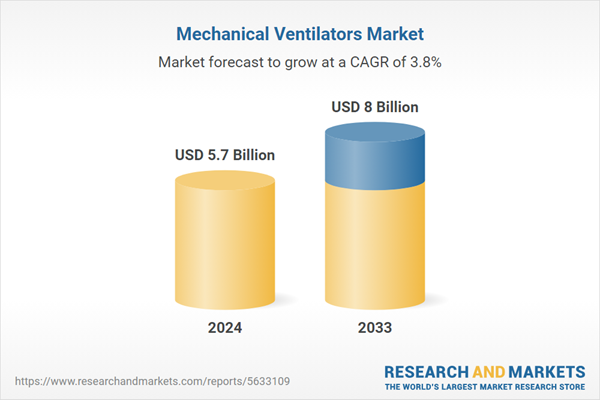

Table 1: Global: Mechanical Ventilators Market: Key Industry Highlights, 2024 and 2033

Table 2: Global: Mechanical Ventilators Market Forecast: Breakup by Product Type (in Million USD), 2025-2033

Table 3: Global: Mechanical Ventilators Market Forecast: Breakup by Interface (in Million USD), 2025-2033

Table 4: Global: Mechanical Ventilators Market Forecast: Breakup by Age Group (in Million USD), 2025-2033

Table 5: Global: Mechanical Ventilators Market Forecast: Breakup by Mode of Ventilation (in Million USD), 2025-2033

Table 6: Global: Mechanical Ventilators Market Forecast: Breakup by End-Use (in Million USD), 2025-2033

Table 7: Global: Mechanical Ventilators Market Forecast: Breakup by Region (in Million USD), 2025-2033

Table 8: Global: Mechanical Ventilators Market: Competitive Structure

Table 9: Global: Mechanical Ventilators Market: Key Players

Companies Mentioned

- Allied Healthcare Products

- Air Liquide

- Asahi Kasei

- GE Healthcare Company

- Hamilton Medical AG

- Maquet GmbH & Co. KG (Gatenge)

- Medtronic Plc

- Mindray Medical International Ltd.

- Philips Healthcare

- ResMed

- Smiths Group Plc

- Vyaire Medical Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 146 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 5.7 Billion |

| Forecasted Market Value ( USD | $ 8 Billion |

| Compound Annual Growth Rate | 3.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |