Fermentation chemicals are used to catalyze or initiate the chemical process of fermentation in various products. These chemicals are majorly manufactured using vegetable feedstock, such as sugar, corn and starch, and are used in the production of bioplastics, biofuels, polymers and composites, among other products. They are crucial for increasing the pace of the chemical reaction, which contributes to minimize the overall manufacturing cost, fermentation time and energy consumption. Owing to this, these chemicals find extensive applications across various industries, including plastic manufacturing, pharmaceuticals, nutraceuticals, and food and beverages (F&B).

The growing F&B industry, along with rapid industrialization across the globe, represent as the key factors driving the growth of the market. Furthermore, the rising demand for alcoholic beverages is also providing a boost to the market growth. Fermented chemicals are primarily used in the production of various alcoholic beverages and food products, such as breads, cheese and pickles. Additionally, advancements in fermentation technologies have enabled large-scale production of several organic acids, such as lactic, tartaric and fumaric acid, thereby increasing the demand for fermentation chemicals across the globe. Moreover, growing consumer awareness regarding environment-friendly and bio-based raw materials is creating a positive outlook for the market growth. Industries are gradually shifting their focus toward fermentation chemicals as an alternative to their synthetic or petroleum-derived counterparts. An increasing product adoption for the manufacturing of steroids and antibiotics, along with extensive research and development (R&D) activities, are also projected to drive the market further.

Key Market Segmentation:

The publisher provides an analysis of the key trends in each sub-segment of the global fermentation chemicals market report, along with forecasts at the global, regional and country level from 2025-2033. Our report has categorized the market based on product, form and application.Breakup by Product:

- Alcohol

- Enzymes

- Organic Acids

- Others

Breakup by Form:

- Liquid

- Powder

Breakup by Application:

- Industrial Applications

- Food and Beverages

- Nutritional and Pharmaceuticals

- Plastics and Fibers

- Others

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Competitive Landscape:

The competitive landscape of the industry has also been examined with some of the key players being BASF SE, AB Enzymes, Ajinomoto Co. Inc., Amano Enzymes USA, Co., Ltd., Archer Daniels Midland Company (ADM), Cargill Incorporated, Chr. Hansen A/S, Koninklijke DSM N.V., Evonik Industries AG, Novozymes A/S, The Dow Chemical Company, Koch Industries Inc. (Invista BV), etc.Key Questions Answered in This Report

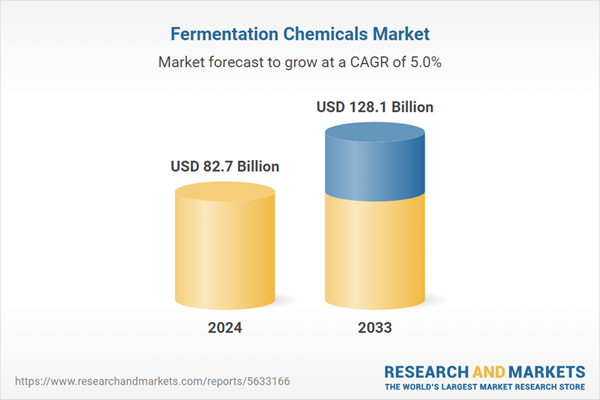

1. What was the size of the global fermentation chemicals market in 2024?2. What is the expected growth rate of the global fermentation chemicals market during 2025-2033?

3. What are the key factors driving the global fermentation chemicals market?

4. What has been the impact of COVID-19 on the global fermentation chemicals market?

5. What is the breakup of the global fermentation chemicals market based on the product?

6. What is the breakup of the global fermentation chemicals market based on the application?

7. What are the key regions in the global fermentation chemicals market?

8. Who are the key players/companies in the global fermentation chemicals market?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global Fermentation Chemicals Market

5.1 Market Overview

5.2 Market Performance

5.3 Impact of COVID-19

5.4 Market Forecast

6 Market Breakup by Product

6.1 Alcohol

6.1.1 Market Trends

6.1.2 Market Forecast

6.2 Enzymes

6.2.1 Market Trends

6.2.2 Market Forecast

6.3 Organic Acids

6.3.1 Market Trends

6.3.2 Market Forecast

6.4 Others

6.4.1 Market Trends

6.4.2 Market Forecast

7 Market Breakup by Form

7.1 Liquid

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 Powder

7.2.1 Market Trends

7.2.2 Market Forecast

8 Market Breakup by Application

8.1 Industrial Applications

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 Food and Beverages

8.2.1 Market Trends

8.2.2 Market Forecast

8.3 Nutritional and Pharmaceuticals

8.3.1 Market Trends

8.3.2 Market Forecast

8.4 Plastics and Fibers

8.4.1 Market Trends

8.4.2 Market Forecast

8.5 Others

8.5.1 Market Trends

8.5.2 Market Forecast

9 Market Breakup by Region

9.1 North America

9.1.1 United States

9.1.1.1 Market Trends

9.1.1.2 Market Forecast

9.1.2 Canada

9.1.2.1 Market Trends

9.1.2.2 Market Forecast

9.2 Europe

9.2.1 Germany

9.2.1.1 Market Trends

9.2.1.2 Market Forecast

9.2.2 France

9.2.2.1 Market Trends

9.2.2.2 Market Forecast

9.2.3 United Kingdom

9.2.3.1 Market Trends

9.2.3.2 Market Forecast

9.2.4 Italy

9.2.4.1 Market Trends

9.2.4.2 Market Forecast

9.2.5 Spain

9.2.5.1 Market Trends

9.2.5.2 Market Forecast

9.2.6 Russia

9.2.6.1 Market Trends

9.2.6.2 Market Forecast

9.2.7 Others

9.2.7.1 Market Trends

9.2.7.2 Market Forecast

9.3 Asia Pacific

9.3.1 China

9.3.1.1 Market Trends

9.3.1.2 Market Forecast

9.3.2 Japan

9.3.2.1 Market Trends

9.3.2.2 Market Forecast

9.3.3 India

9.3.3.1 Market Trends

9.3.3.2 Market Forecast

9.3.4 South Korea

9.3.4.1 Market Trends

9.3.4.2 Market Forecast

9.3.5 Australia

9.3.5.1 Market Trends

9.3.5.2 Market Forecast

9.3.6 Indonesia

9.3.6.1 Market Trends

9.3.6.2 Market Forecast

9.3.7 Others

9.3.7.1 Market Trends

9.3.7.2 Market Forecast

9.4 Latin America

9.4.1 Brazil

9.4.1.1 Market Trends

9.4.1.2 Market Forecast

9.4.2 Mexico

9.4.2.1 Market Trends

9.4.2.2 Market Forecast

9.4.3 Others

9.4.3.1 Market Trends

9.4.3.2 Market Forecast

9.5 Middle East and Africa

9.5.1 Market Trends

9.5.2 Market Breakup by Country

9.5.3 Market Forecast

10 SWOT Analysis

10.1 Overview

10.2 Strengths

10.3 Weaknesses

10.4 Opportunities

10.5 Threats

11 Value Chain Analysis

12 Porters Five Forces Analysis

12.1 Overview

12.2 Bargaining Power of Buyers

12.3 Bargaining Power of Suppliers

12.4 Degree of Competition

12.5 Threat of New Entrants

12.6 Threat of Substitutes

13 Price Analysis

14 Competitive Landscape

14.1 Market Structure

14.2 Key Players

14.3 Profiles of Key Players

14.3.1 BASF SE

14.3.1.1 Company Overview

14.3.1.2 Product Portfolio

14.3.1.3 Financials

14.3.1.4 SWOT Analysis

14.3.2 AB Enzymes

14.3.2.1 Company Overview

14.3.2.2 Product Portfolio

14.3.2.3 Financials

14.3.2.4 SWOT Analysis

14.3.3 Ajinomoto Co. Inc.

14.3.3.1 Company Overview

14.3.3.2 Product Portfolio

14.3.3.3 Financials

14.3.3.4 SWOT Analysis

14.3.4 Amano Enzymes USA, Co., Ltd.

14.3.4.1 Company Overview

14.3.4.2 Product Portfolio

14.3.4.3 Financials

14.3.4.4 SWOT Analysis

14.3.5 Archer Daniels Midland Company (ADM)

14.3.5.1 Company Overview

14.3.5.2 Product Portfolio

14.3.5.3 Financials

14.3.5.4 SWOT Analysis

14.3.6 Cargill Incorporated

14.3.6.1 Company Overview

14.3.6.2 Product Portfolio

14.3.6.3 Financials

14.3.6.4 SWOT Analysis

14.3.7 Chr. Hansen A/S

14.3.7.1 Company Overview

14.3.7.2 Product Portfolio

14.3.7.3 Financials

14.3.7.4 SWOT Analysis

14.3.8 Koninklijke DSM N.V.

14.3.8.1 Company Overview

14.3.8.2 Product Portfolio

14.3.8.3 Financials

14.3.8.4 SWOT Analysis

14.3.9 Evonik Industries AG

14.3.9.1 Company Overview

14.3.9.2 Product Portfolio

14.3.9.3 Financials

14.3.9.4 SWOT Analysis

14.3.10 Novozymes A/S

14.3.10.1 Company Overview

14.3.10.2 Product Portfolio

14.3.10.3 Financials

14.3.10.4 SWOT Analysis

14.3.11 The Dow Chemical Company

14.3.11.1 Company Overview

14.3.11.2 Product Portfolio

14.3.11.3 Financials

14.3.11.4 SWOT Analysis

14.3.12 Koch Industries Inc. (Invista BV)

14.3.12.1 Company Overview

14.3.12.2 Product Portfolio

14.3.12.3 Financials

14.3.12.4 SWOT Analysis

List of Figures

Figure 1: Global: Fermentation Chemicals Market: Major Drivers and Challenges

Figure 2: Global: Fermentation Chemicals Market: Sales Value (in Billion USD), 2019-2024

Figure 3: Global: Fermentation Chemicals Market: Breakup by Product (in %), 2024

Figure 4: Global: Fermentation Chemicals Market: Breakup by Form (in %), 2024

Figure 5: Global: Fermentation Chemicals Market: Breakup by Application (in %), 2024

Figure 6: Global: Fermentation Chemicals Market: Breakup by Region (in %), 2024

Figure 7: Global: Fermentation Chemicals Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 8: Global: Fermentation Chemicals (Alcohol) Market: Sales Value (in Million USD), 2019 & 2024

Figure 9: Global: Fermentation Chemicals (Alcohol) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 10: Global: Fermentation Chemicals (Enzymes) Market: Sales Value (in Million USD), 2019 & 2024

Figure 11: Global: Fermentation Chemicals (Enzymes) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 12: Global: Fermentation Chemicals (Organic Acids) Market: Sales Value (in Million USD), 2019 & 2024

Figure 13: Global: Fermentation Chemicals (Organic Acids) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 14: Global: Fermentation Chemicals (Other Products) Market: Sales Value (in Million USD), 2019 & 2024

Figure 15: Global: Fermentation Chemicals (Other Products) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 16: Global: Fermentation Chemicals (Liquid) Market: Sales Value (in Million USD), 2019 & 2024

Figure 17: Global: Fermentation Chemicals (Liquid) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 18: Global: Fermentation Chemicals (Powder) Market: Sales Value (in Million USD), 2019 & 2024

Figure 19: Global: Fermentation Chemicals (Powder) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 20: Global: Fermentation Chemicals (Industrial Applications) Market: Sales Value (in Million USD), 2019 & 2024

Figure 21: Global: Fermentation Chemicals (Industrial Applications) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 22: Global: Fermentation Chemicals (Food and Beverages) Market: Sales Value (in Million USD), 2019 & 2024

Figure 23: Global: Fermentation Chemicals (Food and Beverages) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 24: Global: Fermentation Chemicals (Nutritional and Pharmaceuticals) Market: Sales Value (in Million USD), 2019 & 2024

Figure 25: Global: Fermentation Chemicals (Nutritional and Pharmaceuticals) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 26: Global: Fermentation Chemicals (Plastics and Fibers) Market: Sales Value (in Million USD), 2019 & 2024

Figure 27: Global: Fermentation Chemicals (Plastics and Fibers) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 28: Global: Fermentation Chemicals (Other Applications) Market: Sales Value (in Million USD), 2019 & 2024

Figure 29: Global: Fermentation Chemicals (Other Applications) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 30: North America: Fermentation Chemicals Market: Sales Value (in Million USD), 2019 & 2024

Figure 31: North America: Fermentation Chemicals Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 32: United States: Fermentation Chemicals Market: Sales Value (in Million USD), 2019 & 2024

Figure 33: United States: Fermentation Chemicals Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 34: Canada: Fermentation Chemicals Market: Sales Value (in Million USD), 2019 & 2024

Figure 35: Canada: Fermentation Chemicals Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 36: Asia Pacific: Fermentation Chemicals Market: Sales Value (in Million USD), 2019 & 2024

Figure 37: Asia Pacific: Fermentation Chemicals Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 38: China: Fermentation Chemicals Market: Sales Value (in Million USD), 2019 & 2024

Figure 39: China: Fermentation Chemicals Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 40: Japan: Fermentation Chemicals Market: Sales Value (in Million USD), 2019 & 2024

Figure 41: Japan: Fermentation Chemicals Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 42: India: Fermentation Chemicals Market: Sales Value (in Million USD), 2019 & 2024

Figure 43: India: Fermentation Chemicals Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 44: South Korea: Fermentation Chemicals Market: Sales Value (in Million USD), 2019 & 2024

Figure 45: South Korea: Fermentation Chemicals Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 46: Australia: Fermentation Chemicals Market: Sales Value (in Million USD), 2019 & 2024

Figure 47: Australia: Fermentation Chemicals Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 48: Indonesia: Fermentation Chemicals Market: Sales Value (in Million USD), 2019 & 2024

Figure 49: Indonesia: Fermentation Chemicals Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 50: Others: Fermentation Chemicals Market: Sales Value (in Million USD), 2019 & 2024

Figure 51: Others: Fermentation Chemicals Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 52: Europe: Fermentation Chemicals Market: Sales Value (in Million USD), 2019 & 2024

Figure 53: Europe: Fermentation Chemicals Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 54: Germany: Fermentation Chemicals Market: Sales Value (in Million USD), 2019 & 2024

Figure 55: Germany: Fermentation Chemicals Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 56: France: Fermentation Chemicals Market: Sales Value (in Million USD), 2019 & 2024

Figure 57: France: Fermentation Chemicals Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 58: United Kingdom: Fermentation Chemicals Market: Sales Value (in Million USD), 2019 & 2024

Figure 59: United Kingdom: Fermentation Chemicals Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 60: Italy: Fermentation Chemicals Market: Sales Value (in Million USD), 2019 & 2024

Figure 61: Italy: Fermentation Chemicals Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 62: Spain: Fermentation Chemicals Market: Sales Value (in Million USD), 2019 & 2024

Figure 63: Spain: Fermentation Chemicals Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 64: Russia: Fermentation Chemicals Market: Sales Value (in Million USD), 2019 & 2024

Figure 65: Russia: Fermentation Chemicals Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 66: Others: Fermentation Chemicals Market: Sales Value (in Million USD), 2019 & 2024

Figure 67: Others: Fermentation Chemicals Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 68: Latin America: Fermentation Chemicals Market: Sales Value (in Million USD), 2019 & 2024

Figure 69: Latin America: Fermentation Chemicals Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 70: Brazil: Fermentation Chemicals Market: Sales Value (in Million USD), 2019 & 2024

Figure 71: Brazil: Fermentation Chemicals Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 72: Mexico: Fermentation Chemicals Market: Sales Value (in Million USD), 2019 & 2024

Figure 73: Mexico: Fermentation Chemicals Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 74: Others: Fermentation Chemicals Market: Sales Value (in Million USD), 2019 & 2024

Figure 75: Others: Fermentation Chemicals Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 76: Middle East and Africa: Fermentation Chemicals Market: Sales Value (in Million USD), 2019 & 2024

Figure 77: Middle East and Africa: Fermentation Chemicals Market Forecast: Breakup by Country (in %), 2024

Figure 78: Middle East and Africa: Fermentation Chemicals Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 79: Global: Fermentation Chemicals Industry: SWOT Analysis

Figure 80: Global: Fermentation Chemicals Industry: Value Chain Analysis

Figure 81: Global: Fermentation Chemicals Industry: Porter’s Five Forces Analysis

List of Tables

Table 1: Global: Fermentation Chemicals Market: Key Industry Highlights, 2024 and 2033

Table 2: Global: Fermentation Chemicals Market Forecast: Breakup by Product (in Million USD), 2025-2033

Table 3: Global: Fermentation Chemicals Market Forecast: Breakup by Form (in Million USD), 2025-2033

Table 4: Global: Fermentation Chemicals Market Forecast: Breakup by Application (in Million USD), 2025-2033

Table 5: Global: Fermentation Chemicals Market Forecast: Breakup by Region (in Million USD), 2025-2033

Table 6: Global: Fermentation Chemicals Market: Competitive Structure

Table 7: Global: Fermentation Chemicals Market: Key Players

Companies Mentioned

- BASF SE

- AB Enzymes

- Ajinomoto Co. Inc.

- Amano Enzymes USA

- Co. Ltd.

- Archer Daniels Midland Company (ADM)

- Cargill Incorporated

- Chr. Hansen A/S

- Koninklijke DSM N.V.

- Evonik Industries AG

- Novozymes A/S

- The Dow Chemical Company and Koch Industries Inc. (Invista BV)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 148 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 82.7 Billion |

| Forecasted Market Value ( USD | $ 128.1 Billion |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |