The worldwide urea market is influenced by various crucial elements, mainly the increasing need for fertilizers in agriculture. With the rising demand for food production globally driven by population growth, farmers depend on urea as an essential nitrogen-rich fertilizer to boost crop yields. Moreover, the industrial sector plays a vital role in market expansion, since urea is extensively utilized in making resins, adhesives, and plastics. The growing use of urea in automotive applications, especially in selective catalytic reduction (SCR) systems to lower nitrogen oxide emissions, enhances market demand. Recent innovations in urea production, such as energy-saving manufacturing methods and carbon capture technologies, are impacting market dynamics as well.

The United States stands out as a key market disruptor, driven by the significant need for fertilizers within the agricultural sector, as farmers depend on urea to improve soil fertility and optimize crop production. The increasing focus on precision agriculture and sustainable farming methods additionally drives its usage. Moreover, the growing use of urea in industrial sectors, including resin and adhesive manufacturing, sustains market expansion. The automotive sector also has an important function, as urea is an essential ingredient in selective catalytic reduction (SCR) systems to comply with strict emissions standards, thereby creating a positive urea market outlook.

Urea Market Trends:

Rising demand for nitrogen-based fertilizers

The global urea market is majorly driven by the increasing demand for nitrogen-based fertilizers in agriculture. According to industry reports, global fertilizer consumption is expected to recover by 4% in 2023, reaching 192.5 Million Metric Tons (mmt), which is an increase from a low in previous years due to high prices. It further projects a 5% increase in 2024, with global nitrogen fertilizer consumption estimated at 108 mmt and production at 109 mmt. Urea is a key source of nitrogen, essential for plant growth and crop yield improvement. With the global population rising, the need for enhanced food production is escalating, leading to greater usage of urea in farming practices. This, in turn, is creating a positive urea market outlook across the globe. For instance, projections from FAO indicate that to feed a global population of 9.1 Billion by 2050, overall food production must increase by approximately 70%. In developing countries, production would need to nearly double to meet this demand. This demand is particularly high in regions with intensive agricultural activities, where maximizing crop output is crucial.Significant advancements in urea production technology

Technological advancements in urea production have significantly boosted market growth. Innovations such as more efficient production processes, cost-effective methods, and environmentally friendly technologies have made urea manufacturing more viable and sustainable. These advancements not only reduce production costs but also improve the quality and consistency of urea, making it a more attractive option for agricultural and industrial applications, thereby driving urea market growth. For instance, in July 2024, NEXTCHEM, a division of MAIRE, was chosen by Linggu Chemical Co. Ltd. to enhance the energy efficiency of a 3,100 metric tons per day urea plant in China through its subsidiary Stamicarbon. NEXTCHEM will supply the necessary licensing and process design. The project will employ their Advanced MP Flash Design technology, part of the EVOLVE Energy™ series, aiming to reduce the plant's energy consumption by up to 20% by optimizing steam usage and feedstock utilization.Government policies and support

Supportive government policies and subsidies for agricultural inputs play a crucial role in driving the urea market toward growth. Governments worldwide are implementing policies to promote agricultural productivity and ensure food security. Subsidies for fertilizers, including urea, make them more affordable for farmers, encouraging widespread use. Additionally, regulations supporting the use of nitrogen fertilizers in various regions further stimulate the product demand, as farmers seek to enhance crop yields and maintain soil fertility. For instance, according to industry reports, India plans to stop importing urea by the end of 2025. The government is implementing a two-pronged strategy, reviving closed urea plants and promoting alternative fertilizers like nano liquid urea. Domestic production capacity has increased to 310 Lakh Tons, aiming for 325 Lakh Tons annually. The government's initiatives include substantial subsidies to ensure affordable fertilizers for farmers and efforts to replace conventional urea with nano liquid variants, further propelling the urea market demand.Urea Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global urea market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on grade, application, and end-use industry.Analysis by Grade:

- Fertilizers Grade

- Feed Grade

- Technical Grade

For instance, recent data indicates that the annual demand for technical-grade urea for industrial use is approximately 1.3 to 1.4 Million Tons, while domestic production is around 150,000 tons. The manufacturing sector imports only about 200,000 tons, falling significantly short of the required quantity, which exceeds one Million tons.

Analysis by Application:

- Nitrogenous Fertilizer

- Stabilizing Agent

- Keratolyte

- Resin

- Others

Analysis by End-Use Industry:

- Agriculture

- Chemical

- Automotive

- Medical

- Others

For instance, in December 2023, Yara announced the acquisition of Agribios Italiana's organic-based fertilizer business, enhancing Yara's organic strategy in Europe. Agribios, with a market share of 10% in Italy, produces approximately 60,000 metric tons of organic-based fertilizers annually. This action is expected to increase Yara's sales in the organic fertilizer market of Italy and its neighboring countries by about 30% within the next three years.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Additionally, government initiatives and subsidies in these countries support urea production and usage, making it more accessible to farmers. The region's rapid industrialization also contributes to the demand for urea in industrial applications. For instance, China's fertilizer industry, one of the largest globally, is undergoing a transformation towards sustainability and efficiency, driven by goals to peak carbon emissions by 2030 and achieve carbon neutrality by 2060. The Belt and Road Initiative (BRI) further supports China's fertilizer industry by expanding access to raw materials and new export markets, aligning with the urea market forecast for increased global trade and supply chain enhancements.

Key Regional Takeaways:

United States Urea Market Analysis

In 2024, the United States accounts for over 84.20% of the urea market in North America. In the United States, the rise in the consumption of urea is primarily driven by the changing chemical industry. According to various reports, total foreign direct investment in the U.S. chemical manufacturing industry totaled USD 766.7 billion in 2023. Since this industry is still growing rapidly, the requirement for urea, which serves as a primary feedstock for many chemical reactions, has gone up significantly. The rising demand for urea in the chemical industry for the production of fertilizers, resins, plastics, and various other products has led to its increased utilization. Additionally, improvements in chemical production technologies, coupled with an increased focus on sustainability and environmentally friendly practices, are promoting a broader use of urea in the sector. The growth of sectors like agrochemicals, plastics, and pharmaceuticals is anticipated to keep fueling urea demand, thereby enhancing its use in the United States.Asia Pacific Urea Market Analysis

In the Asia-Pacific area, the increasing use of urea is associated with higher investments in agriculture. The agricultural industry in this area has been seeing considerable expansion, driven by a rising need for food production to cater to a swiftly increasing population. For example, in 2020, the Indian government plans to allocate around USD 4.32 Million to 346 agritech startups, with the goal of enhancing the agricultural sector's development. Urea, as an essential fertilizer, is crucial for boosting crop yields and increasing agricultural efficiency. The growth in agricultural investments, especially in nations prioritizing the modernization of farming techniques and the extension of arable land, has heightened the need for urea. Additionally, government incentives and agricultural subsidies in certain regions stimulate urea usage, fostering its integration into farming methods. Consequently, urea demand is expected to increase steadily in this area.Europe Urea Market Analysis

In Europe, the increasing use of urea is primarily fueled by the expanding industrial sector, especially because of the advancement of the automotive industry. As the number of vehicles owned continues to rise, the necessity for urea as an essential element for reducing vehicle emissions is also expanding. The International Council on Clean Transportation reports that approximately 10.6 million new vehicles were registered in the 27 Member States in 2023, which is a 14% increase from 2022. Urea is widely utilized in Selective Catalytic Reduction (SCR) systems to decrease nitrogen oxide emissions from diesel engines, which is essential for complying with strict environmental regulations. As vehicle ownership increases, especially in urban regions, the use of urea in automotive emissions control systems is expected to keep growing. Moreover, the rising industrial need for urea in sectors like pharmaceuticals and manufacturing also enhances its usage in the area.Latin America Urea Market Analysis

In Latin America, the rising use of urea is fueled by a boost in agricultural output. The Food and Agriculture Organization of the United Nations (FAO) reports that Brazil’s crop production hit a record 308 million metric tons in 2021. With the agricultural sector growing to fulfill domestic needs and export requirements, the need for urea, an essential fertilizer, increases. Urea plays a crucial role in boosting crop production, and its contribution to increasing soil fertility fosters the overall agricultural development of the region. As farming methods improve and emphasis is placed on enhancing productivity, there is an increasing demand for urea-based fertilizers to maximize agricultural yields. This need is additionally driven by governmental backing and strategies designed to enhance agricultural productivity.Middle East and Africa Urea Market Analysis

In the Middle East and Africa, the increasing use of urea is driven by the flourishing construction industry. Reports indicate that Saudi Arabia's construction industry is thriving, featuring more than 5,200 active projects with a total value of USD 819 billion. With substantial infrastructure development underway in the region, including major construction initiatives, the need for urea has increased. Urea is utilized in multiple industrial applications, including the creation of resins, which are vital in the construction and building materials industry. The swift expansion of the construction sector, along with the necessity for higher-quality building materials, has increased the demand for urea. With construction continuing to flourish in this area, urea usage is anticipated to increase, fueled by its use in materials and products for infrastructure initiatives.Competitive Landscape:

Major participants in the urea market are adopting different strategies to enhance their market stance and promote growth. Large corporations such as CF Industries, Nutrien, and Yara International are putting money into increasing production capabilities to satisfy growing demand, especially in agricultural and industrial sectors. Numerous players are concentrating on technological innovations, including energy-saving urea manufacturing methods and carbon capture technologies, to improve sustainability and lessen environmental effects. Strategic mergers, acquisitions, and collaborations are assisting companies in enhancing their supply chains and optimizing distribution networks.The report provides a comprehensive analysis of the competitive landscape in the urea market with detailed profiles of all major companies, including:

- Acron Group

- BASF SE

- BIP (Oldbury) Limited

- EuroChem

- Jiangsu Sanmu Group Co. Ltd.

- Koch Fertilizer LLC

- OCI N.V

- Petrobras

- Qatar Fertiliser Company

- SABIC

- Yara International ASA

Key Questions Answered in This Report

1. How big is the urea market?2. What is the future outlook of urea market?

3. What are the key factors driving the urea market?

4. Which region accounts for the largest urea market share?

5. Which are the leading companies in the global urea market?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global Urea Market

5.1 Market Overview

5.2 Market Performance

5.3 Impact of COVID-19

5.4 Market Forecast

6 Market Breakup by Grade

6.1 Fertilizers Grade

6.1.1 Market Trends

6.1.2 Market Forecast

6.2 Feed Grade

6.2.1 Market Trends

6.2.2 Market Forecast

6.3 Technical Grade

6.3.1 Market Trends

6.3.2 Market Forecast

7 Market Breakup by Application

7.1 Nitrogenous Fertilizer

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 Stabilizing Agent

7.2.1 Market Trends

7.2.2 Market Forecast

7.3 Keratolyte

7.3.1 Market Trends

7.3.2 Market Forecast

7.4 Resin

7.4.1 Market Trends

7.4.2 Market Forecast

7.5 Others

7.5.1 Market Trends

7.5.2 Market Forecast

8 Market Breakup by End-Use Industry

8.1 Agriculture

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 Chemical

8.2.1 Market Trends

8.2.2 Market Forecast

8.3 Automotive

8.3.1 Market Trends

8.3.2 Market Forecast

8.4 Medical

8.4.1 Market Trends

8.4.2 Market Forecast

8.5 Others

8.5.1 Market Trends

8.5.2 Market Forecast

9 Market Breakup by Region

9.1 North America

9.1.1 United States

9.1.1.1 Market Trends

9.1.1.2 Market Forecast

9.1.2 Canada

9.1.2.1 Market Trends

9.1.2.2 Market Forecast

9.2 Asia Pacific

9.2.1 China

9.2.1.1 Market Trends

9.2.1.2 Market Forecast

9.2.2 Japan

9.2.2.1 Market Trends

9.2.2.2 Market Forecast

9.2.3 India

9.2.3.1 Market Trends

9.2.3.2 Market Forecast

9.2.4 South Korea

9.2.4.1 Market Trends

9.2.4.2 Market Forecast

9.2.5 Australia

9.2.5.1 Market Trends

9.2.5.2 Market Forecast

9.2.6 Indonesia

9.2.6.1 Market Trends

9.2.6.2 Market Forecast

9.2.7 Others

9.2.7.1 Market Trends

9.2.7.2 Market Forecast

9.3 Europe

9.3.1 Germany

9.3.1.1 Market Trends

9.3.1.2 Market Forecast

9.3.2 France

9.3.2.1 Market Trends

9.3.2.2 Market Forecast

9.3.3 United Kingdom

9.3.3.1 Market Trends

9.3.3.2 Market Forecast

9.3.4 Italy

9.3.4.1 Market Trends

9.3.4.2 Market Forecast

9.3.5 Spain

9.3.5.1 Market Trends

9.3.5.2 Market Forecast

9.3.6 Russia

9.3.6.1 Market Trends

9.3.6.2 Market Forecast

9.3.7 Others

9.3.7.1 Market Trends

9.3.7.2 Market Forecast

9.4 Latin America

9.4.1 Brazil

9.4.1.1 Market Trends

9.4.1.2 Market Forecast

9.4.2 Mexico

9.4.2.1 Market Trends

9.4.2.2 Market Forecast

9.4.3 Others

9.4.3.1 Market Trends

9.4.3.2 Market Forecast

9.5 Middle East and Africa

9.5.1 Market Trends

9.5.2 Market Breakup by Country

9.5.3 Market Forecast

10 SWOT Analysis

10.1 Overview

10.2 Strengths

10.3 Weaknesses

10.4 Opportunities

10.5 Threats

11 Value Chain Analysis

11.1 Overview

11.2 Inbound Logistics

11.3 Operations

11.4 Outbound Logistics

11.5 Marketing and Sales

11.6 Service

12 Porters Five Forces Analysis

12.1 Overview

12.2 Bargaining Power of Buyers

12.3 Bargaining Power of Suppliers

12.4 Degree of Competition

12.5 Threat of New Entrants

12.6 Threat of Substitutes

13 Price Indicators

14 Competitive Landscape

14.1 Market Structure

14.2 Key Players

14.3 Profiles of Key Players

14.3.1 Acron Group

14.3.1.1 Company Overview

14.3.1.2 Product Portfolio

14.3.2 BASF SE

14.3.2.1 Company Overview

14.3.2.2 Product Portfolio

14.3.2.3 Financials

14.3.2.4 SWOT Analysis

14.3.3 BIP (Oldbury) Limited

14.3.3.1 Company Overview

14.3.3.2 Product Portfolio

14.3.3.3 Financials

14.3.4 EuroChem

14.3.4.1 Company Overview

14.3.4.2 Product Portfolio

14.3.5 Jiangsu sanmu group Co. Ltd.

14.3.5.1 Company Overview

14.3.5.2 Product Portfolio

14.3.6 Koch Fertilizer LLC

14.3.6.1 Company Overview

14.3.6.2 Product Portfolio

14.3.7 OCI N.V

14.3.7.1 Company Overview

14.3.7.2 Product Portfolio

14.3.7.3 Financials

14.3.8 Petrobras

14.3.8.1 Company Overview

14.3.8.2 Product Portfolio

14.3.8.3 Financials

14.3.8.4 SWOT Analysis

14.3.9 Qatar Fertiliser Company

14.3.9.1 Company Overview

14.3.9.2 Product Portfolio

14.3.10 SABIC

14.3.10.1 Company Overview

14.3.10.2 Product Portfolio

14.3.10.3 Financials

14.3.10.4 SWOT Analysis

14.3.11 Yara International ASA

14.3.11.1 Company Overview

14.3.11.2 Product Portfolio

14.3.11.3 Financials

14.3.11.4 SWOT Analysis

List of Figures

Figure 1: Global: Urea Market: Major Drivers and Challenges

Figure 2: Global: Urea Market: Sales Value (in Billion USD), 2019-2024

Figure 3: Global: Urea Market: Breakup by Grade (in %), 2024

Figure 4: Global: Urea Market: Breakup by Application (in %), 2024

Figure 5: Global: Urea Market: Breakup by End-Use Industry (in %), 2024

Figure 6: Global: Urea Market: Breakup by Region (in %), 2024

Figure 7: Global: Urea Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 8: Global: Urea (Fertilizers Grade) Market: Sales Value (in Million USD), 2019 & 2024

Figure 9: Global: Urea (Fertilizers Grade) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 10: Global: Urea (Feed Grade) Market: Sales Value (in Million USD), 2019 & 2024

Figure 11: Global: Urea (Feed Grade) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 12: Global: Urea (Technical Grade) Market: Sales Value (in Million USD), 2019 & 2024

Figure 13: Global: Urea (Technical Grade) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 14: Global: Urea (Nitrogenous Fertilizer) Market: Sales Value (in Million USD), 2019 & 2024

Figure 15: Global: Urea (Nitrogenous Fertilizer) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 16: Global: Urea (Stabilizing Agent) Market: Sales Value (in Million USD), 2019 & 2024

Figure 17: Global: Urea (Stabilizing Agent) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 18: Global: Urea (Keratolyte) Market: Sales Value (in Million USD), 2019 & 2024

Figure 19: Global: Urea (Keratolyte) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 20: Global: Urea (Resin) Market: Sales Value (in Million USD), 2019 & 2024

Figure 21: Global: Urea (Resin) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 22: Global: Urea (Other Applications) Market: Sales Value (in Million USD), 2019 & 2024

Figure 23: Global: Urea (Other Applications) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 24: Global: Urea (Agriculture) Market: Sales Value (in Million USD), 2019 & 2024

Figure 25: Global: Urea (Agriculture) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 26: Global: Urea (Chemical) Market: Sales Value (in Million USD), 2019 & 2024

Figure 27: Global: Urea (Chemical) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 28: Global: Urea (Automotive) Market: Sales Value (in Million USD), 2019 & 2024

Figure 29: Global: Urea (Automotive) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 30: Global: Urea (Medical) Market: Sales Value (in Million USD), 2019 & 2024

Figure 31: Global: Urea (Medical) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 32: Global: Urea (Other Industries) Market: Sales Value (in Million USD), 2019 & 2024

Figure 33: Global: Urea (Other Industries) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 34: North America: Urea Market: Sales Value (in Million USD), 2019 & 2024

Figure 35: North America: Urea Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 36: United States: Urea Market: Sales Value (in Million USD), 2019 & 2024

Figure 37: United States: Urea Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 38: Canada: Urea Market: Sales Value (in Million USD), 2019 & 2024

Figure 39: Canada: Urea Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 40: Asia Pacific: Urea Market: Sales Value (in Million USD), 2019 & 2024

Figure 41: Asia Pacific: Urea Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 42: China: Urea Market: Sales Value (in Million USD), 2019 & 2024

Figure 43: China: Urea Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 44: Japan: Urea Market: Sales Value (in Million USD), 2019 & 2024

Figure 45: Japan: Urea Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 46: India: Urea Market: Sales Value (in Million USD), 2019 & 2024

Figure 47: India: Urea Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 48: South Korea: Urea Market: Sales Value (in Million USD), 2019 & 2024

Figure 49: South Korea: Urea Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 50: Australia: Urea Market: Sales Value (in Million USD), 2019 & 2024

Figure 51: Australia: Urea Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 52: Indonesia: Urea Market: Sales Value (in Million USD), 2019 & 2024

Figure 53: Indonesia: Urea Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 54: Others: Urea Market: Sales Value (in Million USD), 2019 & 2024

Figure 55: Others: Urea Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 56: Europe: Urea Market: Sales Value (in Million USD), 2019 & 2024

Figure 57: Europe: Urea Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 58: Germany: Urea Market: Sales Value (in Million USD), 2019 & 2024

Figure 59: Germany: Urea Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 60: France: Urea Market: Sales Value (in Million USD), 2019 & 2024

Figure 61: France: Urea Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 62: United Kingdom: Urea Market: Sales Value (in Million USD), 2019 & 2024

Figure 63: United Kingdom: Urea Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 64: Italy: Urea Market: Sales Value (in Million USD), 2019 & 2024

Figure 65: Italy: Urea Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 66: Spain: Urea Market: Sales Value (in Million USD), 2019 & 2024

Figure 67: Spain: Urea Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 68: Russia: Urea Market: Sales Value (in Million USD), 2019 & 2024

Figure 69: Russia: Urea Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 70: Others: Urea Market: Sales Value (in Million USD), 2019 & 2024

Figure 71: Others: Urea Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 72: Latin America: Urea Market: Sales Value (in Million USD), 2019 & 2024

Figure 73: Latin America: Urea Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 74: Brazil: Urea Market: Sales Value (in Million USD), 2019 & 2024

Figure 75: Brazil: Urea Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 76: Mexico: Urea Market: Sales Value (in Million USD), 2019 & 2024

Figure 77: Mexico: Urea Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 78: Others: Urea Market: Sales Value (in Million USD), 2019 & 2024

Figure 79: Others: Urea Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 80: Middle East and Africa: Urea Market: Sales Value (in Million USD), 2019 & 2024

Figure 81: Middle East and Africa: Urea Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 82: Global: Urea Industry: SWOT Analysis

Figure 83: Global: Urea Industry: Value Chain Analysis

Figure 84: Global: Urea Industry: Porter’s Five Forces Analysis

List of Tables

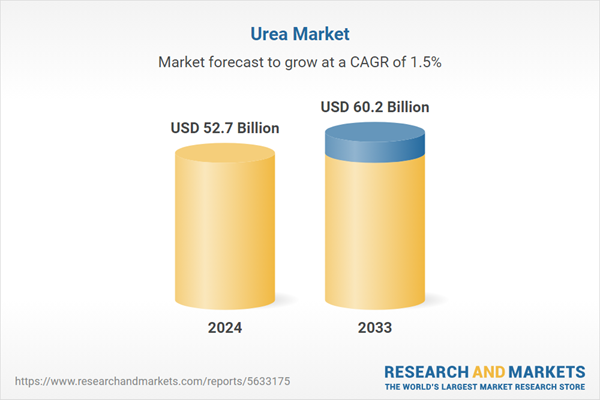

Table 1: Global: Urea Market: Key Industry Highlights, 2024 and 2033

Table 2: Global: Urea Market Forecast: Breakup by Grade (in Million USD), 2025-2033

Table 3: Global: Urea Market Forecast: Breakup by Application (in Million USD), 2025-2033

Table 4: Global: Urea Market Forecast: Breakup by End-Use Industry (in Million USD), 2025-2033

Table 5: Global: Urea Market Forecast: Breakup by Region (in Million USD), 2025-2033

Table 6: Global: Urea Market: Competitive Structure

Table 7: Global: Urea Market: Key Players

Companies Mentioned

- Acron Group

- BASF SE

- BIP (Oldbury) Limited

- EuroChem

- Jiangsu Sanmu Group Co. Ltd.

- Koch Fertilizer LLC

- OCI N.V

- Petrobras

- Qatar Fertiliser Company

- SABIC

- Yara International ASA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 145 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 52.7 Billion |

| Forecasted Market Value ( USD | $ 60.2 Billion |

| Compound Annual Growth Rate | 1.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |