The Rising Brand Consciousness Regarding Imported and Premium Beers Augmenting the Market Growth

Increasing brand consciousness regarding imported and premium beers is a key driver of growth in the Indian beer market. Consumers are increasingly interested in trying new and unique beers and are willing to pay a premium for high-quality, well-known brands. One of the major factors driving this trend is rapid globalization as it makes it easier for consumers to access a wider variety of beer worldwide. As a result, consumers are more knowledgeable about different beer styles and seek new and interesting options. Another factor driving growth in the premium beer market is the rise of craft brewing. Craft breweries are known for producing high-quality, unique beers that often command a higher price point than mass-produced beers. As a result, consumers are increasingly willing to pay more for these types of beers. The rise of e-commerce has also made it easier for consumers to purchase imported and premium beers. Online retailers provide a wider variety of beers than brick-and-mortar stores and often offer competitive pricing. Finally, social media has played a significant role in driving brand consciousness in the beer market. Consumers are increasingly sharing their experiences and opinions about different beers on social media platforms, which can help to raise awareness of lesser-known brands and drive demand for them.Competitive analysis such as market structure, market share by key players, player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. The market structure is concentrated, with several large-, medium- and small-scale players currently operating in the India beer industry. The volume of new entrants in the beer industry is low due to high brand development and marketing cost, low market growth, long licensing, and an approval process. Manufacturers require economies of scale to remain profitable and high capital investments.

What is Beer?

Beer is an alcoholic beverage produced by brewing a combination of malted barley, rice, corn, and other cereals. The ingredients used in beer manufacturing include cereals, hops, yeast, water, adjuncts, and additives. While barley is the most commonly used grain for making beer, the brewmaster may select other grains. The beer production process involves several stages, including germination of the grains, malting, mashing, lautering with water, brewing in a brewer kettle with hops, followed by fermentation, clarification, priming, pasteurization, and carbonation. The robust growth of beer market in India can be attributed to the rising health consciousness of the population. The alcoholic beverage manufacturers aim to cater to the growing health consciousness by making it a major marketing objective to sustain the industry's growth momentum in India.

The COVID-19 Impact:

During the pandemic, breweries experienced a significant reduction in production and were forced to close their taprooms and dining rooms due to lockdowns. The closure of production sites resulted in substantial losses of raw materials and finished products that could not reach retail. The pandemic also disrupted the procurement of raw materials, shut down factories, and led to a production shortage. The shortage of manpower in manufacturing industries due to reverse migration and disruptions in the supply chain, including inter-state and inter-border transportation bans, further impacted the beer market in India. The restrictions on on-road movement disrupted the distribution of beers and raw materials. However, leading beer companies strengthened their logistics and transport services, which slowly helped regain the market post-pandemic. Although opportunities emerged for premiumization, local provenance, and online sales, the on-premises side of the industry, such as hotels, restaurants, bars, pubs, and microbreweries, faced continued challenges due to the ban on on-premises liquor consumption during the nationwide lockdown. The pandemic led to job losses, salary cuts, and lower disposable incomes, which reduced the pace of the shift to beers and premium beer categories in the short term. However, the outlook for beer remains promising in the medium to long term. The Indian beer industry suffered during the first and second waves of COVID-19 but saw a quick revival post-pandemic. The industry evolved from manufacturing standard beers to flavored and various beers in line with changing consumer preferences. The beer industry has been moving smoothly in India for decades, as beer consumption has always been associated with friendly gatherings and parties.India Beer Market Trends:

The growth of the beer market in India can be attributed to the increasing preference for alcoholic beverages, particularly among millennials, during various social and cultural events. This trend is supported by consumers' changing lifestyles and rising brand consciousness regarding premium and imported beers. Furthermore, the adoption of canned beer due to its longer shelf-life and convenient handling and transportation is positively impacting the market growth. Innovations in product offerings, such as freshly brewed and on-tap beers, and customized and tropical flavors like peach, strawberry, apple, lime, and pineapple from micro and craft breweries, are providing further momentum to the market growth. The market is also being driven by the easy availability of products through online platforms and the increasing purchasing power of consumers.India Beer Industry Segmentation:

The publisher provides an analysis of the key trends in each sub-segment of the India beer market report, along with forecasts at the country and regional level from 2025-2033. Our report has categorized the market based on product type, packaging, production, alcohol content, flavor and distribution channel.Product Type Insights:

- Standard Lager

- Premium Lager

- Specialty Beer

- Others

Packaging Insights:

- Glass

- PET Bottle

- Metal Can

- Others

Production Insights:

- Macro-Brewery

- Micro-Brewery

- Others

Alcoholic Content Insights:

- High

- Low

- Alcohol Free

Flavor Insights:

- Flavored

- Unflavored

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- On-Trades

- Specialty Stores

- Convenience Stores

- Others

Region Insights:

- North India

- West and Central India

- South India

- East India

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the India beer market.Some of the companies covered in the report include:

- Anheuser-Bush InBev SA NV

- Arbor Brewing Company India

- B9 Beverages Private Limited

- Carlsberg India Private Limited

- Devans Modern Breweries Ltd.

- Gateway Brewing Company

- SOM Distilleries And Breweries Limited

- Sona Beverages Private Limited

- United Breweries Limited (Heineken N.V.)

- White Rhino Brewing Co.

Key Questions Answered in This Report

1. How big is the beer market in India?2. What is the expected growth rate of the India beer market during 2025-2033?

3. What are the key factors driving the India beer market?

4. What has been the impact of COVID-19 on the India beer market?

5. What is the breakup of the India beer market based on the product type?

6. What is the breakup of the India beer market based on the packaging?

7. What is the breakup of the India beer market based on the production?

8. What is the breakup of the India beer market based on the alcohol content?

9. What is the breakup of the India beer market based on the flavor?

10. What is the breakup of the India beer market based on the distribution channel?

11. What are the key regions in the India beer market?

Table of Contents

Companies Mentioned

- Anheuser-Bush InBev SA NV

- Arbor Brewing Company India

- B9 Beverages Private Limited

- Carlsberg India Private Limited

- Devans Modern Breweries Ltd.

- Gateway Brewing Company

- SOM Distilleries And Breweries Limited

- Sona Beverages Private Limited

- United Breweries Limited (Heineken N.V.)

- White Rhino Brewing Co.

Table Information

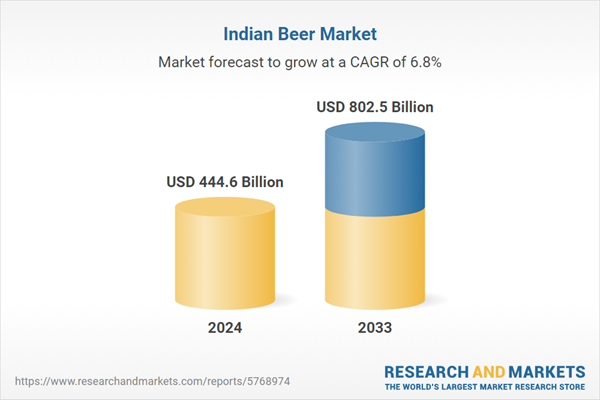

| Report Attribute | Details |

|---|---|

| No. of Pages | 134 |

| Published | January 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 444.6 Billion |

| Forecasted Market Value ( USD | $ 802.5 Billion |

| Compound Annual Growth Rate | 6.8% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |