Market Size & Forecasts:

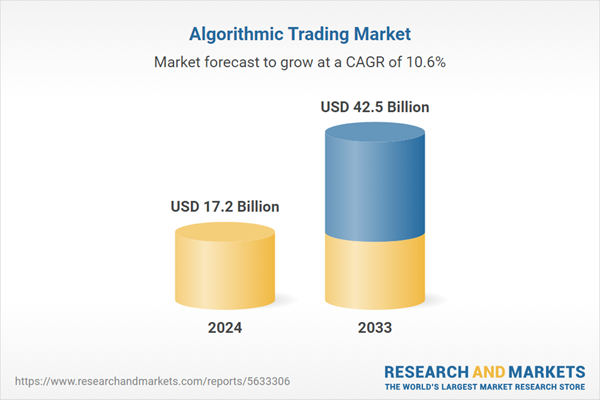

- Algorithmic trading market was valued at USD 17.2 Billion in 2024.

- The market is projected to reach USD 42.5 Billion by 2033, at a CAGR of 9.49% from 2025-2033.

Dominant Segments:

- Trading Type: On the basis of trading type, the market has been segmented into foreign exchange (FOREX), stock markets, exchange-traded fund (ETF), bonds, cryptocurrencies, and others.

- Components: Solutions (platforms and software tools) dominate the market since they serve as the core infrastructure for building, testing, and deploying trading algorithms. These tools enable traders to automate complex strategies, integrate with market data feeds, manage risks, and ensure fast execution.

- Deployment Model: Cloud represents the largest market share as it offers scalability, flexibility, and real-time data processing needed for efficient algorithmic trading. With lower upfront costs and seamless remote access, cloud deployment supports continuous updates and faster backtesting, making it the preferred choice for modern trading environments.

- Organization Size: On the basis of organization size, the market has been bifurcated into small and medium enterprises and large enterprises.

- Region: North America leads the algorithmic trading market due to its mature financial ecosystem, advanced trading infrastructure, and strong presence of key players. Robust regulatory frameworks and increasing access to cutting-edge technology are further fueling the market growth.

Key Players:

- The leading companies in algorithmic trading market include Vela Trading Systems LLC, Meta-Quotes Limited, Trading Technologies International Inc., Software AG, AlgoTrader, uTrade Solutions Private Limited, Automated Trading SoftTech Private Limited, Kuberre Systems Inc., InfoReach Inc., Virtu Financial Inc., Tata Consultancy Services, Argo Group International Holdings Limited, Thomson Reuters Corporation, iRageCapital Advisory Private Limited, 63 Moons Technologies Ltd., etc.

Key Drivers of Market Growth:

- Surge in Real-Time Market Data and Analytics: Immediate access to market movements enhances trade execution, reduces latency, and enables dynamic strategy adjustments. This capability significantly boosts trading efficiency, driving increased adoption of algorithmic trading platforms worldwide.

- Proliferation of Cryptocurrencies: The expansion of cryptocurrencies has expanded trading opportunities, encouraging the use of algorithmic trading for faster, automated transactions in highly volatile markets. With enhanced crypto exchanges, traders continue to rely on algorithms for real-time execution, arbitrage, and risk management.

- Growing Alliance Between Fintech Firms and Traditional Financial Institutions: Collaborations are enhancing the development and adoption of algorithmic trading solutions. These partnerships combine technological innovations with financial expertise, enabling more efficient, automated trading strategies.

- Broadening of Electronic Trading Platforms: Electronic trading platforms offer robust infrastructure, real-time data, and seamless integration with algorithms, thereby enhancing trading efficiency and reducing latency. This is encouraging wider adoption of algorithmic trading across diverse asset classes and regions.

- Increasing Utilization of Artificial Intelligence (AI): AI algorithms analyze large datasets instantaneously, recognize trading patterns, and perform trades with little human involvement. This aids in improving accuracy, efficiency, and profitability while reducing risks associated with emotional or delayed decision-making.

Future Outlook:

- Strong Growth Outlook: The algorithmic trading market is set to see sustained expansion, due to the growing employment of automated systems, increasing demand for high-frequency trading, and real-time data analysis. As financial institutions are seeking efficiency and reduced human error, algorithmic trading is anticipated to broaden further, supported by advancements in AI.

- Market Evolution: The sector is anticipated to shift from basic rule-based systems to sophisticated, AI-based platforms that process massive data in real time. The market is seeing wider use of algorithmic trading platforms among smaller firms. Technological innovations, regulatory adaptation, and high demand for speed and precision are shaping its rapid development.

Algorithmic Trading Market Trends:

Growing assimilation of application programming interfaces (APIs)Rising integration of APIs is fueling the market growth. As per the publisher, the India API market size reached USD 8.02 billion in 2024. APIs allow traders to access real-time market data, automate order execution, and customize trading strategies with greater precision and efficiency. This integration supports faster decision-making and reduces latency, which is critical in high-frequency trading environments. APIs also enable easy integration of third-party analytical tools and risk management systems into existing trading infrastructures. As financial institutions are aiming to optimize trading operations and reduce manual errors, API-based connectivity is becoming essential for building flexible and scalable systems. The growing demand for open trading platforms and the rise of fintech innovations are further accelerating API adoption, thereby strengthening the expansion of the algorithmic trading ecosystem.

Rising utilization of AI

Increasing use of AI is enabling more sophisticated, adaptive, and data-driven trading strategies. AI algorithms can evaluate large volumes of market information instantly, recognize hidden patterns, and make highly precise predictions with minimal human intervention. Machine learning (ML) models continuously improve by learning from historical data, enhancing trade timing, risk management, and asset selection. AI also supports the development of autonomous trading bots that conduct transactions with swiftness and accuracy, responding to market fluctuations in milliseconds. This results in reduced emotional bias and refined consistency in trading outcomes. Additionally, AI facilitates sentiment assessment using news and other unstructured data sources, helping traders anticipate market shifts. Overall, increasing assimilation of AI enhances the intelligence, agility, and profitability of algorithmic trading systems, driving its rapid adoption across the financial sector. A report from UN Trade and Development (UNCTAD) estimated that the worldwide AI market is set to grow from USD 189 Billion in 2023 to USD 4.8 Trillion by 2033.Broadening of electronic trading platforms

The expansion of electronic trading platforms is positively influencing the market. In June 2025, MarketAxess introduced an electronic trading platform for overseas investors in Indian bonds. The platform would be connected with the Clearing Corporation of India's (CCIL) NDS-Order Matching trading system, enabling foreign investors to directly bid and offer securities alongside local investors. Electronic trading platforms provide advanced tools and real-time connectivity that enable traders to automate processes, access diverse asset classes, and execute high-frequency trades with minimal latency. As digital infrastructure is improving, more financial institutions and retail traders are adopting algorithmic systems for better price discovery, lower transaction costs, and increased transparency. Rising integration of customizable interfaces and mobile-enabled trading is further enhancing user engagement, allowing seamless implementation of trading algorithms. With greater reliance on digital solutions, the industry is experiencing robust momentum, contributing significantly to the projected growth in algorithmic trading market size 2025.Key Growth Drivers of Algorithmic Trading Market:

Increasing availability of real-time market data and analytics

The surge in availability of real-time market data and analytics is a key driver of the market. With continuous access to live price feeds, trading volumes, and market sentiment indicators, algorithms can detect patterns and execute trades in milliseconds, maximizing profit opportunities. This abundance of timely data allows the development of more refined and responsive trading models that adapt instantly to market fluctuations. Real-time analytics also support backtesting and risk management, helping firms validate strategies and minimize losses. As financial institutions continue to rely on data for competitive advantage, the demand for sophisticated algorithmic systems is rising. Ultimately, the refined precision, speed, and efficiency enabled by real-time data are transforming trading operations, fueling the broader adoption of algorithmic trading across asset classes and geographies.Proliferation of cryptocurrencies

The proliferation of cryptocurrencies is creating new opportunities for automated and high-frequency trading. With thousands of digital currencies being actively traded on various global exchanges, traders are turning to algorithms to navigate the highly volatile and fragmented crypto environment efficiently. The 24/7 nature of crypto markets demands constant monitoring and rapid execution, which is well-suited to algorithmic systems. These tools can analyze price movements, arbitrage opportunities, and liquidity patterns in real time, executing trades faster than any manual process. Furthermore, the decentralized and digital-first nature of cryptocurrencies aligns seamlessly with API-based platforms, encouraging fintech firms and institutional investors to adopt algorithmic strategies. As interest in crypto trading continues to rise, algorithmic solutions are becoming essential for maintaining speed, precision, and competitiveness in this dynamic market.Rising collaborations between fintech firms and traditional financial institutions

The growing partnerships between fintech firms and traditional financial institutions are offering a favorable market outlook. These collaborations combine the innovation and agility of fintech companies with the regulatory experience, capital strength, and market reach of established financial players. Fintech firms contribute advanced algorithms, data analytics, and automation tools that enhance trading efficiency and reduce latency. Meanwhile, traditional institutions offer access to a wide client base and established trading infrastructure. This synergy is accelerating the adoption of cutting-edge trading technologies, encouraging investments in automated platforms, and supporting real-time decision-making capabilities. As these partnerships are expanding, they are creating scalable and customizable algorithmic trading solutions tailored to diverse trading needs. This growing alliance is directly supporting the expansion of the algorithmic trading market size 2024.Algorithmic Trading Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global algorithmic trading market report, along with forecasts at the global and regional levels from 2025-2033. Our report has categorized the market based on trading type, components, deployment model and organization size.Breakup by Trading Type:

- Foreign Exchange (FOREX)

- Stock Markets

- Exchange-Traded Fund (ETF)

- Bonds

- Cryptocurrencies

- Others

The stock market operates in the industrial environment, where several factors influence the dynamics of the stock market. Furthermore, the contribution of technology is essential, and trading algorithms of high frequency as well as infrastructure continuously form the basis of the changing facet. Macroeconomic factors, such as interest rates, GDP growth, and geopolitical developments, in turn from investor sentiment and trigger market fluctuations. Moreover, the ongoing developments in regulatory regimes can disrupt or bolster the landscape of algorithmic trading, shifting market participants' strategies. Liquidity conditions, as well as trading volumes, directly affect the stock market within the industry by either making the execution of trades smooth or influencing the price movements.

On the other hand, in the crypto industry, regulation and government policy greatly influence the currency. Beyond that, technological progress, for example, blockchain innovations and scalability solutions, is effectively a determinant for the market direction. Moreover, macroeconomic determinants such as inflation rates and global economic trends stimulate investor's feelings and ground their demand for digital assets. Furthermore, such factors as news events, market sentiment, and social media discussions produce such rapid fluctuations on the price. Experienced computer-aided traders of cryptocurrencies cannot do without observing and evaluating these important factors attentively to look for chances and control risks in times of volatility.

Breakup by Components:

- Solutions

- Platforms

- Software Tools

- Services

- Professional Services

- Managed Services

Solutions dominates the market

A detailed breakup and analysis of the market based on the components have also been provided in the report. This includes solutions (platforms, and software tools), and services (professional services, and managed services). According to the report, solutions represented the largest segment.Algorithmic trading software and infrastructure are going through an innovation phase driven by the solutions component. As technology progresses, traders constantly look for more advanced systems and platforms that can maximize their win. Moreover, regulatory changes and compliance requirements greatly affect solutions sort, for the traders should guarantee their systems are in line with corresponding laws and regulations. It is also driven by algorithmic trading market demand for advanced algorithmic solutions for risk management, trading automation, and more efficient execution. Moreover, massive amounts of data and the progress of advanced data analytics techniques allow the trading market to build more perfect trading algorithms. On the other hand, cost-effective and scalable solutions are vital for traders since they are looking for a solution that will enable them to meet their unique needs at a cost-effective and scalable rate.

Breakup by Deployment Model:

- On-Premises

- Cloud

Cloud dominates the market

The report has provided a detailed breakup and analysis of the market based on the deployment model. This includes on-premises and cloud. According to the report, cloud represented the largest segment.In the industry, the cloud deployment model is driven by various market drivers that shape its adoption and growth. Along with this, scalability and flexibility are significant drivers, as the cloud allows traders to easily scale their computational resources based on market demands and adjust their strategies accordingly. In addition, cost-effectiveness plays a pivotal role, as cloud-based solutions often offer a more economical approach compared to traditional on-premises infrastructures, especially for smaller firms and startups. In addition, the escalating volume and complexity of financial data necessitate robust data storage and processing capabilities, which cloud services can readily provide. Moreover, geographic reach and low-latency capabilities offered by cloud providers cater to global trading operations, enabling faster trade execution and reduced network latency. Additionally, the cloud's security measures and compliance offerings align with the stringent regulatory requirements in the financial industry. These factors collectively drive the adoption of cloud deployment models in the algorithmic trading sector, empowering market research and consulting companies to establish themselves as thought leaders in this domain.

Breakup by Organization Size:

- Small and Medium Enterprises

- Large Enterprises

In the industry, small and medium enterprises (SMEs) are driven by advancements in technology. Additionally, the growing availability of data and analytics services empowers SMEs to make informed trading decisions based on real-time market insights. Along with this, regulatory changes and initiatives that aim to level the playing field in the financial markets create opportunities for SMEs to compete with larger players. In addition, the rising demand for niche trading strategies and customized solutions presents a fertile ground for SMEs to carve out specialized market niches. Additionally, cost-effectiveness is a crucial driver, as cloud-based services and outsourcing options allow SMEs to access cutting-edge technologies without substantial upfront investments.

On the other hand, large enterprises in the industry are driven by their established market presence and brand reputation to provide credibility and attract potential clients and partners. In confluence with this, large enterprises benefit from economies of scale, enabling them to negotiate better pricing and access exclusive data and research services. Furthermore, regulatory compliance and risk management capabilities are critical drivers, ensuring adherence to evolving financial regulations and minimizing potential risks. These market drivers, coupled with authoritative market research and consulting services, cement large enterprises' position as influential players in the algorithmic trading domain.

Breakup by Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

North America exhibits a clear dominance, accounting for the largest algorithmic trading market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. According to the report, North America represented the largest share.The algorithmic trading industry in North America is propelled by the region's advanced technological infrastructure and expertise fostering innovation and development in strategies and tools. North America's strong financial markets and well-established regulatory environment create an attractive ecosystem for algorithmic trading firms seeking stability and compliance. Additionally, the region's robust data availability and analytics capabilities offer valuable insights to algorithmic traders, facilitating more informed decision-making. Moreover, the presence of diverse industries and financial instruments in North America allows for the development of specialized algorithmic trading strategies catering to specific market segments. Furthermore, the increasing adoption of cloud-based solutions and artificial intelligence in the region enhances algorithmic trading efficiency and scalability. These market drivers, in conjunction with authoritative market research and consulting services, position North America as a leading hub for innovation and expertise in the algorithmic trading domain.

Competitive Landscape:

The global algorithmic trading market is experiencing significant growth due to continuous advancements in technology, including high-speed computing, sophisticated algorithms, and artificial intelligence. Along with this, evolving financial regulations and market structure reforms influence the adoption and operation of algorithmic trading strategies. Compliance with regulatory requirements is crucial for market participants to ensure fairness and transparency. In addition, the emergence of cost-effective solutions compared to traditional manual trading methods, making it attractive to market participants seeking to optimize operational costs is also impacting the market. Apart from this, the widespread adoption of algorithmic trading for precise risk management and implementing pre-defined risk parameters is significantly supporting the market. Furthermore, the availability of vast amounts of real-time market data allows algorithmic traders to develop sophisticated strategies based on comprehensive and up-to-date information, which contributes to the market.The report has provided a comprehensive analysis of the competitive landscape in the global algorithmic trading market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Vela Trading Systems LLC

- Meta-Quotes Limited

- Trading Technologies International Inc.

- Software AG

- AlgoTrader

- uTrade Solutions Private Limited

- Automated Trading SoftTech Private Limited

- Kuberre Systems Inc.

- InfoReach Inc.

- Virtu Financial Inc.

- Tata Consultancy Services

- Argo Group International Holdings Limited

- Thomson Reuters Corporation

- iRageCapital Advisory Private Limited

- 63 Moons Technologies Ltd.

Key Questions Answered in This Report

1. What was the size of the global algorithmic trading market in 2024?2. What is the expected growth rate of the global algorithmic trading market during 2025-2033?

3. What are the key factors driving the global algorithmic trading market?

4. What has been the impact of COVID-19 on the global algorithmic trading market?

5. What is the breakup of the global algorithmic trading market based on the components?

6. What is the breakup of the global algorithmic trading market based on the deployment model?

7. What are the key regions in the global algorithmic trading market?

8. Who are the key players/companies in the global algorithmic trading market?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global Algorithmic Trading Market

5.1 Market Overview

5.2 Market Performance

5.3 Impact of COVID-19

5.4 Market Breakup by Trading Type

5.5 Market Breakup by Components

5.6 Market Breakup by Deployment Model

5.7 Market Breakup by Organization Size

5.8 Market Breakup by Region

5.9 Market Forecast

6 Market Breakup by Trading Type

6.1 Foreign Exchange (FOREX)

6.1.1 Market Trends

6.1.2 Market Forecast

6.2 Stock Markets

6.2.1 Market Trends

6.2.2 Market Forecast

6.3 Exchange-Traded Fund (ETF)

6.3.1 Market Trends

6.3.2 Market Forecast

6.4 Bonds

6.4.1 Market Trends

6.4.2 Market Forecast

6.5 Cryptocurrencies

6.5.1 Market Trends

6.5.2 Market Forecast

6.6 Others

6.6.1 Market Trends

6.6.2 Market Forecast

7 Market Breakup by Components

7.1 Solutions

7.1.1 Market Trends

7.1.2 Major Types

7.1.2.1 Platforms

7.1.2.2 Software Tools

7.1.3 Market Forecast

7.2 Services

7.2.1 Market Trends

7.2.2 Major Types

7.2.2.1 Professional Services

7.2.2.2 Managed Services

7.2.3 Market Forecast

8 Market Breakup by Deployment Model

8.1 On-Premises

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 Cloud

8.2.1 Market Trends

8.2.2 Market Forecast

9 Market Breakup by Organization Size

9.1 Small and Medium Enterprises

9.1.1 Market Trends

9.1.2 Market Forecast

9.2 Large Enterprises

9.2.1 Market Trends

9.2.2 Market Forecast

10 Market Breakup by Region

10.1 North America

10.1.1 Market Trends

10.1.2 Market Forecast

10.2 Europe

10.2.1 Market Trends

10.2.2 Market Forecast

10.3 Asia Pacific

10.3.1 Market Trends

10.3.2 Market Forecast

10.4 Middle East and Africa

10.4.1 Market Trends

10.4.2 Market Forecast

10.5 Latin America

10.5.1 Market Trends

10.5.2 Market Forecast

11 SWOT Analysis

11.1 Overview

11.2 Strengths

11.3 Weaknesses

11.4 Opportunities

11.5 Threats

12 Value Chain Analysis

13 Porter’s Five Forces Analysis

13.1 Overview

13.2 Bargaining Power of Buyers

13.3 Bargaining Power of Suppliers

13.4 Degree of Competition

13.5 Threat of New Entrants

13.6 Threat of Substitutes

14 Competitive Landscape

14.1 Market Structure

14.2 Key Players

14.3 Profiles of Key Players

14.3.1 Vela Trading Systems LLC

14.3.2 Meta-Quotes Limited

14.3.3 Trading Technologies International Inc.

14.3.4 Software AG

14.3.5 AlgoTrader

14.3.6 uTrade Solutions Private Limited

14.3.7 Automated Trading SoftTech Private Limited

14.3.8 Kuberre Systems Inc.

14.3.9 InfoReach Inc.

14.3.10 Virtu Financial Inc.

14.3.11 Tata Consultancy Services

14.3.12 Argo Group International Holdings Limited

14.3.13 Thomson Reuters Corporation

14.3.14 iRageCapital Advisory Private Limited

14.3.15 63 Moons Technologies Ltd.

List of Figures

Figure 1: Global: Algorithmic Trading Market: Major Drivers and Challenges

Figure 2: Global: Algorithmic Trading Market: Sales Value (in Billion USD), 2019-2024

Figure 3: Global: Algorithmic Trading Market: Breakup by Trading Type (in %), 2024

Figure 4: Global: Algorithmic Trading Market: Breakup by Components (in %), 2024

Figure 5: Global: Algorithmic Trading Market: Breakup by Deployment Model (in %), 2024

Figure 6: Global: Algorithmic Trading Market: Breakup by Organization Size (in %), 2024

Figure 7: Global: Algorithmic Trading Market: Breakup by Region (in %), 2024

Figure 8: Global: Algorithmic Trading Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 9: Global: Algorithmic Trading Industry: SWOT Analysis

Figure 10: Global: Algorithmic Trading Industry: Value Chain Analysis

Figure 11: Global: Algorithmic Trading Industry: Porter’s Five Forces Analysis

Figure 12: Global: Algorithmic Trading (Foreign Exchange- FOREX) Market: Sales Value (in Million USD), 2019 & 2024

Figure 13: Global: Algorithmic Trading (Foreign Exchange- FOREX) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 14: Global: Algorithmic Trading (Stock Markets) Market: Sales Value (in Million USD), 2019 & 2024

Figure 15: Global: Algorithmic Trading (Stock Markets) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 16: Global: Algorithmic Trading (Exchange-Traded Fund- ETF) Market: Sales Value (in Million USD), 2019 & 2024

Figure 17: Global: Algorithmic Trading (Exchange-Traded Fund- ETF) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 18: Global: Algorithmic Trading (Bonds) Market: Sales Value (in Million USD), 2019 & 2024

Figure 19: Global: Algorithmic Trading (Bonds) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 20: Global: Algorithmic Trading (Cryptocurrencies) Market: Sales Value (in Million USD), 2019 & 2024

Figure 21: Global: Algorithmic Trading (Cryptocurrencies) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 22: Global: Algorithmic Trading (Other Trading Types) Market: Sales Value (in Million USD), 2019 & 2024

Figure 23: Global: Algorithmic Trading (Other Trading Types) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 24: Global: Algorithmic Trading (Solutions) Market: Sales Value (in Million USD), 2019 & 2024

Figure 25: Global: Algorithmic Trading (Solutions) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 26: Global: Algorithmic Trading (Services) Market: Sales Value (in Million USD), 2019 & 2024

Figure 27: Global: Algorithmic Trading (Services) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 28: Global: Algorithmic Trading (On-Premises) Market: Sales Value (in Million USD), 2019 & 2024

Figure 29: Global: Algorithmic Trading (On-Premises) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 30: Global: Algorithmic Trading (Cloud) Market: Sales Value (in Million USD), 2019 & 2024

Figure 31: Global: Algorithmic Trading (Cloud) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 32: Global: Algorithmic Trading (Small and Medium Enterprises) Market: Sales Value (in Million USD), 2019 & 2024

Figure 33: Global: Algorithmic Trading (Small and Medium Enterprises) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 34: Global: Algorithmic Trading (Large Enterprises) Market: Sales Value (in Million USD), 2019 & 2024

Figure 35: Global: Algorithmic Trading (Large Enterprises) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 36: North America: Algorithmic Trading Market: Sales Value (in Million USD), 2019 & 2024

Figure 37: North America: Algorithmic Trading Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 38: Europe: Algorithmic Trading Market: Sales Value (in Million USD), 2019 & 2024

Figure 39: Europe: Algorithmic Trading Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 40: Asia Pacific: Algorithmic Trading Market: Sales Value (in Million USD), 2019 & 2024

Figure 41: Asia Pacific: Algorithmic Trading Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 42: Middle East and Africa: Algorithmic Trading Market: Sales Value (in Million USD), 2019 & 2024

Figure 43: Middle East and Africa: Algorithmic Trading Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 44: Latin America: Algorithmic Trading Market: Sales Value (in Million USD), 2019 & 2024

Figure 45: Latin America: Algorithmic Trading Market Forecast: Sales Value (in Million USD), 2025-2033

List of Tables

Table 1: Global: Algorithmic Trading Market: Key Industry Highlights, 2024 and 2033

Table 2: Global: Algorithmic Trading Market Forecast: Breakup by Trading Type (in Million USD), 2025-2033

Table 3: Global: Algorithmic Trading Market Forecast: Breakup by Components (in Million USD), 2025-2033

Table 4: Global: Algorithmic Trading Market Forecast: Breakup by Deployment Model (in Million USD), 2025-2033

Table 5: Global: Algorithmic Trading Market Forecast: Breakup by Organization Size (in Million USD), 2025-2033

Table 6: Global: Algorithmic Trading Market Forecast: Breakup by Region (in Million USD), 2025-2033

Table 7: Global: Algorithmic Trading Market Structure

Table 8: Global: Algorithmic Trading Market: Key Players

Companies Mentioned

- Vela Trading Systems LLC

- Meta-Quotes Limited

- Trading Technologies International Inc.

- Software AG

- AlgoTrader

- uTrade Solutions Private Limited

- Automated Trading SoftTech Private Limited

- Kuberre Systems Inc.

- InfoReach Inc.

- Virtu Financial Inc.

- Tata Consultancy Services

- Argo Group International Holdings Limited

- Thomson Reuters Corporation

- iRageCapital Advisory Private Limited

- 63 Moons Technologies Ltd. etc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 141 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 17.2 Billion |

| Forecasted Market Value ( USD | $ 42.5 Billion |

| Compound Annual Growth Rate | 10.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |