Speak directly to the analyst to clarify any post sales queries you may have.

A strategic orientation to advanced composite materials in sports equipment that contextualizes technical benefits alongside supply, regulatory, and commercial implications

The intersection of material science, athlete performance, and consumer demand has elevated composite materials to a central role in the contemporary sports equipment landscape. Advanced composites now underpin weight reduction, impact resistance, and geometric freedom in product design, enabling manufacturers to create equipment that is simultaneously lighter, stronger, and more responsive. These material-led advances are not isolated technical achievements; rather, they manifest as tangible performance gains on the field, court, and course, reshaping expectations across amateur and professional segments alike.

Against this backdrop, stakeholders must appreciate the broader system dynamics that influence product development: supply chain resilience, regulatory shifts, evolving manufacturing processes, and changing end-user preferences. Transitioning from conventional metals and plastics to carbon fiber, aramid, fiberglass, and hybrid solutions introduces new supply dependencies and quality-control imperatives. Consequently, strategic decisions around sourcing, vertical integration, and partner selection are as critical as material choice itself.

This executive summary synthesizes the most consequential developments affecting sports composites today, highlights how trade and policy adjustments are influencing cost and availability, and clarifies segmentation and regional patterns that are defining investment priorities. The content that follows is structured to inform manufacturers, suppliers, investors, and equipment designers, providing a coherent view of where competitive advantage can be won and how to operationalize material innovation responsibly and profitably.

Key transformative forces reshaping sports composites including manufacturing automation, sustainability mandates, digital design ecosystems, and changing distribution dynamics

The sports composites landscape is undergoing several transformative shifts that extend beyond incremental material improvements. Electrification of personal mobility and cross-disciplinary performance demands have accelerated integration of composites into bicycles and frames, while racquet sports and golf equipment suppliers are increasingly focused on fine-tuning stiffness and vibration damping through tailored fiber architectures. At the same time, sustainability imperatives are redirecting research toward recyclable matrices, bio-based resins, and mitigating end-of-life disposal challenges, prompting manufacturers to rethink product lifecycles from raw material sourcing through reclamation.

Concurrently, manufacturing innovation is reshaping how components are produced at scale. Advances in prepreg handling, out-of-autoclave curing, and automated filament winding are lowering cycle times and reducing labor intensity, while resin transfer molding variants enable more complex geometries with consistent quality. These developments are complemented by digital design tools and additive manufacturing techniques that allow topology optimization and predictive simulation, reducing prototyping cycles and accelerating time-to-market.

Market dynamics are also evolving: distribution channels are fragmenting as brand-owned e-commerce increases direct-to-consumer engagement, while specialty retail and dealer-distributor networks remain essential for high-touch product categories. Finally, heightened scrutiny on supply-chain transparency and material provenance is compelling firms to adopt stringent supplier auditing and certification practices. Together, these shifts demand integrated strategies that balance technological adoption, regulatory compliance, and go-to-market agility.

Anticipated cumulative effects of tariff measures on supply chain configuration, procurement strategies, material substitution efforts, and pricing dynamics across product tiers

The imposition of tariffs and trade measures can produce ripple effects across the sports composites ecosystem, influencing raw material sourcing, component supply chains, and final product pricing. When duties are applied to fibers, resins, or finished components, manufacturers often face immediate cost pressures that force reassessment of supplier footprints and inventory strategies. In response, many firms implement near-term mitigation measures such as inventory pre-positioning and renegotiation of long-term supply contracts to preserve margin stability.

Over the medium term, tariffs incentivize structural adjustments: manufacturers evaluate reshoring, regional sourcing, and increased vertical integration to reduce exposure to cross-border tariffs. Such shifts can favor localized manufacturing investments and strategic partnerships with domestic producers, but they also require capital outlays and adjustments to production planning. Importantly, the pass-through of higher input costs to end consumers varies by product segment and competitive intensity; premium, performance-driven categories can absorb more cost than value-sensitive amateur or school channels.

Tariffs also accelerate innovation in material substitution and process efficiency. Facing increased costs for certain fibers or resin systems, research teams intensify efforts to qualify alternative materials and optimize manufacturing yields through better automation and waste reduction. At the same time, regulatory uncertainty prompts firms to enhance scenario planning and sensitivity analysis. From a procurement perspective, enhanced supplier diversification becomes a strategic priority, while distributors re-evaluate inventory strategies to maintain service levels without elevating working capital disproportionately.

Detailed segmentation insight that maps product categories, material families, manufacturing processes, end-user cohorts, and multi-channel distribution patterns to strategic decision levers

A nuanced segmentation framework is essential to clarify where value accrues and which product lines demand distinct technical and commercial strategies. Based on product type, categories include bicycles and frames, golf clubs and accessories, hockey sticks and protective gear, and racquet sports equipment. Within bicycles and frames, notable distinctions arise between electric bikes, hybrid bikes, mountain bikes, and road bikes, each presenting unique structural and fatigue requirements that influence composite layups and joint design considerations. Golf clubs and accessories break down into accessories, drivers, irons, and putters, with drivers often prioritizing lightweight stiffness and irons emphasizing controlled flex and impact attenuation. Hockey equipment encompasses helmets, protective apparel, and sticks, where impact-energy management and durability are paramount. Racquet sports equipment differentiates across badminton racquets, squash racquets, and tennis racquets, each varying in swing dynamics, stringbed interaction, and balance targets.

Material type segmentation identifies distinct performance and cost profiles across aramid composites, carbon fiber composites, fiberglass composites, and hybrid composites. Aramid excels in impact resistance and abrasion tolerance, carbon fiber is prized for high stiffness-to-weight ratios, fiberglass offers cost-effective resilience, and hybrids combine fiber types to balance performance and price. Manufacturing process segmentation highlights compression molding, filament winding, prepreg molding, and resin transfer molding as primary methods, with important sub-processes such as autoclave curing and out-of-autoclave curing for prepreg molding, and high pressure injection and vacuum injection for resin transfer molding; these choices influence cycle time, part complexity, and capital intensity. End-user segmentation spans amateur sports, commercial facilities, professional sports, and school and collegiate markets, each with distinct purchasing behaviors, durability expectations, and certification needs. Distribution channels range from direct sales to offline retail and online retail, with offline retail further defined by dealer distributors, specialty stores, and sporting goods chains, and online retail including brand websites, e-commerce platforms, and online marketplaces. Together, this segmentation matrix enables targeted product development, differentiated go-to-market approaches, and tailored quality assurance protocols that align with the technical demands and commercial realities of each cohort.

Geographic analysis of supply chain advantages, regulatory regimes, manufacturing capacity, and demand profiles across the Americas, Europe Middle East & Africa, and Asia-Pacific regions

Regional dynamics shape supply chains, regulatory regimes, and demand patterns in materially different ways. The Americas region demonstrates broad variability: mature recreational markets coexist with high-growth specialty segments, and proximity to raw material suppliers can be an advantage for certain fiber and resin imports. Meanwhile, regulatory and safety certification pathways in this region emphasize consumer protection and liability mitigation, creating a predictable framework for product testing and market entry.

In Europe, Middle East & Africa, regulatory stringency and sustainability mandates often take center stage, pushing manufacturers toward recyclable matrices, emissions-aware manufacturing, and greater transparency across supplier networks. This region's established sporting traditions and strong professional leagues generate consistent demand for high-performance equipment, yet market access is frequently governed by rigorous compliance requirements. The Middle East introduces project-driven opportunities tied to large-scale sports infrastructure investments and events.

Asia-Pacific remains a pivotal growth and manufacturing hub where capacity expansion, integrated supply chains, and localized engineering capabilities coexist. Rapid urbanization, rising disposable incomes, and strong participation rates in key sports categories support demand across both premium and mass-market segments. Additionally, Asia-Pacific’s manufacturing ecosystem provides a competitive advantage in cost-effective production and rapid prototyping, although quality differentiation and intellectual property protection are important considerations for brands seeking to maintain technological leadership. Understanding these regional contrasts is critical for establishing appropriate manufacturing footprints, certification strategies, and go-to-market plans that reflect local consumer preferences and regulatory expectations.

Strategic corporate behaviors and partnership models among manufacturers, converters, OEMs, and distribution partners that drive innovation, control supply, and secure market positioning

Key corporate players across the sports composites value chain are differentiating through a combination of technological leadership, strategic partnerships, and supply-chain control. Leading manufacturers and component suppliers invest heavily in R&D to refine fiber architecture, resin chemistry, and process automation, aiming to reduce variability and accelerate qualification cycles. At the OEM level, product teams increasingly embed materials expertise to translate composite capabilities into measurable on-field performance attributes, supported by internal testing facilities and close collaboration with athletes and coaches.

Tier suppliers are restructuring relationships to offer bundled services including prototype development, small-batch production, and post-sale support. Strategic alliances between material producers and converters are also becoming more common, intended to secure preferential access to innovative fiber grades and to co-develop application-specific formulations. Meanwhile, distribution partners that can combine technical sales support with aftercare services are gaining preference in high-touch segments like professional sports and specialty retail.

Capital allocation trends indicate a focus on automation, workforce upskilling, and quality management systems to sustain throughput while mitigating scrap rates. Furthermore, market leaders are prioritizing traceability and certification pathways to meet increasing buyer expectations for provenance and sustainability. For potential entrants and investors, understanding these corporate dynamics is essential to identify partnership opportunities and to anticipate competitive moves across product categories and geographies.

Practical, high-impact strategic moves for manufacturers and suppliers to link material innovation with resilient sourcing, manufacturing automation, sustainability, and channel optimization

Industry leaders should prioritize a set of actionable steps that link material innovation to commercial outcomes while managing operational risk. First, integrate material selection with system-level product design by establishing cross-functional teams that include materials scientists, mechanical engineers, procurement, and marketing. This alignment ensures that choices around fiber orientation, resin chemistry, and joining methods support targeted performance attributes and end-user expectations. Second, diversify supplier footprints to reduce exposure to trade policy changes and single-source dependencies, while building qualifying protocols that accelerate supplier onboarding.

Third, invest in selective automation and advanced manufacturing capabilities such as out-of-autoclave curing and automated tape laying to improve yield and reduce per-unit labor intensity. Fourth, develop a clear sustainability roadmap that addresses recyclability, end-of-life recovery, and supply-chain transparency; certification and visible commitments will increasingly influence procurement decisions in commercial and institutional channels. Fifth, adopt segmented commercialization strategies: premium and professional tiers should emphasize technical differentiation and aftercare services, whereas amateur and school channels should prioritize durability and cost-efficiency. Sixth, strengthen digital channels and brand-owned e-commerce to capture direct consumer insights and increase margins, while maintaining relationships with specialty retailers and dealer networks for complex, fit-dependent sales.

Finally, enhance scenario planning and stress-testing capabilities around tariff exposures, raw material scarcity, and logistics disruptions. By operationalizing these recommendations, firms can convert emerging risks into strategic advantages and sustain consistent performance across evolving market conditions.

Methodology overview describing qualitative interviews, technical literature review, process case study analysis, and cross-validation techniques used to ensure robustness and mitigate bias

This research synthesis draws on a hybrid methodology that combines primary qualitative interviews, technical literature review, and cross-validation of industry practices to build a robust view of the sports composites landscape. Primary inputs included structured interviews with materials engineers, product managers, procurement leads, and distribution partners to capture firsthand accounts of production constraints, performance priorities, and go-to-market strategies. These perspectives were complemented by a targeted review of technical standards, manufacturing process guides, and peer-reviewed materials science literature to ensure the technical accuracy of material and process descriptions.

Secondary validation focused on triangulating findings across multiple independent sources to reduce bias and to reconcile divergent viewpoints. Process-level insights were obtained by analyzing manufacturing case studies and by reviewing process parameter ranges for prepreg handling, filament winding, and resin transfer molding. Where appropriate, scenario analysis was applied to evaluate the operational impact of tariffs and to assess probable responses by manufacturers, such as reshoring or supplier diversification.

Limitations of the methodology are acknowledged: engagement primarily with industry practitioners can introduce selection bias toward more prominent supply-chain actors, and rapid technological change means some process innovations may evolve faster than documented literature. To mitigate these risks, the research remains iterative and recommends periodic updates and targeted deep dives for specific product families or regions to maintain relevance.

Conclusive synthesis highlighting the interplay between material advances, manufacturing evolution, regulatory exposure, and commercialization strategies that determine long-term competitiveness

The cumulative assessment points to an ecosystem in which materials innovation, process modernization, and supply-chain strategy collectively determine competitive advantage. Advances in composite formulations and manufacturing techniques are creating opportunities for lighter, stronger, and more precisely tuned equipment across bicycles, golf, hockey, and racquet sports, while distribution and commercialization strategies are evolving to meet new consumer behaviors. At the same time, geopolitical and trade developments underscore the need for resilient procurement strategies and flexible manufacturing footprints that can adapt to tariff shifts and logistics disruptions.

Looking forward, the most successful players will be those that align product engineering with sustainable material choices, optimize manufacturing for both quality and throughput, and implement distribution strategies that balance direct consumer engagement with channel partner expertise. Moreover, firms that invest in traceability and certification will be better positioned to respond to buyer demands and regulatory expectations. Finally, operational readiness-manifested through supplier diversification, scenario planning, and targeted automation investments-will determine how effectively organizations can translate innovation into commercial success.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China Sports Composites Market

Companies Mentioned

The key companies profiled in this Sports Composites market report include:- Amer Sports Corporation

- Arkema S.A.

- Callaway Golf Company

- COBRA INTERNATIONAL Co., Ltd.

- Connova Deutschland GmbH

- DuPont de Nemours, Inc.

- Exel Composites PLC

- Fischer Sports GmbH

- Fujikura Composites Inc.

- Hexcel Corporation

- Lanxess AG

- Mitsubishi Chemical Group Corporation

- Owens Corning

- Rockwood Composites Limited

- Saint-Gobain Group

- SGL Carbon SE

- Silverstone Composites Ltd.

- Solvay S.A.

- Sportsmatik.com

- Teijin Limited

- Topkey Corporation

- Toray Industries, Inc.

- TPT Golf Inc.

- True Temper Sports

- United States Ski Pole Company

- Völkl Int. GmbH

- Zhongfu Shenying Carbon Fiber Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | January 2026 |

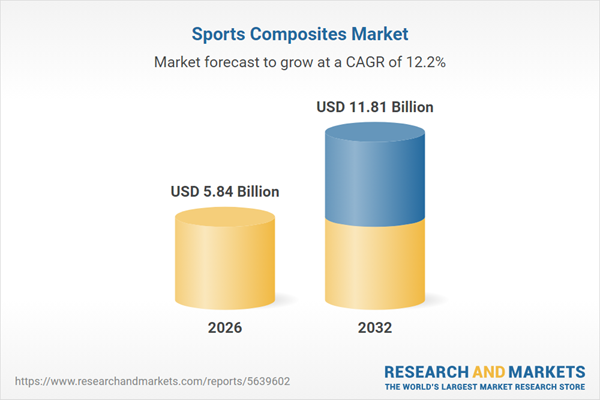

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 5.84 Billion |

| Forecasted Market Value ( USD | $ 11.81 Billion |

| Compound Annual Growth Rate | 12.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 28 |