Qatar holds the lowest unemployment rate and highest GDP per capita income, which is leading to a rise in disposable income. Therefore, this is driving the citizens to spend more on the Small home appliances industry. The day to day improving technology, the innovation that is being introduced in the small appliances of the industry, and an increasing level of internet penetration, which is strengthening m-commerce and mobile shopping in the region, are a few of the major factors that are driving the small home appliances market in Qatar. Qatar’s booming construction industry is also encouraging the sales of home appliances, as customers are highly interested in procuring their new home with the latest appliances and furniture that fits their home size and give their home an attractive look. Consumers are also attracted to appliances that can be connected to smartphones and are wireless. Furthermore, appliances that minimizes consumers average time and effort are attracting attention in the recent times. Smart connectivity is a growing segment of the industry, which enables a consumer to monitor or operate the appliances, even when they are away. The Qatar government’s initiative to replace the old, high-power consuming appliances is also a driving factor that has the high potential to increase the sales for less power and water utilizing appliances, with minimized harmful emissions.

Key Market Trends

Growth in Online sales is Driving the Market

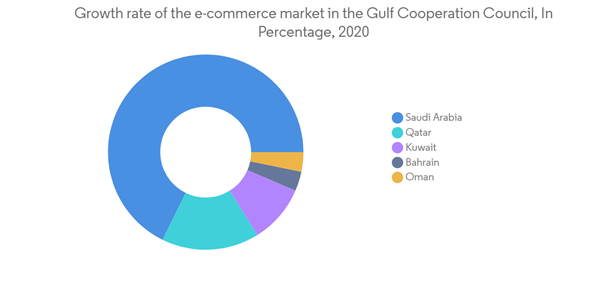

Qatar had an e-commerce industry with an expected market size of 1.9 billion U.S. dollars in 2020. The market size of e-commerce in the GCC region was expected to grow to reach 21.6 billion U.S. dollars in that year. Qatar holds a high internet penetration rate that exposes customers to various online platforms to make their purchases. Launched in 2014, the Qatar government’s Connect 2020 ICT Policy boosted internet usage in the country and increased customer’s interest to try online platforms for their different shopping needs. This is enabling a higher growth rate in internet-based sales, and this trend is expected to continue in the future, owing to the convenience it holds. Through gaining the trust of the customers and strengthening the payment security, internet retailers can increase their number of purchases, as most of the internet users have concerns about payment security.

Increasing Construction Activity is Driving the Market

In Qatar, the construction industry stood second in yielding the highest contribution to GDP, by contributing 15% of the total economy. Residential construction is increasing in the region. To cope with the growing competition, buyers are trying to attract customers by offering smart homes, and by providing different layouts that hold a dedicated space for different home appliances. The demand for these homes is increasing, as they make an ordinary home look more attractive with those structural and architectural design. Manufacturers are trying to grab this opportunity by introducing sleek designs, materials that are highly attractive, aesthetically pleasing colors for the living rooms, and by providing stainless steel finishing to kitchen appliances, among others.

Competitive Landscape

Qatar Small Home Appliances Market is moderatly consolidated in nature. Some of the major players operating currently dominate the market. However, with technological advancement and product innovation, mid-size to smaller companies is increasing their market presence by securing new contracts and by tapping new markets.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Whirlpool Corporation

- Gettco

- LG Electronics Inc.

- Samsung Electronics Co. Ltd

- Panasonic Corporation

- Haier Electronics Group Co. Ltd

- BSH Hausgerte GmbH

- Electro

- Gorenje Group

- Mitsubishi Electric Corp*