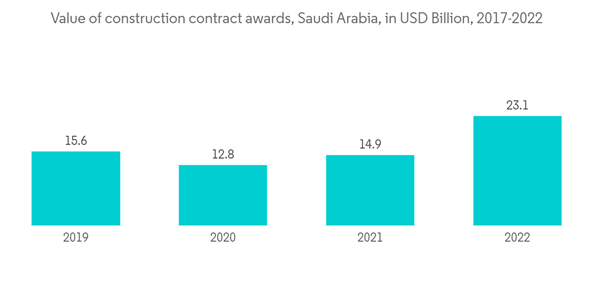

The COVID-19 had a meager impact on the Saudi Arabia construction sector in 2020, contracted by 0.9%, this Pandemic did not affect the transportation infrastructure construction market, as continuous investments were implemented by Saudi Arabian government.

Recently, Saudi Arabia planned a massive program of infrastructure development, 22 projects worth over USD 134 billion, out of which eight will be for road works, this will create a huge demand for transportation construction companies.

Saudi Arabia's Vision 2030, along with a significant investment in housing and infrastructure development promoted across the country by local authorities, is revitalizing the transportation construction industry and generating interest in a growing number of international players.

Saudi Arabia Transportation Infrastructure Construction Market Trends

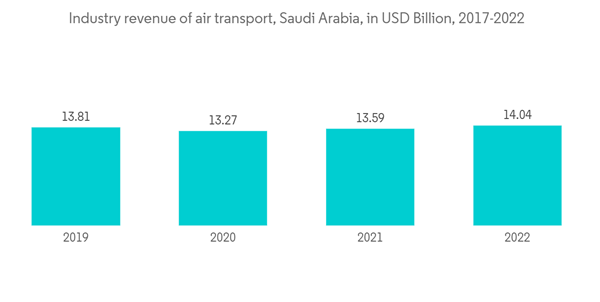

Increased investment in air infrastructure driving the market

- The Kingdom has four international and 21 domestic airports, two of which are among the top five import entry points: King Khalid International Airport in Riyadh, which had a 13% share of imports in 2021, and King Fahd International Airport in Dammam, which had a 6.4% share. GACA said that by 2021, Jeddah's King Khalid International Airport and King Abdulaziz International Airport could be made bigger so that they could handle a total of 100 million passengers per year. Saudi and regional airlines provide a competitive marketplace for passengers.

- As part of plans to make the Kingdom the fifth-largest air transit hub in the world, plans are in the works for a new national airline that will compete internationally. This is likely to make the competition even tougher.The plan would be similar to what Emirates Airlines, Dubai's flag carrier, and Qatar Airways do, which is to use sixth-freedom rights to move people and goods between international destinations with stops and connections in Saudi airports.

- As the Kingdom works toward its Vision 2030 goals of global connectivity and passenger mobility, investment opportunities are likely to stay a key part of its plans for growth and development. Privatization, joint ventures, and other structures will be used as part of a comprehensive, multi-pronged plan to build large-scale infrastructure, look for ways to make operations more efficient, and implement strategies for digitization.

Increased investment in various projects and government initiatives driving the market

- As Vision 2030 reforms are put into place to make it easier for the private sector to invest, the roles of several groups will change. The government anticipates that privatization will increase operational efficiency while also creating financial benefits. GACA will become a regulatory body under NIDLP and will separate ownership of assets from operational capacity. In preparation for privatization, its assets will be transferred to the GACA-owned Saudi Civil Aviation Holding Company. In 2021, the two state-owned rail operators, Saudi Railway Company and Saudi Railways Organization, agreed to merge, paving the way for the privatization of some assets and functions. Saudi Arabia Railways is the name of the merged entity.

- The proposed GCC railway is a USD 15.5 billion project that will connect the six countries with a network of 2172 kilometres of track. It will handle up to 29 million tonnes of the 61 million tonnes that are moved around the region every year by all means of transportation. Rail expansion plans need money from outside the country, and the Kingdom welcomes both public and private sector partners. In 2022, Al Jasser, as minister of transport and logistic services, signed two memoranda of understanding with France's transport minister, Jean-Baptiste Djebbari, to collaborate on rail and other upcoming logistics innovations.

Saudi Arabia Transportation Infrastructure Construction Industry Overview

The Saudi Arabia Transportation Infrastructure Construction Market is relatively fragmented, with a large number of local and regional players and a few global players. The major players include Almabani, CCC, AL-Ayuni, SCCSA, BINYAH, and many others. There are many new projects upcoming in the sector, increasing public-private partnerships in the market to explore opportunities. This has created opportunities for the global players to invest in the market, as they have world-class facilities to deliver in it.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Binyah

- CCC

- Almabani

- SCC

- Al-Ayuni

- Bechtel

- CB&I LLC

- China Energy Engineering Corp. Ltd.

- China Railway Construction Corp. Ltd

- Fluor Corp.

- Tekfen Construction and Installation Co. Inc.

- Gilbane Building Co.

- Jacobs

- AL Jazirah Engineers & Consultants

- Al Latifa Trading and Contracting

- Afras For Trading And Contracting Company

- Al-Rashid Trading & Contracting Company

- Al Yamama For Business And Contracting

- Mohammed Al Mojil Group Co

- Al-Jabreen Contracting Co*