Water treatment refers to the process which is carried out for eliminating impurities from water and making it fit for industrial and domestic use. It is primarily divided into four basic processes, boiler water treatment, water purification, cooling water treatment and wastewater effluent treatment. These processes assist in eliminating suspended solids, fungi, viruses, algae, bacteria and minerals present in the water. Some of the chemicals used in the water treatment process include algicides, muriatic acid, chlorine, chlorine dioxide and soda ash. As the existing water supply is insufficient to fulfil the rising demand for safe and fresh water, water treatment chemicals are increasingly being used for purifying ground, sea, and industrial wastewater.

The market is experiencing significant growth due to growing population and rapid industrialization across both developed and emerging market which is escalating the demand for fresh and useable water. In addition, the surging requirement of clean water in power plants, oil and gas, metal and mining, pulp and paper, and chemical processing industries is contributing to market growth. Besides, the rising awareness of waterborne diseases and the importance of clean water for public health have led to an increased emphasis on water treatment. Water treatment chemicals help eliminate harmful microorganisms, bacteria, and viruses, reducing the risk of waterborne diseases. Moreover, the deterioration of water infrastructure across many countries is increasing the need for effective water treatment solutions to maintain water quality and prevent contamination.

Water Treatment Chemicals Market Trends/Drivers

The increasing consumption of water

Water treatment chemicals are essential for purifying and treating water from various sources to make it safe for consumption, industrial processes, and other applications. The growing need for water treatment drives the demand for these chemicals. Moreover, with increased water consumption, there is a higher risk of water pollution and contamination. Industrial discharges, agricultural runoff, and improper wastewater disposal contribute to the deterioration of water quality. This necessitates the use of water treatment chemicals to address the specific contaminants and ensure the supply of clean and safe water. Besides, as water resources become scarcer, water treatment plants often need to adopt more advanced treatment processes to meet the growing demand for clean water. Advanced treatment methods, such as reverse osmosis, membrane filtration, and advanced oxidation processes, require specific chemicals for efficient operation. The adoption of these advanced treatment processes drives the demand for specialized water treatment chemicals.Industrial growth and increased water usage

Industrial sectors such as power generation, manufacturing, oil and gas, chemicals, and mining require substantial amounts of water for their processes. This increased water usage leads to a greater demand for water treatment chemicals to ensure that the water used in these industries is adequately treated and meets the required quality standards. Water treatment chemicals are used to remove impurities, contaminants, and pollutants from industrial water sources, making it suitable for various industrial applications. Moreover, industrial activities are subject to environmental regulations aimed at protecting water resources and minimizing pollution. Compliance with these regulations often requires industries to implement efficient water treatment systems and technologies. Water treatment chemicals play a crucial role in helping industries meet these regulatory requirements and achieve sustainable water management practices. The need for compliance and sustainability drives the demand for water treatment chemicals in industrial applications.The implementation of stringent environmental regulations

Stringent environmental regulations emphasize pollution prevention and reduction. Industries are required to implement measures that minimize the discharge of pollutants and contaminants into water bodies. Water treatment chemicals play a vital role in reducing the levels of pollutants in wastewater and ensuring that the discharged water meets the prescribed standards. The focus on pollution prevention and reduction drives the demand for water treatment chemicals that can effectively remove or neutralize pollutants. Moreover, there is a growing focus on minimizing the use of harmful chemicals and replacing them with safer alternatives. This includes the development of biodegradable, non-toxic, and environmentally friendly water treatment chemicals. The implementation of stringent regulations encourages the market to provide more sustainable solutions, leading to innovation and expansion in the water treatment chemicals market.Water Treatment Chemicals Industry Segmentation

This report provides an analysis of the key trends in each segment of the global water treatment chemicals market report, along with forecasts at the global, regional and country levels from 2025-2033. The report has categorized the market based on type and end-user.Breakup by Type

- Coagulants and Flocculants

- Corrosion and Scale Inhibitors

- Biocides and Disinfectants

- Ph Adjusters and Softeners

- Defoaming Agents

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes coagulants and flocculants, corrosion and scale inhibitors, biocides and disinfectants, Ph adjusters and softeners, defoaming agents, and others. According to the report, coagulants and flocculants represented the largest segment.

Coagulants and flocculants play a crucial role in the removal of suspended solids from water. Coagulants are used to destabilize and aggregate the suspended particles, while flocculants aid in the formation of larger flocs that can be easily removed through settling or filtration processes. This efficient removal of suspended solids helps improve water clarity and quality, making coagulants and flocculants essential in water treatment processes. find applications across various sectors and water treatment processes. They are used in municipal water treatment plants, industrial water treatment systems, wastewater treatment facilities, and even in specialized applications such as mining and oil and gas industries. Their versatility and ability to address a wide range of water treatment challenges contribute to their leading position in the market.

Breakup by End User

- Municipal

- Power

- Oil and Gas

- Mining

- Chemical

- Food and Beverage

- Pulp and Paper

- Others

Municipal water treatment involves the purification and treatment of water for public water supply and wastewater treatment. Water treatment chemicals are used in municipal water treatment plants to ensure the supply of clean and safe drinking water to the population and to treat wastewater before its discharge into the environment.

The power industry, including thermal power plants, nuclear power plants, and renewable energy facilities, requires significant amounts of water for cooling, steam generation, and other processes. Water treatment chemicals are used to maintain the efficiency and reliability of power generation equipment by preventing scaling, corrosion, and fouling caused by impurities in the water.

The oil and gas industry relies on water for various operations, such as drilling, hydraulic fracturing, refining, and cooling. Water treatment chemicals are employed to treat and recycle water used in these processes, remove impurities, and prevent equipment damage. They help maintain water quality and ensure compliance with environmental regulations.

The mining industry uses water for mineral processing, dust suppression, and site maintenance. Water treatment chemicals are essential for treating water used in mining operations, removing contaminants and suspended solids, and minimizing environmental impacts associated with mining activities.

The chemical industry utilizes water in various manufacturing processes, such as cooling, rinsing, and solvent preparation. Water treatment chemicals are employed to ensure the quality and purity of water used in chemical production, prevent contamination, and protect equipment from corrosion and fouling.

The food and beverage industry requires water for production, cleaning, and sanitation purposes. Water treatment chemicals play a vital role in maintaining water quality and meeting regulatory standards for the food and beverage industry. They help remove impurities, disinfect water, and ensure the safety and quality of water used in food processing and beverage production.

The pulp and paper industry relies on water for various processes, including pulping, bleaching, and paper manufacturing. Water treatment chemicals are used to treat water used in these operations, remove impurities, control pH levels, and prevent the buildup of scale and deposits in equipment.

The others category includes various industries and applications where water treatment chemicals are utilized. This can include sectors such as pharmaceuticals, textiles, electronics, automotive, hospitality, and more, where water treatment chemicals are used to meet specific water quality requirements and ensure efficient water management.

Breakup by Region

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (United States, Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others); Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others); Latin America (Brazil, Mexico, Others); and the Middle East and Africa. According to the report, Asia Pacific was the largest market for water treatment chemicals.

Asia Pacific is home to a significant portion of the global population, including densely populated countries such as China and India. The growing population and rapid urbanization in the region lead to increased water consumption and wastewater generation, driving the demand for water treatment chemicals. Moreover, some parts of Asia Pacific face water scarcity and water stress due to various factors such as population density, limited freshwater resources, and climate change. This necessitates efficient water management and treatment to maximize water availability and minimize wastage. Water treatment chemicals play a crucial role in treating and reusing water resources, making them indispensable in water-stressed regions.

Competitive Landscape

The competitive landscape of the water treatment chemicals market is characterized by the presence of several key players and a mix of global and regional companies. Nowadays, companies are investing heavily in research and development to develop innovative and advanced water treatment chemicals. They are improving the efficiency, performance, and environmental sustainability of their products. They are also expanding their product portfolios by introducing new water treatment chemicals or enhancing existing ones. This allows them to offer a comprehensive range of solutions and cater to a wider range of applications and industries. Moreover, various companies are expanding their geographic reach by establishing a presence in new regions or strengthening their distribution networks. This involves setting up production facilities, partnerships, or acquiring local companies to gain market access and better serve customers in different geographic areas.The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- BASF SE

- Ecolab Inc.

- Kemira OYJ

- Solenis LLC

- Akzo Nobel N.V.

- Baker Hughes Incorporated

- Lonza

- The DOW Chemical Company

- Snf Floerger

- Suez S.A.

Key Questions Answered in This Report

1. How big is the water treatment chemicals market?2. What is the future outlook of the water treatment chemicals market?

3. What are the key factors driving the water treatment chemicals market?

4. Which region accounts for the largest water treatment chemicals market share?

5. Who are the key players/companies in the global water treatment chemicals market?

Table of Contents

Companies Mentioned

- BASF SE

- Ecolab Inc.

- Kemira OYJ

- Solenis LLC

- Akzo Nobel N.V.

- Baker Hughes Incorporated

- Lonza

- The DOW Chemical Company

- Snf Floerger

- Suez S.A

Table Information

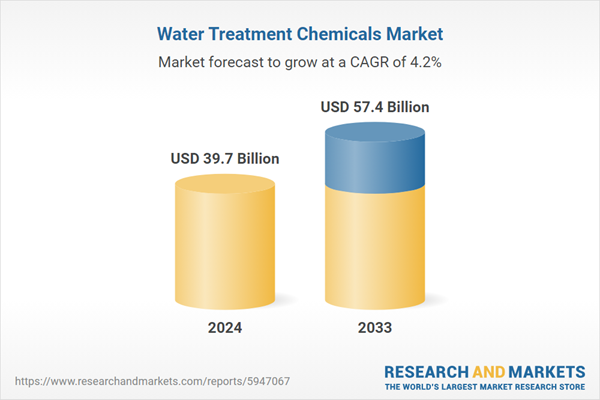

| Report Attribute | Details |

|---|---|

| No. of Pages | 134 |

| Published | February 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 39.7 Billion |

| Forecasted Market Value ( USD | $ 57.4 Billion |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |