Global Digital Banking Platform Market Analysis:

- Major Market Drivers: The rising demand for digital platforms that offer mobile banking, online payments, and remote account management due to the increasing consumer preference for convenient, on-the-go banking services is primarily driving the growth of the market.

- Key Market Trends: The increasing integration of advanced technologies, such as artificial intelligence (AI), biometrics, and blockchain, with banking platforms to enable enhanced security and personalized banking experiences is acting as a primary key trend for the market.

- Geographical Trend: According to the report, North America holds the largest regional market for digital banking platforms. This region boasts an advanced technological infrastructure, high internet penetration rates, and a large base of tech-savvy consumers, which makes it the leading region for the digital banking platform market.

- Competitive Landscape: Some of the digital banking platform market leaders are Appway AG (FNZ (UK) Ltd.), Fidelity Information Services (FIS), Finastra Limited, Fiserv Inc., Infosys Limited, nCino, NCR Corporation, Oracle Corporation, SAP SE, Sopra Steria, Tata Consultancy Services Limited, Temenos AG, The Bank of New York Mellon Corporation, Worldline, among others.

- Challenges and Opportunities: The susceptibility to fraudulent transactions and technical delays are prominent challenges faced by industry operators. However, the integration of enhanced security technologies with online banking is anticipated to offer lucrative growth opportunities to the overall market.

Global Digital Banking Platform Market Trends:

Increasing Demand for Seamless and Convenient banking

The escalating customer demand for seamless and convenient banking experiences is primarily catalyzing the market for digital banking platforms. Modern consumers expect banking services that align with their fast-paced lifestyles, enabling them to conduct transactions and manage finances on-the-go, without being constrained by traditional brick-and-mortar operations.Consequently, various financial institutions, in collaboration with technology providers, are taking initiatives to make online banking more seamless and secure. For instance, in December 2022, Deloitte announced a collaboration with AWS to address a chronic difficulty in banking: the transition to digital-first systems that span the client interface to back-office operations.

Similarly, In January 2023, Axis Bank collaborated with OPEN to provide its clients, including SMEs, freelancers, homepreneurs, influencers, and others, with a completely native digital current account. This collaboration gives the larger business community access to Axis Bank's comprehensive banking experience and OPEN's end-to-end financial automation capabilities for business administration. In addition to this, digital banking platforms are offering mobile applications, online banking portals, and user-friendly interfaces that provide real-time access to account information, fund transfers, and bill payments, which is anticipated to propel the digital banking platform market share in the coming years.

Technological Advancements and Innovations

Rapid technological advancements are playing a pivotal role in driving the digital banking platform market forward. Various leading market players are increasingly integrating emerging technologies like artificial intelligence (AI), machine learning (ML), biometrics, and blockchain offer immense potential to revolutionize the banking sector. Moreover, increased adoption of third-party applications for real-time payments, such as WhatsApp Pay and Phone Pay, has led to increased demand for reliable infrastructure by the banks to carry out UPI transactions smoothly.For instance, Visa recently completed a US$ 5.3 Billion acquisition of Plaid, a fintech startup that allows applications to connect with customers' bank accounts easily and instantly. Moreover, the integration of cloud-based platforms with online banking platforms is also creating a positive outlook for the overall market. In January 2023, the digital bank in the Philippines, GoTyme Bank, collaborated with the worldwide cloud banking platform Mambu to create an innovative digital banking solution that seeks to increase Filipinos' access to high-quality financial services. These innovations empower digital banking platforms to provide enhanced security measures, personalized services based on consumer behavior and preferences, efficient transaction processing, and data-driven insights for better decision-making.

Regulatory Initiatives and Open Banking

Government and regulatory authorities are making efforts to regulate online transactions and promote open banking and data sharing, which is positively impacting the global digital banking platform market. For instance, in February 2024, the Reserve Bank of India (RBI) released a major policy statement outlining several developmental and regulatory initiatives covering financial markets, regulations pertaining to lending institutions, and payment systems, including digital currency and fintech.On the financial markets front, RBI announced that it would comprehensively review the existing regulatory guidelines for Electronic Trading Platforms (ETPs) that enable transactions in financial instruments regulated by RBI, such as foreign exchange and government securities. Open banking mandates financial institutions to share customer data securely with authorized third-party providers, which is fostering a more interconnected financial ecosystem.

Digital Banking Platform Industry Segmentation:

The research provides an analysis of the key trends in each segment of the global digital banking platform market report, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on component, type, deployment mode, and banking mode.Breakup by Component:

- Solutions

- Service.

Solutions dominate the market

The report has provided a detailed breakup and analysis of the market based on the components. This includes solutions and services. According to the report, solutions represented the largest segment.Solutions drive innovation by providing flexible and customizable offerings to financial institutions. Rather than a monolithic approach, digital banking platform providers offer modular solutions that can be integrated into existing systems, allowing banks to select specific functionalities based on their needs and preferences. Additionally, a number of banks are launching banking solutions with improved security, which is catering to eh growth of this segment. For instance, Next Bank, a Taiwanese digital bank, launched Temenos in January 2023. Next Bank can bring products to market quickly and effectively with Temenos' open platform.

The bank intends to add foreign exchange services, such as remittance services for migrant workers and wealth management tools, over time. Next Bank, which is powered by Temenos, swiftly expanded to approximately 300,000 users within nine months of its launch. Additionally, solutions foster collaboration between banks and fintech partners, promoting the development of new and innovative services.

Breakup by Type:

- Retail Banking

- Corporate Bankin.

Retail banking holds the largest share of the market

A detailed breakup and analysis of the market based on the type has also been provided in the report. This includes retail and corporate banking. According to the report, retail banking accounted for the largest market share.Retail banking has a massive customer base and is witnessing a substantial increase in demand for convenient and personalized banking services. Customers are increasingly opening saving accounts in retail banks to leverage benefits such as mobile banking, online account management, contactless payments, and real-time customer support. For instance, in 2023, RBL Bank reported a total of INR 78,186 crore, which is a 21% surge from the year 2022.

Breaking this down, the bank's retail advances grew by 34% year-on-year, while its wholesale advances rose by 7%. Moreover, retail banking is undergoing a significant transformation, requiring banks to adopt advanced technologies such as natural language processing (NLP), artificial intelligence (AI), and machine learning (ML) to become trusted partners and deliver improved services.

Breakup by Deployment Mode:

- On-premises

- Cloud-base.

On-premises represents the most popular mode of deployment

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premises and cloud-based. According to the report, on-premises represented the largest segment.On-premises deployment caters to the specific needs and preferences of financial institutions that prioritize maintaining control and security over their infrastructure and data. Many banks, especially large and established ones, prefer on-premises solutions owing to regulatory compliance requirements and data privacy concerns.

Breakup by Banking Mode:

- Online Banking

- Mobile Bankin.

Online banking accounts for the majority of the share in the market

The report has provided a detailed breakup and analysis of the market based on the banking mode. This includes online and mobile banking. According to the report, online banking represented the largest segment.Online banking enables financial institutions to offer a wide range of services to customers through digital channels. According to Deloitte Insights reports, web/online banking is preferred over mobile for tasks like paying bills, updating account details, making international transfers, and researching financial products. This is due to the need for greater accuracy, ease of comparison, or simply personal preference. According to an October 2023 ABA study, Baby Boomers, at 39%, lead the pack in using online banking as their primary banking channel. Moreover, with the rapid proliferation of smartphones, tablets, and internet connectivity, customers today expect seamless and convenient access to their accounts and banking services online.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America was the largest regional market for digital banking platforms.

The presence of various big banks in North America is one of the primary reasons for the region's growth. Digital banking companies in the region offer software as a service so that legacy systems can be turned into digital ones. For instance, Temenos helps new US digital banks go live in 90 days with the most functionally rich and technologically advanced front-to-back SaaS digital banking offering. Moreover, the region's strong economy and well-established banking sector is further contributing to the growth of digital banking platforms. With a highly competitive financial services landscape, banks in the North American region are constantly seeking innovative ways to attract and retain customers.

Competitive Landscape:

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the digital banking platform top companies are listed below:- Appway AG (FNZ (UK) Ltd.)

- Fidelity Information Services (FIS)

- Finastra Limited

- Fiserv Inc.

- Infosys Limited

- nCino

- NCR Corporation

- Oracle Corporation

- SAP SE

- Sopra Steria

- Tata Consultancy Services Limited

- Temenos AG

- The Bank of New York Mellon Corporation

- Worldlin.

Key Questions Answered in This Report

- How big is the global digital banking platform market?

- What is the expected growth rate of the global digital banking platform market during 2025-2033?

- What are the key factors driving the global digital banking platform market?

- What has been the impact of COVID-19 on the global digital banking platform market?

- What is the breakup of the global digital banking platform market based on the component?

- What is the breakup of the global digital banking platform market based on the type?

- What is the breakup of the global digital banking platform market based on the deployment mode?

- What is the breakup of the global digital banking platform market based on the banking mode?

- What are the key regions in the global digital banking platform market?

- Who are the key players/companies in the global digital banking platform market?

Table of Contents

Companies Mentioned

- Appway AG (FNZ (UK) Ltd.)

- Fidelity Information Services (FIS)

- Finastra Limited

- Fiserv Inc.

- Infosys Limited

- nCino

- NCR Corporation

- Oracle Corporation

- SAP SE

- Sopra Steria

- Tata Consultancy Services Limited

- Temenos AG

- The Bank of New York Mellon Corporation

- Worldline

Table Information

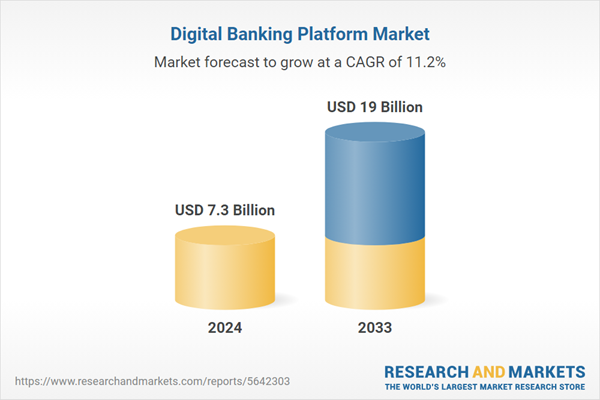

| Report Attribute | Details |

|---|---|

| No. of Pages | 145 |

| Published | June 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 7.3 Billion |

| Forecasted Market Value ( USD | $ 19 Billion |

| Compound Annual Growth Rate | 11.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 14 |