Agriculture drones refer to unmanned aerial vehicles (UAVs) that are equipped with devices to assist in farming and agriculture tasks. It includes fixed-wing, multi-rotor, and hybrid drones, each with distinct capabilities. They are comprised of several components, such as flight controllers, sensors, cameras, navigation systems, and application-specific payloads. Agriculture drones finds extensive applications in soil analysis, crop monitoring, planting, irrigation management, livestock tracking, pest control, yield estimation, weather forecasting, aerial mapping, and data collection. They aid in increasing operational efficiency, reducing labor costs, enhancing crop yield, and improving safety.

The imposition of various government initiatives offering grants and subsidies to encourage the adoption of modern farming technology, including drones, is positively influencing the market growth. Besides this, the escalating consumer expectation for better-quality, pesticide-free produce is facilitating the product demand to enable more precise and data-driven agriculture. Additionally, the widespread product utilization to provide actionable insights that assist in the efficient use of limited resources, such as water and soil, is contributing to the market growth. Furthermore, the growing product demand, owing to its economic benefits over traditional agricultural practices, such as resource optimization, low labor cost, and improved efficiency, is catalyzing the market growth. In addition, the rising product adoption owing to the increasing unpredictability of weather patterns, which require frequent and precise monitoring and quick decision-making, is supporting the market growth.

Agriculture Drones Market Trends/Drivers:

The significant technological advancements

Technological advancement in drone capabilities is a key driver in the agriculture drones market. Drones are becoming more specialized and equipped with advanced features tailored to agricultural needs. In line with this, the integration of sophisticated sensors, such as multispectral, hyperspectral, and thermal cameras, has enabled the collection of highly accurate data, which can be analyzed in real-time for informed decision-making. Furthermore, the incorporation of advanced global positioning systems (GPS) and geographic information systems (GIS) to offer precise location tracking and data mapping is positively influencing the market growth. Apart from this, the advancements in artificial intelligence (AI) and machine learning (ML) algorithms that are revolutionizing data analytics and providing actionable insights into crop health, soil conditions, and irrigation needs is contributing to the market growth.The rising labor shortage across the globe

The agricultural sector is facing a growing labor shortage problem, which is driving the demand for automated solutions, such as drones. Additionally, the rising geriatric population in many developed countries and younger generations increasingly moving towards urban areas for employment opportunities are causing a shortage of skilled labor for farming activities. Besides this, manual labor is not only hard to find but can also be expensive and seasonal, adding to the inconsistency in workforce availability. Drones provide a solution to this labor gap by automating many tasks, such as crop monitoring, that would otherwise require significant human effort. In addition, they can also apply fertilizers and pesticides in a targeted manner, thus reducing the need for manpower. As a result, drones allow agricultural enterprises to maintain or even increase productivity despite labor shortages.The escalating environmental consciousness among the masses

The growing environmental consciousness is a crucial factor driving the adoption of drones in agriculture. Traditional farming practices involve the indiscriminate use of resources, such as water and fertilizers, which causes soil degradation and water pollution. Drones, with their precision agriculture capabilities, address these concerns effectively by enabling targeted application of fertilizers and pesticides, thereby reducing wastage and minimizing environmental impact. In addition, drones can generate detailed maps of farmland, highlighting areas that may require special attention, such as those with poor drainage or soil conditions. This data aids in the optimal utilization of resources, thus preserving the environment, saving costs, and promoting eco-friendly practices.Agriculture Drones Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global agriculture drones market report, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on offering, component, farming environment, and application.Breakup by Offering:

- Hardware

- Fixed Wing

- Rotary Wing

- Hybrid Wing

- Software

- Data Management Software

- Imaging Software

- Data Analytics Software

- Others

Hardware (Fixed wing) dominates the market

The report has provided a detailed breakup and analysis of the market based on offering. This includes hardware (fixed wing, rotary wing, and hybrid wing) and software (data management software, imaging software, data analytics software, and others). According to the report, hardware (fixed wing) represented the largest segment.Hardware (fixed-wing) is dominating the market as it offers longer flight times compared to its rotary-wing counterparts, allowing for the surveying of larger agricultural fields in a single flight. Furthermore, it is generally faster, covering more ground in less time, which enhances its suitability for large-scale agricultural applications, such as crop monitoring, soil analysis, and mapping. Moreover, fixed-wing drones are more energy-efficient, as they require less power to stay aloft, which makes them highly cost-effective in the long run, lowering operational costs for farmers and agricultural companies. Additionally, their designs enable them to carry heavier payloads, including advanced imaging technologies and larger batteries. This capacity allows for more sophisticated data collection, which is crucial for modern, data-driven agricultural practices.

Breakup by Component:

- Controller Systems

- Propulsion Systems

- Cameras

- Batteries

- Navigation Systems

- Others

Cameras hold the largest share in the market

A detailed breakup and analysis of the market based on component has also been provided in the report. This includes controller systems, propulsion systems, cameras, batteries, navigation systems, and others. According to the report, cameras represented the largest segment.Cameras are dominating the market as they provide high-resolution imaging, which allows detailed crop monitoring, soil assessment, and mapping, enabling farmers to make informed decisions. Additionally, the recent advancements in camera technology, which have led to the development of specialized cameras capable of multispectral, hyperspectral, and thermal imaging, are contributing to the market growth. Besides this, cameras are becoming increasingly cost-effective, making them an accessible option for even smaller agricultural operations. Furthermore, the cost-effectiveness and wider affordability has accelerated the adoption of camera-equipped drones across the agricultural sector. Moreover, the ease of integrating cameras with drone hardware and data analytics platforms facilitates efficient data processing and interpretation, which is crucial for modern agriculture practices that rely on real-time information.

Breakup by Farming Environment:

- Indoor

- Outdoor

Outdoor holds the largest share in the market

A detailed breakup and analysis of the market based on farming environment has also been provided in the report. This includes indoor and outdoor. According to the report, outdoor accounted for the largest market share.Outdoor farming environments, such as large farms and plantations, cover vast areas that are difficult to monitor manually. Drones offer an efficient, scalable solution to survey these large tracts of land, making them highly suitable for outdoor applications. Furthermore, agricultural drones are primarily used for field mapping, crop monitoring, and soil analysis, tasks that are predominantly relevant to outdoor farming practices. Additionally, outdoor farming often involves varied terrains and ecological conditions, which can be challenging to navigate through ground-based methods. In line with this, drones offer the flexibility to easily adapt to different outdoor conditions, thus offering more reliable and efficient data collection. Moreover, the outdoor environment provides more opportunities for the deployment of advanced drone technologies, such as multispectral imaging and LIDAR.

Breakup by Application:

- Field Mapping

- Variable Rate Application

- Crop Scouting

- Others

Field mapping holds the largest share in the market

A detailed breakup and analysis of the market based on application has also been provided in the report. This includes field mapping, variable rate application, crop scouting, and others. According to the report, field mapping accounted for the largest market share.Field mapping is dominating the market as it provides critical data that helps farmers understand the variability in their fields, allowing them to make informed decisions about irrigation, fertilization, and pest control. Furthermore, the advancements in drone technology, which have enabled high-resolution imaging capabilities, making field mapping more precise and accurate, are positively influencing the market growth. Additionally, the advent of precision agriculture, which depends heavily on accurate field maps, is acting as another growth-inducing factor. Moreover, field mapping with drones is significantly faster and provides the ability to quickly gather data, which allows timely interventions, such as planting adjustments, irrigation modifications, or pest treatments. Along with this, the imposition of favorable policies by governments to encourage the use of drones for non-intrusive applications like field mapping is catalyzing the market growth.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America exhibits a clear dominance, accounting for the largest agriculture drones market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.North America has a strong technological infrastructure that readily supports advancements in drone technology. Along with this, the region hosts some of the world's leading tech companies specializing in drone manufacturing. Furthermore, North America benefits from robust regulatory frameworks that facilitate easier implementation of drone technology in agriculture, including clear guidelines and quicker approvals for drone operations. Besides this, the regional farmers possess the capital required to invest in sophisticated drone systems, making it a lucrative market for companies. Additionally, the agricultural sector in the region is more industrialized and open to adopting new technologies to improve efficiency and yields. Moreover, North America has a vast expanse of arable land, which necessitates more effective and scalable solutions, such as drones, for crop monitoring, soil assessment, and yield prediction.

Competitive Landscape:

Leading players are focusing on technological innovation to provide drones with advanced features, such as enhanced imaging capabilities, machine learning (ML) algorithms for crop analysis, and improved battery life for extended flight times. Besides this, companies are entering into partnerships and collaborations with agricultural tech firms and research institutions to develop drones with specialized functionalities. Furthermore, they are participating in agricultural exhibitions, hosting webinars, and publishing case studies to demonstrate the effectiveness of drone technology in modern agriculture. Additionally, several product manufacturers are actively working with governmental bodies to help define regulations that are conducive to the agricultural drone industry, ensuring safety and compliance. Moreover, they are exploring various pricing models, including leasing options, to make drone technology accessible to small and medium-sized farms, thus broadening the consumer base.The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

Some of the key players in the market include:

- 3D Robotics Inc.

- AeroVironment Inc.

- AGCO Corporation

- AgEagle Aerial Systems Inc.

- American Robotics Inc. (Ondas Holdings Inc.)

- DJI

- DroneDeploy

- Parrot Drone SAS

- PrecisionHawk

- Trimble Inc.

- Yamaha Motor Co. Ltd.

Key Questions Answered in This Report

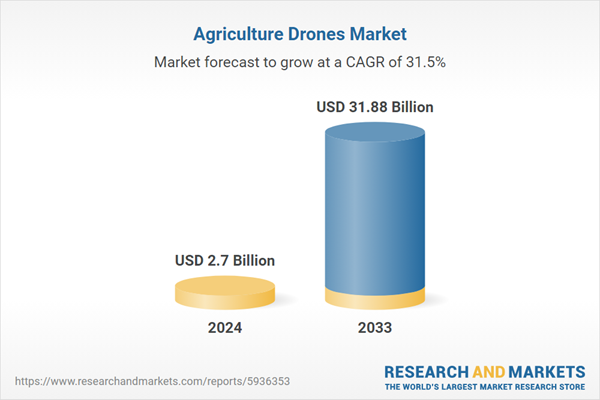

- What was the size of the global agriculture drones market in 2024?

- What is the expected growth rate of the global agriculture drones market during 2025-2033?

- What are the key factors driving the global agriculture drones market?

- What has been the impact of COVID-19 on the global agriculture drones market?

- What is the breakup of the global agriculture drones market based on the offering?

- What is the breakup of the global agriculture drones market based on component?

- What is the breakup of the global agriculture drones market based on the farming environment?

- What are the key regions in the global agriculture drones market?

- Who are the key players/companies in the global agriculture drones market?

Table of Contents

Companies Mentioned

- 3D Robotics Inc.

- AeroVironment Inc.

- AGCO Corporation

- AgEagle Aerial Systems Inc.

- American Robotics Inc. (Ondas Holdings Inc.)

- DJI

- DroneDeploy

- Parrot Drone SAS

- PrecisionHawk

- Trimble Inc.

- Yamaha Motor Co. Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 147 |

| Published | March 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 2.7 Billion |

| Forecasted Market Value ( USD | $ 31.88 Billion |

| Compound Annual Growth Rate | 31.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |