Workforce Management Market Analysis:

- Major Market Drivers: The global market is experiencing strong growth, driven by rising preferences for cloud-based solutions and the need for compliance with labor regulations.

- Key Market Trends: The increasing adoption of digitalization and automation and the rising remote work arrangements in companies are main trends in the market.

- Geographical Trends: North America exhibits a clear dominance, accounting for the biggest market share owing to the early adoption of cutting-edge technologies.

- Competitive Landscape: Some of the major market players in the workforce management industry include ADP, Atoss Software AG, HotSchedules Inc., Huntington Business Systems, IBM, Kronos Inc., Oracle Corporation, Reflexis Systems, SAP SE, Ultimate Software Group Inc., Verint Systems, Workday Inc., WorkForce Software LLC, among many others.

- Challenges and Opportunities: Data privacy and security concerns about sensitive user data represent a key market challenge. Nonetheless, the rising focus on mobile workforce solutions, coupled with the increasing emphasis on employee well-being, particularly around mental health and work-life balance, is projected to overcome these challenges and provide market opportunities.

Workforce Management Market Trends:

Adoption of Digitalization and Automation

The global market is witnessing growth due to the increasing adoption of digitalization and automation across industries. As businesses are transitioning towards digital platforms, the demand for efficient management of human resources is growing. There is a rise in the need to enhance operational agility, improve workforce productivity, and optimize resource allocation. Organizations are recognizing the value of streamlined processes achieved through digital workforce management systems. By leveraging advanced technologies such as cloud-based solutions and mobile applications, businesses can effectively schedule shifts, monitor attendance, and allocate tasks, thereby reducing manual effort and minimizing errors. This transition towards digitized workforce management not only increase overall efficiency but also contributes to cost savings. Furthermore, companies are engaging in partnerships and collaborations to provide accurate and automated solutions. For instance, on 27 March 2023, UJET, Inc., announced UJET WFM, in partnership with Google Cloud. With the launch of its workforce management suite, also natively available within Google Cloud Contact Center AI Platform, UJET introduced new business intelligence solutions for the contact center industry. UJET WFM offers highly accurate forecasting, scheduling, and real time adherence monitoring to improve remote contact center agent performance and overall user experience.Optimization Of Workforce Productivity and Cost Control

Strata Decision Technology (Strata) launched its Real Time Workforce Management (RTWM) solution on 26 June 2023 that is designed to address the financial and operational goals of nursing leaders. The solution offers nursing leadership with accurate and actionable data to improve communication between leaders and staff. The global workforce management market is experiencing growth because of the focus on optimizing workforce productivity and controlling labor costs. Organizations are striving to achieve maximum output while minimizing expenses. Workforce management solutions benefits in enabling businesses to align labor resources with operational demands. These solutions facilitate accurate demand forecasting, efficient scheduling, and real time monitoring of workforce performance. Organizations can enhance productivity and reduce overstaffing or understaffing issues by ensuring that right people are assigned to the right tasks at the right time. Moreover, the ability to track labor expenses and manage overtime helps control costs, ultimately contributing to improved profitability.Rise of Remote and Flexible Work Arrangements

The increasing focus on remote and flexible work arrangements is bolstering the market growth. The rising number of organizations are adopting remote work models or offering flexible scheduling options, which is supporting workforce management market growth. This shift possesses various challenges related to workforce coordination, communication, and performance monitoring. To address these challenges, businesses are choosing advanced workforce management solutions. These solutions enable remote employee tracking, task assignment, and real time collaboration, ensuring that regardless of the physical location, the workforce remains connected and productive. Additionally, flexible work arrangements require dynamic scheduling capabilities that accommodate varying employee preferences and availability. Organizations are investing in workforce management solutions to maintain operational efficiency and empower their distributed teams. Besides this, market players are forming acquisitions and partnerships to introduce new solutions and provide superior operational efficiency. For example, on 30 May 2023, WorkAxle, a leading provider of workforce management (WFM) solutions, and TalenTeam, SAP Gold Partner and Human Experience Management expert, announced a strategic partnership. This collaboration aims to empower organizations in Europe and the Middle East with cutting-edge solutions that optimize workforce management processes and drive operational efficiency.Workforce Management Market Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on solution, service, deployment type, organization size, and vertical.Breakup by Solution:

- Absence Management

- Performance Management

- Workforce Scheduling

- Time and Attendance Management

- Workforce Analytics

- Others

Time and attendance management accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the solution. This includes absence management, performance management, workforce scheduling, time and attendance management, workforce analytics, and others. According to the report, time and attendance management represented the largest segment.The rising demand for accurate time and attendance for effective workforce management and efficient resource allocation is supporting the market growth. Organizations are recognizing the importance of real time insights into employee attendance patterns and productivity levels. This enables them to make informed decisions, optimize staffing, and minimize operational disruptions. Additionally, there is an increase in the need for solutions to monitor off-site employees and ensures accountability and task completion. Moreover, the integration of biometric authentication and mobile applications enhances accuracy and convenience. Besides this, workforce management market value is projected to further increase due to the rising need to identify trends, forecast labor needs, and optimize schedules.

Breakup by Service:

- Implementation Services

- Support and Maintenance Services

- Training and Education Services

The growth of the implementation services segment is propelled by the increasing demand for seamless integration of workforce management solutions into existing organizational systems. Businesses are seeking expertise to ensure a smooth transition, optimize processes, and customize solutions to their unique needs in order to enhance operational efficiency and workforce productivity.

The rising need for continuous functionality of workforce management systems is catalyzing the demand for support and maintenance services. Organizations require timely troubleshooting, updates, and technical assistance to prevent disruptions. Reliable support services ensure uninterrupted operations, data security, and adherence to compliance standards.

The understanding of the importance of appropriate user training for the efficient use of workforce management solutions is driving the expansion of the training and education services market. Thorough training gives users the abilities to make the most out of the system. Education services allow organizations to adapt to evolving features and technologies while staying ahead in the dynamic workforce management landscape.

Breakup by Deployment Type:

- Cloud-based

- On-premises

Cloud-based represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the deployment type. This includes cloud-based and on-premises. According to the report, cloud-based represented the largest segment.Cloud-based services offer unmatched accessibility and scalability. These solutions are easily accessible to organizations from a variety of locations and devices. Subscription-based solutions offer organizations the option to extend their workforce management capabilities as needed, all without requiring large upfront commitments. This affordability is especially suitable to small and medium-sized businesses (SMEs). Moreover, cloud-based solutions offer data synchronization and real time updates, guaranteeing that all stakeholders access the latest information. Furthermore, these solutions address issues regarding data privacy and compliance and are supported by strong cybersecurity safeguards.

Breakup by Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

Large enterprises exhibit a clear dominance in the market

A detailed breakup and analysis of the market based on the organization size have also been provided in the report. This includes small and medium-sized enterprises (SMEs) and large enterprises. According to the report, large enterprises account for the largest market share.Large enterprises have complex organizational structures and requires extensive workforce to ensure streamlined operations. Moreover, the scale of operations in large enterprises demands efficient allocation of resources including human capital as to optimize productivity and control costs. Furthermore, as the workforce grows, it is getting harder to comply with complex labor rules and regulations. This is increasing the need for comprehensive solutions to efficiently handle legal complications. Additionally, the incorporation of state-of-the-art technologies facilitates data-driven decision-making and process optimization.

Breakup by Vertical:

- Government and Defense

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare

- Transportation and Logistics

- Telecom and IT

- Consumer Goods and Retail

- Manufacturing

- Energy and Utilities

- Others

Telecom and IT dominate the market

The report has provided a detailed breakup and analysis of the market based on the vertical. This includes government and defense, banking, financial services, and insurance (BFSI), healthcare, transportation and logistics, telecom and IT, consumer goods and retail, manufacturing, energy and utilities, and others. According to the report, telecom and IT represents the largest segment.The telecom and IT necessitate efficient management of a skilled workforce to meet dynamic demands. Additionally, the integration of artificial intelligence (AI) and data analytics into telecom and IT workforce management enhances resource allocation, project planning, and overall efficiency. Furthermore, the sector's reliance on compliance with intricate industry regulations and labor laws is catalyzing the demand for comprehensive workforce management solutions to ensure adherence and avoid legal complications. Besides this, as competition intensifies, telecom and IT companies are seeking to optimize employee engagement and satisfaction.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest workforce management market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market for workforce management.North America leads in the workforce management market due to its early adoption of cutting-edge technologies like cloud computing and AI. This technological preparedness gives businesses in the region an advantage in optimizing HR operations. Workforce management systems help organizations allocate resources efficiently, streamline operations, and comply with local labor laws. In addition, the rising focus on data-driven decision-making is impelling the market growth. There is an increase in the demand for tools that enable remote team management including task assignment and performance monitoring. Furthermore, top market players in the region are engaging in mergers and acquisitions (M&As) and partnerships to streamline processes. For instance, on 3 May 2024, the US-based corporation Veriforce acquired Global Worker Pass, a cutting-edge software program made to make it easier to instantly validate workers’ qualifications and certifications in real time. The acquisition will enhance Veriforce's product line and provide businesses with a complete labor management solution for their international workforce.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the workforce management industry include ADP, Atoss Software AG, HotSchedules Inc., Huntington Business Systems, IBM, Kronos Inc., Oracle Corporation, Reflexis Systems, SAP SE, Ultimate Software Group Inc., Verint Systems, Workday Inc., WorkForce Software LLC.

- Leading companies in the industry are providing creative solutions to meet the changing demands of various industries. To improve workforce optimization, they are making investments in state-of-the-art platforms like cloud integration and AI-driven analytics. Customization and personalization of solutions are also becoming more popular as businesses look for solutions that are specifically designed to meet their workforce management needs. Additionally, strategic alliances and partnerships are helping businesses to grow their product lines and enter new markets. For instance, on 31 January 2023, Accenture and UKG partnered with Ardent Health Services in enhancing worker agility and visibility throughout its network of 200 care sites and 30 hospitals. In order to empower frontline workers with more flexible scheduling options that enhance work-life experiences, Ardent is revolutionizing workforce operations.

Key Questions Answered in This Report

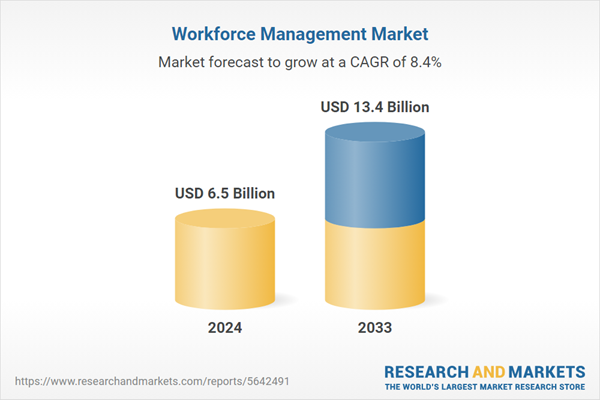

1. What was the size of the global workforce management market in 2024?2. What is the expected growth rate of the global workforce management market during 2025-2033?

3. What are the key factors driving the global workforce management market?

4. What has been the impact of COVID-19 on the global workforce management market?

5. What is the breakup of the global workforce management market based on the solution?

6. What is the breakup of the global workforce management market based on the deployment type?

7. What is the breakup of the global workforce management market based on organization size?

8. What is the breakup of the global workforce management market based on the vertical?

9. What are the key regions in the global workforce management market?

10. Who are the key players/companies in the global workforce management market?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global Workforce Management Market

5.1 Market Overview

5.2 Market Performance

5.3 Impact of COVID-19

5.4 Market Forecast

6 Market Breakup by Solution

6.1 Absence Management

6.1.1 Market Trends

6.1.2 Market Forecast

6.2 Performance Management

6.2.1 Market Trends

6.2.2 Market Forecast

6.3 Workforce Scheduling

6.3.1 Market Trends

6.3.2 Market Forecast

6.4 Time and Attendance Management

6.4.1 Market Trends

6.4.2 Market Forecast

6.5 Workforce Analytics

6.5.1 Market Trends

6.5.2 Market Forecast

6.6 Others

6.6.1 Market Trends

6.6.2 Market Forecast

7 Market Breakup by Service

7.1 Implementation Services

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 Support and Maintenance Services

7.2.1 Market Trends

7.2.2 Market Forecast

7.3 Training and Education Services

7.3.1 Market Trends

7.3.2 Market Forecast

8 Market Breakup by Deployment Type

8.1 Cloud-based

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 On-premises

8.2.1 Market Trends

8.2.2 Market Forecast

9 Market Breakup by Organization Size

9.1 Small and Medium-sized Enterprises (SMEs)

9.1.1 Market Trends

9.1.2 Market Forecast

9.2 Large Enterprises

9.2.1 Market Trends

9.2.2 Market Forecast

10 Market Breakup by Vertical

10.1 Government and Defense

10.1.1 Market Trends

10.1.2 Market Forecast

10.2 Banking, Financial Services, and Insurance (BFSI)

10.2.1 Market Trends

10.2.2 Market Forecast

10.3 Healthcare

10.3.1 Market Trends

10.3.2 Market Forecast

10.4 Transportation and Logistics

10.4.1 Market Trends

10.4.2 Market Forecast

10.5 Telecom and IT

10.5.1 Market Trends

10.5.2 Market Forecast

10.6 Consumer Goods and Retail

10.6.1 Market Trends

10.6.2 Market Forecast

10.7 Manufacturing

10.7.1 Market Trends

10.7.2 Market Forecast

10.8 Energy and Utilities

10.8.1 Market Trends

10.8.2 Market Forecast

10.9 Others

10.9.1 Market Trends

10.9.2 Market Forecast

11 Market Breakup by Region

11.1 North America

11.1.1 United States

11.1.1.1 Market Trends

11.1.1.2 Market Forecast

11.1.2 Canada

11.1.2.1 Market Trends

11.1.2.2 Market Forecast

11.2 Asia Pacific

11.2.1 China

11.2.1.1 Market Trends

11.2.1.2 Market Forecast

11.2.2 Japan

11.2.2.1 Market Trends

11.2.2.2 Market Forecast

11.2.3 India

11.2.3.1 Market Trends

11.2.3.2 Market Forecast

11.2.4 South Korea

11.2.4.1 Market Trends

11.2.4.2 Market Forecast

11.2.5 Australia

11.2.5.1 Market Trends

11.2.5.2 Market Forecast

11.2.6 Indonesia

11.2.6.1 Market Trends

11.2.6.2 Market Forecast

11.2.7 Others

11.2.7.1 Market Trends

11.2.7.2 Market Forecast

11.3 Europe

11.3.1 Germany

11.3.1.1 Market Trends

11.3.1.2 Market Forecast

11.3.2 France

11.3.2.1 Market Trends

11.3.2.2 Market Forecast

11.3.3 United Kingdom

11.3.3.1 Market Trends

11.3.3.2 Market Forecast

11.3.4 Italy

11.3.4.1 Market Trends

11.3.4.2 Market Forecast

11.3.5 Spain

11.3.5.1 Market Trends

11.3.5.2 Market Forecast

11.3.6 Russia

11.3.6.1 Market Trends

11.3.6.2 Market Forecast

11.3.7 Others

11.3.7.1 Market Trends

11.3.7.2 Market Forecast

11.4 Latin America

11.4.1 Brazil

11.4.1.1 Market Trends

11.4.1.2 Market Forecast

11.4.2 Mexico

11.4.2.1 Market Trends

11.4.2.2 Market Forecast

11.4.3 Others

11.4.3.1 Market Trends

11.4.3.2 Market Forecast

11.5 Middle East and Africa

11.5.1 Market Trends

11.5.2 Market Breakup by Country

11.5.3 Market Forecast

12 SWOT Analysis

12.1 Overview

12.2 Strengths

12.3 Weaknesses

12.4 Opportunities

12.5 Threats

13 Value Chain Analysis

14 Porters Five Forces Analysis

14.1 Overview

14.2 Bargaining Power of Buyers

14.3 Bargaining Power of Suppliers

14.4 Degree of Competition

14.5 Threat of New Entrants

14.6 Threat of Substitutes

15 Price Indicators

16 Competitive Landscape

16.1 Market Structure

16.2 Key Players

16.3 Profiles of Key Players

16.3.1 ADP

16.3.1.1 Company Overview

16.3.1.2 Product Portfolio

16.3.1.3 Financials

16.3.1.4 SWOT Analysis

16.3.2 Atoss Software AG

16.3.2.1 Company Overview

16.3.2.2 Product Portfolio

16.3.2.3 Financials

16.3.3 HotSchedules Inc.

16.3.3.1 Company Overview

16.3.3.2 Product Portfolio

16.3.4 Huntington Business Systems

16.3.4.1 Company Overview

16.3.4.2 Product Portfolio

16.3.5 IBM

16.3.5.1 Company Overview

16.3.5.2 Product Portfolio

16.3.5.3 Financials

16.3.5.4 SWOT Analysis

16.3.6 Kronos Inc.

16.3.6.1 Company Overview

16.3.6.2 Product Portfolio

16.3.7 Oracle Corporation

16.3.7.1 Company Overview

16.3.7.2 Product Portfolio

16.3.7.3 Financials

16.3.7.4 SWOT Analysis

16.3.8 Reflexis Systems

16.3.8.1 Company Overview

16.3.8.2 Product Portfolio

16.3.9 SAP SE

16.3.9.1 Company Overview

16.3.9.2 Product Portfolio

16.3.9.3 Financials

16.3.9.4 SWOT Analysis

16.3.10 Ultimate Software Group Inc.

16.3.10.1 Company Overview

16.3.10.2 Product Portfolio

16.3.10.3 SWOT Analysis

16.3.11 Verint Systems

16.3.11.1 Company Overview

16.3.11.2 Product Portfolio

16.3.11.3 Financials

16.3.11.4 SWOT Analysis

16.3.12 Workday Inc.

16.3.12.1 Company Overview

16.3.12.2 Product Portfolio

16.3.12.3 Financials

16.3.12.4 SWOT Analysis

16.3.13 WorkForce Software LLC

16.3.13.1 Company Overview

16.3.13.2 Product Portfolio

List of Figures

Figure 1: Global: Workforce Management Market: Major Drivers and Challenges

Figure 2: Global: Workforce Management Market: Sales Value (in Billion USD), 2019-2024

Figure 3: Global: Workforce Management Market: Breakup by Solution (in %), 2024

Figure 4: Global: Workforce Management Market: Breakup by Service (in %), 2024

Figure 5: Global: Workforce Management Market: Breakup by Deployment Type (in %), 2024

Figure 6: Global: Workforce Management Market: Breakup by Organization Size (in %), 2024

Figure 7: Global: Workforce Management Market: Breakup by Vertical (in %), 2024

Figure 8: Global: Workforce Management Market: Breakup by Region (in %), 2024

Figure 9: Global: Workforce Management Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 10: Global: Workforce Management (Absence Management) Market: Sales Value (in Million USD), 2019 & 2024

Figure 11: Global: Workforce Management (Absence Management) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 12: Global: Workforce Management (Performance Management) Market: Sales Value (in Million USD), 2019 & 2024

Figure 13: Global: Workforce Management (Performance Management) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 14: Global: Workforce Management (Workforce Scheduling) Market: Sales Value (in Million USD), 2019 & 2024

Figure 15: Global: Workforce Management (Workforce Scheduling) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 16: Global: Workforce Management (Time and Attendance Management) Market: Sales Value (in Million USD), 2019 & 2024

Figure 17: Global: Workforce Management (Time and Attendance Management) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 18: Global: Workforce Management (Workforce Analytics) Market: Sales Value (in Million USD), 2019 & 2024

Figure 19: Global: Workforce Management (Workforce Analytics) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 20: Global: Workforce Management (Others) Market: Sales Value (in Million USD), 2019 & 2024

Figure 21: Global: Workforce Management (Others) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 22: Global: Workforce Management (Implementation Services) Market: Sales Value (in Million USD), 2019 & 2024

Figure 23: Global: Workforce Management (Implementation Services) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 24: Global: Workforce Management (Support and Maintenance Services) Market: Sales Value (in Million USD), 2019 & 2024

Figure 25: Global: Workforce Management (Support and Maintenance Services) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 26: Global: Workforce Management (Training and Education Services) Market: Sales Value (in Million USD), 2019 & 2024

Figure 27: Global: Workforce Management (Training and Education Services) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 28: Global: Workforce Management (Cloud-based) Market: Sales Value (in Million USD), 2019 & 2024

Figure 29: Global: Workforce Management (Cloud-based) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 30: Global: Workforce Management (On-premises) Market: Sales Value (in Million USD), 2019 & 2024

Figure 31: Global: Workforce Management (On-premises) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 32: Global: Workforce Management (Small and Medium-sized Enterprises) Market: Sales Value (in Million USD), 2019 & 2024

Figure 33: Global: Workforce Management (Small and Medium-sized Enterprises) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 34: Global: Workforce Management (Large Enterprises) Market: Sales Value (in Million USD), 2019 & 2024

Figure 35: Global: Workforce Management (Large Enterprises) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 36: Global: Workforce Management (Government and Defense) Market: Sales Value (in Million USD), 2019 & 2024

Figure 37: Global: Workforce Management (Government and Defense) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 38: Global: Workforce Management (Banking, Financial Services, and Insurance) Market: Sales Value (in Million USD), 2019 & 2024

Figure 39: Global: Workforce Management (Banking, Financial Services, and Insurance) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 40: Global: Workforce Management (Healthcare) Market: Sales Value (in Million USD), 2019 & 2024

Figure 41: Global: Workforce Management (Healthcare) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 42: Global: Workforce Management (Transportation and Logistics) Market: Sales Value (in Million USD), 2019 & 2024

Figure 43: Global: Workforce Management (Transportation and Logistics) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 44: Global: Workforce Management (Telecom and IT) Market: Sales Value (in Million USD), 2019 & 2024

Figure 45: Global: Workforce Management (Telecom and IT) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 46: Global: Workforce Management (Consumer Goods and Retail) Market: Sales Value (in Million USD), 2019 & 2024

Figure 47: Global: Workforce Management (Consumer Goods and Retail) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 48: Global: Workforce Management (Manufacturing) Market: Sales Value (in Million USD), 2019 & 2024

Figure 49: Global: Workforce Management (Manufacturing) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 50: Global: Workforce Management (Energy and Utilities) Market: Sales Value (in Million USD), 2019 & 2024

Figure 51: Global: Workforce Management (Energy and Utilities) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 52: Global: Workforce Management (Others) Market: Sales Value (in Million USD), 2019 & 2024

Figure 53: Global: Workforce Management (Others) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 54: North America: Workforce Management Market: Sales Value (in Million USD), 2019 & 2024

Figure 55: North America: Workforce Management Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 56: United States: Workforce Management Market: Sales Value (in Million USD), 2019 & 2024

Figure 57: United States: Workforce Management Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 58: Canada: Workforce Management Market: Sales Value (in Million USD), 2019 & 2024

Figure 59: Canada: Workforce Management Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 60: Asia Pacific: Workforce Management Market: Sales Value (in Million USD), 2019 & 2024

Figure 61: Asia Pacific: Workforce Management Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 62: China: Workforce Management Market: Sales Value (in Million USD), 2019 & 2024

Figure 63: China: Workforce Management Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 64: Japan: Workforce Management Market: Sales Value (in Million USD), 2019 & 2024

Figure 65: Japan: Workforce Management Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 66: India: Workforce Management Market: Sales Value (in Million USD), 2019 & 2024

Figure 67: India: Workforce Management Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 68: South Korea: Workforce Management Market: Sales Value (in Million USD), 2019 & 2024

Figure 69: South Korea: Workforce Management Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 70: Australia: Workforce Management Market: Sales Value (in Million USD), 2019 & 2024

Figure 71: Australia: Workforce Management Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 72: Indonesia: Workforce Management Market: Sales Value (in Million USD), 2019 & 2024

Figure 73: Indonesia: Workforce Management Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 74: Others: Workforce Management Market: Sales Value (in Million USD), 2019 & 2024

Figure 75: Others: Workforce Management Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 76: Europe: Workforce Management Market: Sales Value (in Million USD), 2019 & 2024

Figure 77: Europe: Workforce Management Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 78: Germany: Workforce Management Market: Sales Value (in Million USD), 2019 & 2024

Figure 79: Germany: Workforce Management Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 80: France: Workforce Management Market: Sales Value (in Million USD), 2019 & 2024

Figure 81: France: Workforce Management Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 82: United Kingdom: Workforce Management Market: Sales Value (in Million USD), 2019 & 2024

Figure 83: United Kingdom: Workforce Management Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 84: Italy: Workforce Management Market: Sales Value (in Million USD), 2019 & 2024

Figure 85: Italy: Workforce Management Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 86: Spain: Workforce Management Market: Sales Value (in Million USD), 2019 & 2024

Figure 87: Spain: Workforce Management Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 88: Russia: Workforce Management Market: Sales Value (in Million USD), 2019 & 2024

Figure 89: Russia: Workforce Management Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 90: Others: Workforce Management Market: Sales Value (in Million USD), 2019 & 2024

Figure 91: Others: Workforce Management Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 92: Latin America: Workforce Management Market: Sales Value (in Million USD), 2019 & 2024

Figure 93: Latin America: Workforce Management Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 94: Brazil: Workforce Management Market: Sales Value (in Million USD), 2019 & 2024

Figure 95: Brazil: Workforce Management Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 96: Mexico: Workforce Management Market: Sales Value (in Million USD), 2019 & 2024

Figure 97: Mexico: Workforce Management Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 98: Others: Workforce Management Market: Sales Value (in Million USD), 2019 & 2024

Figure 99: Others: Workforce Management Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 100: Middle East and Africa: Workforce Management Market: Sales Value (in Million USD), 2019 & 2024

Figure 101: Middle East and Africa: Workforce Management Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 102: Global: Workforce Management Industry: SWOT Analysis

Figure 103: Global: Workforce Management Industry: Value Chain Analysis

Figure 104: Global: Workforce Management Industry: Porter’s Five Forces Analysis

List of Tables

Table 1: Global: Workforce Management Market: Key Industry Highlights, 2024 and 2033

Table 2: Global: Workforce Management Market Forecast: Breakup by Solution (in Million USD), 2025-2033

Table 3: Global: Workforce Management Market Forecast: Breakup by Service (in Million USD), 2025-2033

Table 4: Global: Workforce Management Market Forecast: Breakup by Deployment Type (in Million USD), 2025-2033

Table 5: Global: Workforce Management Market Forecast: Breakup by Organization Size (in Million USD), 2025-2033

Table 6: Global: Workforce Management Market Forecast: Breakup by Vertical (in Million USD), 2025-2033

Table 7: Global: Workforce Management Market Forecast: Breakup by Region (in Million USD), 2025-2033

Table 8: Global: Workforce Management Market: Competitive Structure

Table 9: Global: Workforce Management Market: Key Players

Companies Mentioned

- ADP

- Atoss Software AG

- HotSchedules Inc.

- Huntington Business Systems

- IBM

- Kronos Inc.

- Oracle Corporation

- Reflexis Systems

- SAP SE

- Ultimate Software Group Inc.

- Verint Systems

- Workday Inc.

- WorkForce Software LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 139 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 6.5 Billion |

| Forecasted Market Value ( USD | $ 13.4 Billion |

| Compound Annual Growth Rate | 8.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |