Key Highlights

- The oil and gas market volume is defined as the total consumption (barrels of oil equivalent) of refined petroleum products and natural gas by end-users in each country. The value of the oil segment reflects the total volume of refined petroleum products, including refinery consumption and losses, multiplied by the hub price of crude oil. The value of the gas segment is calculated as the total volume of natural gas consumed multiplied by the price of natural gas (Henry Hub spot price). The values represent the total revenues available to exploration and production companies from sales of crude oil and natural gas. All market data and forecasts are represented in nominal terms (i.e., without adjustment for inflation) and all currency conversions used in the creation of this report have been calculated using constant 2022 annual average exchange rates.

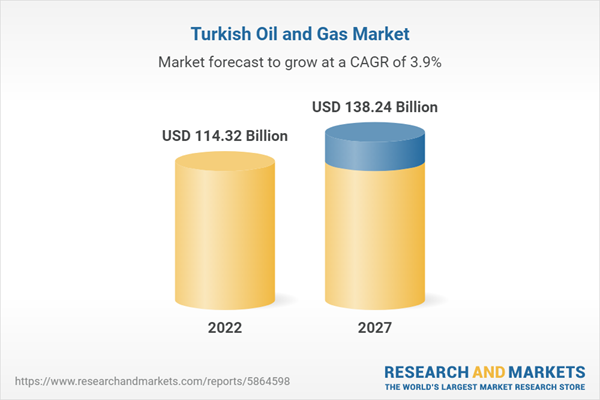

- The Turkish oil & gas market had total revenues of $114.3 billion in 2022, representing a compound annual growth rate (CAGR) of 12.4% between 2017 and 2022.

- Market consumption volumes declined with a negative CAGR of 0.7% between 2017 and 2022, to reach a total of 659 million BoE in 2022.

- The Turkish oil & gas market is driven by several macroeconomic factors, such as rising GDP, increasing industrialization, and rising inflation. According to in-house research, in 2022, the real GDP annual growth rate of Turkey stood at 5.6%.

Scope

- Save time carrying out entry-level research by identifying the size, growth, major segments, and leading players in the oil & gas market in Turkey

- Use the Five Forces analysis to determine the competitive intensity and therefore attractiveness of the oil & gas market in Turkey

- Leading company profiles reveal details of key oil & gas market players’ global operations and financial performance

- Add weight to presentations and pitches by understanding the future growth prospects of the Turkey oil & gas market with five year forecasts

Reasons to Buy

- What was the size of the Turkey oil & gas market by value in 2022?

- What will be the size of the Turkey oil & gas market in 2027?

- What factors are affecting the strength of competition in the Turkey oil & gas market?

- How has the market performed over the last five years?

- What are the main segments that make up Turkey's oil & gas market?

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Turkiye Petrol Rafinerileri A.S.

- Lukoil Oil Co.

- Turkiye Petrolleri Anonim Ortakligi

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 45 |

| Published | June 2023 |

| Forecast Period | 2022 - 2027 |

| Estimated Market Value ( USD | $ 114.32 Billion |

| Forecasted Market Value ( USD | $ 138.24 Billion |

| Compound Annual Growth Rate | 3.8% |

| Regions Covered | Turkey |