Architectural Lighting Market Analysis:

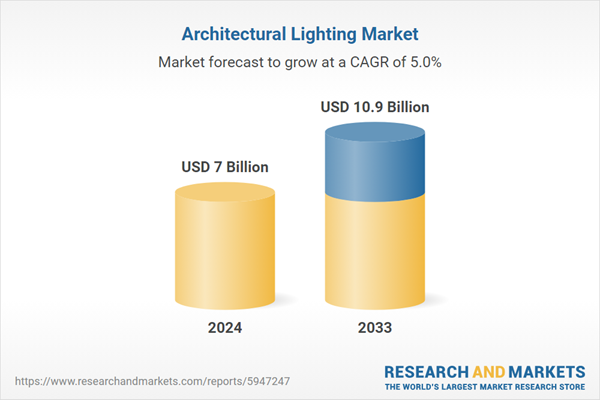

- Market Growth and Size: The market is witnessing stable growth, driven by rapid globalization and infrastructural developments, increasing economic growth, and ongoing urban development.

- Major Market Drivers: Key drivers influencing the market growth include significant technological advancements in LED and smart lighting, increasing focus on energy efficiency, surge in infrastructure projects, and growing demand for aesthetically appealing and energy-efficient lighting solutions in residential, commercial, and industrial sectors.

- Technological Advancements: Recent innovations in LED technology, along with the integration of the Internet of Things (IoT) and smart lighting systems that offer improved energy efficiency, enhanced lighting quality, and greater control over lighting systems, is supporting the market growth.

- Industry Applications: The market is experiencing high product demand across various sectors, such as commercial, residential, and industrial for both functional and aesthetic lighting needs.

- Key Market Trends: The key market trends involve the ongoing shift towards energy-efficiency and sustainable lighting solutions, the growing popularity of smart and connected lighting, and an increased focus on customized lighting solutions.

- Geographical Trends: Asia Pacific leads the market due to rapid urbanization, economic growth, and infrastructure development. Other regions are also showing significant growth, fueled by technological innovation and stringent energy regulations.

- Competitive Landscape: The market is competitive with major players focusing on innovation, global expansion, and sustainability initiatives. Additionally, companies are engaging in strategic partnerships, mergers, and acquisitions to strengthen their market positions and expand their product portfolios.

- Challenges and Opportunities: The market faces various challenges, such as rapidly changing technology, the need for continuous innovation, and compliance with international and regional regulations. However, the rising demand for smart and automated lighting solutions and the increasing importance of eco-friendly lighting solutions is creating new opportunities for the market growth.

Architectural Lighting Market Trends:

Recent technological advancements

Technological advancements in the field of architectural lighting are a significant factor catalyzing the market growth. In line with this, the evolution of light emitting diode (LED) technology, which offers superior energy efficiency, a wide range of colors, and longer lifespans compared to traditional lighting solutions, is supporting the market growth. It has made LED lights highly attractive for architectural applications, where both functionality and aesthetics are important. Moreover, recent innovations in lighting control systems, such as dimming capabilities and color temperature adjustments, which allow for higher customization and flexibility in design, are positively impacting the market growth. Besides this, the introduction of the Internet of Things (IoT)-enabled systems, which has opened up new possibilities for energy management and personalized lighting experiences, is favoring the market growth.Heightened energy efficiency and safety concerns

Energy efficiency and sustainability across the globe are becoming increasingly important in all sectors, including architectural lighting. In line with this, the ongoing push towards reducing energy consumption and lowering environmental impact is contributing to the market growth. Besides this, the introduction of energy-efficient lighting solutions, such as LED lights, which consume significantly less energy compared to traditional fluorescent and incandescent lights, is favoring the market growth. This reduction in energy utilization directly translates to lower electricity bills and a smaller carbon footprint, aligning with the growing environmental consciousness among consumers and businesses. Additionally, several governments are introducing regulations and incentives to encourage the adoption of energy-efficient lighting, which is further bolstering the market growth.Rapid urbanization and infrastructure development

The rapid pace of urbanization is a primary factor driving the growth of the architectural lighting market. People are moving to urban areas, leading to a heightened demand for residential and commercial buildings, all requiring effective lighting solutions. Furthermore, the development of public spaces, commercial centers, and infrastructures like airports and subway stations, which require efficient lighting, is supporting the market growth. Architectural lighting plays a vital role in these developments, both in terms of functionality and enhancing the aesthetic appeal of these structures. Additionally, the increasing investments in infrastructure projects, which often include significant lighting components, as governments and developers seek to create landmarks and promote tourism and business, are favoring the market growth.Emerging aesthetic and design trends

Emerging aesthetic and design trends are positively influencing the architectural lighting market growth. Architectural designs are evolving rapidly, leading to the need for lighting that complements and enhances these spaces. Modern architecture often features unique forms and structures, where lighting becomes an integral part of the design rather than just a functional addition. Architects and designers are increasingly using lighting as a tool to highlight architectural features, create mood, and influence the perception of space. It has led to innovative uses of lighting, such as dynamic and interactive installations that respond to environmental conditions or user interactions. Furthermore, the shifting trend towards minimalism in design, with a growing preference for sleek, unobtrusive lighting fixtures, is favoring the market growth.Imposition of various government initiatives and regulations

Governments are implementing policies aimed at promoting energy efficiency and environmental sustainability, which directly impact the lighting industry. Several countries have enacted regulations that phase out incandescent bulbs in favor of energy-efficient lighting technologies, such as LEDs. These regulations not only reduce energy consumption and environmental impact but also drive innovation in the lighting industry as manufacturers strive to meet these new standards. In addition to this, governments often offer incentives to encourage the adoption of energy-efficient lighting solutions, including tax credits, rebates, and grants for using or manufacturing energy-efficient lighting products. These policies make energy-efficient lighting solutions more economically attractive to consumers and businesses, thereby stimulating market demand.Architectural Lighting Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on light source, lighting type, application, and end use.Breakup by Light Source:

- Fluorescent Lights

- High Intensity Discharge (HID) Lights

- Light Emitting Diode (LED) Lights

- Others

Light emitting diode (LED) lights accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the light source. This includes fluorescent lights, high intensity discharge (HID) lights, light emitting diode (LED) lights, and others. According to the report, light emitting diode (LED) lights represented the largest segment.Light-emitting diode (LED) lights hold the largest market share owing to their superior energy efficiency, longer lifespan, and versatility. LEDs work by transmitting an electrical current through a semiconductor, which emits light when the electrons recombine with electron holes. This process generates very little heat compared to other lighting technologies, making LEDs more energy-efficient. LED lights also provide a broad range of color temperatures and high color rendering, making them suitable for various applications, such as accentuating architectural features and providing functional lighting in residential, commercial, and industrial settings. Furthermore, their small size allows for innovative design and integration into various architectural elements.

Fluorescent lights offer energy efficiency and longer lifespans compared to traditional incandescent bulbs. They work by passing an electric current through a gas, which produces ultraviolet (UV) light, causing a phosphor coating inside the bulb to glow. Fluorescent lights are known for their bright, even illumination, making them suitable for a variety of settings, including offices, schools, and commercial areas.

High intensity discharge (HID) lights are known for their high light output and efficiency, making them a popular choice for lighting large areas, such as warehouses, industrial spaces, stadiums, and streetlights. HID lights operate by passing an electric current through a gas-filled tube, which generates intense light. It includes various types of bulbs, such as metal halide, high-pressure sodium, and mercury vapor.

Breakup by Lighting Type:

- Ambient

- Task

- Accent

Ambient holds the largest share in the industry

A detailed breakup and analysis of the market based on the lighting type have also been provided in the report. This includes ambient, task, and accent. According to the report, ambient accounted for the largest market share.Ambient lighting holds the major market share as it offers a uniform level of illumination throughout an area. It is fundamental in setting the overall tone and atmosphere of a space. Ambient lighting is typically achieved through ceiling fixtures, wall-mounted fixtures, or recessed lighting. It serves as the foundational layer of lighting in architectural design, ensuring sufficient visibility and comfort for occupants in both residential and commercial settings. Furthermore, its prevalence in a wide range of applications, from homes to offices and public spaces, is driving the market growth.

Task lighting is designed to offer focused light for specific activities, such as working, cooking, and reading. It targets a particular area to enhance visibility and reduce eye strain during detailed work. Task lighting is essential in both residential and commercial settings, as it enhances functionality and can improve productivity and comfort.

Accent lighting is utilized to highlight specific objects or architectural features, creating visual interest and adding drama to a space. It is often used in museums, galleries, and retail settings to draw attention to artworks, products, or displays. Accent lighting also enhances the aesthetic appeal of a space and helps in creating layers of light that add depth and dimension.

Breakup by Application:

- Wall Wash

- Cove Lighting

- Backlighting

- Others

Wall wash represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the application. This includes wall wash, cove lighting, backlighting, and others. According to the report, wall wash represented the largest segment.Wall wash lighting holds the largest market share due to its ability to transform spaces by enhancing the texture and color of walls, creating a sense of brightness and openness. It is commonly used in both commercial and residential settings, including galleries, retail spaces, offices, and homes, to highlight artwork and architectural details or to create a more spacious ambiance. Furthermore, the growing popularity of minimalist and contemporary interior designs, which emphasize clean lines and open spaces, is positively influencing the market growth. Besides this, wall wash lighting is known for its ability to provide a subtle yet impactful lighting effect that can dramatically enhance the aesthetic appeal of a space without being overly conspicuous.

Cove lighting refers to a form of indirect lighting that is built into recesses, ledges, or valences in a ceiling or high on the walls of a room. It is primarily used for aesthetic and ambiance-enhancing purposes, creating a soft, diffused light that adds warmth and depth to a space. Furthermore, cove lighting is popular in various architectural settings, including residential, hospitality, and commercial environments, as it contributes to creating a relaxed and inviting atmosphere.

Backlighting is a lighting technique where light is directed from behind objects or surfaces to create a glowing effect. It is known for its ability to add depth, dimension, and visual interest to various elements, such as panels, onyx countertops, signage, and displays. Furthermore, backlighting transforms ordinary objects into focal points, enhancing their aesthetic appeal and drawing attention.

Breakup by End Use:

- Commercial

- Residential

- Industrial

- Others

Commercial exhibits a clear dominance in the market

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes commercial, residential, industrial, and others. According to the report, commercial accounted for the largest market share.The commercial segment represents the largest market share, driven by the widespread application of architectural lighting in various settings, such as hotels, retail stores, offices, restaurants, and public spaces. Lighting plays a critical role in these settings, not just in functionality but also in creating an ambiance that can enhance customer experience and brand perception. Furthermore, commercial lighting is highly versatile, catering to both aesthetic appeal and practical requirements like energy efficiency and cost-effectiveness. Moreover, commercial spaces often use lighting as a key element of their interior design, using it to highlight products, create inviting atmospheres, and make spaces feel more welcoming and comfortable.

The residential segment of the architectural lighting market focuses on lighting solutions for homes and living spaces. In line with this, the increasing importance of the functional and aesthetic aspects of lighting among homeowners is bolstering the market growth. Besides this, the rising interest in home decor and interior design, leading to a greater demand for stylish and innovative lighting solutions, is supporting the market growth.

The industrial segment encompasses lighting solutions for factories, warehouses, and other industrial facilities. Lighting is crucial in these settings for safety, productivity, and operational efficiency. Furthermore, the primary focus in industrial lighting is on functionality and durability, as the lighting must withstand harsh conditions and provide adequate illumination for complex tasks.

Breakup by Region:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- Australia

- Indonesia

- South Korea

- Others

- Middle East and Africa

- United Arab Emirates

- Saudi Arabia

- Qatar

- Iraq

- Others

- Latin America

- Brazil

- Mexico

- Others

Asia Pacific leads the market, accounting for the largest architectural lighting market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); the Middle East and Africa (United Arab Emirates, Saudi Arabia, Qatar, Iraq, and others); and Latin America (Brazil, Mexico, and others). According to the report, Asia Pacific accounted for the largest market share.Asia Pacific holds the largest segment in the architectural lighting market, primarily driven by rapid urbanization, economic growth, and infrastructure development. Additionally, the region's massive population base and expanding middle class, which are contributing to the escalating demand for architectural lighting in residential, commercial, and industrial sectors, are strengthening the market growth. Besides this, the region is a hub for manufacturing and technological innovation in lighting, making it a significant player in both the production and consumption of architectural lighting products. Moreover, regional governments are actively promoting energy-efficient lighting through various initiatives and investments, particularly in smart city projects, which are boosting the market growth.

In North America, the architectural lighting market is characterized by advanced technology adoption and a strong emphasis on energy-efficient and smart lighting solutions. Additionally, the presence of numerous leading lighting manufacturers, a well-established infrastructure, and high consumer awareness about energy conservation and sustainable practices are contributing to the market growth.

Europe's architectural lighting market is marked by a strong focus on design aesthetics, energy efficiency, and adherence to strict environmental regulations. Additionally, European countries are at the forefront of adopting eco-friendly lighting solutions, driven by European Union (EU) directives and regulations aimed at reducing energy consumption and carbon emissions. Besides this, the region is known for its innovative lighting design, with a high demand for customized and designer lighting solutions in both the residential and commercial sectors.

The architectural lighting market in the Middle East and Africa is characterized by its investment in large-scale infrastructure projects and urban development. Additionally, the strong demand for high-quality and luxurious lighting solutions in the commercial sector, driven by the region's focus on tourism, retail, and luxury real estate development, is bolstering the market growth.

In Latin America, the architectural lighting market is expanding due to increasing urbanization and economic development across the region. Additionally, the ongoing shift towards energy-efficient lighting solutions, particularly LED technology, driven by rising energy costs and environmental awareness, is bolstering the market growth. Furthermore, the growing demand for both commercial and residential lighting solutions that balance cost-effectiveness with modern design is favoring the market growth.

Leading Key Players in the Architectural Lighting Industry:

Top companies are heavily investing in research and development (R&D) to innovate new products. It includes the development of more energy-efficient lighting solutions, advanced LED technologies, and smart lighting systems integrated with IoT and automation capabilities. Furthermore, major players are expanding their global presence through strategic partnerships, mergers, and acquisitions. Additionally, the growing emphasis on sustainability, prompting companies to focus on producing environmentally friendly products, is favoring the market growth. Besides this, several manufacturers are also investing in marketing and branding efforts to establish themselves as leaders in innovation and sustainability.The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Signify Holding B.V.

- OSRAM GmbH

- Cree Lighting

- The General Electric Company

- Acuity Brands Lighting Inc.

- Seoul Semiconductor Co., Ltd.

- Samsung Electronics Co., Ltd.

- Griven S.r.l

Key Questions Answered in This Report

1. What is the market size for the global architectural lighting market 2024?2. What is the global architectural lighting market growth 2025-2033?

3. What are the global architectural lighting market drivers?

4. What are the key industry trends in the global architectural lighting market?

5. What is the impact of COVID-19 on the global architectural lighting market?

6. What is the global architectural lighting market breakup by light source?

7. What is the global architectural lighting market breakup by lighting type?

8. What is the global architectural lighting market breakup by application?

9. What is the global architectural lighting market breakup by end use?

10. What are the major regions in the global architectural lighting market?

11. Who are the key companies/players in the global architectural lighting market?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global Architectural Lighting Market

5.1 Market Overview

5.2 Market Performance

5.3 Impact of COVID-19

5.4 Market Forecast

6 Market Breakup by Light Source

6.1 Fluorescent Lights

6.1.1 Market Trends

6.1.2 Market Forecast

6.2 High Intensity Discharge (HID) Lights

6.2.1 Market Trends

6.2.2 Market Forecast

6.3 Light Emitting Diode (LED) Lights

6.3.1 Market Trends

6.3.2 Market Forecast

6.4 Others

6.4.1 Market Trends

6.4.2 Market Forecast

7 Market Breakup by Lighting Type

7.1 Ambient

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 Task

7.2.1 Market Trends

7.2.2 Market Forecast

7.3 Accent

7.3.1 Market Trends

7.3.2 Market Forecast

8 Market Breakup by Application

8.1 Wall Wash

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 Cove Lighting

8.2.1 Market Trends

8.2.2 Market Forecast

8.3 Backlighting

8.3.1 Market Trends

8.3.2 Market Forecast

8.4 Others

8.4.1 Market Trends

8.4.2 Market Forecast

9 Market Breakup by End Use

9.1 Residential

9.1.1 Market Trends

9.1.2 Market Forecast

9.2 Commercial

9.2.1 Market Trends

9.2.2 Market Forecast

9.3 Industrial

9.3.1 Market Trends

9.3.2 Market Forecast

9.4 Others

9.4.1 Market Trends

9.4.2 Market Forecast

10 Market Breakup by Region

10.1 North America

10.1.1 United States

10.1.1.1 Market Trends

10.1.1.2 Market Forecast

10.1.2 Canada

10.1.2.1 Market Trends

10.1.2.2 Market Forecast

10.2 Europe

10.2.1 Germany

10.2.1.1 Market Trends

10.2.1.2 Market Forecast

10.2.2 France

10.2.2.1 Market Trends

10.2.2.2 Market Forecast

10.2.3 United Kingdom

10.2.3.1 Market Trends

10.2.3.2 Market Forecast

10.2.4 Italy

10.2.4.1 Market Trends

10.2.4.2 Market Forecast

10.2.5 Spain

10.2.5.1 Market Trends

10.2.5.2 Market Forecast

10.2.6 Others

10.2.6.1 Market Trends

10.2.6.2 Market Forecast

10.3 Asia Pacific

10.3.1 China

10.3.1.1 Market Trends

10.3.1.2 Market Forecast

10.3.2 Japan

10.3.2.1 Market Trends

10.3.2.2 Market Forecast

10.3.3 India

10.3.3.1 Market Trends

10.3.3.2 Market Forecast

10.3.4 Australia

10.3.4.1 Market Trends

10.3.4.2 Market Forecast

10.3.5 Indonesia

10.3.5.1 Market Trends

10.3.5.2 Market Forecast

10.3.6 South Korea

10.3.6.1 Market Trends

10.3.6.2 Market Forecast

10.3.7 Others

10.3.7.1 Market Trends

10.3.7.2 Market Forecast

10.4 Middle East and Africa

10.4.1 United Arab Emirates

10.4.1.1 Market Trends

10.4.1.2 Market Forecast

10.4.2 Saudi Arabia

10.4.2.1 Market Trends

10.4.2.2 Market Forecast

10.4.3 Qatar

10.4.3.1 Market Trends

10.4.3.2 Market Forecast

10.4.4 Iraq

10.4.4.1 Market Trends

10.4.4.2 Market Forecast

10.4.5 Others

10.4.5.1 Market Trends

10.4.5.2 Market Forecast

10.5 Latin America

10.5.1 Brazil

10.5.1.1 Market Trends

10.5.1.2 Market Forecast

10.5.2 Mexico

10.5.2.1 Market Trends

10.5.2.2 Market Forecast

10.5.3 Others

10.5.3.1 Market Trends

10.5.3.2 Market Forecast

11 SWOT Analysis

11.1 Overview

11.2 Strengths

11.3 Weaknesses

11.4 Opportunities

11.5 Threats

12 Value Chain Analysis

13 Porters Five Forces Analysis

13.1 Overview

13.2 Bargaining Power of Buyers

13.3 Bargaining Power of Suppliers

13.4 Degree of Competition

13.5 Threat of New Entrants

13.6 Threat of Substitutes

14 Competitive Landscape

14.1 Market Structure

14.2 Key Players

14.3 Profiles of Key Players

14.3.1 Signify Holding B.V.

14.3.1.1 Company Overview

14.3.1.2 Product Portfolio

14.3.1.3 Financials

14.3.1.4 SWOT Analysis

14.3.2 OSRAM GmbH

14.3.2.1 Company Overview

14.3.2.2 Product Portfolio

14.3.2.3 Financials

14.3.2.4 SWOT Analysis

14.3.3 Cree Lighting

14.3.3.1 Company Overview

14.3.3.2 Product Portfolio

14.3.3.3 Financials

14.3.3.4 SWOT Analysis

14.3.4 The General Electric Company

14.3.4.1 Company Overview

14.3.4.2 Product Portfolio

14.3.4.3 Financials

14.3.4.4 SWOT Analysis

14.3.5 Acuity Brands Lighting Inc.

14.3.5.1 Company Overview

14.3.5.2 Product Portfolio

14.3.5.3 Financials

14.3.5.4 SWOT Analysis

14.3.6 Seoul Semiconductor Co., Ltd.

14.3.6.1 Company Overview

14.3.6.2 Product Portfolio

14.3.6.3 Financials

14.3.6.4 SWOT Analysis

14.3.7 Samsung Electronics Co., Ltd.

14.3.7.1 Company Overview

14.3.7.2 Product Portfolio

14.3.7.3 Financials

14.3.7.4 SWOT Analysis

14.3.8 Griven S.r.l.

14.3.8.1 Company Overview

14.3.8.2 Product Portfolio

14.3.8.3 Financials

14.3.8.4 SWOT Analysis

List of Figures

Figure 1: Global: Architectural Lighting Market: Major Drivers and Challenges

Figure 2: Global: Architectural Lighting Market: Sales Value (in Billion USD), 2019-2024

Figure 3: Global: Architectural Lighting Market: Breakup by Light Source (in %), 2024

Figure 4: Global: Architectural Lighting Market: Breakup by Lighting Type (in %), 2024

Figure 5: Global: Architectural Lighting Market: Breakup by Application (in %), 2024

Figure 6: Global: Architectural Lighting Market: Breakup by End Use (in %), 2024

Figure 7: Global: Architectural Lighting Market: Breakup by Region (in %), 2024

Figure 8: Global: Architectural Lighting Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 9: Global: Architectural Lighting (Fluorescent Lights) Market: Sales Value (in Million USD), 2019 & 2024

Figure 10: Global: Architectural Lighting (Fluorescent Lights) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 11: Global: Architectural Lighting (HID) Market: Sales Value (in Million USD), 2019 & 2024

Figure 12: Global: Architectural Lighting (HID) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 13: Global: Architectural Lighting (LED) Market: Sales Value (in Million USD), 2019 & 2024

Figure 14: Global: Architectural Lighting (LED) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 15: Global: Architectural Lighting (Others) Market: Sales Value (in Million USD), 2019 & 2024

Figure 16: Global: Architectural Lighting (Others) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 17: Global: Architectural Lighting (Ambient) Market: Sales Value (in Million USD), 2019 & 2024

Figure 18: Global: Architectural Lighting (Ambient) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 19: Global: Architectural Lighting (Task) Market: Sales Value (in Million USD), 2019 & 2024

Figure 20: Global: Architectural Lighting (Task) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 21: Global: Architectural Lighting (Accent) Market: Sales Value (in Million USD), 2019 & 2024

Figure 22: Global: Architectural Lighting (Accent) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 23: Global: Architectural Lighting (Wall Wash) Market: Sales Value (in Million USD), 2019 & 2024

Figure 24: Global: Architectural Lighting (Wall Wash) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 25: Global: Architectural Lighting (Cove Lighting) Market: Sales Value (in Million USD), 2019 & 2024

Figure 26: Global: Architectural Lighting (Cove Lighting) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 27: Global: Architectural Lighting (Backlighting) Market: Sales Value (in Million USD), 2019 & 2024

Figure 28: Global: Architectural Lighting (Backlighting) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 29: Global: Architectural Lighting (Others) Market: Sales Value (in Million USD), 2019 & 2024

Figure 30: Global: Architectural Lighting (Others) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 31: Global: Architectural Lighting (Commercial) Market: Sales Value (in Million USD), 2019 & 2024

Figure 32: Global: Architectural Lighting (Commercial) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 33: Global: Architectural Lighting (Residential) Market: Sales Value (in Million USD), 2019 & 2024

Figure 34: Global: Architectural Lighting (Residential) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 35: Global: Architectural Lighting (Industrial) Market: Sales Value (in Million USD), 2019 & 2024

Figure 36: Global: Architectural Lighting (Industrial) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 37: Global: Architectural Lighting (Others) Market: Sales Value (in Million USD), 2019 & 2024

Figure 38: Global: Architectural Lighting (Others) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 39: North America: Architectural Lighting Market: Sales Value (in Million USD), 2019 & 2024

Figure 40: North America: Architectural Lighting Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 41: United States: Architectural Lighting Market: Sales Value (in Million USD), 2019 & 2024

Figure 42: United States: Architectural Lighting Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 43: Canada: Architectural Lighting Market: Sales Value (in Million USD), 2019 & 2024

Figure 44: Canada: Architectural Lighting Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 45: Europe: Architectural Lighting Market: Sales Value (in Million USD), 2019 & 2024

Figure 46: Europe: Architectural Lighting Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 47: Germany: Architectural Lighting Market: Sales Value (in Million USD), 2019 & 2024

Figure 48: Germany: Architectural Lighting Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 49: France: Architectural Lighting Market: Sales Value (in Million USD), 2019 & 2024

Figure 50: France: Architectural Lighting Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 51: United Kingdom: Architectural Lighting Market: Sales Value (in Million USD), 2019 & 2024

Figure 52: United Kingdom: Architectural Lighting Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 53: Italy: Architectural Lighting Market: Sales Value (in Million USD), 2019 & 2024

Figure 54: Italy: Architectural Lighting Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 55: Spain: Architectural Lighting Market: Sales Value (in Million USD), 2019 & 2024

Figure 56: Spain: Architectural Lighting Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 57: Others: Architectural Lighting Market: Sales Value (in Million USD), 2019 & 2024

Figure 58: Others: Architectural Lighting Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 59: Asia Pacific: Architectural Lighting Market: Sales Value (in Million USD), 2019 & 2024

Figure 60: Asia Pacific: Architectural Lighting Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 61: China: Architectural Lighting Market: Sales Value (in Million USD), 2019 & 2024

Figure 62: China: Architectural Lighting Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 63: Japan: Architectural Lighting Market: Sales Value (in Million USD), 2019 & 2024

Figure 64: Japan: Architectural Lighting Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 65: India: Architectural Lighting Market: Sales Value (in Million USD), 2019 & 2024

Figure 66: India: Architectural Lighting Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 67: Australia: Architectural Lighting Market: Sales Value (in Million USD), 2019 & 2024

Figure 68: Australia: Architectural Lighting Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 69: Indonesia: Architectural Lighting Market: Sales Value (in Million USD), 2019 & 2024

Figure 70: Indonesia: Architectural Lighting Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 71: South Korea: Architectural Lighting Market: Sales Value (in Million USD), 2019 & 2024

Figure 72: South Korea: Architectural Lighting Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 73: Others: Architectural Lighting Market: Sales Value (in Million USD), 2019 & 2024

Figure 74: Others: Architectural Lighting Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 75: Middle East and Africa: Architectural Lighting Market: Sales Value (in Million USD), 2019 & 2024

Figure 76: Middle East and Africa: Architectural Lighting Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 77: United Arab Emirates: Architectural Lighting Market: Sales Value (in Million USD), 2019 & 2024

Figure 78: United Arab Emirates: Architectural Lighting Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 79: Saudi Arabia: Architectural Lighting Market: Sales Value (in Million USD), 2019 & 2024

Figure 80: Saudi Arabia: Architectural Lighting Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 81: Qatar: Architectural Lighting Market: Sales Value (in Million USD), 2019 & 2024

Figure 82: Qatar: Architectural Lighting Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 83: Iraq: Architectural Lighting Market: Sales Value (in Million USD), 2019 & 2024

Figure 84: Iraq: Architectural Lighting Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 85: Others: Architectural Lighting Market: Sales Value (in Million USD), 2019 & 2024

Figure 86: Others: Architectural Lighting Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 87: Latin America: Architectural Lighting Market: Sales Value (in Million USD), 2019 & 2024

Figure 88: Latin America: Architectural Lighting Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 89: Brazil: Architectural Lighting Market: Sales Value (in Million USD), 2019 & 2024

Figure 90: Brazil: Architectural Lighting Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 91: Mexico: Architectural Lighting Market: Sales Value (in Million USD), 2019 & 2024

Figure 92: Mexico: Architectural Lighting Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 93: Others: Architectural Lighting Market: Sales Value (in Million USD), 2019 & 2024

Figure 94: Others: Architectural Lighting Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 95: Global: Architectural Lighting Industry: SWOT Analysis

Figure 96: Global: Architectural Lighting Industry: Value Chain Analysis

Figure 97: Global: Architectural Lighting Industry: Porter’s Five Forces Analysis

List of Tables

Table 1: Global: Architectural Lighting Market: Key Industry Highlights, 2024 and 2033

Table 2: Global: Architectural Lighting Market Forecast: Breakup by Light Source (in Million USD), 2025-2033

Table 3: Global: Architectural Lighting Market Forecast: Breakup by Lighting Type (in Million USD), 2025-2033

Table 4: Global: Architectural Lighting Market Forecast: Breakup by Application (in Million USD), 2025-2033

Table 5: Global: Architectural Lighting Market Forecast: Breakup by End Use (in Million USD), 2025-2033

Table 6: Global: Architectural Lighting Market Forecast: Breakup by Region (in Million USD), 2025-2033

Table 7: Global: Architectural Lighting Market: Competitive Structure

Table 8: Global: Architectural Lighting Market: Key Players

Companies Mentioned

- Signify Holding B.V.

- OSRAM GmbH

- Cree Lighting

- The General Electric Company

- Acuity Brands Lighting Inc.

- Seoul Semiconductor Co. Ltd.

- Samsung Electronics Co. Ltd.

- Griven S.r.l. etc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 146 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 7 Billion |

| Forecasted Market Value ( USD | $ 10.9 Billion |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |