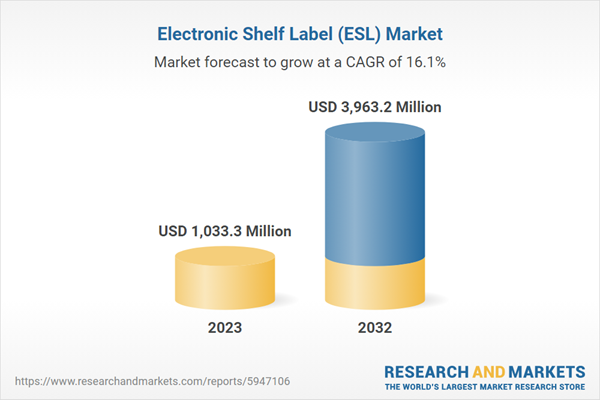

Electronic Shelf Label Market Analysis:

Market Growth and Size: The market is witnessing robust growth, driven by the increasing adoption of digital pricing solutions in retail.Technological Advancements: Technological advancements, such as E-ink displays and wireless connectivity, have revolutionized the electric shelf label industry. These advancements enable quick price updates and enhance the overall shopping experience.

Industry Applications: Electric shelf labels find applications in retail and also in sectors such as, healthcare and logistics. They help improve inventory management, reduce errors, and enhance operational efficiency.

Geographical Trends: North America and Europe dominate the electric shelf label market, primarily due to established retail infrastructures. Emerging markets in Asia-Pacific are showing increasing interest in adopting this technology.

Competitive Landscape: Key players in the market include companies such as, SES-imagotag, Pricer AB, and Altierre Corporation. Intense competition has led to product innovation and improved offerings for retailers.

Challenges and Opportunities: Challenges include initial implementation costs and resistance to change from traditional price tags. Opportunities lie in the potential for energy savings, reduced labor costs, and improved consumer experience.

Future Outlook: The electric shelf label market is expected to continue growing as retailers seek efficiency and consumer engagement. Integration with IoT and AI technologies may further enhance the capabilities of these labels, offering new avenues for growth.

Electronic Shelf Label Market Trends:

Growing Demand for Retail Efficiency and Accuracy

The demand for electric shelf labels has increased due to their ability to enhance retail efficiency and accuracy. Retailers are under constant pressure to keep up with dynamic pricing strategies, promotions, and inventory management. Traditional paper price tags are time-consuming to update and prone to errors. Electric shelf labels enable retailers to instantly update prices across their stores, ensuring accuracy and consistency. This efficiency reduces labor costs associated with manual price changes and minimizes pricing errors that can lead to consumer dissatisfaction. As a result, retailers are increasingly adopting electric shelf labels to stay competitive in the fast-paced retail industry.Enhancement of Consumer Experience

Another driving factor is the desire to enhance the consumer shopping experience. Electric shelf labels provide consumers with real-time pricing information, enabling them to make informed purchase decisions. This transparency fosters trust and consumer satisfaction. Moreover, retailers can use these labels to display additional product information, such as nutritional facts or consumer reviews, enriching the overall shopping experience. In an era where consumer experience is a critical differentiator, electric shelf labels help retailers stay ahead by providing a seamless and informative shopping environment.Growing Concern Regarding Environmental Sustainability

Environmental sustainability is a growing concern, and electric shelf labels contribute to this by reducing paper waste. Traditional price tags require constant printing and disposal, resulting in significant environmental impact. Electric shelf labels, on the other hand, are reusable and consume minimal power. This eco-friendly aspect resonates with both consumers and retailers aiming to reduce their carbon footprint. As sustainability becomes a core value for many businesses, the adoption of electric shelf labels aligns with their environmental objectives.Significant Technological Advancements

Technological advancements in display technology and wireless communication have made electric shelf labels more versatile and cost-effective. E-ink displays provide clear visibility and consume minimal power, ensuring long battery life. Additionally, wireless connectivity allows for real-time updates, making it easier for retailers to manage pricing and promotions centrally. These advancements improve the functionality of electric shelf labels and also make them more accessible and affordable for a wider range of retailers, driving market growth.Competitive Pressure and Differentiation

In the highly competitive retail landscape, differentiation is crucial. Retailers are constantly seeking innovative solutions to stand out and attract consumers. Electric shelf labels differentiate stores by offering a modern and tech-savvy shopping experience and enable dynamic pricing strategies. This agility in pricing can help retailers respond to market trends and competitor actions swiftly. As a result, the competitive pressure in the retail sector is a significant driver for the adoption of electric shelf labels, as they offer a competitive edge and the ability to stay agile in pricing and promotions.Electronic Shelf Label Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with forecasts at the global, and regional levels for 2024-2032. The report has categorized the market based on type, component, technology, and application.Breakup by Type:

- Liquid Crystal Display (LCD)

- Full Graphic E-Paper

- Segmented E-Paper

- Others

LCD accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the type. This includes liquid crystal display (LCD), full graphic e-paper, segmented e-paper, and others. According to the report, LCD represented the largest segment.Liquid Crystal Display (LCD) electric shelf labels are a prominent segment in the market. These labels use traditional LCD technology to display pricing and product information. They offer vibrant colors, high contrast, and good visibility, making them suitable for various retail environments. LCD labels are known for their responsiveness to real-time updates, enabling retailers to change prices and promotions instantly. This flexibility is especially valuable in highly competitive retail settings, where pricing changes are frequent. However, LCD labels tend to consume more power compared to other types, requiring more frequent battery replacement or recharging. Despite this, they remain popular in retail settings where visual appeal and quick updates are paramount.

Full Graphic E-Paper electric shelf labels are characterized by their use of electronic paper displays, commonly known as E-ink. These labels mimic the appearance of traditional paper price tags, offering a natural and easy-to-read display. One of their primary advantages is their minimal power consumption, as they only use power when updating the screen. Full Graphic E-Paper labels excel in scenarios where long battery life is crucial, as they can operate for extended periods on a single charge. They are well-suited for retailers focused on sustainability, as they reduce paper waste significantly.

Segmented E-Paper electric shelf labels are a variation of E-ink technology. They use segmented displays to show essential information such as prices and product codes. These labels are energy-efficient and offer excellent visibility in various lighting conditions. Segmented E-Paper labels are often used in grocery stores and supermarkets, where simplicity and cost-effectiveness are key. While they may not provide the same level of graphical sophistication as full graphic E-paper or LCD labels, they excel in displaying essential pricing information clearly. Their longevity on a single battery charge is a significant advantage, as they can function for months without requiring maintenance.

Breakup by Component:

- Hardware

- Software

Hardware holds the largest share in the industry

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes hardware and software. According to the report, hardware accounted for the largest market share.The hardware component is a fundamental pillar of the electric shelf label market, comprising the physical devices that make up the label infrastructure. Hardware elements encompass the electronic shelf labels themselves, as well as the associated infrastructure required for their operation. These components are key drivers of the market's growth. Electronic shelf labels (ESLs) are the core hardware element, typically featuring e-ink displays for clear and energy-efficient visuals. ESLs come in various sizes and designs to cater to different retail environments. Their robust construction ensures durability, even in high-traffic retail settings.

The software component in the electric shelf label market plays a crucial role in managing and controlling the content displayed on electronic shelf labels. This segment encompasses the software solutions responsible for pricing updates, inventory management, and data synchronization across the retail network. Price management software is at the forefront of the software component, allowing retailers to update product prices in real-time, implement promotions, and manage pricing strategies efficiently. It provides a centralized platform for pricing changes, ensuring consistency across all ESLs in a store or retail chain.

Breakup by Technology:

- Radiofrequency

- Infrared

- NFC

- Others

Radiofrequency represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on technology. This includes radiofrequency, infrared, near-field communication (NFC) and others. According to the report, radiofrequency represented the largest segment.Radiofrequency technology is a widely adopted and versatile choice for electric shelf labels. RF-based labels use wireless communication to update pricing and product information in real time. These labels are equipped with RF transmitters and receivers, allowing them to connect to a central system or server. One of the key advantages of RF technology is its range, which enables labels to be updated even from a distance, making it suitable for large retail spaces. RF-based electric shelf labels are known for their reliability and durability. They have a longer battery life compared to some other technologies, reducing maintenance costs. Additionally, RF labels offer the flexibility to transmit pricing information and also additional data such as product descriptions and inventory status.

Infrared technology is another option in the electric shelf label market, although it has a more limited range compared to RF. IR-based labels communicate with infrared transmitters positioned throughout the store. When an update is required, the label receives the signal from the nearest transmitter and updates its information accordingly. IR technology is often favored for its lower implementation costs compared to RF, making it an attractive choice for smaller retailers or businesses with budget constraints. However, its limited range can be a drawback in larger stores, where multiple transmitters are needed to cover the entire space effectively.

Near-Field Communication (NFC) is a technology that has gained prominence in recent years, due to its use in various applications, including electric shelf labels. NFC-enabled labels use short-range wireless communication to update information. To update an NFC label, a handheld device or smartphone equipped with NFC capabilities is used to interact with the label directly. NFC technology is known for its simplicity and ease of use. It allows retailers to update prices and product information efficiently without the need for complex infrastructure. This technology is particularly attractive for businesses looking for a cost-effective and straightforward solution to digitize their pricing and improve inventory management.

Breakup by Application:

- Supermarkets and Hypermarkets

- Convenience Stores

- Others

Supermarkets and hypermarkets represent the leading market segment

The report has provided a detailed breakup and analysis of the market based on application. This includes supermarkets and hypermarkets, convenience stores and others. According to the report, supermarkets and hypermarkets represented the largest segment.Supermarkets are typically expansive retail spaces offering a wide variety of products ranging from groceries and household items to electronics and apparel. Electric shelf labels provide several advantages in this context. They streamline price management, ensuring that prices are accurate and consistent throughout the store. This minimizes pricing errors, enhancing consumer trust and satisfaction. Supermarkets often run frequent promotions and sales. Hypermarkets, which combine supermarket and department store formats, are even larger retail spaces. Electric shelf labels are particularly valuable in hypermarkets because of the vast range of products they offer. Managing pricing and promotions across numerous product categories can be a complex task, but electric shelf labels simplify this process. Additionally, hypermarkets often attract a large and diverse consumer base, making real-time pricing updates crucial to cater to various preferences and budgets.

Convenience stores, known for their small footprint and focus on quick, on-the-go shopping, have also begun to adopt electric shelf labels. Convenience stores thrive on speed and efficiency, and electric shelf labels support these objectives. In these compact stores, every inch of shelf space counts, and electronic shelf labels allow for flexible use of shelf space by instantly updating prices and promotions. This flexibility is essential in a convenience store setting, where products may change frequently. Moreover, convenience store consumers often prioritize convenience over price comparison, so having accurate and up-to-date prices displayed on electric shelf labels is vital to meet consumer expectations.

Breakup by Region:

- Europe

- North America

- Asia Pacific

- Latin America

- Middle East and Africa

Europe leads the market, accounting for the largest electronic shelf label market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. According to the report, Europe accounted for the largest market share.Europe has been a stronghold for the electric shelf label market. The mature and highly competitive retail sector of the region has driven extensive adoption of these labels. Countries such as, Germany, France, and the UK have embraced the technology to streamline pricing strategies and enhance the shopping experience. Moreover, the focus of Europe on sustainability aligns with the eco-friendly nature of electric shelf labels, further boosting their adoption. As a result, the European market continues to grow, with retailers across the region investing in these solutions to remain competitive and meet consumer demands for transparency and efficiency.

In North America, the electric shelf label market has witnessed robust growth. The large retail chains and tech-savvy consumers of the region have prompted retailers to implement these labels to stay ahead. The United States, in particular, has seen substantial adoption due to its dynamic retail landscape. Real-time pricing updates and the ability to run promotions efficiently have been key drivers in this market. As competition among retailers intensifies, the demand for electric shelf labels is expected to remain strong in North America.

The Asia Pacific region has emerged as a promising market for electric shelf labels. Rapid urbanization, the growth of modern retail formats, and increasing consumer expectations have fueled adoption. Countries such as, China, Japan, and South Korea have witnessed significant investments in these labels to improve retail efficiency and enhance consumer experiences. Additionally, the manufacturing capabilities of the region have made electric shelf labels more affordable, encouraging smaller retailers to adopt the technology. As Asia Pacific continues to modernize its retail sector, the electric shelf label market is poised for continued expansion.

Latin America is gradually embracing electric shelf labels, albeit at a somewhat slower pace compared to other regions. Economic factors, infrastructure challenges, and varying levels of retail development have contributed to this trend. However, larger retail chains in countries such as, Brazil and Mexico are beginning to explore the benefits of these labels, particularly in urban areas where modernization is more pronounced. As infrastructure improves and consumer demand for convenience grows, the Latin American market for electric shelf labels is expected to show robust growth.

The Middle East and Africa region have shown increasing interest in electric shelf labels, primarily in countries with well-established retail sectors such as, the UAE and South Africa. These labels are seen as a means to enhance competitiveness and provide a more advanced shopping experience. However, challenges related to infrastructure and economic stability in some parts of the region have limited widespread adoption. As economies stabilize and the retail landscape matures further, the market for electric shelf labels in the Middle East and Africa is likely to expand.

Leading Key Players in the Electronic Shelf Label Industry:

The key players in the market are actively engaging in strategic initiatives to maintain their competitive edge and drive market growth. These initiatives include continuous innovation in display technology, expansion into emerging markets, and fostering partnerships with retailers to provide comprehensive solutions. Companies such as, SES-imagotag are focusing on developing energy-efficient and cost-effective label solutions, ensuring they align with sustainability trends. Pricer AB is expanding its global footprint, particularly in the Asia Pacific region, to tap into growing markets. Altierre Corporation is emphasizing IoT integration to enable data-driven pricing and inventory management. Overall, these industry leaders are committed to delivering advanced, efficient, and consumer-centric solutions to cater to the evolving needs of retailers worldwide.The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Altierre SAS

- Diebold Nixdorf Incorporated

- DIGI System Gurgaon Pvt. Ltd

- Displaydata Ltd

- LG CNS

- M2C Communication doo Belgrade

- Panasonic Corporation

- Pricer AB

- Samsung Electronics

SES Imagotag

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)Latest News:

September, 2022: SES Imagotag has unveiled an exciting collaboration with Instacart, a prominent player in the grocery technology sector. This partnership signifies a significant development in the retail industry, as it brings together SES Imagotag's expertise in electronic shelf labeling and Instacart's innovative grocery technology solutions.September, 2021: Panasonic has recently unveiled plans to broaden its electronic shelf labeling (ESL) and digital signage solutions, with the introduction of the next-generation Digital Sign Edge 2.0. This expansion reflects Panasonic's commitment to staying at the forefront of the retail technology landscape.

Key Questions Answered in This Report:

- How has the global electronic shelf label market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global electronic shelf label market?

- What is the impact of each driver, restraint, and opportunity on the global electronic shelf label market?

- What are the key regional markets?

- Which countries represent the most attractive electronic shelf label market?

- What is the breakup of the market based on the type?

- Which is the most attractive type in the electronic shelf label market?

- What is the breakup of the market based on the component?

- Which is the most attractive component in the electronic shelf label market?

- What is the breakup of the market based on technology?

- Which is the most attractive technology in the electronic shelf label market?

- What is the breakup of the market based on the application?

- Which is the most attractive application the electronic shelf label market?

- What is the competitive structure of the market?

- Who are the key players/companies in the global electronic shelf label market?

Table of Contents

Companies Mentioned

- Altierre SAS

- Diebold Nixdorf Incorporated

- DIGI System Gurgaon Pvt. Ltd.

- Displaydata Ltd.

- LG CNS

- M2C Communication doo Belgrade

- Panasonic Corporation

- Pricer AB

- Samsung Electronics

- SES Imagotag

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 125 |

| Published | March 2024 |

| Forecast Period | 2023 - 2032 |

| Estimated Market Value ( USD | $ 1033.3 Million |

| Forecasted Market Value ( USD | $ 3963.2 Million |

| Compound Annual Growth Rate | 16.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |