Aerospace materials refer to specialized products designed and engineered for use in the aerospace industry. It includes metals, alloys, composites, ceramics, polymers, and advanced materials. They are widely used in aircraft structures, engines, propulsion systems, interior and cabin components, electrical systems, avionics, and thermal protection systems. Aerospace materials are lightweight, flexible, and high-strength products that enhance safety, improve performance, and provide resistance against corrosion, high temperature, and fatigue. They also aid in improving fuel efficiency, reducing operational costs, and maintaining structural integrity in extreme conditions.

The increasing air travel due to rising tourism activities is strengthening the market growth. Aerospace materials are widely used in the construction of commercial aircraft due to their cost-effectiveness, easy processing, and lower maintenance. Furthermore, the widespread product utilization to construct military aircraft, such as helicopters, fighter aircraft, and unmanned aerial vehicles (UAVs), owing to their high strength, durability, and superior performance characteristics, is positively influencing the market growth.

Additionally, the implementation of strict government policies to maintain high safety and security standards in general aviation is favoring the market growth. Other factors, including rapid military modernization activities, increasing investments in the development of advanced materials, and the rising focus on sustainability, are anticipated to drive the market growth.

Aerospace Materials Market Trends/Drivers:

The increasing product utilization in aircraft interiors

Aerospace materials are extensively used in aircraft seat upholstery and fabrics to ensure passenger comfort, durability, and ease of maintenance. They are also resistant to fire and offer anti-microbial properties, which ensure high safety standards and provide a pleasant and hygienic seating environment. Moreover, the widespread product utilization in aircraft flooring and carpets to dampen noise levels in the cabin and ensure a quieter and more comfortable flying experience is contributing to the market growth. Additionally, the increasing adoption of aerospace materials in wall panels and trims to provide a visually appealing and functional cabin environment is providing an impetus to the market growth. Besides this, they are used in overhead bins and storage compartments to offer efficient storage solutions while maintaining safety and durability.The growing product utilization in electrical and electronic systems

Aerospace materials are widely used in the production of electrical components and systems within an aircraft owing to their excellent electrical properties, high-temperature resistance, and lightweight nature. They are widely used in connectors and terminals to ensure secure and efficient electrical connections. Moreover, the widespread product utilization to manufacture printed circuit boards (PCBs) for aircraft systems due to their excellent thermal conductivity, electrical insulation properties, and dimensional stability is supporting the market growth.Additionally, aerospace materials are extensively used to construct enclosures and housings for electrical components to provide protection from environmental factors, electromagnetic interference (EMI), and physical damage. Besides this, they are used in thermal management systems to enhance heat transfer, dissipate excess heat, and ensure the reliability and performance of sensitive electronic components.

Extensive research and development (R&D) activities

The introduction of carbon fiber composites, which offer superior stiffness, high strength, and excellent fatigue resistance, making them ideal for structural components in aircraft and spacecraft, is positively influencing the market growth. Additionally, the recent development of ceramic matrix composites (CMCs), which exhibit exceptional high-temperature resistance, low thermal conductivity, and lightweight properties, thus making them suitable for manufacturing hot-section components of jet engines, such as turbine blades and combustors are providing an impetus to the market growth.Moreover, the utilization of three-dimensional (3D) printing to produce lightweight and intricately designed components using aerospace materials, such as titanium and nickel-based superalloys, is contributing to the market growth. Apart from this, the development of sustainable aerospace materials, such as bio-based composites, natural fibers, and recycled materials, which lower manufacturing costs, reduce carbon footprint, and improve end-of-life recyclability, is favoring the market growth.

Aerospace Materials Industry Segmentation:

This report provides an analysis of the key trends in each segment of the global aerospace materials market report, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on type, aircraft type, and application.Breakup by Type:

- Aluminium Alloys

- Titanium Alloys

- Super Alloys

- Steel Alloys

- Composite Materials

Aluminium Alloys dominate the aerospace materials market

The report has provided a detailed breakup and analysis of the aerospace materials market based on the type. This includes aluminium alloys, titanium alloys, super alloys, steel alloys, and composite materials. According to the report, aluminium alloys represented the largest market segment.Aluminium alloys are dominating the aerospace materials market due to their lightweight and high strength-to-weight ratio, which aids in increasing fuel efficiency, reducing operating costs, and improving the overall performance of aircraft. Furthermore, aluminum alloys are known for their ease of manufacturing and processing, as they can be easily cast, formed, machined, and welded, allowing for efficient and cost-effective production of complex aircraft components.

Moreover, the presence of a well-established supply chain, which ensures a consistent and readily available supply of aluminum alloys, is positively influencing the market growth. Apart from this, they exhibit excellent structural integrity, durability, high tensile strength, and resistance to fatigue, which enables them to withstand the stresses and loads experienced during flight.

Breakup by Aircraft Type:

- Commercial Aircraft

- Business and General Aviation

- Helicopters

Commercial aircraft account for the largest market share

The report has provided a detailed breakup and analysis of the aerospace materials market based on the aircraft type. This includes commercial aircraft, business and general aviation, and helicopters. According to the report, commercial aircraft represented the largest market segment.Commercial aircraft are dominating the market owing to the rapid expansion of the commercial aircraft business. Along with this, the increasing demand for commercial aircraft due to the growing number of passengers traveling by air is acting as another growth-inducing factor. Furthermore, aerospace materials are widely used in commercial aircraft to reduce fuel consumption, minimize operating costs, and increase profitability. Moreover, the widespread utilization of aerospace materials in commercial aircraft manufacturing due to their cost-effectiveness, ease of processing, and established supply chains is supporting the market growth.

Apart from this, the implementation of strict government regulations to maintain aircraft safety is facilitating the demand for aerospace materials in the manufacturing process, as they are highly heat resistant and aid in ensuring structural integrity, fire prevention, and resistance to environmental factors. Besides this, the increasing demand for commercial aircraft to facilitate trade, tourism, and economic activities is positively influencing the market growth.

Breakup by Application:

- Interior

- Passenger Seating

- Galley

- Interior Panels

- Others

- Exterior

- Propulsion Systems

- Air Frame

- Tail and Fin

- Windows and Windshields

Exterior represents the leading application segment

The report has provided a detailed breakup and analysis of the aerospace materials market based on the application. This includes interior (passenger seating, galley, interior panels, and others) and exterior (propulsion systems, air frame, tail and fin, and windows and windshields). According to the report, exterior represented the largest market segment.Exterior applications are dominating the market due to the widespread product utilization in the fuselage, wings, windows, propulsion systems, and empennage. In line with this, aerospace materials are lightweight, durable, and offer a high strength-to-weight ratio, which aids in lowering fuel consumption, reducing operating costs, and minimizing environmental impact. Furthermore, the growing product adoption in external aircraft components to maintain structural integrity, enhance safety, and protect from extreme weather conditions is supporting the market growth.

Moreover, aerospace materials are used in exterior applications to provide superior aerodynamic performance, as they assist in optimizing airflow, reducing drag, and enhancing overall efficiency. They are also chosen for exterior applications, as they aid in minimizing noise generated by air turbulence, engines, and other sources, which helps in creating a comfortable environment and improving passenger experience.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America exhibits a clear dominance in the market, accounting for the largest aerospace materials market share

The report has also provided a comprehensive analysis of all the major regional markets, which includes North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represented the largest market segment.North America is dominating the market owing to the presence of a well-established aerospace industry comprising major aircraft manufacturers and suppliers. Furthermore, the region boasts a strong manufacturing base with advanced technologies for aerospace material production, such as additive manufacturing and composite material fabrication techniques. Additionally, the implementation of supportive policies by the regional governments to promote aircraft manufacturing and encourage research and development (R&D) activities in aerospace materials is contributing to the market growth.

Additionally, the presence of a well-developed and integrated aerospace supply chain, which facilitates efficient procurement, manufacturing, and distribution of aerospace materials, is strengthening the market growth. Apart from this, the increasing expenditure on defense modernization and aircraft procurement by the regional government is supporting the market growth.

Competitive Landscape:

The top companies in the aerospace materials market are heavily investing in the development of advanced materials with improved performance characteristics, such as enhanced strength, durability, and resistance to extreme temperatures. Furthermore, the growing strategic partnerships and collaboration between key players, aircraft manufacturers, engine manufacturers, and other industry stakeholders to gain access to new markets, enhance product offerings, and leverage the expertise and resources of partners are positively influencing the market growth.Apart from this, companies are offering customized solutions to the unique requirements of aircraft manufacturers to build long-term relationships and enhance customer loyalty. Moreover, the increasing focus on sustainability has prompted leading companies to develop eco-friendly materials and manufacturing processes to attract environmentally conscious customers and meet regulatory requirements related to carbon emissions and waste reduction.

The report has provided a comprehensive analysis of the competitive landscape in the global aerospace materials market. Detailed profiles of all major companies have also been provided.

Some of the key players in the market include:

- Allegheny Technologies Incorporated

- Arkema S.A.

- BASF SE

- DuPont de Nemours Inc.

- Hexcel Corporation

- Kaiser Aluminum Corporation

- Materion Corporation

- Mitsubishi Chemical Holdings Corporation

- Röchling SE & Co. KG

- SGL Carbon SE

- Solvay S.A.

- Sumitomo Bakelite Company Limited

- Toray Industries Inc.

Key Questions Answered in This Report:

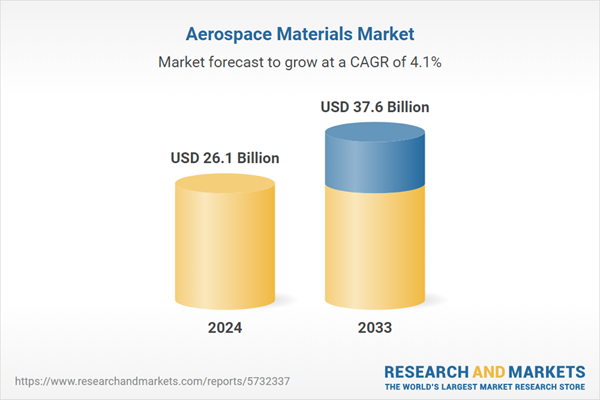

- What was the size of the global aerospace materials market in 2024?

- What is the expected growth rate of the global aerospace materials market during 2025-2033?

- What are the key factors driving the global aerospace materials market?

- What has been the impact of COVID-19 on the global aerospace materials market?

- What is the breakup of the global aerospace materials market based on the type?

- What is the breakup of the global aerospace materials market based on the aircraft type?

- What is the breakup of the global aerospace materials market based on application?

- What are the key regions in the global aerospace materials market?

- Who are the key players/companies in the global aerospace materials market?

Table of Contents

Companies Mentioned

- Allegheny Technologies Incorporated

- Arkema S.A.

- BASF SE

- DuPont de Nemours Inc.

- Hexcel Corporation

- Kaiser Aluminum Corporation

- Materion Corporation

- Mitsubishi Chemical Holdings Corporation

- Röchling SE & Co. KG

- SGL Carbon SE

- Solvay S.A.

- Sumitomo Bakelite Company Limited

- Toray Industries Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 138 |

| Published | April 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 26.1 Billion |

| Forecasted Market Value ( USD | $ 37.6 Billion |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |