Fracking Chemicals and Fluids Market Analysis:

- Major Market Drivers: The rising need for enhanced extraction methods like hydraulic fracturing is primarily propelling the market. Additionally, the widespread adoption of cost-effective production methods is also acting as another significant growth-inducing factor.

- Key Market Trends: Continuous advancements in drilling technologies and the growing number of shale gas and tight oil exploration projects are among the emerging trends bolstering the market.

- Competitive Landscape: Some of the prominent companies in the global market include Akzo Nobel N.V., Albermarle Corporation, Ashland Inc., Baker Hughes Incorporated, BASF SE, Calfrac Well Services Ltd., Chevron Phillips Chemical Company, Clariant International Ltd., E.I. du Pont de Nemours and Company, FTS International, Halliburton Company, Pioneer Engineering Services, Schlumberger Ltd., The Dow Chemical Company, and Weatherford International, among many others.

- Geographical Trends: North America exhibits a clear dominance in the market, owing to well-established energy infrastructures and technological expertise.

- Challenges and Opportunities: One of the limitations hindering the market is the environmental and health concerns associated with the use of potentially hazardous chemicals. However, the development of eco-friendly and non-toxic alternatives will continue to fuel the market over the forecasted period.

Fracking Chemicals and Fluids Market Trends:

Growing Technological Advancements

Numerous innovations are leading to the introduction of more efficient and effective fracking fluids, which is propelling the market. Moreover, advanced fluid systems, such as Schlumberger’s BroadBand Sequence® service, improve fracture initiation and distribution, thereby optimizing resource extraction. These advancements include better proppant transport capabilities and stability under extreme conditions, which are crucial for the success of hydraulic fracturing in challenging environments. Besides this, in May 2024, Sherwin-Williams Protective & Marine established a new coatings category with a system that resists erosion inside pipes located near fracking wellheads, thereby minimizing downtime maintenance costs and enhancing drilling productivity. This is increasing the fracking chemicals and fluids market statistics.Rising Customization Options

There is an escalating demand for fracking fluids tailored to specific geological conditions. Customized fluid formulations improve the efficiency of fracking operations in various shale formations. For instance, Halliburton's VFR (Viscoelastic Fracturing Fluid) is specifically designed for high-temperature, high-pressure environments, thereby ensuring optimal performance in different geological settings. Customization also aids in maximizing hydrocarbon recovery and operational efficiency, which is bolstering the fracking chemicals and fluids market's recent price. For example, in April 2024, CNX Resources and Deep Well Services partnered to introduce AutoSep Technologies that target flow back, including methane, sand, water, and fracking chemicals.Increasing Need for Monitoring

The widespread integration of digital technologies in the fracking process is a major trend. Real-time monitoring and data analytics improve the management and optimization of fracking fluid use, which is another significant growth-inducing factor. For example, Schlumberger’s FRACCADE™ service offers real-time data on fluid properties and well conditions, enabling precise adjustments to improve efficiency and reduce waste. Digitalization also ensures better control over the fracking process, thereby leading to cost savings and improved safety. For instance, in July 2024, HONEYWELL acquired Air Products’ liquefied natural gas (LNG) process technology and equipment business to offer natural gas pre-treatment and liquefaction by using digital automation technologies available under Honeywell’s Forge and Experion platforms.Global Fracking Chemicals and Fluids Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with the fracking chemicals and fluids market forecast at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on the type, well type, and function type.Breakup by Type:

- Water-Based

- Foam-Based

- Gelled Oil-Based

- Others

Water-based currently exhibits a clear dominance in the market

The report has provided a detailed breakup and analysis of the market based on the type. This includes water-based, foam-based, gelled oil-based, and others. According to the report, water-based represented the largest market segmentation.Water-based fracking chemicals and fluids are increasingly being adopted in the hydraulic fracturing industry as a more environmentally friendly alternative to traditional methods. These water-based solutions use a combination of water, sand, and various additives to create a high-pressure mixture that fractures rock formations and releases natural gas or oil. For example, Halliburton's CleanStim® fluid system is designed to minimize environmental impact by utilizing ingredients sourced from the food industry, thus ensuring the fluids are safe and biodegradable. This is elevating the fracking chemicals and fluids market revenue.

Breakup by Well Type:

- Horizontal Wells

- Vertical Wells

Currently, horizontal wells hold the largest market share

The report has provided a detailed breakup and analysis of the market based on the well type. This includes horizontal wells and vertical wells. According to the report, horizontal wells represented the largest market segmentation.Fracking chemicals and fluids for horizontal wells are specifically formulated to enhance the efficiency and effectiveness of hydraulic fracturing in these complex drilling environments. As per the fracking chemicals and fluids market overview, horizontal drilling requires precise fluid formulations that can navigate the extended lateral sections of the wellbore and effectively fracture the rock to release hydrocarbons. For instance, Baker Hughes' SmartCare™ family of fracturing fluids includes solutions designed for horizontal wells, offering enhanced viscosity and proppant transport capabilities to optimize the fracturing process.

Breakup by Function Type:

- Gelling Agent

- Friction Reducer

- Surfactant

- Scale Inhibitor

- Clay Stabilizer

- Acid

- Cross-Linkers

- Breaker

- Ph Adjusting Agent

- Iron Control Agent

- Corrosion Inhibitor

- Biocide

- Others

Gelling agent account for the majority of the total fracking chemicals and fluids market share

The report has provided a detailed breakup and analysis of the market based on the function type. This includes gelling agent, friction reducer, surfactant, scale inhibitor, clay stabilizer, acid, cross-linkers, breaker, Ph adjusting agent, iron control agent, corrosion inhibitor, biocide, and others. According to the report, gelling agent represented the largest market segmentation.Fracking chemicals and fluids include gelling agents to increase the viscosity of the fluid, which is crucial for the effective transportation of proppants into the fractures created during hydraulic fracturing. These gelling agents help to suspend sand or other proppants in the fluid, allowing them to be evenly distributed throughout the fractures, thereby keeping them open and enhancing the flow of oil or gas. For example, Halliburton's HAIOS™ gelling agent is designed to improve the performance of fracturing fluids by providing stable viscosity under a wide range of conditions. This product launch is escalating the fracking chemicals and fluids market demand.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America currently dominates the market

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.The North American fracking chemicals and fluids market is a robust and dynamic sector driven by the region's substantial shale gas and tight oil production activities. This market is characterized by continuous innovation and a strong focus on improving the efficiency and environmental sustainability of fracking operations. For instance, companies like Halliburton and Schlumberger dominate the market by offering advanced fluid systems tailored to the specific geological conditions of North American shale formations. Halliburton's CleanStim® fluid system, for example, is designed to minimize environmental impact by using food-grade additives while still delivering effective performance in fracturing operations. Another example is Baker Hughes' SmartCare™, which is positively influencing the fracking chemicals and fluids market outlook across the region.

Competitive Landscape:

The integration of digital solutions for real-time monitoring and process optimization gains prominence, enhancing operational effectiveness. The competitive arena also witnesses efforts to achieve cost-effectiveness in production methods, driving advancements in chemical formulations and process optimization. Brand reputation and thought leadership play pivotal roles as companies seek to establish their expertise in the market, elevating their credibility as reliable suppliers of essential fracking chemicals and fluids. This represents one of the fracking chemicals and fluids market recent opportunities. The global market's competitive landscape remains fluid, shaped by innovation, sustainability, technological progress, and the ability to navigate the evolving energy landscape effectively.The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major fracking chemicals and fluids market companies have also been provided. Some of the key players in the market include:

- Akzo Nobel N.V.

- Albemarle Corporation

- Ashland Inc.

- Baker Hughes Incorporated

- BASF SE

- Calfrac Well Services Ltd.

- Chevron Phillips Chemical Company

- Clariant International Ltd.

- E.I. du Pont de Nemours and Company

- FTS International

- Halliburton Company

- Pioneer Engineering Services

- Schlumberger Ltd.

- The Dow Chemical Company

- Weatherford International

Key Questions Answered in This Report:

- How has the global fracking chemicals and fluids market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global fracking chemicals and fluids market?

- What is the impact of each driver, restraint, and opportunity on the global fracking chemicals and fluids market growth?

- What are the key regional markets?

- Which countries represent the most attractive fracking chemicals and fluids market?

- What is the breakup of the market based on the type?

- Which is the most attractive type in the fracking chemicals and fluids market?

- What is the breakup of the market based on the well type?

- Which is the most attractive well type in the fracking chemicals and fluids market?

- What is the breakup of the market based on the function type?

- Which is the most attractive function type in the fracking chemicals and fluids market?

- What is the competitive structure of the global fracking chemicals and fluids market?

- Who are the key players/companies in the global fracking chemicals and fluids market?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global Fracking Chemicals and Fluids Market

5.1 Market Overview

5.2 Market Performance

5.3 Impact of COVID-19

5.4 Market Forecast

6 Market Breakup by Type

6.1 Water-Based

6.1.1 Market Trends

6.1.2 Market Forecast

6.2 Foam-Based

6.2.1 Market Trends

6.2.2 Market Forecast

6.3 Gelled Oil-Based

6.3.1 Market Trends

6.3.2 Market Forecast

6.4 Others

6.4.1 Market Trends

6.4.2 Market Forecast

7 Market Breakup by Well Type

7.1 Horizontal Wells

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 Vertical Wells

7.2.1 Market Trends

7.2.2 Market Forecast

8 Market Breakup by Function Type

8.1 Gelling Agent

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 Friction Reducer

8.2.1 Market Trends

8.2.2 Market Forecast

8.3 Surfactant

8.3.1 Market Trends

8.3.2 Market Forecast

8.4 Scale Inhibitor

8.4.1 Market Trends

8.4.2 Market Forecast

8.5 Clay Stabilizer

8.5.1 Market Trends

8.5.2 Market Forecast

8.6 Acid

8.6.1 Market Trends

8.6.2 Market Forecast

8.7 Cross-Linkers

8.7.1 Market Trends

8.7.2 Market Forecast

8.8 Breaker

8.8.1 Market Trends

8.8.2 Market Forecast

8.9 Ph Adjusting Agent

8.9.1 Market Trends

8.9.2 Market Forecast

8.10 Iron Control Agent

8.10.1 Market Trends

8.10.2 Market Forecast

8.11 Corrosion Inhibitor

8.11.1 Market Trends

8.11.2 Market Forecast

8.12 Biocide

8.12.1 Market Trends

8.12.2 Market Forecast

8.13 Others

8.13.1 Market Trends

8.13.2 Market Forecast

9 Market Breakup by Region

9.1 North America

9.1.1 United States

9.1.1.1 Market Trends

9.1.1.2 Market Forecast

9.1.2 Canada

9.1.2.1 Market Trends

9.1.2.2 Market Forecast

9.2 Asia Pacific

9.2.1 China

9.2.1.1 Market Trends

9.2.1.2 Market Forecast

9.2.2 Japan

9.2.2.1 Market Trends

9.2.2.2 Market Forecast

9.2.3 India

9.2.3.1 Market Trends

9.2.3.2 Market Forecast

9.2.4 South Korea

9.2.4.1 Market Trends

9.2.4.2 Market Forecast

9.2.5 Australia

9.2.5.1 Market Trends

9.2.5.2 Market Forecast

9.2.6 Indonesia

9.2.6.1 Market Trends

9.2.6.2 Market Forecast

9.2.7 Others

9.2.7.1 Market Trends

9.2.7.2 Market Forecast

9.3 Europe

9.3.1 Germany

9.3.1.1 Market Trends

9.3.1.2 Market Forecast

9.3.2 France

9.3.2.1 Market Trends

9.3.2.2 Market Forecast

9.3.3 United Kingdom

9.3.3.1 Market Trends

9.3.3.2 Market Forecast

9.3.4 Italy

9.3.4.1 Market Trends

9.3.4.2 Market Forecast

9.3.5 Spain

9.3.5.1 Market Trends

9.3.5.2 Market Forecast

9.3.6 Russia

9.3.6.1 Market Trends

9.3.6.2 Market Forecast

9.3.7 Others

9.3.7.1 Market Trends

9.3.7.2 Market Forecast

9.4 Latin America

9.4.1 Brazil

9.4.1.1 Market Trends

9.4.1.2 Market Forecast

9.4.2 Mexico

9.4.2.1 Market Trends

9.4.2.2 Market Forecast

9.4.3 Others

9.4.3.1 Market Trends

9.4.3.2 Market Forecast

9.5 Middle East and Africa

9.5.1 Market Trends

9.5.2 Market Breakup by Country

9.5.3 Market Forecast

10 SWOT Analysis

10.1 Overview

10.2 Strengths

10.3 Weaknesses

10.4 Opportunities

10.5 Threats

11 Value Chain Analysis

12 Porters Five Forces Analysis

12.1 Overview

12.2 Bargaining Power of Buyers

12.3 Bargaining Power of Suppliers

12.4 Degree of Competition

12.5 Threat of New Entrants

12.6 Threat of Substitutes

13 Price Indicators

14 Competitive Landscape

14.1 Market Structure

14.2 Key Players

14.3 Profiles of Key Players

14.3.1 Akzo Nobel N.V.

14.3.1.1 Company Overview

14.3.1.2 Product Portfolio

14.3.1.3 Financials

14.3.1.4 SWOT Analysis

14.3.2 Albemarle Corporation

14.3.2.1 Company Overview

14.3.2.2 Product Portfolio

14.3.2.3 Financials

14.3.2.4 SWOT Analysis

14.3.3 Ashland Inc.

14.3.3.1 Company Overview

14.3.3.2 Product Portfolio

14.3.4 Baker Hughes Incorporated

14.3.4.1 Company Overview

14.3.4.2 Product Portfolio

14.3.5 BASF SE

14.3.5.1 Company Overview

14.3.5.2 Product Portfolio

14.3.5.3 Financials

14.3.5.4 SWOT Analysis

14.3.6 Calfrac Well Services Ltd.

14.3.6.1 Company Overview

14.3.6.2 Product Portfolio

14.3.6.3 Financials

14.3.6.4 SWOT Analysis

14.3.7 Chevron Phillips Chemical Company

14.3.7.1 Company Overview

14.3.7.2 Product Portfolio

14.3.7.3 SWOT Analysis

14.3.8 Clariant International Ltd.

14.3.8.1 Company Overview

14.3.8.2 Product Portfolio

14.3.9 E.I. du Pont de Nemours and Company

14.3.9.1 Company Overview

14.3.9.2 Product Portfolio

14.3.9.3 Financials

14.3.9.4 SWOT Analysis

14.3.10 FTS International

14.3.10.1 Company Overview

14.3.10.2 Product Portfolio

14.3.11 Halliburton Company

14.3.11.1 Company Overview

14.3.11.2 Product Portfolio

14.3.11.3 Financials

14.3.11.4 SWOT Analysis

14.3.12 Pioneer Engineering Services

14.3.12.1 Company Overview

14.3.12.2 Product Portfolio

14.3.13 Schlumberger Ltd.

14.3.13.1 Company Overview

14.3.13.2 Product Portfolio

14.3.13.3 Financials

14.3.13.4 SWOT Analysis

14.3.14 The DOW Chemical Company

14.3.14.1 Company Overview

14.3.14.2 Product Portfolio

14.3.14.3 Financials

14.3.15 Weatherford International

14.3.15.1 Company Overview

14.3.15.2 Product Portfolio

List of Figures

Figure 1: Global: Fracking Chemicals and Fluids Market: Major Drivers and Challenges

Figure 2: Global: Fracking Chemicals and Fluids Market: Sales Value (in Billion USD), 2019-2024

Figure 3: Global: Fracking Chemicals and Fluids Market: Breakup by Type (in %), 2024

Figure 4: Global: Fracking Chemicals and Fluids Market: Breakup by Well Type (in %), 2024

Figure 5: Global: Fracking Chemicals and Fluids Market: Breakup by Function Type (in %), 2024

Figure 6: Global: Fracking Chemicals and Fluids Market: Breakup by Region (in %), 2024

Figure 7: Global: Fracking Chemicals and Fluids Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 8: Global: Fracking Chemicals and Fluids (Water-Based) Market: Sales Value (in Million USD), 2019 & 2024

Figure 9: Global: Fracking Chemicals and Fluids (Water-Based) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 10: Global: Fracking Chemicals and Fluids (Foam-Based) Market: Sales Value (in Million USD), 2019 & 2024

Figure 11: Global: Fracking Chemicals and Fluids (Foam-Based) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 12: Global: Fracking Chemicals and Fluids (Gelled Oil-Based) Market: Sales Value (in Million USD), 2019 & 2024

Figure 13: Global: Fracking Chemicals and Fluids (Gelled Oil-Based) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 14: Global: Fracking Chemicals and Fluids (Other Types) Market: Sales Value (in Million USD), 2019 & 2024

Figure 15: Global: Fracking Chemicals and Fluids (Other Types) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 16: Global: Fracking Chemicals and Fluids (Horizontal Wells) Market: Sales Value (in Million USD), 2019 & 2024

Figure 17: Global: Fracking Chemicals and Fluids (Horizontal Wells) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 18: Global: Fracking Chemicals and Fluids (Vertical Wells) Market: Sales Value (in Million USD), 2019 & 2024

Figure 19: Global: Fracking Chemicals and Fluids (Vertical Wells) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 20: Global: Fracking Chemicals and Fluids (Gelling Agent) Market: Sales Value (in Million USD), 2019 & 2024

Figure 21: Global: Fracking Chemicals and Fluids (Gelling Agent) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 22: Global: Fracking Chemicals and Fluids (Friction Reducer) Market: Sales Value (in Million USD), 2019 & 2024

Figure 23: Global: Fracking Chemicals and Fluids (Friction Reducer) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 24: Global: Fracking Chemicals and Fluids (Surfactant) Market: Sales Value (in Million USD), 2019 & 2024

Figure 25: Global: Fracking Chemicals and Fluids (Surfactant) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 26: Global: Fracking Chemicals and Fluids (Scale Inhibitor) Market: Sales Value (in Million USD), 2019 & 2024

Figure 27: Global: Fracking Chemicals and Fluids (Scale Inhibitor) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 28: Global: Fracking Chemicals and Fluids (Clay Stabilizer) Market: Sales Value (in Million USD), 2019 & 2024

Figure 29: Global: Fracking Chemicals and Fluids (Clay Stabilizer) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 30: Global: Fracking Chemicals and Fluids (Acid) Market: Sales Value (in Million USD), 2019 & 2024

Figure 31: Global: Fracking Chemicals and Fluids (Acid) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 32: Global: Fracking Chemicals and Fluids (Cross-Linkers) Market: Sales Value (in Million USD), 2019 & 2024

Figure 33: Global: Fracking Chemicals and Fluids (Cross-Linkers) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 34: Global: Fracking Chemicals and Fluids (Breaker) Market: Sales Value (in Million USD), 2019 & 2024

Figure 35: Global: Fracking Chemicals and Fluids (Breaker) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 36: Global: Fracking Chemicals and Fluids (Ph Adjusting Agent) Market: Sales Value (in Million USD), 2019 & 2024

Figure 37: Global: Fracking Chemicals and Fluids (Ph Adjusting Agent) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 38: Global: Fracking Chemicals and Fluids (Iron Control Agent) Market: Sales Value (in Million USD), 2019 & 2024

Figure 39: Global: Fracking Chemicals and Fluids (Iron Control Agent) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 40: Global: Fracking Chemicals and Fluids (Corrosion Inhibitor) Market: Sales Value (in Million USD), 2019 & 2024

Figure 41: Global: Fracking Chemicals and Fluids (Corrosion Inhibitor) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 42: Global: Fracking Chemicals and Fluids (Biocide) Market: Sales Value (in Million USD), 2019 & 2024

Figure 43: Global: Fracking Chemicals and Fluids (Biocide) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 44: Global: Fracking Chemicals and Fluids (Other Function Types) Market: Sales Value (in Million USD), 2019 & 2024

Figure 45: Global: Fracking Chemicals and Fluids (Other Function Types) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 46: North America: Fracking Chemicals and Fluids Market: Sales Value (in Million USD), 2019 & 2024

Figure 47: North America: Fracking Chemicals and Fluids Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 48: United States: Fracking Chemicals and Fluids Market: Sales Value (in Million USD), 2019 & 2024

Figure 49: United States: Fracking Chemicals and Fluids Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 50: Canada: Fracking Chemicals and Fluids Market: Sales Value (in Million USD), 2019 & 2024

Figure 51: Canada: Fracking Chemicals and Fluids Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 52: Asia Pacific: Fracking Chemicals and Fluids Market: Sales Value (in Million USD), 2019 & 2024

Figure 53: Asia Pacific: Fracking Chemicals and Fluids Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 54: China: Fracking Chemicals and Fluids Market: Sales Value (in Million USD), 2019 & 2024

Figure 55: China: Fracking Chemicals and Fluids Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 56: Japan: Fracking Chemicals and Fluids Market: Sales Value (in Million USD), 2019 & 2024

Figure 57: Japan: Fracking Chemicals and Fluids Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 58: India: Fracking Chemicals and Fluids Market: Sales Value (in Million USD), 2019 & 2024

Figure 59: India: Fracking Chemicals and Fluids Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 60: South Korea: Fracking Chemicals and Fluids Market: Sales Value (in Million USD), 2019 & 2024

Figure 61: South Korea: Fracking Chemicals and Fluids Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 62: Australia: Fracking Chemicals and Fluids Market: Sales Value (in Million USD), 2019 & 2024

Figure 63: Australia: Fracking Chemicals and Fluids Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 64: Indonesia: Fracking Chemicals and Fluids Market: Sales Value (in Million USD), 2019 & 2024

Figure 65: Indonesia: Fracking Chemicals and Fluids Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 66: Others: Fracking Chemicals and Fluids Market: Sales Value (in Million USD), 2019 & 2024

Figure 67: Others: Fracking Chemicals and Fluids Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 68: Europe: Fracking Chemicals and Fluids Market: Sales Value (in Million USD), 2019 & 2024

Figure 69: Europe: Fracking Chemicals and Fluids Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 70: Germany: Fracking Chemicals and Fluids Market: Sales Value (in Million USD), 2019 & 2024

Figure 71: Germany: Fracking Chemicals and Fluids Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 72: France: Fracking Chemicals and Fluids Market: Sales Value (in Million USD), 2019 & 2024

Figure 73: France: Fracking Chemicals and Fluids Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 74: United Kingdom: Fracking Chemicals and Fluids Market: Sales Value (in Million USD), 2019 & 2024

Figure 75: United Kingdom: Fracking Chemicals and Fluids Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 76: Italy: Fracking Chemicals and Fluids Market: Sales Value (in Million USD), 2019 & 2024

Figure 77: Italy: Fracking Chemicals and Fluids Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 78: Spain: Fracking Chemicals and Fluids Market: Sales Value (in Million USD), 2019 & 2024

Figure 79: Spain: Fracking Chemicals and Fluids Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 80: Russia: Fracking Chemicals and Fluids Market: Sales Value (in Million USD), 2019 & 2024

Figure 81: Russia: Fracking Chemicals and Fluids Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 82: Others: Fracking Chemicals and Fluids Market: Sales Value (in Million USD), 2019 & 2024

Figure 83: Others: Fracking Chemicals and Fluids Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 84: Latin America: Fracking Chemicals and Fluids Market: Sales Value (in Million USD), 2019 & 2024

Figure 85: Latin America: Fracking Chemicals and Fluids Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 86: Brazil: Fracking Chemicals and Fluids Market: Sales Value (in Million USD), 2019 & 2024

Figure 87: Brazil: Fracking Chemicals and Fluids Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 88: Mexico: Fracking Chemicals and Fluids Market: Sales Value (in Million USD), 2019 & 2024

Figure 89: Mexico: Fracking Chemicals and Fluids Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 90: Others: Fracking Chemicals and Fluids Market: Sales Value (in Million USD), 2019 & 2024

Figure 91: Others: Fracking Chemicals and Fluids Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 92: Middle East and Africa: Fracking Chemicals and Fluids Market: Sales Value (in Million USD), 2019 & 2024

Figure 93: Middle East and Africa: Fracking Chemicals and Fluids Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 94: Global: Fracking Chemicals and Fluids Industry: SWOT Analysis

Figure 95: Global: Fracking Chemicals and Fluids Industry: Value Chain Analysis

Figure 96: Global: Fracking Chemicals and Fluids Industry: Porter’s Five Forces Analysis

List of Tables

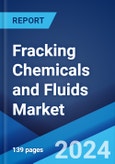

Table 1: Global: Fracking Chemicals and Fluids Market: Key Industry Highlights, 2024 and 2033

Table 2: Global: Fracking Chemicals and Fluids Market Forecast: Breakup by Type (in Million USD), 2025-2033

Table 3: Global: Fracking Chemicals and Fluids Market Forecast: Breakup by Well Type (in Million USD), 2025-2033

Table 4: Global: Fracking Chemicals and Fluids Market Forecast: Breakup by Function Type (in Million USD), 2025-2033

Table 5: Global: Fracking Chemicals and Fluids Market Forecast: Breakup by Region (in Million USD), 2025-2033

Table 6: Global: Fracking Chemicals and Fluids Market: Competitive Structure

Table 7: Global: Fracking Chemicals and Fluids Market: Key Players

Companies Mentioned

- Akzo Nobel N.V.

- Albemarle Corporation

- Ashland Inc.

- Baker Hughes Incorporated

- BASF SE

- Calfrac Well Services Ltd.

- Chevron Phillips Chemical Company

- Clariant International Ltd.

- E.I. du Pont de Nemours and Company

- FTS International

- Halliburton Company

- Pioneer Engineering Services

- Schlumberger Ltd.

- The Dow Chemical Company

- Weatherford International

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 146 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 49.3 Billion |

| Forecasted Market Value ( USD | $ 95.5 Billion |

| Compound Annual Growth Rate | 7.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |