The market is growing due to several key drivers. The rising global incidence of autoimmune disorders like rheumatoid arthritis, lupus, and multiple sclerosis has increased the need for accurate diagnosis. Awareness among patients and healthcare providers has improved, prompting earlier testing and treatment. Technological advancements, especially in biomarker discovery and imaging, allow faster and more precise detection. Aging populations are more prone to autoimmune conditions, which further fuels demand. There's also increased investment in research and development, leading to better diagnostic tools. Expansion of healthcare infrastructure in emerging markets has improved access to testing services. In addition, the growing use of point-of-care testing and automation in labs helps reduce turnaround time, making diagnosis more efficient. These combined factors are pushing the market forward and encouraging innovation across diagnostic platforms.

In the United States, efforts to improve early detection of autoimmune disorders like lupus and rheumatoid arthritis are gaining pace through new multi-biomarker assays. These tools aim to raise diagnostic sensitivity by targeting markers such as TC4d, TIgG, and TIgM, signaling a shift toward more precise, blood-based testing methods in clinical immunology. For instance, in January 2025, Exagen Inc. received conditional approval from the New York State Department of Health for its new biomarker assays to enhance the detection of lupus and rheumatoid arthritis. The assays, set to be added to the AVISE CTD platform, were designed to improve diagnostic sensitivity using biomarkers like TC4d, TIgG, and TIgM.

Autoimmune Disease Diagnosis Market Trends:

Advancements in Diagnostic Technologies

New biomarkers like autoantibodies are discovered to diagnose specific autoimmune diseases like lupus, rheumatoid arthritis, and celiac disease. For instance, epidemiological studies have shown that the incidence (rate of new cases) of global autoimmune diseases has risen yearly by 19.1% with rheumatological diseases such as Sjögren’s and lupus rising 7.1% per year. Biomarkers can provide more precise classification and early identification of autoimmune diseases. More individualized diagnostics are allowing for the discovery of distinct protein signatures or metabolic profiles linked to autoimmune disorders only because of developments in proteomics and metabolomics. Furthermore, microarray technology allows simultaneous testing of multiple biomarkers, which makes it easier to diagnose complex autoimmune diseases involving multiple genetic or protein factors. Additionally, companies are launching cutting-edge products and new technologies, which is positively influencing the autoimmune disease diagnosis market outlook. For instance, on 25 March 2024, AbbVie Inc. and Landos Biopharma, Inc. announced a definitive agreement under which AbbVie will acquire Landos, a clinical stage biopharmaceutical company focused on the development of novel and oral therapeutics for patients with autoimmune diseases. The main investigational asset of Landos is NX-13, a first-in-class, oral NLRX1 agonist with a bimodal mechanism of action (MOA).Rising Focus on Improving Patient Outcomes

The US Food and Drug Administration (FDA) provided clearance for Werfen's Aptiva connective tissue disease (CTD) essential reagent under 510(k) on October 16, 2023. New reagents benefit in speeding up diagnosis and enhancing patient outcomes in difficult-to-diagnose autoimmune disorders. As per the autoimmune disease diagnosis market forecast, rising efforts to enhance early and precise detection for improved patient care are likely to boost demand. Apart from this, early diagnosis of autoimmune disorders enables medical professionals to start treatment quickly while preventing or delaying the onset of diseases, including multiple sclerosis, lupus, and rheumatoid arthritis.Collaborations and Partnerships among Key Players

On January 10, 2023, ScipherMedicine acquired CrossBridge, a Philadelphia-based data, analytics, and software company, to enhance its data and analytics capabilities. This enables a more granular and real time understanding of patients' treatment pathways. The software as a service (SaaS) value-based care platform aids in lowering healthcare costs while enhancing patient outcomes. Through various collaborations, companies combine their expertise in immunology, molecular biology, and bioinformatics, which supports the autoimmune disease diagnosis market growth. A large number of pharmaceutical companies are collaborating with diagnostic companies to provide companion diagnostics tests that are intended to determine which patients will benefit the most from particular treatments. For instance, in total 2,399,600 of the 15 key diagnostic tests were performed during April 2025. This is an increase of 70,600 (3.0%) from April 2024, which is 8.2% when adjusted for working days. These diagnostics aid in matching patients with the best biologic therapy for autoimmune illnesses, enhancing results while decreasing treatment selection trial and error. These partnerships also involve the co-development of treatments and diagnostic tools. For instance, pharmaceutical companies might work with diagnostics firms to create tests that monitor treatment efficacy, helping doctors adjust therapies in real time to improve patient outcomes.Autoimmune Disease Diagnosis Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global autoimmune disease diagnosis market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, disease type, test type, and end-user.Analysis by Product Type:

- Consumables and Assay Kits

- Instruments

Analysis by Disease Type:

- Systemic Autoimmune Disease

- Rheumatoid Arthritis

- Psoriasis

- Systemic Lupus Erythematosus (SLE)

- Multiple Sclerosis

- Others

- Localized Autoimmune Disease

- Inflammatory Bowel Disease

- Type 1 Diabetes

- Thyroid

- Others

Analysis by Test Type:

- Routine Laboratory Tests

- Inflammatory Markers

- Autoantibodies and Immunologic Tests

- Others

Analysis by End-User:

- Clinical Laboratories

- Hospitals

- Others

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Key Regional Takeaways:

United States Autoimmune Disease Diagnosis Market Analysis

In 2024, the United States accounted for 91.50% of the market share in North America. United States is witnessing increased autoimmune disease diagnosis adoption due to the sharp rise of autoimmune diseases across various age groups. Over 50 Million Americans (8% of the U.S. population) are affected by autoimmune diseases and current data suggests that the prevalence of autoimmune diseases is rising. The growing prevalence of conditions such as multiple sclerosis and rheumatoid arthritis has prompted healthcare providers to invest in advanced testing tools. The rise of autoimmune diseases has created pressure on public health systems, leading to enhanced diagnostic programs and early intervention strategies. Hospitals and clinics are emphasizing personalized diagnostics, which is accelerating the adoption of specialized screening tools. Growing awareness, availability of advanced diagnostic technologies, and integration of electronic health records further support early detection. In addition, insurance coverage for autoimmune disease-related tests has improved access to diagnosis. Rising clinical research initiatives are also contributing to the adoption of advanced autoimmune disease diagnosis tools nationwide.Asia Pacific Autoimmune Disease Diagnosis Market Analysis

Asia-Pacific is experiencing growing autoimmune disease diagnosis adoption primarily due to the increasing number of Type 1 Diabetes patients. For instance, the estimated number of individuals with diabetes in India was 32 Million in the year 2000, which rose to 63 Million by 2012, 74 Million in 2021, and it is now 101 Million, according to the ICMR-INDIAB Study. This autoimmune disorder, commonly diagnosed in children and young adults, has seen a notable surge across urban and semi-urban populations. The rising incidence of Type 1 Diabetes is prompting significant investments in early diagnostic platforms, with a focus on improving glycemic control and disease monitoring. Healthcare systems are expanding their diagnostic infrastructure to manage growing pediatric and adolescent cases. The increase in Type 1 Diabetes patients is also driving innovation in test kits, especially those supporting rapid and accurate detection.Europe Autoimmune Disease Diagnosis Market Analysis

Europe is seeing a rising prevalence of thyroid-related autoimmune disorders, particularly Hashimoto’s thyroiditis and Graves’ disease, which is leading to greater reliance on diagnostic technologies. Expansion of healthcare infrastructure across urban and rural areas is improving access to advanced autoimmune disease diagnostic services. For instance, Germany has more than 1,900 hospitals, including over 30 elite university hospitals, combining top-level patient care with research and innovation. Public health campaigns targeting thyroid awareness and increased physician focus on autoimmune symptoms are enhancing early detection. New investments in immunology labs and academic research centres are aiding diagnosis accuracy. Technological upgrades in laboratories and clinical support systems are boosting adoption further. Rising healthcare expenditure and the aging population are also contributing to broader diagnosis initiatives. With growing thyroid cases and investment on healthcare infrastructure in Europe, the region continues to strengthen its position in autoimmune disease diagnostics.Latin America Autoimmune Disease Diagnosis Market Analysis

Latin America is witnessing increased autoimmune disease diagnosis adoption driven by rising incidences of lupus, rheumatoid arthritis, and celiac disease. Awareness campaigns and support from medical societies are prompting early clinical consultations. Expanding diagnostic facilities and greater availability of trained professionals are improving accessibility. For instance, Novo Nordisk plans to invest USD 1.09 Billion to boost Ozempic, Wegovy production in Brazil. As autoimmune diseases like lupus, rheumatoid arthritis, and celiac disease gain attention, diagnostic procedures are becoming more widespread. Rising focus on public healthcare support is contributing to enhanced diagnosis practices.Middle East and Africa Autoimmune Disease Diagnosis Market Analysis

Middle East and Africa are undergoing rapid improvements in healthcare systems, leading to broader autoimmune disease diagnosis adoption. Growing healthcare facilities are increasing the availability of diagnostics in both urban and semi-urban areas. For the 2025 fiscal year, the UAE allocated AED 5.7 Billion, equivalent to 8% of the federal budget, to healthcare and community prevention services, reflecting its sustained commitment to developing the health sector. With more hospitals and laboratories being equipped for autoimmune screenings, patients now have better access to early-stage diagnostics. Expansion of medical infrastructure continues to support effective diagnosis in the region.Competitive Landscape:

The autoimmune disease diagnostics market is seeing steady activity across product development, research, and collaborations. Diagnostic tools are becoming more precise, with new technologies enabling earlier and less invasive detection. Research groups and labs are working closely with diagnostics firms to bring innovations into clinical use more quickly. AI and machine learning are starting to influence test development, especially in pattern recognition and predictive diagnostics. Governments are showing more interest through national health strategies and dedicated funding for autoimmune conditions. Product launches and R&D remain the most consistent forms of progress, while formal partnerships and agreements are also frequent. Compared to others, large-scale fundraising or private investment announcements are less common right now. Most movement is driven by research and collaboration.The report provides a comprehensive analysis of the competitive landscape in the autoimmune disease diagnosis market with detailed profiles of all major companies, including:

- Abbott Laboratories

- AESKU.GROUP

- Danaher Corp.

- bioMérieux SA

- Bio-Rad Laboratories, Inc.

- PerkinElmer Inc.

- Hemagen Diagnostics, Inc.

- Inova Diagnostics, Inc.

- Myriad Genetics, Inc.

- Quest Diagnostics Incorporated

- Siemens Healthineers AG

- SQI Diagnostics

- Thermo Fisher Scientific Inc.

- Trinity Biotech plc

Key Questions Answered in This Report

1. How big is the autoimmune disease diagnosis market?2. What is the future outlook of autoimmune disease diagnosis market?

3. What are the key factors driving the autoimmune disease diagnosis market?

4. Which region accounts for the largest autoimmune disease diagnosis market share?

5. Which are the leading companies in the global autoimmune disease diagnosis market?

Table of Contents

Companies Mentioned

- Abbott Laboratories

- AESKU.GROUP

- Danaher Corp.

- bioMérieux SA

- Bio-Rad Laboratories Inc.

- PerkinElmer Inc.

- Hemagen Diagnostics Inc.

- Inova Diagnostics Inc.

- Myriad Genetics Inc.

- Quest Diagnostics Incorporated

- Siemens Healthineers AG

- SQI Diagnostics

- Thermo Fisher Scientific Inc.

- Trinity Biotech plc

Table Information

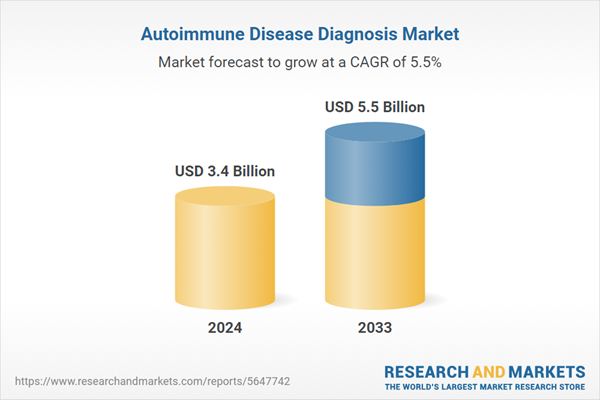

| Report Attribute | Details |

|---|---|

| No. of Pages | 149 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 3.4 Billion |

| Forecasted Market Value ( USD | $ 5.5 Billion |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 14 |