Fertility Services Market Analysis:

- Major Market Drivers: The global market is experiencing robust growth, driven by the introduction of advanced technologies like machine learning (ML) and artificial intelligence (AI). These technologies can predict the success of in-vitro fertilization (IVF) cycles by analyzing large datasets from previous cycles.

- Key Market Trends: The rising number of infertility cases and favorable government initiatives are some of the important trends.

- Geographical Trends: Asia Pacific exhibits a clear dominance, accounting for the biggest market share owing to various partnerships among key players.

- Competitive Landscape: Major market players in the fertility services industry are Instituto Bernabéu Group, INVO Bioscience, Inc., Monash IVF Group, Apollo Hospitals Enterprise Ltd., CARE Fertility Group Ltd., Carolinas Fertility Institute, Genea Limited, The Cooper Companies, Inc., Virtus Health Group, Vitrolife Sweden AB, The Johns Hopkins Health System Corporation, Medicover AB (publ), OvaScience, Inc., Progyny, Inc., and Xytex Corporation, among many others.

- Challenges and Opportunities: High costs of treatments is a major market challenge. Nonetheless, the increasing need for digital health solutions, coupled with the rising focus on personalized treatment plans among individuals, is projected to overcome these challenges and provide market opportunities.

Fertility Services Market Trends:

Favorable Government Initiatives

In an effort to increase the birth rate, Shanghai integrated 12 forms of assisted reproductive technology (ART) into basic health insurance on May 31, 2024. This initiative reduced infertile couples' burden from expensive fertility treatments. Government agencies of various countries are making fertility treatments more accessible and affordable for individuals facing infertility issues by providing numerous services. They are providing direct financial assistance or subsidies for fertility treatments such as in vitro fertilization (IVF). This reduces the out-of-pocket costs for patients, thereby increasing fertility services demand. They are also investing in public fertility clinics to provide high-quality care at lower costs as compared to private clinics. This ensures that a wider range of people, regardless of their financial status, can access fertility services. In addition, governing authorities are establishing legal frameworks that regulate and support fertility treatments and ensuring that they are safe, ethical, and accessible. Furthermore, in some countries, the costs associated with fertility treatments may be tax-deductible, allowing individuals to reduce their taxable income and lessen the financial burden of these services.Increasing Number of Infertility Cases

The growing number of infertility cases among the masses across the globe is offering a favorable fertility services market outlook. Individuals are dealing with these problems as a result of changing lifestyles, environmental influences, age-related problems, and medical ailments. Modern diets are deficient in vital nutrients, which can be harmful to reproductive health. In today's fast-paced lifestyle, high levels of stress are prevalent and can cause menstrual cycle disruption and sperm quality reduction. In addition to causing lifestyle disorders like diabetes and hypertension, chronic stress also causes infertility issues. Apart from this, the rising number of people are choosing to delay parenthood for various reasons including career aspirations, financial stability, and personal goals, which provide fertility services market insights. Furthermore, there is an increase in the demand for treatment devices that are beneficial in treating these issues among individuals. As per the research report of the publisher, the global infertility treatment devices market is expected to reach US$ 729.5 Million by 2032.Rising Awareness and Acceptance About a Variety of Treatment

The increasing awareness and acceptance of various fertility treatments among individuals is propelling the market growth. Governing agencies and non-governmental agencies around the world are organizing campaigns that benefit in generating awareness among individuals about the wide availability of treatment options available, which is bolstering the fertility services growth. These campaigns often use media, social platforms, and community outreach to disseminate information about the causes of infertility and the benefits of early intervention. Besides this, publicized instances involving celebrities who candidly talk about their infertility issues and usage of IVF, surrogacy, or egg freezing help to lessen the stigma attached to these procedures. Its visibility inspires others to investigate comparable choices without worrying about being judged by others. Furthermore, major companies in the market are engaging in partnerships and collaborations among major players to expand their services and increase fertility services market revenue. For instance, on 26 April 2023, a nationwide platform for family-building with flexible financing plans and concierge support services ‘Future Family (FF)’ and Prelude Network®, a top provider of all-inclusive reproductive services in North America, established an exclusive agreement. The partnership will expand financial accessibility to premium fertility services and empower patients with more financial options and a proper understanding of treatment costs. FF also developed a personalized payment choice tool that allows patients to understand fertility costs based on their individual treatment plans.Fertility Services Market Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with forecasts at the global and regional levels for 2025-2033. Our report has categorized the market based on cause of infertility, procedure, service, and end-user.Breakup by Cause of Infertility:

- Male Infertility

- Female Infertility

Male infertility accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the cause of infertility. This includes male infertility and female infertility. According to the report, male infertility represented the largest segment.Male infertility issues can result from a number of factors including bad eating and poor exercise habits. Treatments like intracytoplasmic sperm injection (ICSI), in which a single sperm is injected straight into an egg, are becoming common, especially when it comes to low sperm counts or motility problems. Several medications and hormonal therapies are available to address specific causes of male infertility like hormonal imbalances or infections. These treatments are effective in providing a viable solution to male infertility.

Breakup by Procedure:

- In Vitro Fertilization with Intracytoplasmic Sperm Injection (IVF with ICSI)

- Surrogacy

- In Vitro Fertilization Without Intracytoplasmic Sperm Injection (IVF without ICSI)

- Intrauterine Insemination (IUI)

- Others

In vitro fertilization with intracytoplasmic sperm injection (IVF with ICSI) holds the largest share of the industry

A detailed breakup and analysis of the market based on the procedure have also been provided in the report. This includes in vitro fertilization with intracytoplasmic sperm injection (IVF with ICSI), surrogacy, in vitro fertilization without intracytoplasmic sperm injection (IVF without ICSI), intrauterine insemination (IUI), and others. According to the report, in vitro fertilization with intracytoplasmic sperm injection (IVF with ICSI) accounts for the largest market share.In vitro fertilization with intracytoplasmic sperm injection (IVF with ICSI) is beneficial in cases of severe male infertility, where traditional IVF methods might not be as effective. It is used to maximize the chances of fertilization among individuals. The growing demand for effective treatments like IVF with ICSI, as people are seeking assisted reproductive technologies (ART) to overcome infertility, is offering a favorable fertility services industry outlook.

Breakup by Service:

- Fresh Non-Donor

- Frozen Non-Donor

- Egg and Embryo Banking

- Fresh Donor

- Frozen Donor

Frozen non-donor represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the service. This includes fresh non-donor, frozen non-donor, egg and embryo banking, fresh donor, and frozen donor. According to the report, frozen non-donor represents the largest segment.Frozen non-donor services include the use of frozen eggs or embryos from the intended mother or parents, without the involvement of donors. The preference for frozen non-donor services is likely driven by advancements in cryopreservation techniques, offering higher success rates and flexibility for patients in terms of timing their fertility treatments. Advancements in egg freezing techniques like vitrification are leading to higher survival rates of eggs during the freezing and thawing processes. This makes frozen eggs a more viable option for future fertility treatments and shows fertility services market dynamics.

Breakup by End-User:

- Fertility Clinics

- Hospitals

- Surgical Centres

- Clinical Research Institutes

- Cryobanks

Fertility clinics exhibit a clear dominance in the market

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes fertility clinics, hospitals, surgical centres, clinical research institutes, and cryobanks. According to the report, fertility clinics account for the largest market share.Fertility clinics offer a wide range of treatments like IVF, ICSI, egg and sperm donation, fertility preservation, and genetic testing. Their ability to provide a full spectrum of services under one roof makes them the go-to option for patients. These clinics often provide personalized treatment plans tailored to the specific needs of each patient, which increases the chances of patient satisfaction. Fertility services market highlights that fertility clinics are focusing on expanding their reach and establishing networks of clinics in various regions, making their services more accessible to a broader population. In addition, these clinics are staffed with experts in reproductive medicine including fertility specialists, embryologists, and genetic counselors, ensuring high-quality care. They are also equipped with the latest technology and lab facilities, which are crucial for performing advanced procedures.

Breakup by Region:

- Europe

- North America

- Asia Pacific

- Middle East and Africa

- Latin America

Asia Pacific leads the market, accounting for the largest fertility services market share

The report has also provided a comprehensive analysis of all the major regional markets, which include Europe, North America, Asia Pacific, the Middle East and Africa, and Latin America. According to the report, Asia Pacific represents the largest regional market for fertility services.Asia Pacific is home to some of the world's most populous countries such as China and India. With a large population, the number of people facing infertility is significant, driving the demand for fertility services. Urbanization, changing lifestyles, delayed marriages, and increasing age of first-time parents are contributing to rising infertility rates among individuals in the region. Moreover, fertility services industry report demonstrates that environmental factors such as pollution and exposure to toxins, play a crucial role. Besides this, governing authorities in the region are encouraging treatment solutions related to infertility. For instance, in 2024, government agencies in Maharashtra launched in-vitro fertilization (IVF) centers in some selected government-run medical colleges and hospitals (GMCH) to provide free treatment to thousands of couples grappling with infertility. The move was made in response to the alarming drop in Maharashtra's total fertility rate (TFR).

Competitive Landscape:

- The fertility services market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the fertility services industry include Instituto Bernabéu Group, INVO Bioscience, Inc., Monash IVF Group, Apollo Hospitals Enterprise Ltd., CARE Fertility Group Ltd., Carolinas Fertility Institute, Genea Limited, The Cooper Companies, Inc., Virtus Health Group, Vitrolife Sweden AB, The Johns Hopkins Health System Corporation, Medicover AB (publ), OvaScience, Inc., Progyny, Inc., Xytex Corporation, etc.

Key players in the market are expanding their range of services to include not just basic fertility treatments but also advanced technologies like preimplantation genetic testing (PGT), fertility preservation (egg or sperm freezing), and third-party reproduction (egg or sperm donation and surrogacy). They are also expanding their footprint by opening new fertility clinics in emerging markets. Furthermore, companies are engaging in strategic partnerships and acquisitions to strengthen their market presence. For example, on 25 April 2023, Cryoport, Inc., a leading global provider of innovative temperature-controlled supply chain solutions for the life sciences, reproductive medicine and animal health industries, announced that it signed a 3-year agreement with Boston IVF, a one of the world's most experienced fertility treatment providers.

Key Questions Answered in This Report

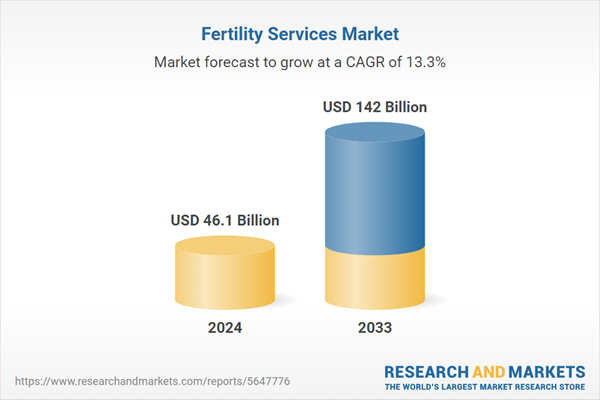

1. What was the size of the global fertility services market in 2024?2. What is the expected growth rate of the global fertility services market during 2025-2033?

3. What has been the impact of COVID-19 on the global fertility services market?

4. What are the key factors driving the global fertility services market?

5. What is the breakup of the global fertility services market based on the cause of infertility?

6. What is the breakup of the global fertility services market based on the procedure?

7. What is the breakup of the global fertility services market based on the service?

8. What is the breakup of the global fertility services market based on the end-user?

9. What are the key regions in the global fertility services market?

10. Who are the key players/companies in the global fertility services market?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global Fertility Services Market

5.1 Market Overview

5.2 Market Performance

5.3 Impact of COVID-19

5.4 Market Breakup by Cause of Infertility

5.5 Market Breakup by Procedure

5.6 Market Breakup by Service

5.7 Market Breakup by End-User

5.8 Market Breakup by Region

5.9 Market Forecast

6 Market Breakup by Cause of Infertility

6.1 Male Infertility

6.1.1 Market Trends

6.1.2 Market Forecast

6.2 Female Infertility

6.2.1 Market Trends

6.2.2 Market Forecast

7 Market Breakup by Procedure

7.1 In Vitro Fertilization with Intracytoplasmic Sperm Injection (IVF with ICSI)

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 Surrogacy

7.2.1 Market Trends

7.2.2 Market Forecast

7.3 In Vitro Fertilization Without Intracytoplasmic Sperm Injection (IVF without ICSI)

7.3.1 Market Trends

7.3.2 Market Forecast

7.4 Intrauterine Insemination (IUI)

7.4.1 Market Trends

7.4.2 Market Forecast

7.5 Others

7.5.1 Market Trends

7.5.2 Market Forecast

8 Market Breakup by Service

8.1 Fresh Non-Donor

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 Frozen Non-Donor

8.2.1 Market Trends

8.2.2 Market Forecast

8.3 Egg and Embryo Banking

8.3.1 Market Trends

8.3.2 Market Forecast

8.4 Fresh Donor

8.4.1 Market Trends

8.4.2 Market Forecast

8.5 Frozen Donor

8.5.1 Market Trends

8.5.2 Market Forecast

9 Market Breakup by End-User

9.1 Fertility Clinics

9.1.1 Market Trends

9.1.2 Market Forecast

9.2 Hospitals

9.2.1 Market Trends

9.2.2 Market Forecast

9.3 Surgical Centres

9.3.1 Market Trends

9.3.2 Market Forecast

9.4 Clinical Research Institutes

9.4.1 Market Trends

9.4.2 Market Forecast

9.5 Cryobanks

9.5.1 Market Trends

9.5.2 Market Forecast

10 Market Breakup by Region

10.1 Europe

10.1.1 Market Trends

10.1.2 Market Forecast

10.2 North America

10.2.1 Market Trends

10.2.2 Market Forecast

10.3 Asia Pacific

10.3.1 Market Trends

10.3.2 Market Forecast

10.4 Middle East and Africa

10.4.1 Market Trends

10.4.2 Market Forecast

10.5 Latin America

10.5.1 Market Trends

10.5.2 Market Forecast

11 SWOT Analysis

11.1 Overview

11.2 Strengths

11.3 Weaknesses

11.4 Opportunities

11.5 Threats

12 Value Chain Analysis

13 Porters Five Forces Analysis

13.1 Overview

13.2 Bargaining Power of Buyers

13.3 Bargaining Power of Suppliers

13.4 Degree of Competition

13.5 Threat of New Entrants

13.6 Threat of Substitutes

14 Price Analysis

15 Competitive Landscape

15.1 Market Structure

15.2 Key Players

15.3 Profiles of Key Players

15.3.1 Instituto Bernabéu Group

15.3.2 INVO Bioscience, Inc.

15.3.3 Monash IVF Group

15.3.4 Apollo Hospitals Enterprise Ltd.

15.3.5 CARE Fertility Group Ltd.

15.3.6 Carolinas Fertility Institute

15.3.7 Genea Limited

15.3.8 The Cooper Companies, Inc.

15.3.9 Virtus Health Group

15.3.10 Vitrolife Sweden AB

15.3.11 The Johns Hopkins Health System Corporation

15.3.12 Medicover AB (publ)

15.3.13 OvaScience, Inc.

15.3.14 Progyny, Inc.

15.3.15 Xytex Corporation

List of Figures

Figure 1: Global: Fertility Services Market: Major Drivers and Challenges

Figure 2: Global: Fertility Services Market: Sales Value (in Billion USD), 2019-2024

Figure 3: Global: Fertility Services Market: Breakup by Cause of Infertility (in %), 2024

Figure 4: Global: Fertility Services Market: Breakup by Procedure (in %), 2024

Figure 5: Global: Fertility Services Market: Breakup by Service (in %), 2024

Figure 6: Global: Fertility Services Market: Breakup by End-User (in %), 2024

Figure 7: Global: Fertility Services Market: Breakup by Region (in %), 2024

Figure 8: Global: Fertility Services Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 9: Global: Fertility Services Industry: SWOT Analysis

Figure 10: Global: Fertility Services Industry: Value Chain Analysis

Figure 11: Global: Fertility Services Industry: Porter’s Five Forces Analysis

Figure 12: Global: Fertility Services (Male Infertility) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 13: Global: Fertility Services (Male Infertility) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 14: Global: Fertility Services (Female Infertility) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 15: Global: Fertility Services (Female Infertility) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 16: Global: Fertility Services (In Vitro Fertilization with Intracytoplasmic Sperm Injection (IVF with ICSI)) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 17: Global: Fertility Services (In Vitro Fertilization with Intracytoplasmic Sperm Injection (IVF with ICSI)) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 18: Global: Fertility Services (Surrogacy) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 19: Global: Fertility Services (Surrogacy) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 20: Global: Fertility Services In Vitro Fertilization Without Intracytoplasmic Sperm Injection (IVF without ICSI) ) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 21: Global: Fertility Services (In Vitro Fertilization Without Intracytoplasmic Sperm Injection (IVF without ICSI) ) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 22: Global: Fertility Services (Intrauterine Insemination (IUI)) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 23: Global: Fertility Services (Intrauterine Insemination (IUI)) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 24: Global: Fertility Services (Other Procedures) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 25: Global: Fertility Services (Other Procedures) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 26: Global: Fertility Services (Fresh Non-Donor) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 27: Global: Fertility Services (Fresh Non-Donor) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 28: Global: Fertility Services (Frozen Non-Donor) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 29: Global: Fertility Services (Frozen Non-Donor) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 30: Global: Fertility Services (Egg and Embryo Banking) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 31: Global: Fertility Services (Egg and Embryo Banking) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 32: Global: Fertility Services (Fresh Donor) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 33: Global: Fertility Services (Fresh Donor) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 34: Global: Fertility Services (Frozen Donor) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 35: Global: Fertility Services (Frozen Donor) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 36: Global: Fertility Services (Fertility Clinics) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 37: Global: Fertility Services (Fertility Clinics) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 38: Global: Fertility Services (Hospitals) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 39: Global: Fertility Services (Hospitals) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 40: Global: Fertility Services (Surgical Centres) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 41: Global: Fertility Services (Surgical Centres) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 42: Global: Fertility Services (Clinical Research Institutes) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 43: Global: Fertility Services (Clinical Research Institutes) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 44: Global: Fertility Services (Cryobanks) Market: Sales Value (in Billion USD), 2019 & 2024

Figure 45: Global: Fertility Services (Cryobanks) Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 46: Europe: Fertility Services Market: Sales Value (in Billion USD), 2019 & 2024

Figure 47: Europe: Fertility Services Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 48: North America: Fertility Services Market: Sales Value (in Billion USD), 2019 & 2024

Figure 49: North America: Fertility Services Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 50: Asia Pacific: Fertility Services Market: Sales Value (in Billion USD), 2019 & 2024

Figure 51: Asia Pacific: Fertility Services Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 52: Middle East and Africa: Fertility Services Market: Sales Value (in Billion USD), 2019 & 2024

Figure 53: Middle East and Africa: Fertility Services Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 54: Latin America: Fertility Services Market: Sales Value (in Billion USD), 2019 & 2024

Figure 55: Latin America: Fertility Services Market Forecast: Sales Value (in Billion USD), 2025-2033

List of Tables

Table 1: Global: Fertility Services Market: Key Industry Highlights, 2024 and 2033

Table 2: Global: Fertility Services Market Forecast: Breakup by Cause of Infertility (in Billion USD), 2025-2033

Table 3: Global: Fertility Services Market Forecast: Breakup by Procedure (in Billion USD), 2025-2033

Table 4: Global: Fertility Services Market Forecast: Breakup by Service (in Billion USD), 2025-2033

Table 5: Global: Fertility Services Market Forecast: Breakup by End-User (in Billion USD), 2025-2033

Table 6: Global: Fertility Services Market Forecast: Breakup by Region (in Billion USD), 2025-2033

Table 7: Global: Fertility Services Market: Competitive Structure

Table 8: Global: Fertility Services Market: Key Players

Companies Mentioned

- Instituto Bernabéu Group

- INVO Bioscience Inc.

- Monash IVF Group

- Apollo Hospitals Enterprise Ltd.

- CARE Fertility Group Ltd.

- Carolinas Fertility Institute

- Genea Limited

- The Cooper Companies Inc.

- Virtus Health Group

- Vitrolife Sweden AB

- The Johns Hopkins Health System Corporation

- Medicover AB (publ)

- OvaScience Inc.

- Progyny Inc.

- Xytex Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 139 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 46.1 Billion |

| Forecasted Market Value ( USD | $ 142 Billion |

| Compound Annual Growth Rate | 13.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |