Pharmaceutical Continuous Manufacturing Market Analysis:

- Major Market Drivers: Regulatory agencies are supportive of continuous manufacturing due to its potential to enhance product quality, reduce contamination risks, and provide real-time monitoring of the production process.

- Key Market Trends: The rising demand for effective medicine production systems is positively impacting the market growth.

- Competitive Landscape: Some of the prominent companies in the market include Baker Perkins, Coperion GmbH (Hillenbrand Inc.), Eli Lilly and Company, GEA Group Aktiengesellschaft, Glatt GmbH, Korsch AG, Novartis AG, Siemens, SK biotek, Thermo Fisher Scientific Inc., and Viatris Inc., among many others.

- Geographical Trends: North America exhibits a clear dominance in the market due to its advanced technological infrastructure. Apart from this, the region’s highly skilled workforce and strong regulatory support accelerate the market growth.

- Challenges and Opportunities: The high cost of systems is hindering the market. However, industry collaborations and shared resources help in distributing the cost and knowledge, which strengthens the market growth.

Pharmaceutical Continuous Manufacturing Market Trends:

Innovation in Drug Delivery System

Modern advances in drug delivery systems, like advanced materials, process analytical technology (PAT), and targeted nanomedicine, enable continuous production lines to produce drugs with improved targeted delivery, stability, real-time monitoring, and solubility. Collectively, these factors accelerate the market. For instance, an article published by the National Library of Medicine in May 2024 mentioned that focusing on technologies, such as liposomes and lipid nanoparticles (LNPs) and development in smart, carrier-based, and 3D-printed drug delivery methods improve bioavailability, address conventional limitations, and advance research.Regulatory Support in Manufacturing Process

Regulatory bodies have increasingly acknowledged the benefits of continuous manufacturing, like product consistency and enhanced efficiency. These agencies established comprehensive guidelines and programs that provide clear standards and regulatory pathways for implementing continuous manufacturing technologies. For instance, in May 2024, the U.S. Food and Drug Administration (FDA) launched the START pilot program to accelerate the development of rare disease therapeutics. It focuses on clinical trial support and regulatory guidance, which benefits continuous manufacturing by accelerating novel product development and optimizing production requirements, which is increasing the pharmaceutical continuous manufacturing market statistics.Increasing Incidence of Chronic Disease

As chronic conditions such as cardiovascular diseases, diabetes, and chronic respiratory diseases become more prevalent, there is an increased demand for reliable and long-term treatments. Continuous manufacturing processes meet this demand due to their ability to produce quality pharmaceuticals at scale with efficiency and consistent quality. In line with this, the adoption of pharmaceutical continuous manufacturing price trends reduces production costs and waste, thereby making treatments more affordable and accessible. For example, research published by Public Health Research in February 2024 showed that approximately 129 million people in the United States have at least one major chronic disease.Global Pharmaceutical Continuous Manufacturing Industry Segmentation:

The research provides an analysis of the key trends in each segment of the market, along with the pharmaceutical continuous manufacturing market forecast at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on therapeutics type, formulation, application, and end user.Breakup by Therapeutics Type:

- Large Molecules

- Small Molecule.

Small molecules dominate the pharmaceutical continuous manufacturing market

The report has provided a detailed breakup and analysis of the market based on the therapeutics type. This includes large molecules and small molecules. According to the report, small molecules represented the largest market segmentation.Continuous manufacturing enhances efficiency and consistency in small-molecule drugs. Vertex Pharmaceuticals introduced Suzetrigine, a small molecule drug manufactured using continuous processes, optimizing production efficiency and ensuring consistent quality for pain management.

Breakup by Formulation:

- Solid Formulation

- Liquid and Semi-solid Formulatio.

Solid formulation currently holds most of the pharmaceutical continuous manufacturing market demand

The report has provided a detailed breakup and analysis of the market based on the formulation. This includes solid formulation and liquid and semi-solid formulation. According to the report, solid formulation represented the largest market segmentation.Solid formulations, such as capsules and tablets, excel in continuous manufacturing due to improved consistency and efficiency. For example, XenoPharma’s tablet production ensures uniform quality and scalable output, which is acting as another significant growth-inducing factor.

Breakup by Application:

- Final Drug Product Manufacturing

- API Manufacturin.

Final drug product manufacturing dominates the market

The report has provided a detailed breakup and analysis of the market based on the application. This includes final drug product manufacturing and API manufacturing. According to the report, final drug product manufacturing represented the largest market segmentation.Final drug product manufacturing in continuous processes ensures efficient production with consistent quality and scalability, thereby reducing waste and enhancing overall process control. It also results in cost savings. This is bolstering the pharmaceutical continuous manufacturing market revenue.

Breakup by End User:

- Pharmaceutical Companies

- Contract Manufacturing Organizations

- Other.

Pharmaceutical companies hold most of the pharmaceutical continuous manufacturing market outlook

The report has provided a detailed breakup and analysis of the market based on the end user. This includes pharmaceutical companies, contract manufacturing organizations, and others. According to the report, pharmaceutical companies represented the largest market segmentation.Pharmaceutical companies increasingly adopt continuous manufacturing to enhance efficiency, streamline production processes, and ensure consistent product quality. This is leading to faster and more cost-effective drug development.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Afric.

North America exhibits a clear dominance, accounting for the largest pharmaceutical continuous manufacturing market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.As per the pharmaceutical continuous manufacturing market research report, North America accounted for the largest share, driven by advanced drug delivery technologies. Moreover, regulatory bodies in the region are highly supportive of continuous manufacturing practices. The corporation with regulatory bodies encourages pharmaceutical companies to adopt continuous manufacturing solutions, thereby propelling the market growth. For instance, in May 2024, the U.S. Food and Drug Administration (FDA) introduced the START pilot program to catalyze the development of rare disease therapeutics.

Competitive Landscape:

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major market pharmaceutical continuous manufacturing companies have also been provided. Some of the key players in the market include:- Baker Perkins

- Coperion GmbH (Hillenbrand Inc.)

- Eli Lilly and Company

- GEA Group Aktiengesellschaft

- Glatt GmbH

- Korsch AG

- Novartis AG

- Siemens

- SK biotek

- Thermo Fisher Scientific Inc.

- Viatris Inc.

Key Questions Answered in This Report

- How big is the global pharmaceutical continuous manufacturing market?

- What is the expected growth rate of the global pharmaceutical continuous manufacturing market during 2025-2033?

- What are the key factors driving the global pharmaceutical continuous manufacturing market?

- What has been the impact of COVID-19 on the global pharmaceutical continuous manufacturing market growth?

- What is the breakup of the global pharmaceutical continuous manufacturing market based on the therapeutics type?

- What is the breakup of the global pharmaceutical continuous manufacturing market based on formulation?

- What is the breakup of the global pharmaceutical continuous manufacturing market based on the application?

- What is the breakup of the global pharmaceutical continuous manufacturing market based on the end user?

- What are the key regions in the global pharmaceutical continuous manufacturing market?

- Who are the key players/companies in the global pharmaceutical continuous manufacturing market?

Table of Contents

Companies Mentioned

- Baker Perkins

- Coperion GmbH (Hillenbrand Inc.)

- Eli Lilly and Company

- GEA Group Aktiengesellschaft

- Glatt GmbH

- Korsch AG

- Novartis AG

- Siemens

- SK biotek

- Thermo Fisher Scientific Inc.

- Viatris Inc

Table Information

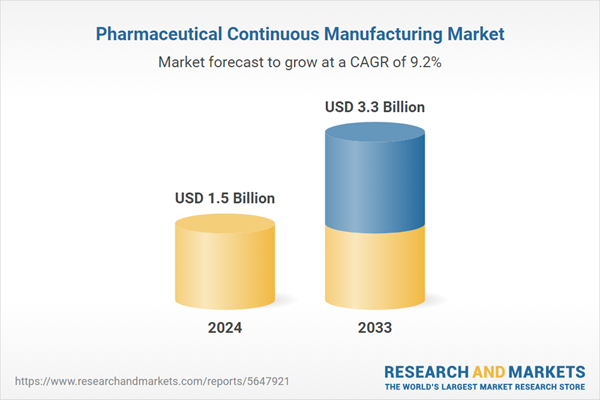

| Report Attribute | Details |

|---|---|

| No. of Pages | 150 |

| Published | June 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 1.5 Billion |

| Forecasted Market Value ( USD | $ 3.3 Billion |

| Compound Annual Growth Rate | 9.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |