Vodka-based Ready to Drink (RTD) beverages such as pre-mixed cocktails, spirits, and hard seltzers are witnessing a huge increase in new product development, which is expected to drive the market. For example, in March 2022, under the Svedka brand, Constellation Brands launched a canned vodka line. The Tea Spritz line is described as a spirit-based hard seltzer that combines real tea, sparkling water, and natural tropical fruit flavors and is available in three flavors: Orange Mango, Pineapple Guava (both of which include turmeric), and Raspberry Kiwi.

Unlike beer and wine, vodka consumption at restaurants and bars has been growing. The growth is expected to continue outpacing on-premise consumption. With consumers' return to bars following the COVID-19 disruptions, vodka's on-premise consumption has been fueled, and this trend is anticipated to continue. According to IWSR Drinks Market Analysis in 2019, total vodka on-premise sales increased by 5.9% in the U.S. Grey Goose, for example, saw a 181% increase in on-premises sales in 2021, presenting lucrative opportunities for premium vodka manufacturers.

The flavored segment is anticipated to witness the fastest growth rate during the forecast period owing to the growing demand for high-end flavored vodka, especially among the millennial population. key companies are trying to offer a variety of vodka products and pioneer the ‘ready-to-shake’ drinks category. The newly launched product line includes the ‘Whisky Sour’ with DEWAR’S Blended Scotch whisky, ‘Rum Daiquirí’ made with BACARDÍ rum, and the ‘Espresso Martini Cocktail’ and ‘Passion Fruit Martini Cocktail’ made with 42BELOW vodka. With such initiatives

The off-trade segment is expected to register significant growth during the forecast period owing to the discounts and promotional offers provided by the retail outlets. The ease of accessing different varieties of alcohol at the outlets is expected to notable growth during the forecast period.

Asia Pacific is expected to register a significant CAGR of 6.1% during the forecast period. Asia Pacific is one of the leading markets for vodka owing to increased spending from people on better quality beverages in the region. In China, there has been a well-documented shift to buying alcohol online since the start of the pandemic. According to the study published by IWSR, the data shows that from 2019-2020, the value of China’s alcohol e-commerce sector grew by approximately 20%. The increased penetration of online sales of alcohol in China is driving the growth of the vodka market.

Leading manufacturers are Diageo, Bacardi Limited, and Pernod Ricard. Large players in the market are also setting the trend of acquiring regional brands that serve multiple states. Players are recognizing the importance and dominance of regional brands, not just in terms of scaling their businesses but also in terms of the positive impact of consistent service on customers.

Vodka Market Report Highlights

- Based on type, the non-flavored vodka segment led the market with the largest revenue share of 64.9% in 2024. The flavored market is projected to grow at the fastest CAGR of 7.3% from 2025 to 2030.

- Based on distribution channel, the on-trade segment led the market with the largest revenue share of 67.5% in 2024. The off-trade segment is projected to grow at the fastest CAGR of 7.5% from 2025 to 2030.

- North America vodka market dominated with the largest revenue share of 34.9% in 2024. North America's robust cocktail culture and high demand for premium and flavored vodkas are major contributors to this dominance.

- The vodka market in Asia Pacific is projected to grow at a significant CAGR of 7.0% from 2025 to 2030. Urbanization and economic development in the region have led to increased disposable incomes, enabling consumers to spend more on premium spirits such as vodka.

Why should you buy this report?

- Comprehensive Market Analysis: Gain detailed insights into the global market across major regions and segments.

- Competitive Landscape: Explore the market presence of key players worldwide.

- Future Trends: Discover the pivotal trends and drivers shaping the future of the global market.

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions.

This Report Addresses:

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segment and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listing for you to stay ahead of the curve

- COVID-19's impact and how to sustain in these fast-evolving markets

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Brown-Forman Corporation

- Diageo

- Pernod Ricard

- Belvedere Vodka

- Bacardi Limited

- Constellation Brands, Inc.

- Proximo Spirits, Inc.

- Distell Limited

- Stoli Group

- Iceberg Vodka Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 110 |

| Published | March 2025 |

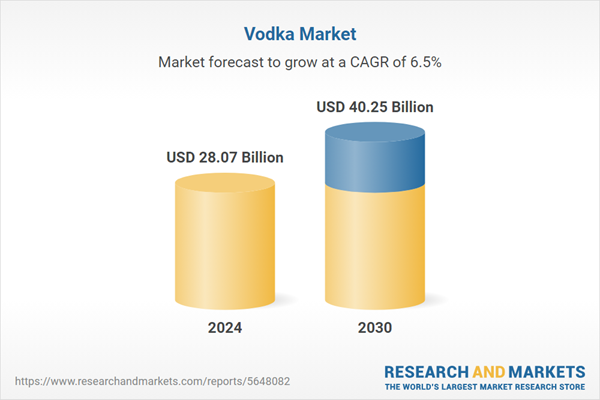

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 28.07 Billion |

| Forecasted Market Value ( USD | $ 40.25 Billion |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |