Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

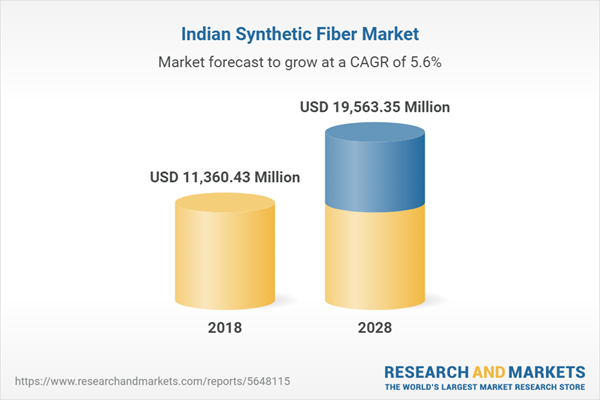

In India, the synthetic fiber market has been experiencing significant growth, driven by increasing demand in sectors such as apparel, automotive, home textiles, and industrial applications. Known for their durability, versatility, and cost-effectiveness, synthetic fibers are gaining popularity as consumers look for high-performance materials. India ranks as the second-largest global producer of both polyester and viscose. The growth of this market is further supported by expanding manufacturing capabilities, rising textile exports, and a growing middle class with increased disposable incomes. The manmade fiber (MMF) industry accounts for 17% of India’s textile exports, positioning the country as the sixth-largest exporter of MMF textiles worldwide.

However, the production and disposal of synthetic fibers present environmental challenges, leading to a shift toward sustainable practices and biodegradable alternatives. While synthetic fibers continue to dominate, there is a rising preference for eco-friendly natural fibers that may influence market dynamics. The ongoing transition toward sustainable materials is expected to shape the industry's future, offering both challenges and opportunities. Companies that respond to these trends and invest in research and development will be well-positioned for future growth. With supportive government policies in place, the market is anticipated to evolve, creating new opportunities for both manufacturers and consumers.

Key Market Drivers

Growing Demand in Textiles

With a large and expanding population, the demand for clothing and textile products is on the rise. As urban areas develop, there is an increasing need for diverse clothing options, which bolsters the synthetic fiber market. Urbanization drives lifestyle changes, leading individuals to seek modern and stylish apparel. This trend is particularly pronounced in metropolitan regions where fashion evolves quickly. Today’s consumers are more fashion-conscious and expect a wide range of choices. Synthetic fibers can be engineered to replicate the look and feel of natural fibers while providing additional benefits.The popularity of athleisure, a combination of athletic and leisurewear has further increased the demand for synthetic materials that offer comfort, stretch, and moisture management, particularly among younger consumers. Additionally, synthetic fibers are generally more cost-effective to produce than natural fibers like cotton or silk, making them appealing to both manufacturers and consumers due to competitive pricing. Their lower cost enhances accessibility, especially among low-to-middle income demographics where affordability is essential.

Materials such as polyester, nylon, and acrylic are valued for their durability, wrinkle resistance, and ease of maintenance, making them ideal for everyday wear and performance apparel. Technological advancements have led to the creation of specialized synthetic fibers with benefits like UV protection, moisture-wicking, and antimicrobial properties, addressing specific consumer needs and driving further demand.

The rise of e-commerce has significantly changed how consumers purchase textiles. Online platforms provide a vast selection of synthetic clothing, allowing for convenient browsing and buying. According to IBEF, India has approximately 936.16 million internet subscribers, with around 350 million active online users engaged in transactions. This growth in e-commerce has expanded access to a wider array of textile products, with synthetic fibers playing a key role in online offerings.

As consumer preferences evolve and technology progresses, manufacturers have the opportunity to innovate and effectively respond to these increasing demands. The combination of affordability, performance, and sustainability will shape the future of the synthetic fiber industry in India, establishing it as a dynamic segment within the broader textile market.

Government Initiatives

Government initiatives play a crucial role in the growth and development of the synthetic fiber market in India. The Production-Linked Incentive (PLI) Scheme for Textiles is a notable measure aimed at strengthening the man-made fiber (MMF) industry. This initiative specifically targets the expansion of the MMF and technical textiles segments within the textile value chain. Over five years, USD 1.34 billion in incentives will be allocated for the manufacturing of designated MMF fabrics and apparel, aiming to help the textile sector scale up and improve competitiveness.The increased availability of MMF and MMF yarns, such as polyester and nylon, is expected to contribute to overall growth in the textile industry utilizing blended fibers. By providing financial incentives, the scheme motivates companies to invest in expanding production capacities, which can lead to greater output of synthetic fibers and improved competitiveness against imports. The Prime Minister and the Cabinet Committee on Economic Affairs (CCEA) approved the establishment of a National Technical Textiles Mission with a budget of USD194 million for a four-year implementation period from FY 2020-24. The government is actively implementing policies to enhance the competitiveness of Indian textiles, including synthetic fibers, in international markets through trade agreements and participation in global trade fairs.

To further promote exports, the CCEA launched the Remission of Duties and Taxes on Exported Products (RoDTEP) scheme, which aims to make Indian exports more cost-competitive and generate better employment opportunities in export-oriented manufacturing sectors. Various incentives, including duty drawbacks and export promotion schemes, help ease the financial burden on exporters, facilitating their entry into global markets.

Initiatives such as the establishment of textile parks provide dedicated infrastructure, including utilities, logistics, and common processing facilities, to support textile manufacturers. The government has also proposed the Mega Investment Textiles Parks (MITRA) scheme to enhance global competitiveness, attract significant investments, and boost employment and exports.

The creation of Special Economic Zones (SEZs) for textiles encourages investment by offering benefits like tax exemptions and simplified regulatory compliance, attracting both domestic and foreign businesses. Additionally, the government runs skill development programs tailored for the textile industry, focusing on training workers in modern manufacturing techniques and sustainable practices.

Efforts are underway to streamline regulatory processes for setting up and operating textile businesses, reducing bureaucratic hurdles and accelerating the establishment of new manufacturing facilities. Specific initiatives are also designed to support Micro, Small, and Medium Enterprises (MSMEs) in the textile sector, providing access to financing, technology, and markets. These government initiatives not only foster growth and innovation in the synthetic fiber sector but also position India as a competitive player in the global textile market. Continued government support will be essential for maintaining this momentum as the industry evolves.

Key Market Challenges

Environmental concerns

Environmental concerns present significant challenges for the synthetic fiber market in India. The production of synthetic fibers, particularly those derived from petroleum, can emit harmful pollutants into the air and water, leading to environmental degradation and potential public health risks. Additionally, synthetic fibers are often linked to plastic pollution, contributing to the growing issue of microplastics that can adversely affect both marine and terrestrial ecosystems.Consumers are increasingly favoring sustainable and eco-friendly products, which pressures manufacturers to adopt more sustainable practices. This shift necessitates substantial investment in new technologies and processes. Moreover, governments and regulatory bodies are implementing stricter environmental regulations, resulting in higher compliance costs and the need for cleaner technologies.

The synthetic fiber industry’s heavy reliance on fossil fuels raises sustainability concerns, especially regarding climate change and the shift towards renewable energy sources. Furthermore, the production processes for synthetic fibers can be water-intensive, exacerbating water scarcity issues in already vulnerable regions.

Many synthetic fibers are non-biodegradable, leading to long-term environmental impacts when disposed of. The accumulation of these materials in landfills poses significant ecological challenges. While recycling initiatives exist for synthetic fibers, they are often complex and not widely adopted, limiting the potential for effective closed-loop systems that could reduce environmental impact.To address these challenges, manufacturers must make concerted efforts to embrace sustainable practices, invest in innovation, and adhere to regulatory standards. The industry needs to strike a balance between economic viability and environmental responsibility to ensure long-term growth and competitiveness in a market that increasingly values sustainability.

Import Pressure

Import pressure is a major challenge for the synthetic fiber market in India, affecting competitive dynamics and operational strategies. Countries with lower production costs, like China and Vietnam, can provide synthetic fibers at significantly lower prices. This situation leads to intense price competition, forcing Indian manufacturers to reduce their prices, which can adversely impact profit margins.Cheaper imports may weaken the competitive position of local producers, making it difficult for them to retain market share and invest in innovation. Furthermore, imported synthetic fibers are often perceived as higher quality, especially from well-known international brands, which can shift consumer preferences away from domestic products.

Reliance on imported materials also exposes the domestic industry to vulnerabilities in global supply chains, including trade disputes, natural disasters, and geopolitical tensions. Additionally, navigating complex import regulations, tariffs, and duties can create extra costs and administrative challenges for domestic manufacturers competing with imports.

An influx of imported synthetic fibers can lead to market saturation, decreasing overall demand and making it tougher for local manufacturers to sell their products. As competition from imports increases, domestic manufacturers may be reluctant to invest in growth or innovation, hindering the advancement of the local industry. Fluctuations in currency exchange rates can also influence the competitiveness of imported fibers, affecting the pricing strategies of local manufacturers. To address these challenges, domestic producers must focus on enhancing their competitive advantages through innovation, improving product quality, and implementing effective marketing strategies. Moreover, government support in the form of protective tariffs or incentives could strengthen the local industry against the challenges posed by imported goods.

Key Market Trends

Rising Demand for Sustainable Fabrics

The trend toward sustainable fabrics is becoming increasingly significant in the Indian synthetic fiber market, driven by various factors that influence consumer behavior, manufacturing practices, and industry strategies. As awareness of environmental issues rises, consumers are more mindful of the ecological impact of their purchases, leading many to seek sustainable options that reduce harm to the planet. Additionally, concerns about the potential health risks associated with synthetic fibers made from harmful chemicals are prompting a preference for eco-friendly alternatives.One notable development is the emergence of bio-based synthetic fibers, which are produced from renewable resources like plant materials and offer similar properties to traditional synthetics while being more environmentally friendly. For instance, in September 2023, Birla Cellulose introduced Birla Viscose EcoSoft, a new variant of viscose made exclusively from bamboo pulp. EcoSoft fibers represent an advancement over conventional viscose, providing improved moisture management, high breathability for thermal regulation, and lightweight, soft textures. The bamboo pulp used is sourced from sustainably managed (FSC-certified) forests, and the production processes comply with stringent quality and environmental standards. Furthermore, Birla Viscose EcoSoft incorporates a molecular tracer that enables manufacturers to track the supply chain journey through detailed transaction certificates.

To enhance transparency, companies are working to provide consumers with insights into the sourcing and production processes behind the fabrics they buy. There is also a growing trend of collaboration among brands, research institutions, and sustainability organizations to promote sustainable manufacturing practices. For example, in January 2023, Century Enka developed a new sustainable material for Apollo Tyres, utilizing 100% recycled nylon waste to produce nylon tire cord fabric (NTCF). This initiative was the result of over a year of collaboration between the two companies, with the first commercial supplies dispatched from Century Enka’s plant in Gujarat, India, in November 2022.

As sustainability becomes a central focus for both consumers and manufacturers, the industry must continue to adapt by developing eco-friendly products, improving transparency, and promoting responsible practices. This trend not only advances environmental objectives but also creates new opportunities for growth and competitiveness in the market.

Growth of Athleisure and Performance Wear

The growing popularity of athleisure and performance wear is a notable trend influencing the Indian synthetic fiber market. This evolution reflects shifts in consumer lifestyles and preferences, particularly a heightened focus on health and wellness that encourages more active living. Consequently, there is an increasing demand for clothing that seamlessly transitions from workout sessions to everyday activities. Athleisure combines comfort and style, making it suitable for a variety of occasions.Consumers are looking for versatile apparel that meets both their fitness needs and casual outings. Advances in synthetic fiber technology have resulted in fabrics with improved features like moisture-wicking, breathability, elasticity, and durability, specifically designed for active individuals. The rise of athleisure has also been fueled by endorsements from celebrities and influencers promoting fitness-oriented lifestyles, which has heightened consumer interest in stylish performance wear.

The trend towards casual fashion, accelerated by the pandemic, has solidified athleisure as a wardrobe staple, with consumers increasingly wearing athletic-inspired clothing in their daily lives. In January 2024, Lululemon announced its entry into the Indian market, aiming to align its products and experiences with the local wellness culture. This initiative goes beyond merely selling activewear; it seeks to integrate into India’s wellness landscape.

The youthful demographic in India is a key driver of the athleisure trend, as younger consumers place a high value on comfort and style. This group is particularly open to new styles and innovative products. As the demand for versatile, high-performance clothing continues to grow, manufacturers must innovate and adapt their offerings to meet these changing preferences. By harnessing advancements in fabric technology and focusing on sustainability, brands can take advantage of this dynamic trend and enhance their competitive position in the market.

Segmental Insights

Type Insights

Based on Type, the Polyester Staple Fiber (PSF) emerged as the dominating segment in the Indian market for Synthetic Fiber during the forecast period. Polyester Staple Fiber (PSF) is utilized across various industries, including apparel, home textiles, and industrial applications. Its versatility allows it to be used in clothing, upholstery, non-woven fabrics, and more. Additionally, the production of polyester is comparatively cost-effective relative to other synthetic fibers, enabling manufacturers to maintain competitive pricing and making it accessible to a wider consumer base.PSF is recognized for its strength and durability, which is essential for products that need to withstand heavy use. Its resistance to wear and tear is particularly crucial for textiles in high-traffic areas. Furthermore, polyester fibers excel in moisture-wicking, helping to keep users dry and comfortable, a feature that is especially attractive in the activewear and sportswear segments.

PSF fabrics typically resist shrinking, stretching, and wrinkling, which simplifies maintenance and appeals to consumers seeking low-maintenance clothing options. The growing trend of athleisure and performance wear has further fueled demand for PSF, as it meets the comfort and functionality required by active lifestyles.

India's robust polyester production infrastructure encompassing fiber manufacturing, spinning, and weaving further supports the growth of the PSF market. These combined factors establish Polyester Staple Fiber as the leading segment in the Indian synthetic fiber market, thanks to its versatility, cost-effectiveness, durability, and alignment with consumer preferences.

Application Insights

Based on Application, Apparel emerged as the fastest growing segment in the Indian market for Synthetic Fiber in 2024. The growing focus on health and fitness has resulted in a notable increase in demand for athleisure and activewear, which blend functionality with style. Synthetic fibers such as polyester and nylon are preferred for their moisture-wicking and stretchy characteristics, making them well-suited for workout clothing. Athleisure garments are designed for easy transitions between exercise and casual activities, appealing to consumers who seek both comfort and style in their daily attire.The fashion industry is experiencing rapid transformations, with consumers increasingly seeking trendy, lightweight, and breathable materials. Synthetic fibers can replicate the look and feel of natural fibers while delivering superior performance, making them highly sought after. Recent advancements in textile technology have led to the creation of innovative fabrics that offer additional benefits, such as improved durability, UV protection, and antimicrobial properties, enhancing their appeal in the fashion market.

As the Indian middle class continues to grow and disposable incomes rise, consumers are more inclined to invest in quality clothing. Since synthetic fibers are generally cheaper to produce than natural alternatives, manufacturers can offer competitive pricing. The expanding urban population is driving demand for a diverse range of clothing options, from casual to formal wear, further propelling growth in the apparel segment.

E-commerce platforms also play a crucial role in increasing consumer awareness about various fabric types and their advantages, fostering interest in synthetic materials. The pandemic has further accelerated the shift towards more casual and comfortable clothing, increasing the demand for synthetic fibers in everyday apparel. The younger demographic, which values comfort, versatility, and sustainability is a key contributor to the growth of the apparel segment. As the market evolves, the demand for innovative, sustainable, and versatile apparel made from synthetic fibers is expected to remain robust, reinforcing its status as the leading application in this sector.

Regional Insights

Based on Region, South India emerged as the dominant region in the Indian market for Synthetic Fiber in 2024. States such as Tamil Nadu and Karnataka are recognized as major textile hubs, boasting significant manufacturing capabilities for synthetic fibers and textiles. These regions benefit from a strong supply chain and a high concentration of spinning and weaving facilities. The South has a large urban population that drives demand for apparel, particularly in key cities like Chennai, Bengaluru, and Hyderabad, which in turn affects the consumption of synthetic fibers. Additionally, the Southern region serves as a center for various applications of synthetic fibers, including home textiles and industrial fabrics, further contributing to overall demand.Many textile manufacturers in the South are investing in advanced technologies and innovations, improving the quality and variety of synthetic fiber products. There is also an increasing emphasis on sustainable practices and eco-friendly production within the Southern textile sector, aligning with global trends and rising consumer preferences. Furthermore, the Southern states are strategically located for exports, benefiting from well-established logistics and transportation networks that facilitate trade. This combination of manufacturing prowess, urban demand, and technological progress positions the Southern region as the leading region in the Indian synthetic fiber market.

Key Market Players

- Reliance Industries Ltd.

- Indo Rama Synthetics India Ltd.

- Shubhalakshmi Polyesters Ltd.

- Bombay Dyeing Ltd.

- Garden Silk Mills Ltd

- Grasim Industries Ltd.

- Pasupati Acrylon Ltd.

- Sanathan Textile Pvt. Ltd.

- Bhilosa Industries Pvt. Ltd.

- Sumit Industries Ltd.

Report Scope:

In this report, the India Synthetic Fiber Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Synthetic Fiber Market, By Type:

- Polyester Staple Fiber

- Acrylic Staple Fiber

- Polypropylene Staple Fiber

- Polyester Filament Yarn

- Polypropylene Filament Yarn

- Viscose Staple Fiber

- Viscose Filament Yarn

- Nylon Filament Yarn

India Synthetic Fiber Market, By Application:

- Apparel

- Home Furnishing

- Industrial Textiles

- Healthcare

- Automotive

- Others

India Synthetic Fiber Market, By Region:

- West India

- North India

- South India

- East India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Synthetic Fiber Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Reliance Industries Ltd.

- Indo Rama Synthetics India Ltd.

- Shubhalakshmi Polyesters Ltd.

- Bombay Dyeing Ltd.

- Garden Silk Mills Ltd

- Grasim Industries Ltd.

- Pasupati Acrylon Ltd.

- Sanathan Textile Pvt. Ltd.

- Bhilosa Industries Pvt. Ltd.

- Sumit Industries Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | November 2024 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value in 2024 | 4.52 Million Metric Tonnes |

| Forecasted Market Value by 2030 | 6.21 Million Metric Tonnes |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |