Feed additives are the type of extra nutrients and medicated drugs, like vitamins, calcium, and other microorganisms, which are prepared for the livestock to supply them with a nutrient-filled diet. These products are also mixed in the animal feed to increase its nutritional value. Animal feed is generally of various categories, like feed manufacturing, performance-enhancing, nutritional feeds, and feed additives. Feed manufacturing additives are the type of additives, that are used during the manufacturing of animal feeds. These additives indirectly influence the nutritional value of the feed by improving its hygienic and handling components. The feed manufacturing additives include components like antifungal agents, antioxidants, and pellet binders.

The feed additives result in multiple benefits to the livestock owners, like increased feed utilization, along with improving the quality of the livestock products. These additives also improve the feed processing by the livestock. They contain various classes of molecules and compounds that increase the productivity of the livestock naturally. The feed additives promote ingestion in the livestock and faster absorption of nutrients in the animal body.

One of the major drivers for the animal additive market growth is the increase in the global demand for animal products and meats. The use of animal feed additives like vitamins and nutrients helps the owner of the livestock to achieve more production naturally, with improvement in quality. The global animal products demand increased from about US$421 billion in 2021 to about US$455 billion in 2022, according to the Observatory of Economic Complexity (OEC). Similarly, the global trade of dairy and its products has also grown in the recent few years. According to the data published by InvestIndia, India in 2022-23 exported a total of 67572.99 MT of dairy products, which were valued at about US$284.65 million.

FEED ADDITIVES MARKET DRIVERS:

Increasing the global animal products and meat trade.

One of the major drivers for the growth of the animal feed market in the globe can be the increase in the global trade in animal products and meats. The global trade of animal meat and its products like dairy, cheese, eggs, and others is increasing significantly, giving the need for a boost in production by the use of additives, like vitamins and antioxidants. According to the Observatory of Economic Complexity, the global trade of beef, frozen and boneless, reached about US$ 35.3 billion in 2022, which observed a significant increase from US$ 28.6 billion in 2021.Similarly, the dairy trade has also increased in recent years, mainly because of the increase in the global vegetarian population. According to the same data, the global milk trade reached US$11.5 billion in 2022, up from US$10.4 billion in 2021. The increase in global milk demand significantly boosted the demand for feed addictive, as it offers a natural and non-preservative increase in the production capability of the cattle.

Another major driver for the increase in the global animal additive market is the increase in the livestock and cattle population. According to the Central Statistics Office of Ireland, the nation's cattle population increased by about 37,300 from 2021 to about 7,396,200 in 2023.

The global increase in the trade of fish and aquaculture is expected to propel the feed additive market.

Feed additives are important components for aquatic or fish production. They help to improve the growth of marine life, along with improving their immunity against allergies and diseases. Some feed additives, such as probiotics, prebiotics, microalgae, and enzymes, are given to aquatic animals, like fish, shrimp, shellfish, etc., to increase their productivity.The increase in the global aquatic product is expected to increase the global demand for feed additives. According to the report published by the Indian Trade Portal, India's aquaculture exports increased by about 17%. In 2021-2022, the nation's marine exports accounted for about US$7.76 billion and about 1.36 million MT in volume. InvestIndia further stated that in 2021-22, the nation exported about 13.13 million MT of inland fisheries in 2022-23 and about 4.13 million MT of marine fisheries in 2021-22.

FEED ADDITIVES MARKET RESTRAINTS:

Increasing the global ban on additives may restrict the global feed additives growth.

One of the major risks associated with the feed additive sector is the increasing global ban on various types of additives, like antibiotics. Countries like the USA and some nations of the EU have imposed various types of bans and restrictions on the use of various types of feed additives. For instance, in March 2022, the European Food Safety Authority (EFSA) proposed a precautionary ban on the use of ethoxyquin in animal feed compounds.FEED ADDITIVES MARKET GEOGRAPHICAL OUTLOOK

North America is anticipated to hold a significant share of the feed additive market.

The North American market is anticipated to hold a major share of the global feed additive market, as the region offers a huge animal husbandry landscape globally. Countries like the US, Canada, and Mexico are also among the biggest consumers of animal meat and other products like cheese, poultry, eggs, and dairy. The increase in the animal husbandry industry in the region is sure to push the regional market for animal feed additives.The North American region is one of the biggest among the biggest exporters of animal feed nutrients to the world, supplying various types of nutrients, that help in increasing the productivity of cattle and other livestock. The USA is among the top suppliers of animal food in the global market, giving a boost to animal additives in the region.

Feed Additives Market Major Players and Products:

- BASF: BASF is a global leader in the manufacturing of animal feed and its additives. The company offers various types of feed additives, such as carotenoids, enzymes, glycinates, and monoglycerides.

- Cargill: Cargill is one of the global animal feed nutrient suppliers, which offers products for various species, like aquaculture, beef, dairy, equine, poultry, and pets. Their products include DVAWQUA, Syrena Boost, Notox, and TruEquine.

Feed Additives Market Key Developments:

- In October 2023, the European Commission stated that the use of nanotech solutions could boost cattle nutrition and increase food production. The NanoFEED project applied nanotechnology solutions to improve the functionality and the nutritional value of the feed.

The Feed Additives Market is segmented and analyzed as follows:

By Product Type

- Antibiotic

- Tetracycline

- Penicillin

- Enzyme

- Carbohydrates

- Phytases

- Others

- Vitamins

- Vitamin A

- Vitamin E

- Vitamin B

- Vitamin C

- Vitamin D

- Others

- Amino Acid

- DL-Methionine

- L-Lysine HCI

- L-Threonine

- L-Tryptophan

- Antioxidant

- Ethoxyquin

- BHA

- BHT

- Acidifiers

- Inorganic

- Organic

- Compound

- Minerals

- Micro

- Macro

- Others

By Livestock

- Aquatic

- Poultry

- Swine

- Cattle

- Others

By Form

- Dry

- Liquid

By Source

- Synthetic

- Natural

By Geography

North America

- By Product Type

- By Livestock

- By Form

- By Source

- By Country

- United States

- Canada

- Mexico

- South America

- By Product Type

- By Livestock

- By Form

- By Source

- By Country

- Brazil

- Argentina

- Others

- Europe

- By Product Type

- By Livestock

- By Form

- By Source

- By Country

- UK

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- By Product Type

- By Livestock

- By Form

- By Source

- By Country

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- By Product Type

- By Livestock

- By Form

- By Source

- By Country

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

Table of Contents

Companies Mentioned

- Cargill Incorporated

- BASF SE

- Novozymes

- Nutreco

- Chr. Hansen Holding A/S

- Evonik Industries

- Archer Daniels Midland Company

- Alltech Inc

- Elanco Animal Health

- DSM

- Adisseo

Table Information

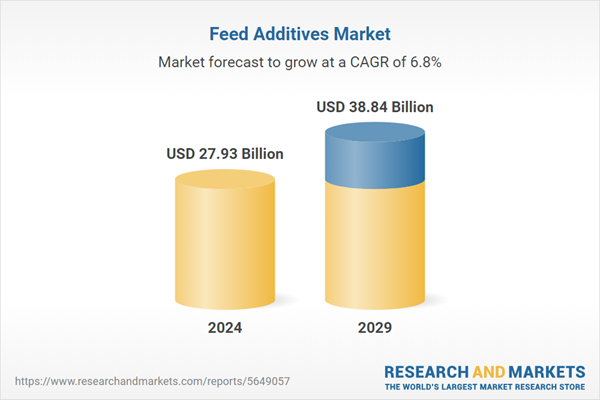

| Report Attribute | Details |

|---|---|

| No. of Pages | 225 |

| Published | June 2024 |

| Forecast Period | 2024 - 2029 |

| Estimated Market Value ( USD | $ 27.93 Billion |

| Forecasted Market Value ( USD | $ 38.84 Billion |

| Compound Annual Growth Rate | 6.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |