Heating, ventilation, and air conditioning (HVAC) system involves multiple technology usage for monitoring and controlling air humidity, purity, and temperature in an enclosed environment. The system functions to provide acceptable indoor air quality and optimal thermal comfort. HVAC equipment works on the principles of sub-disciplines of mechanical engineering based on principles of heat transfer, fluid mechanics, and thermodynamics. These systems address the need of constant monitoring and regulating the air conditioning and heating systems.

HVAC controls comprise a set of systems that differ based on their utility areas and functionality such as a large-scale production facility or a typical residential application. The demand for such devices is expected to show positive growth fuelled by booming remote technology usage, investment in smart homes, and IIoTS.

The global HVAC control market has segmented the type of system, component, end-user industry, and geography. Based on end-user the market is analyzed into, residential, commercial, and industrial segments.

Market Drivers

The rapid adoption of Industry 4.0 and automation is expected to propel the market growth.

The emergence of Industry 4.0 and the growing trend of automation are adding impetus to the growth of the HVAC control market. HVACs improve energy efficiency while avoiding waste consumption, provide enhanced output, and have a longer life span. Thus, HVACs are extensively being adopted in residential, industrial, commercial, and other areas. The industrial segments, for instance, the mechanical systems and machinery, are complex, owing to the large size of facilities. Thus, there is a need for the operational processes to be streamlined effectively, without wastage of energy. Consolidating various systems, including lighting, security, and fire alarm systems into a single platform proves highly advantageous when enveloping a smart building.Favorable government initiatives are propelling the HVAC controls market growth.

Initiatives undertaken by the government regarding smart energy usage while lowering its environmental impact followed by the growing demand to conserve energy efficiency are constituting major two factors attributing to the growth. Such policies aim to provide sustainable thermal and cooling comfort for society while securing socio-economic and environmental benefits.By 2038, the ICAP (India’s Cooling Action Plan) aims to reduce cooling demand across multiple sectors by 20-25 percent. The plan also outlines research and advancements in the energy efficiency of HVAC systems and retrofitting inefficient and old HVAC systems with new and efficient ones. Through such initiatives the Indian government aims to integrate energy conservation with zero carbon footprint.

Other related programs such as “New York’s Energy Efficiency Program” focus on supporting the city’s energy goals and aim to finance over $1.5 billion for the same across New York till 2025. The program involved investments of up to $300 million annually. Heat pump replacements, updated controls, heat pumps, and HVAC upgrades to reduce the consumption of natural resources are a few of the solutions for energy efficiency measures.

Market Challenges

Price volatility and high will restrain the market growth.

Though HVAC system provides benefits in terms of temperature and humidity control, however, technology awareness is still lacking in certain end-users. Moreover, raw material price fluctuations and the complexity associated with the HVAC system upgrade which requires an extensive study of the present devices, designing of the new systems, and implementation that consumes both time and money are further expected to pose a challenge for the market growth.Asia Pacific will constitute a significant share.

Asia Pacific is projected to hold a considerable share of the global HVAC market fuelled by the rapid industrialization and investments in smart cities and homes by the major APAC economies such as India, China, Japan, and South Korea which is anticipated to propel the market demand for HVAC control for adjusting heating, and cooling temperature withing such establishments. For instance, in December 2023, the Indian Prime Minister laid the foundation stone for projects worth INR3,600 crores in Shivamogga smart city. Furthermore, as per the August 2023 PIB (Press Information Bureau) release, work orders for 7,978 projects in 100 smart cities had been issued from which 5,909 projects have been completed. A total investment of INR73,454 crores has been made in the 100 smart cities projects of which INR66,023 crores has been utilized.Key Developments

- In September 2023: Daikin launched “Daikin Cloud Plus” which enabled facility managers, building owners, and staff to manage, control, and service HVAC controls remotely thereby ensuring the comfort of occupants and also optimizing the building’s environmental performance.

- In September 2023: Johnson Controls-Hitachi Air Conditioning launched the “Hitachi air365 Hybrid” dual fuel system that by combining furnace and heat pumps provides efficient & economical home comfort. The Hybrid system features Hitachi’s “Mini VRF heat pump” as the primary cooling & heating source.

- In March 2023: LG Electronics launched its HVAC solutions at the International Trade Fair for Sanitation, Heating, and Air (ISH) 2023. The company’s “Commercial Solution Booth” featured its “Multi V™ I Variable Refrigerant Flow System” whereas, the Residential Solution Booth consisted of Air Source Heat Pumps (ASHP) which employed advanced ERV (Energy Recovery Ventilation) system, and (low-global Warming Potential (GWP) refrigerants.

Segmentation:

By System

- Humidity Control

- Temperature Control

- Ventilation Control

- Integrated Control

By Component

- Sensors

- Heating and Cooling Coils

- Controllers

- Others

By End-User

- Residential

- Industrial

- Commercial

- Others

By Geography

- Americas

- USA

- Canada

- Mexico

- Others

- Europe, Middle East and Africa

- UK

- Germany

- France

- Saudi Arabia

- UAE

- Others

- Asia-Pacific

- China

- India

- Japan

- Others

Table of Contents

Companies Mentioned

- Honeywell International, Inc.

- Emerson Electric

- Siemens AG

- Delta Electronics

- Johnson Controls

- Mitsubishi Electric

- Ingersoll Rand

- Schneider Electric

- Azbil

- Lennox International

- LG Electronics

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 125 |

| Published | May 2024 |

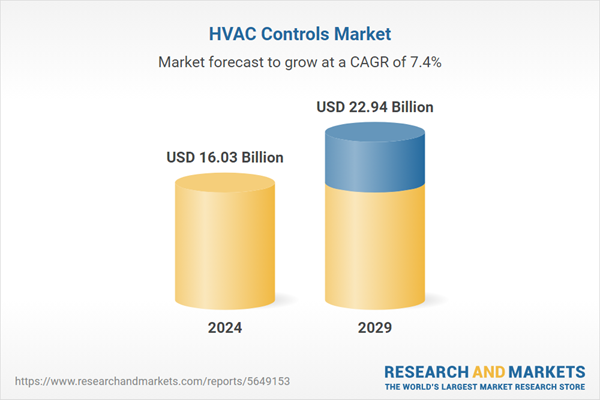

| Forecast Period | 2024 - 2029 |

| Estimated Market Value ( USD | $ 16.03 Billion |

| Forecasted Market Value ( USD | $ 22.94 Billion |

| Compound Annual Growth Rate | 7.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |