Electricity poles, also known as power poles, are essential structures that support the wires and cables used to transmit electricity from power companies to consumers. These poles are typically made from materials such as wood, steel, and composites, with the choice of material influenced by the intended application and desired lifespan. They play a crucial role in supporting various electrical lines, including distribution and sub-transmission lines. The global market for electricity transmission poles is experiencing growth due to several factors. An increase in the number of factories across different industries contributes to this expansion, as does the rapid urban infrastructure development in emerging economies, which drives the demand for electricity transmission poles for both residential and commercial buildings. Furthermore, the rising need for reliable and efficient electricity transmission systems is fueled by increasing energy consumption, particularly in rapidly urbanizing and industrializing regions. The transition towards renewable energy sources like wind and solar is also creating a demand for advanced transmission poles capable of handling high voltages over long distances.

Key Drivers of the Electricity Transmission Poles Market

- Technological Advancements and Government Investments: Ongoing technological innovations and government funding aimed at modernizing electrical grids are significant drivers of market growth. Smart grid initiatives enhance energy efficiency and reduce transmission losses, leading to a higher demand for durable, lightweight transmission poles made from composite materials. To align with Net Zero Emissions by 2050 goals, investments in smart grids will need to more than double by 2030, especially in emerging markets.

- Infrastructure Replacement and Rural Electrification: The need to replace aging infrastructure in developed countries and expand rural electrification projects in underdeveloped regions further supports the growth of the electricity transmission poles market.

Geographical Outlook

The global electricity transmission poles market is divided into five regions: North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.- North America: This region is expected to hold a significant share of the market by 2030. High electricity consumption in countries like the United States and Canada is driving market expansion. Major investments are being made in new electricity distribution and transmission infrastructure to address aging systems that require refurbishment. The U.S. electric power sector is under pressure to expand and upgrade its infrastructure due to increasing loads and outdated equipment.

Reasons for buying this report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape up future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decision to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive Intelligence.Report Coverage:

- Historical data & forecasts from 2022 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, Customer Behaviour, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others)

The electricity transmission poles market has been segmented as following:

- By Material

- Wood

- Cement

- Steel

- By Area

- Rural

- Urban

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

- North America

Table of Contents

Companies Mentioned

- Koppers Inc.

- KEC International Ltd.

- Skipper Limited

- Europoles GmbH & Co. KG

- Nippon Concrete Industries Co., Ltd.

- Weatherspoon & Williams LLC

- Valmont Industries, Inc.

- Nello Corporation

- Nova Pole International Inc.

- Finntrepo Ltd

- PPL Corporation

- OTDS UK Ltd.

- Eiforsa

Table Information

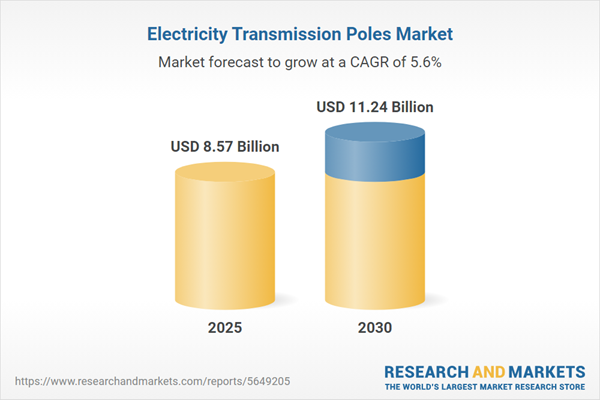

| Report Attribute | Details |

|---|---|

| No. of Pages | 144 |

| Published | January 2025 |

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 8.57 Billion |

| Forecasted Market Value ( USD | $ 11.24 Billion |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |