Moreover, the Canadian Organization for Rare Disorders (CORD) offers a strong platform to streamline health policy and a healthcare system that is dedicated to the management of patients with disorders. The agency works with clinicians, researchers, governments, and the diagnostic industry to advance R&D, diagnosis, treatment, and service availability for all rare conditions in the country. As per the National Institutes of Health (NIH), around 30 million Americans have been identified with one of 7,000+ known rare diseases. The number of patients undergoing disease testing is expected to increase in the coming years with growing awareness. The U.S. celebrates Rare Disease Day and promotes developments in this area by raising awareness.

In addition, the presence of the Rare Diseases Clinical Research Network (RDCRN), an NIH-funded research network of 23 active consortia or research groups that includes patients, researchers, and clinicians who are focused on the diagnosis & treatment of disorders is anticipated to positively impact the industry. Amidst the COVID-19 pandemic, patients with undiagnosed and rare diseases have been facing significant health challenges. According to a study published in January 2021 by a group of researchers from the U.S., there is an urgent need for the development of approaches that can reduce the serious challenges affecting Rare & Undiagnosed diseases (RUD) patients and families. The challenges include diagnostic and/or prognostic uncertainty coupled with medical complexity leading to poor health outcomes.

In response to the challenges created by the pandemic, patient support groups and professional societies are actively involved in addressing these challenges. For instance, the Rare Chromosome Support Group (Unique), the British Society for Genomic Medicine, and Genetic Alliance U.K. are actively involved in supporting, advocating, and providing information to patients with diseases. Several rare conditions remain unclassified. The charity SWAN U.K. estimated that around 6,000 children are born each year with genetic conditions in the U.K. As per the agency, the conditions are extremely rare and cannot be named. Thus, there is a lack of proper diagnosis and prognosis for evidence-based treatment. At present, around 50% of the children who undergo genetic testing in the U.K. would not receive a confirmed diagnosis.

Around 50% of the children with learning disabilities and approximately 60% of children with congenital conditions do not receive a definitive diagnosis to identify the cause of their disabilities. Furthermore, the lack of awareness among patients and families about diagnosis and genetic testing has further impeded the industry's growth. North America dominated the industry in 2021 due to the high incidence of rare diseases, a large number of registries, the presence of substantial numbers of R&D facilities in this area, and extensive investments in diagnosis. Asia Pacific is expected to register the fastest CAGR during the forecast years owing to the presence of a substantial number of organizations that are focusing on disease management.

Rare Disease Genetic Testing Market Report Highlights

- The immunological disorders segment held the largest share of 12.56% in 2024 and is expected to continue the trend during the forecast period.

- The Next Generation Sequencing segment held the largest share of 35.50% in 2024. The wide availability and adoption of NGS-based gene panels for cancer, neurological diseases, cardiovascular diseases, pediatric conditions, psychiatric disorders, and other rare diseases have significantly driven the segment.

- Based on specialty, the molecular genetic tests segment accounted for the largest revenue share of 41.12% in 2024 and expected to maintain its dominant position with fastest CAGR during the forecast period.

- On the basis of end-use, the diagnostic laboratories segment is expected to register the fastest CAGR of 17.36% over the study period, driven by rising number of partnership and collaboration activities of diagnostic laboratories with genetic testing companies.

Why should you buy this report?

- Comprehensive Market Analysis: Gain detailed insights into the global market across major regions and segments.

- Competitive Landscape: Explore the market presence of key players worldwide.

- Future Trends: Discover the pivotal trends and drivers shaping the future of the global market.

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions.

This Report Addresses:

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segment and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listing for you to stay ahead of the curve

- COVID-19's impact and how to sustain in these fast-evolving markets

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned

- Quest Diagnostics Inc.

- Centogene N.V.

- Invitae Corp.

- 3billion, Inc.

- Arup Laboratories

- Eurofins Scientific

- Strand Life Sciences

- Ambry Genetics

- Perkin Elmer, Inc.

- Realm IDX, Inc.

- Macrogen, Inc.

- Baylor Genetics

- Color Genomics, Inc.

- Health Network Laboratories

- PreventionGenetics

- Progenity, Inc.

- Coopersurgical, Inc.

- Fulgent Genetics Inc.

- Myriad Genetics, Inc.

- Laboratory Corporation of America Holdings

- Opko Health, Inc.

- Artemis DNA

Table Information

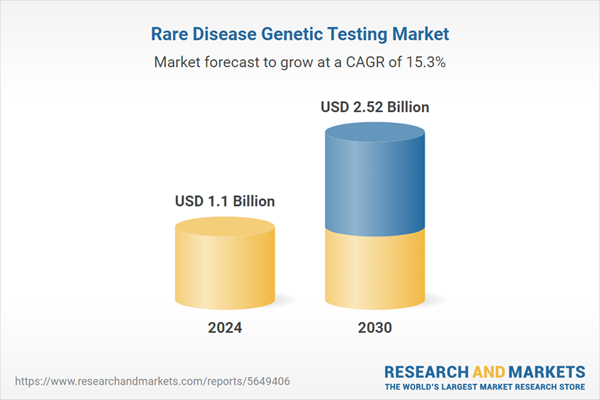

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | March 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.1 Billion |

| Forecasted Market Value ( USD | $ 2.52 Billion |

| Compound Annual Growth Rate | 15.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 22 |