Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Technological advancements in diagnostic techniques and equipment, coupled with investments in healthcare infrastructure, are enhancing service capabilities across the country. Government initiatives aimed at improving healthcare access and quality also play a crucial role. The growing emphasis on early disease detection and personalized medicine is boosting the demand for advanced diagnostic tests. These factors collectively contribute to the dynamic growth of the diagnostic labs market in Indonesia, catering to the evolving healthcare needs of its population.

Key Market Drivers

Healthcare Awareness and Chronic Diseases

Increasing awareness of healthcare and the rising incidence of chronic diseases are pivotal drivers shaping the demand for diagnostic services in Indonesia. As societal awareness of health issues grows, driven by improved access to healthcare information through media, internet, and community health initiatives, Indonesians are becoming more proactive about managing their health. This heightened awareness prompts individuals to seek regular health check-ups and diagnostic tests to detect diseases early, even before symptoms appear.The escalating prevalence of chronic diseases like cardiovascular disorders, diabetes, and cancer necessitates frequent monitoring and early diagnosis for effective management and treatment. Chronic diseases are increasingly recognized as major contributors to morbidity and mortality in Indonesia, underscoring the importance of timely and accurate diagnostic services in disease management strategies. The emphasis on early detection and disease prevention is crucial in reducing healthcare costs and improving health outcomes. Diagnostic labs play a vital role in this landscape by offering a range of tests including blood tests, imaging scans, genetic screenings, and specialized diagnostics tailored to detect and monitor chronic conditions. This proactive approach not only enhances individual health but also alleviates the burden on healthcare systems by preventing complications and reducing hospitalizations.

Key Market Drivers

Infrastructure and Equipment Limitations

Many diagnostic laboratories across Indonesia encounter significant challenges stemming from outdated infrastructure and insufficient equipment, which impede their ability to effectively conduct advanced diagnostic tests and deliver timely results. The issue is particularly acute in rural and underserved areas, where healthcare facilities often struggle with limited resources and access to modern technologies.The primary obstacle faced by these labs is the outdated infrastructure, which may lack adequate space, proper ventilation, and suitable conditions for conducting sensitive diagnostic procedures. Outmoded facilities can hinder workflow efficiency, compromise the accuracy of test results, and increase the risk of contamination or errors. Older infrastructure may not meet current regulatory standards or accommodate the technological requirements necessary for modern diagnostic techniques. In addition to infrastructure limitations, many diagnostic labs in Indonesia grapple with inadequate equipment. Essential diagnostic tools such as analyzers, imaging machines, and laboratory instruments may be outdated, unreliable, or simply unavailable. Without access to state-of-the-art equipment, labs are constrained in their ability to offer a comprehensive range of diagnostic services and meet the growing demand for specialized tests.

Key Market Trends

Private Sector Investments

Increased investments from the private sector in diagnostic labs are playing a pivotal role in driving market growth across Indonesia. As private healthcare providers recognize the expanding demand for diagnostic services, they are actively expanding their capabilities and enhancing their offerings to meet the needs of both patients and healthcare professionals.Private sector investments in diagnostic labs encompass a variety of initiatives aimed at improving infrastructure, acquiring state-of-the-art equipment, and deploying advanced technologies. These investments enable private labs to offer a comprehensive range of diagnostic tests, including but not limited to blood tests, imaging studies (such as MRI and CT scans), genetic testing, and specialized pathology services. By leveraging cutting-edge technologies and methodologies, private labs can provide more accurate diagnoses, faster turnaround times, and personalized healthcare solutions tailored to individual patient needs.

Key Market Players

- Laboratorium Klinik CITO Indraprasta Semarang (CITO)

- Bio Medika Kelapa Gading

- PT Prodia Diacro Laboratories (Prodia the CRO)

- PT Kimia Farma Diagnostika

- Laboratorium Parahita Diagnostic Center

- PT Indec Diagnostics

- Ultra Medica Clinic Surabaya

- PT Prima Medika Laboratories

- ABC Central Clinical Laboratory

Report Scope:

In this report, the Indonesia Diagnostic Labs Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Indonesia Diagnostic Labs Market, By Provider Type:

- Hospital Based Diagnostic Labs

- Diagnostic Chains

- Stand Alone Diagnostic Labs

Indonesia Diagnostic Labs Market, By Test Type:

- Pathology

- Radiology

Indonesia Diagnostic Labs Market, By End User:

- Walk-ins

- Referrals

- Corporate Clients

Indonesia Diagnostic Labs Market, By Region:

- Bali

- Java

- Kalimantan

- Sumatra

- Sulawesi

- Indonesian Papua

- Nusa Tenggara

- Moluccas

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Indonesia Diagnostic Labs Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Laboratorium Klinik CITO Indraprasta Semarang (CITO)

- Bio Medika Kelapa Gading

- PT Prodia Diacro Laboratories (Prodia the CRO)

- PT Kimia Farma Diagnostika

- Laboratorium Parahita Diagnostic Center

- PT Indec Diagnostics

- Ultra Medica Clinic Surabaya

- PT Prima Medika Laboratories

- ABC Central Clinical Laboratory

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 80 |

| Published | September 2025 |

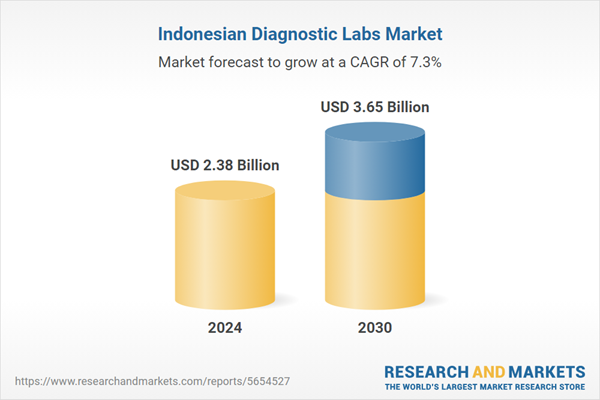

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.38 Billion |

| Forecasted Market Value ( USD | $ 3.65 Billion |

| Compound Annual Growth Rate | 7.2% |

| Regions Covered | Indonesia |

| No. of Companies Mentioned | 9 |