Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Government Policy and Incentives

Policy initiatives and financial incentives are a key catalyst for EV market expansion in India. The Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme plays a pivotal role by subsidizing EV acquisition and fostering domestic manufacturing. Incentives including tax reductions, registration fee waivers, and lower GST rates have made EVs more accessible. States are also contributing with capital subsidies, interest-free loans for infrastructure, and exemptions on road tax.These policy frameworks aim to drive electric mobility adoption across both personal and public transport segments. Long-term national roadmaps and regulatory clarity have encouraged automakers to invest in R&D and local production. For example, under FAME-II, USD 100 million was allocated to charging station development, while USD 250 million was committed under PM E-DRIVE for expanding public EV charging infrastructure. Initiatives like PLI ACC and the Capital Goods Scheme further support this transition with up to 80% government funding for EV technology projects in institutions such as IITs and IISc.

Key Market Challenges

Inadequate Charging Infrastructure

One of the most significant obstacles hindering EV adoption in India is the limited availability of widespread and dependable charging infrastructure. Urban areas often lack sufficient public charging stations, and many residents do not have access to private parking where home chargers can be installed. This impacts user confidence and convenience, particularly in high-density urban settings and underdeveloped rural regions. Moreover, the scarcity of fast-charging options poses challenges for long-distance EV travel. The lack of standardized connectors and charging protocols further complicates usability across different EV brands. These issues are particularly problematic in commercial transport, where operational efficiency is critical and downtime due to slow or incompatible charging systems is not acceptable.Key Market Trends

Rise of Shared Electric Mobility

Shared electric mobility is emerging as a key trend in India’s evolving transportation ecosystem. Companies in ride-hailing, vehicle rentals, and last-mile delivery are increasingly deploying electric vehicles due to their low operating costs and suitability for short, frequent trips. Electric two-wheelers and three-wheelers are becoming integral to logistics and mobility services, particularly in urban areas.The adoption of connected technologies allows operators to monitor fleet performance, optimize routes, and ensure timely maintenance - enhancing reliability and efficiency. This trend aligns with shifting consumer preferences toward sustainable, cost-effective, and convenient transport solutions. The rise of e-commerce and express delivery services is further driving demand for electric last-mile solutions. Shared EV models also reduce the cost burden of ownership, making them more accessible. For instance, BluSmart, India’s all-electric cab service, operates the country’s largest EV ride-hailing fleet with over 8,000 vehicles across major cities like Delhi, Mumbai, and Bengaluru, underscoring the growing traction of shared electric mobility in urban markets.

Key Market Players

- Tata Motors Limited

- MG Motor India Private Limited

- Mahindra & Mahindra Limited

- PMI Electro Mobility Solutions Private Limited

- JBM Auto Ltd

- Hero Electric Vehicles Pvt. Ltd

- Okinawa Autotech Pvt. Ltd

- Greaves Electric Mobility Private Limited

- YC Electric Vehicle

- Saera Electric Auto Pvt. Ltd

Report Scope:

In this report, the India Electric Vehicle Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Electric Vehicle Market, By Range:

- 0-100 Km

- 101-200 Km

- Above 200 Km

India Electric Vehicle Market, By Propulsion:

- BEV

- HEV

- PHEV

- FCEV

India Electric Vehicle Market, By Vehicle Type:

- Passenger Car

- Commercial Vehicle

- Two-Wheeler

India Electric Vehicle Market, By Region:

- North

- South

- East

- West

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Electric Vehicle Market.Available Customizations:

With the given market data, the publisher offers customizations according to the company’s specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Tata Motors Limited

- MG Motor India Private Limited

- Mahindra & Mahindra Limited

- PMI Electro Mobility Solutions Private Limited

- JBM Auto Ltd

- Hero Electric Vehicles Pvt. Ltd

- Okinawa Autotech Pvt. Ltd

- Greaves Electric Mobility Private Limited

- YC Electric Vehicle

- Saera Electric Auto Pvt. Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | July 2025 |

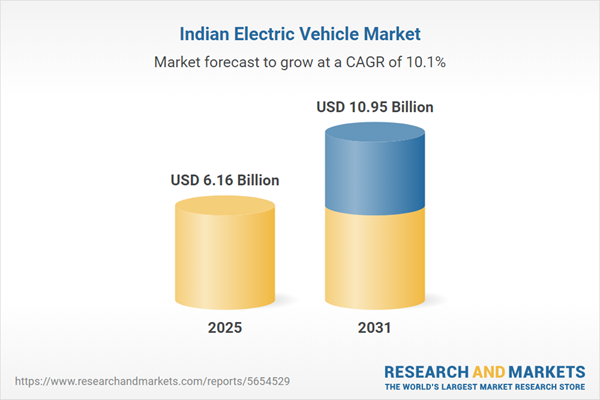

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 6.16 Billion |

| Forecasted Market Value ( USD | $ 10.95 Billion |

| Compound Annual Growth Rate | 10.0% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |