Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Indonesia's air conditioner market is primarily divided into two segments: residential and commercial. The residential sector dominates the market due to the growing middle-class population and the construction of modern housing complexes. Demand for energy-efficient and eco-friendly units has also been on the rise. Government initiatives promoting energy efficiency and sustainability are influencing consumer choices. Indonesia's air conditioning market is poised for further growth, driven by urban expansion, increasing consumer awareness, and technological advancements, making it a promising sector for investors and manufacturers alike.

Key Market Drivers

Tropical Climate and Rising Temperatures

Indonesia's tropical climate, characterized by high temperatures and humidity levels, is a key driver for the growing demand for air conditioners (ACs). Over the years, the region has seen rising temperatures, which have led to a higher reliance on cooling systems for comfort and health. Climate change has further exacerbated this trend, making hot spells more frequent and prolonged. As average temperatures rise, both consumers and businesses increasingly prioritize air conditioning to maintain comfortable living and working conditions.The growing awareness of the health risks associated with extreme heat, such as heat exhaustion and heatstroke, also drives the adoption of air conditioners. In homes, particularly in densely populated urban areas like Jakarta, where the heat can be unbearable, AC units are seen as essential. Likewise, commercial spaces like offices, malls, and restaurants require air conditioning systems to ensure a comfortable environment for both employees and customers. As more areas experience extreme heat, the demand for air conditioners will likely continue to rise.

Key Market Challenges

Economic Uncertainty and Price Sensitivity

One of the foremost challenges in the Indonesian air conditioner market is the economic uncertainty that the country faces. The nation's economy can be volatile, influenced by factors like currency fluctuations and changes in government policies. As a result, consumers often exhibit a high degree of price sensitivity when purchasing air conditioners. Many potential buyers opt for lower-priced models rather than premium, energy-efficient units due to budget constraints. This price sensitivity can hinder the adoption of energy-efficient and environmentally friendly air conditioning technologies, which are often more expensive upfront. Manufacturers must find ways to balance affordability with sustainability to address this challenge effectively.Key Market Trends

Shift Towards Energy-Efficient and Eco-Friendly Air Conditioners

One of the major trends in the Indonesia air conditioners market is the growing demand for energy-efficient and environmentally friendly cooling solutions. As the country faces rising electricity costs and concerns over environmental sustainability, consumers are increasingly opting for air conditioners that consume less power while providing optimal cooling. This shift is in line with global efforts to reduce carbon footprints and address climate change. Manufacturers are responding to this demand by designing air conditioners with advanced technologies, such as inverter systems, which adjust compressor speed to maintain the desired temperature more efficiently.These systems use less electricity than traditional air conditioning units, making them an attractive option for cost-conscious consumers. Additionally, many modern air conditioners are equipped with eco-friendly refrigerants, such as R-32, which have a lower environmental impact compared to older refrigerants like R-22, known for contributing to ozone depletion and global warming.

The Indonesian government has also been promoting energy efficiency and sustainability through regulations and incentives. As part of Indonesia’s commitment to reducing greenhouse gas emissions, there are initiatives encouraging the adoption of energy-efficient appliances. This has further boosted the market for energy-efficient air conditioners, as consumers are increasingly aware of their environmental impact and long-term cost savings. With the rising awareness of climate change, eco-friendly air conditioning units are expected to continue gaining traction in the coming years.

Key Market Players

- PT. Daikin Airconditioning Indonesia

- PT. Panasonic Gobel Indonesia

- PT. Gree Electric Appliances Indonesia

- PT Mitsubishi Electric Indonesia

- PT. LG Electronics Indonesia

- PT Samsung Electronics Indonesia

- PT. Sharp Electronics Indonesia

- PT. Berca Carrier Indonesia

- PT Johnson Controls Hitachi Air Conditioning Indonesia

- PT. Trane Indonesia

Report Scope:

In this report, the Indonesia Air Conditioners Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Indonesia Air Conditioners Market, By Product Type:

- Split

- VRF

- Window

- Chiller

- Others (Cassette, Ductable Split, etc.)

Indonesia Air Conditioners Market, By End Use Sector:

- Commercial/Industrial

- Residential

Indonesia Air Conditioners Market, By Region:

- Java

- Jakarta

- Sumatra

- Kalimantan

- Bali

- Rest of Indonesia

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Indonesia Air Conditioners Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- PT. Daikin Airconditioning Indonesia

- PT. Panasonic Gobel Indonesia

- PT. Gree Electric Appliances Indonesia

- PT Mitsubishi Electric Indonesia

- PT. LG Electronics Indonesia

- PT Samsung Electronics Indonesia

- PT. Sharp Electronics Indonesia

- PT. Berca Carrier Indonesia

- PT Johnson Controls Hitachi Air Conditioning Indonesia

- PT. Trane Indonesia

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | February 2025 |

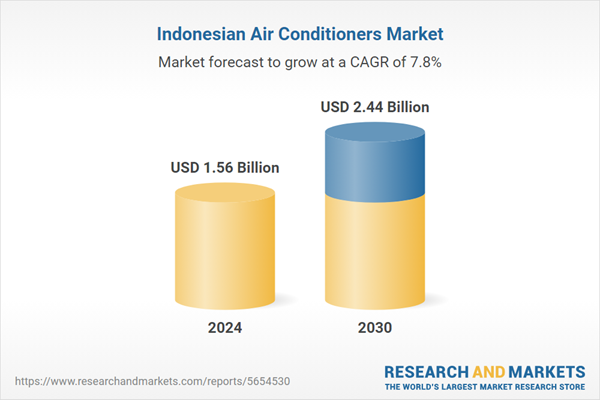

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.56 Billion |

| Forecasted Market Value ( USD | $ 2.44 Billion |

| Compound Annual Growth Rate | 7.8% |

| Regions Covered | Indonesia |

| No. of Companies Mentioned | 10 |