Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The Commercial Interior Fit Out market refers to the industry involved in designing and outfitting interior spaces of commercial buildings to meet the specific needs and aesthetic preferences of businesses. This market encompasses a wide range of services and products, including space planning, interior design, furniture procurement, installation, and the integration of technical systems such as lighting, HVAC, and IT infrastructure. Companies operating in this market work closely with clients to transform raw or previously used commercial spaces into functional and visually appealing environments tailored to their operational requirements and brand identity.

Key sectors within the Commercial Interior Fit Out market include offices, retail spaces, hospitality venues, healthcare facilities, and educational institutions. The process typically involves collaboration among architects, interior designers, project managers, and various trade contractors to ensure that the fit-out project is completed on time, within budget, and to the desired quality standards.

Key Market Drivers

Economic Diversification and Vision 2030Saudi Arabia’s ambitious Vision 2030 plan is a cornerstone in driving the Commercial Interior Fit Out market. This strategic framework aims to diversify the economy away from oil dependency, focusing on various sectors such as tourism, entertainment, healthcare, and education. The government's commitment to this vision has led to substantial investments in infrastructure and real estate, fueling the demand for interior fit out services.

Vision 2030 outlines several mega-projects, including the NEOM smart city, the Red Sea Project, and the Qiddiya entertainment city. These projects not only require state-of-the-art architectural designs but also bespoke interior solutions that align with modern standards and technological advancements. As these developments progress, the need for professional interior fit out services to furnish offices, hotels, retail spaces, and residential units becomes paramount.

Vision 2030 emphasizes creating more attractive work environments to boost productivity and innovation. This focus on modernizing workspaces to meet international standards has led to a surge in demand for interior fit out services that can deliver ergonomic, aesthetically pleasing, and technologically integrated office environments. As a result, the interior fit out market is experiencing robust growth, driven by the need to align with the national vision.

Growth in Commercial Real Estate

The expansion of commercial real estate in Saudi Arabia significantly drives the interior fit out market. The increasing number of office buildings, shopping malls, hotels, and mixed-use developments across major cities like Riyadh, Jeddah, and Dammam creates substantial demand for interior design and fit out services. Developers and investors are keen to enhance the value of their properties through high-quality interiors that attract premium tenants and customers.Office space demand is rising, fueled by a growing economy and an influx of multinational companies setting up regional headquarters. These companies often require customized interiors that reflect their corporate identity and culture, necessitating specialized fit out services. Additionally, the retail sector's growth, spurred by increasing consumer spending and tourism, demands unique and appealing store designs to enhance customer experience and competitiveness.

The hospitality industry, crucial for supporting tourism growth, also requires extensive interior fit out services. New hotels and resorts need interiors that provide luxury, comfort, and cultural relevance, making them attractive to both local and international tourists. Consequently, the robust development in commercial real estate drives continuous demand for interior fit out services to create functional, innovative, and aesthetically appealing spaces. As of 2023, the value of the commercial real estate market in Saudi Arabia was estimated at USD 20 billion, and it is projected to grow at a CAGR of 5-6% through 2028.

Technological Advancements

Technological advancements are significantly shaping the Saudi Arabian Commercial Interior Fit Out market. Innovations in building information modeling (BIM), virtual reality (VR), and augmented reality (AR) have revolutionized the way interior fit out projects are designed, planned, and executed. These technologies provide precise, efficient, and collaborative approaches to interior design, enhancing overall project quality and client satisfaction.BIM allows for detailed 3D modeling of interior spaces, enabling designers, architects, and clients to visualize the final outcome before construction begins. This technology facilitates better planning, reduces errors, and streamlines communication among all stakeholders, leading to more efficient project execution. Moreover, BIM's ability to integrate various building systems ensures that all elements work harmoniously, resulting in cohesive and well-functioning interiors.

VR and AR technologies offer immersive experiences, allowing clients to walk through virtual models of their spaces and make real-time adjustments. This interactive approach helps in making informed design decisions, ensuring that the final fit out aligns with the client's vision and requirements. Additionally, these technologies enhance client engagement and satisfaction, as they can visualize and approve designs with greater confidence.

Smart building technologies are increasingly being incorporated into interior fit out projects. Automation systems for lighting, climate control, and security are becoming standard features, requiring specialized fit out services to integrate these advanced systems seamlessly. The growing demand for technologically advanced and connected spaces continues to drive the need for innovative interior fit out solutions.

Key Market Challenges

Regulatory and Compliance Challenges

The regulatory landscape in Saudi Arabia poses significant challenges for the Commercial Interior Fit Out market. Navigating the complex web of building codes, zoning laws, and safety regulations can be daunting for interior fit out companies. Compliance with these regulations is essential to avoid legal issues, project delays, and financial penalties.One of the primary challenges is the frequent updates and changes in regulations. The Saudi government continuously reforms and updates its policies to align with international standards and its Vision 2030 goals. While these changes are beneficial in the long term, they can create confusion and uncertainty in the short term. Interior fit out companies must stay abreast of the latest regulations and ensure their projects comply with all legal requirements. Additionally, obtaining necessary permits and approvals can be time-consuming and bureaucratic. The process often involves multiple government agencies and requires detailed documentation.

Delays in obtaining permits can halt project progress and increase costs, making it crucial for fit out companies to have a thorough understanding of the regulatory process and establish good relationships with regulatory bodies. Moreover, the enforcement of regulations can vary between regions, adding another layer of complexity. Companies operating in multiple cities or regions need to be aware of local variations in building codes and standards. Ensuring compliance across different jurisdictions requires meticulous planning and coordination.

To mitigate these challenges, interior fit out companies need to invest in regulatory expertise, either by hiring knowledgeable staff or partnering with local consultants. Keeping up with regulatory changes and maintaining open communication with authorities can help navigate the complexities of compliance and avoid potential pitfalls.

Supply Chain Disruptions

Supply chain disruptions present a significant challenge for the Saudi Arabian Commercial Interior Fit Out market. The construction and fit out industries rely heavily on a steady supply of materials, equipment, and furnishings. Any disruptions in the supply chain can lead to project delays, increased costs, and reduced profitability.Global events, such as the COVID-19 pandemic, have highlighted the vulnerability of supply chains. Lockdowns, travel restrictions, and manufacturing shutdowns have caused shortages and delays in the delivery of materials. These disruptions have forced interior fit out companies to find alternative suppliers, often at higher costs, or face project delays. Additionally, geopolitical factors and trade policies can impact the availability and cost of materials. Tariffs, trade restrictions, and political instability in key supplier regions can create uncertainty and affect the timely procurement of materials. Interior fit out companies must constantly monitor the global supply chain environment and develop contingency plans to address potential disruptions.

Logistics and transportation challenges within Saudi Arabia also contribute to supply chain issues. The vast geographical area and varying infrastructure quality can lead to delays in material delivery, especially for projects located in remote or less-developed regions. Ensuring timely and efficient transportation of materials requires careful planning and coordination with logistics providers.

To mitigate supply chain disruptions, interior fit out companies need to diversify their supplier base and establish strong relationships with reliable vendors. Investing in inventory management systems and maintaining buffer stock can also help cushion the impact of supply chain fluctuations. Additionally, leveraging technology for real-time tracking and monitoring of materials can enhance visibility and control over the supply chain.

Key Market Trends

Increasing Demand for Sustainable and Green Design

Sustainability has become a prominent trend in the Saudi Arabian Commercial Interior Fit Out market. With growing awareness of environmental issues and the Saudi government's commitment to sustainable development as part of Vision 2030, there is a significant push towards green building practices and eco-friendly interiors. Businesses and developers are increasingly seeking LEED (Leadership in Energy and Environmental Design) certification and other green building credentials to enhance their environmental stewardship and appeal to eco-conscious consumers and tenants.The trend towards sustainable design encompasses various elements, including the use of energy-efficient lighting, HVAC systems, and water-saving fixtures. Interior fit out projects now commonly incorporate materials that are recycled, locally sourced, or have a low environmental impact. These materials not only reduce the carbon footprint of the fit out process but also contribute to healthier indoor environments. Moreover, sustainable interiors often include design features that enhance natural light and ventilation, reducing reliance on artificial lighting and climate control. Biophilic design, which integrates natural elements like plants and water features into interior spaces, is also gaining popularity. This approach not only improves air quality but also enhances occupants' well-being and productivity.

The emphasis on sustainability is driven by both regulatory requirements and market demand. The Saudi Green Building Forum's Mostadam certification and similar initiatives are promoting green building standards, encouraging developers to adopt sustainable practices. As more companies prioritize corporate social responsibility, the demand for green interiors is expected to grow, driving innovation and investment in sustainable fit out solutions.

Rise of Smart and Connected Interiors

The integration of smart technologies in commercial interiors is a rapidly growing trend in Saudi Arabia. As part of the broader push towards smart cities and digital transformation, businesses are increasingly adopting smart office solutions to enhance efficiency, comfort, and user experience. Smart interiors utilize advanced technologies such as IoT (Internet of Things), AI (Artificial Intelligence), and automation to create interconnected and responsive environments.Smart lighting and climate control systems, for instance, can adjust settings based on occupancy, time of day, and user preferences, leading to significant energy savings and improved comfort. These systems are often integrated into centralized management platforms, allowing for seamless control and monitoring of various building functions. Moreover, smart interiors include features such as advanced security systems, automated blinds, and intelligent furniture that can adapt to different needs. In office environments, technologies like smart desks and meeting rooms equipped with video conferencing capabilities are becoming standard. These solutions enhance productivity and collaboration by providing flexible and efficient workspaces.

The trend towards smart interiors is supported by the growing availability of cutting-edge technologies and the increasing demand for high-tech environments. Businesses are recognizing the benefits of smart solutions in terms of operational efficiency, energy savings, and employee satisfaction. As the adoption of smart technologies continues to rise, interior fit out companies are expected to offer more integrated and technologically advanced solutions to meet market demands.

Emphasis on Health and Wellness in Design

The focus on health and wellness in interior design is a significant trend shaping the Saudi Arabian Commercial Interior Fit Out market. In response to the global health crisis and the increasing awareness of the impact of the built environment on well-being, businesses are prioritizing designs that promote health, safety, and comfort.Wellness-oriented interiors include features that enhance indoor air quality, such as advanced ventilation systems and air purifiers. The use of non-toxic, low-VOC (volatile organic compounds) materials is also prioritized to reduce indoor pollutants. Additionally, natural lighting and circadian lighting systems, which mimic natural light patterns, are incorporated to support occupants' mental and physical health.

Ergonomic design is another critical aspect of wellness-focused interiors. Adjustable furniture, sit-stand desks, and ergonomic chairs are becoming standard in office environments to reduce physical strain and improve comfort. Spaces are also designed to encourage movement and activity, with features like standing meeting areas, walking paths, and fitness facilities.

Biophilic design principles, which incorporate natural elements into the interior environment, are gaining traction. The inclusion of plants, natural materials, and water features creates a calming and rejuvenating atmosphere, contributing to occupants' well-being. Moreover, the design of communal and relaxation spaces is emphasized to promote social interaction and mental well-being. Wellness rooms, meditation areas, and recreational facilities are increasingly integrated into commercial interiors to support a holistic approach to health.

As businesses recognize the benefits of wellness-oriented design in terms of employee satisfaction, productivity, and retention, the demand for health-focused interior fit out solutions is expected to grow. This trend underscores the importance of creating environments that support physical, mental, and emotional well-being. The demand for health and wellness centers, including gyms, spas, and mental health facilities, is also on the rise, with over 1,500 wellness centers expected to be operational across the country by 2030. Additionally, the government has allocated substantial funds to healthcare infrastructure, with USD 13 billion earmarked for new hospitals and health centers by 2025, emphasizing the importance of public health as part of urban development.

Segmental Insights

Application Insights

The offices held the largest market share in 2023. Saudi Arabia's Vision 2030 initiative has been pivotal in driving economic diversification and attracting foreign investment. As part of this vision, there has been a concerted effort to create vibrant business hubs and innovation centers across the kingdom. This has led to a surge in office construction and refurbishment projects, particularly in major cities like Riyadh, Jeddah, and Dammam. These developments aim to support the growth of local businesses and multinational corporations expanding their regional presence.The regulatory environment in Saudi Arabia emphasizes the importance of modern and compliant office spaces. The government has implemented building codes and standards that mandate safety, accessibility, and energy efficiency in commercial buildings. Compliance with these regulations is essential for obtaining permits and approvals, which underscores the demand for professional interior fit out services capable of meeting regulatory requirements.

The modernization of office environments is driven by global workplace trends and the adoption of innovative technologies. Companies are increasingly prioritizing employee well-being, productivity, and retention by creating agile and collaborative workspaces. This includes the integration of smart office solutions, flexible layout designs, and sustainable building practices. Interior fit out companies play a crucial role in implementing these trends, offering expertise in space planning, ergonomic design, and technological integration.

The influx of multinational corporations and startups into Saudi Arabia has heightened competition among businesses to attract top talent. Well-designed office spaces that reflect corporate culture, foster creativity, and enhance employee satisfaction are seen as strategic assets. Interior fit outs that incorporate modern amenities, such as state-of-the-art meeting rooms, breakout areas, and wellness facilities, are increasingly in demand to support these goals.

The COVID-19 pandemic has accelerated trends towards hybrid work models and remote collaboration. Offices are being reimagined to accommodate flexible work arrangements, with a focus on health and safety measures. This includes the implementation of touchless technologies, improved air ventilation systems, and adaptable furniture layouts that support physical distancing requirements. Interior fit out companies are instrumental in redesigning office spaces to meet these evolving needs while maintaining functionality and aesthetic appeal.

Regional Insights

Riyadh held the largest market share in 2023. Riyadh serves as the economic heart of Saudi Arabia, housing the headquarters of numerous national and international corporations. The city's status as a major business hub attracts significant investments in commercial real estate, including office buildings, retail centers, and mixed-use developments. These developments require extensive interior fit out services to create functional, attractive, and efficient spaces that meet the needs of modern businesses.Under Vision 2030, Riyadh has been earmarked for extensive infrastructure development and urban revitalization projects. These initiatives include the construction of new government buildings, cultural centers, healthcare facilities, educational institutions, and entertainment complexes. Each of these projects demands specialized interior fit out solutions tailored to their unique requirements, whether it's creating state-of-the-art healthcare environments, innovative educational spaces, or iconic civic landmarks.

Riyadh's population has been steadily growing, driven by internal migration from rural areas and other regions of Saudi Arabia. This demographic shift has spurred urban expansion and the development of new residential communities, commercial districts, and retail hubs. Each new development or renovation project necessitates comprehensive interior fit out services to transform raw spaces into livable, workable, and commercial-ready environments.

As the cultural and administrative capital of Saudi Arabia, Riyadh is home to diverse cultural institutions, museums, galleries, and heritage sites. These venues require sensitive and innovative interior designs that preserve and promote Saudi Arabia's rich cultural heritage while accommodating modern visitor expectations. Interior fit out companies in Riyadh play a crucial role in creating immersive and culturally resonant experiences within these spaces.

Riyadh is at the forefront of technological advancements and innovation in Saudi Arabia. The city's commitment to digital transformation and smart city initiatives is reflected in its buildings and infrastructure. Modern interior fit out projects in Riyadh often incorporate advanced technologies such as smart lighting, energy management systems, and IoT devices to enhance efficiency, sustainability, and user experience.

The competitive landscape of the interior fit out market in Riyadh is characterized by a robust network of local and international firms specializing in architecture, design, construction, and project management. The presence of these skilled professionals and firms ensures that Riyadh remains at the forefront of interior fit out innovation and excellence in Saudi Arabia. Moreover, the city's strategic location and logistical infrastructure facilitate the timely delivery of materials and services, further bolstering its dominance in the market.

Key Market Players

- Fitout Interiors & Contracting WLL

- Design Solutions Inc,

- American Design Source

- A&T Group Interiors

- Construction & Planning Co. Ltd

- Havelock One

- Khansaheb Civil Engineering LLC

- Motif Interiors

Report Scope:

In this report, the Saudi Arabia Commercial Interior Fit Out Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Saudi Arabia Commercial Interior Fit Out Market, By Ownership:

- Self Owned

- Rented

Saudi Arabia Commercial Interior Fit Out Market, By Application:

- Offices

- Hotels & Resort

- Retail

- Healthcare

- Education

- Others

Saudi Arabia Commercial Interior Fit Out Market, By Region:

- Riyadh

- Makkah

- Madinah

- Eastern Province

- Dammam

- Rest of Saudi Arabia

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Saudi Arabia Commercial Interior Fit Out Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Fitout Interiors & Contracting WLL

- Design Solutions Inc,

- American Design Source

- A&T Group Interiors

- Construction & Planning Co. Ltd

- Havelock One

- Khansaheb Civil Engineering LLC

- Motif Interiors

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 88 |

| Published | December 2024 |

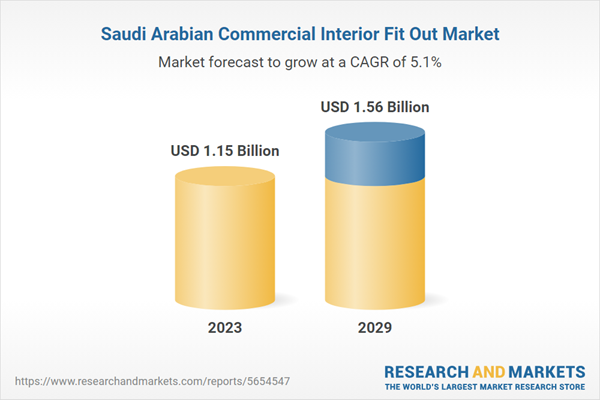

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 1.15 Billion |

| Forecasted Market Value ( USD | $ 1.56 Billion |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Saudi Arabia |

| No. of Companies Mentioned | 8 |