The increasing cost of healthcare in the U.S. has created a growing demand for cost-effective treatment options. According to industry reports, in 2023 and 2024, the United States' per capita healthcare expenditures were predicted to be $14,423 and $15,074, respectively. Between 2023 and 2032, spending is expected to increase by an average of 5.6% annually, exceeding the 4.3% annual growth rate of the gross domestic product. Specialty generics offer similar efficacy as branded drugs at lower prices and are an attractive solution for patients and healthcare providers. Moreover, the expiration of patents on numerous branded specialty drugs has paved the way for generic manufacturers to enter the market. This has led to increased availability of generic versions of high-cost specialty drugs, further driving market growth.

The increasing cases of chronic diseases such as cancer, diabetes, autoimmune disorders, and cardiovascular conditions has increased the demand for specialty medications. According to the National Cancer Institute, as of January 2022, there were an estimated 18.1 million cancer survivors in the United States. By 2032, it is expected that there will be 22.5 million cancer survivors. Prostate, lung, and colorectal cancers account for an estimated 48% of all cancers diagnosed in men in 2024. For women, the three most common types of cancers are breast, lung, and colorectal, and they account for an estimated 51% of all new cancer diagnoses in women in 2024. Specialty generics cater to these conditions, offering affordable treatment alternatives for long-term care.

United States Specialty Generics Market Trends:

Rising Healthcare Costs

The rising costs of medications within the United States is one of the key drivers for the specialty generics market. Specialty generics are less costly than costly branded drugs thus attracting patients, prescribers, and insurers. Since the emphasis is made on decreasing total healthcare expenditures, these generics offer a significant chance of obtaining reasonably priced therapies for chronic and complicated illnesses. Specialty generics are less expensive while maintaining effectiveness, thus encouraging its adoption in the healthcare sector. For instance, in October 2024, the U.S. Centers for Medicare & Medicaid Services released a preliminary list of 101 generic drugs available for no more than $2 for a month's supply to those enrolled in the government's Medicare program. The first list contains medications for high blood pressure, high cholesterol, and other chronic illnesses, as well as typical prescriptions like metformin, lithium, penicillin, and albuterol asthma inhalers.Patent Expirations

The rising expiration of patents on branded specialty drugs is positively impacting the generic manufacturers to offer alternatives at cheaper costs. These patent cliffs affect competition within the pharmaceutical industry by facilitating the availability and advancements in specialty generics. When the exclusivity of key branded drugs expires, generics are promptly available, rendering treatment more accessible than ever and fueling the overall specialty generics market. For instance, in August 2024, Lupin introduced Doxorubicin Hydrochloride Liposome Injection, a generic cancer treatment medication, to the US market. The drug, a generic form of Doxil from Baxter Healthcare Corporation, is used to treat multiple myeloma, ovarian cancer, and Kaposi's Sarcoma, which is linked to AIDS. The medication's expected yearly sales were USD 40.9 million.Regulatory Support and Advancements

The FDA’s streamlined approval processes for generic drugs, including specialty generics, encourage market expansion. For instance, in December 2024, the U.S. Food and Drug Administration (FDA) approved Victoza (liraglutide injection) 18 milligram/3 milliliter, a glucagon-like peptide-1 (GLP-1) receptor agonist as the first generic reference. It is recommended as a supplement to diet and exercise to improve glycemic control in adults and pediatric patients with type 2 diabetes who are 10 years of age and older. Regulatory initiatives promoting competition in the pharmaceutical sector boost the availability of complex generics like injectables and biologics. Technological developments in the formulation of medicines also increase the creation of superior specialty generics, which also boosts the market’s progression.United States Specialty Generics Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the United States specialty generics market report, along with forecasts for the period 2025-2033. Our report has categorized the market based on route of administration, therapeutic application, and distribution channel.Analysis by Route of Administration:

- Injectables

- Oral

- Others

These medications often require precise delivery methods and rapid absorption, making injectables the preferred choice for many therapies. The growing prevalence of chronic illnesses and the rising adoption of biosimilars further drive demand for injectable generics. Additionally, advancements in formulation technologies, ease of administration, and healthcare providers' preference for cost-effective treatment options contribute to their dominance in the specialty generics market. Regulatory approvals also support their widespread availability.

Analysis by Therapeutic Application:

- Oncology

- Hepatitis

- Multiple Sclerosis

- HIV

- Other Autoimmune Diseases

- Others

Analysis by Distribution channel:

- Retail Pharmacies

- Specialty Pharmacies

- Hospital Pharmacies

Competitive Landscape:

The specialty generics market in the United States is effectively competitive and comprises key players such as Teva Pharmaceuticals, Sandoz, Mylan, and Amgen. These companies majorly focus on creating affordable versions of specialty branded drugs such as injectable and biosimilar products aimed at chronic diseases like cancers, autoimmune diseases, and diabetes. The market is also affected by agencies such as the FDA that help to fast-track the approval of generic medicines. The increasing patent expiration and players of all types seeking growth opportunities to add to their stables. Furthermore, retail pharmacies and hospitals have a positive impact on growth and fuel the market distribution channels. For instance, in June 2024, a U.S. unit of Teva Pharmaceutical Industries Ltd., Teva Pharmaceuticals, Inc., declared the introduction of an authorized generic of Victoza®1 (liraglutide injection 1.8mg), in the United States. Generic Victoza, the first generic GLP-1, helps meet the growing demand for this class of treatments in the US market.Key Questions Answered in This Report

1. How big is the specialty generics market in the United States?2. What factors are driving the growth of the United States specialty generics market?

3. What is the forecast for the keyword market in the region?

4. Which segment accounted for the largest United States specialty generics therapeutic application market share?

5. What are specialty drugs in the United States?

6. What are the key opportunities in the market?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Global Specialty Generics Market: Introduction

4.1 What are Specialty Generic Drugs?

4.2 Types of Specialty Generics

5 Why are Specialty Generics So Lucrative?

6 Global Specialty Generics Market

6.1 Market Overview

6.2 Market Performance

6.3 Market Breakup by Route of Administration

6.4 Market Breakup by Therapeutic Application

6.5 Market Breakup by Distribution Channel

6.6 Market Breakup by Region

6.7 Market Forecast

7 US Specialty Generics Market

7.1 Market Overview

7.2 Market Performance

7.3 Impact of COVID-19

7.4 Market Breakup by Route of Administration

7.5 Market Breakup by Therapeutic Application

7.6 Market Breakup by Distribution Channel

7.7 Market Forecast

7.8 SWOT Analysis

7.8.1 Overview

7.8.2 Strengths

7.8.3 Weaknesses

7.8.4 Opportunities

7.8.5 Threats

7.9 Value Chain Analysis

7.10 Porters Five Forces Analysis

7.10.1 Overview

7.10.2 Bargaining Power of Buyers

7.10.3 Bargaining Power of Suppliers

7.10.4 Degree of Competition

7.10.5 Threat of New Entrants

7.10.6 Threat of Substitutes

7.11 Key Market Drivers and Success Factors

8 Market Breakup by Route of Administration

8.1 Injectables

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 Oral

8.2.1 Market Trends

8.2.2 Market Forecast

8.3 Others

8.3.1 Market Trends

8.3.2 Market Forecast

9 Market Breakup by Therapeutic Application

9.1 Oncology

9.1.1 Market Trends

9.1.2 Market Forecast

9.2 Hepatitis

9.2.1 Market Trends

9.2.2 Market Forecast

9.3 Multiple Sclerosis

9.3.1 Market Trends

9.3.2 Market Forecast

9.4 HIV

9.4.1 Market Trends

9.4.2 Market Forecast

9.5 Other Autoimmune Diseases

9.5.1 Market Trends

9.5.2 Market Forecast

9.6 Others

9.6.1 Market Trends

9.6.2 Market Forecast

10 Market Breakup by Distribution Channel

10.1 Retail Pharmacies

10.1.1 Market Trends

10.1.2 Market Forecast

10.2 Specialty Pharmacies

10.2.1 Market Trends

10.2.2 Market Forecast

10.3 Hospital Pharmacies

10.3.1 Market Trends

10.3.2 Market Forecast

11 Competitive Landscape

11.1 Market Structure

11.2 Key Players

11.3 Profiles of Key Players

List of Figures

Figure 1: US: Specialty Generics Market: Major Drivers and Challenges

Figure 2: Global: Specialty Generics Market: Sales Value (in Billion USD), 2019-2024

Figure 3: Global: Specialty Generics Market: Breakup by Route of Administration (in %), 2024

Figure 4: Global: Specialty Generics Market: Breakup by Therapeutic Application (in %), 2024

Figure 5: Global: Specialty Generics Market: Breakup by Distribution Channel (in %), 2024

Figure 6: Global: Specialty Generics Market: Breakup by Region (in %), 2024

Figure 7: Global: Specialty Generics Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 8: US: Specialty Generics Market: Sales Value (in Billion USD), 2019-2024

Figure 9: US: Specialty Generics Market: Breakup by Route of Administration (in %), 2024

Figure 10: US: Specialty Generics Market: Breakup by Therapeutic Application (in %), 2024

Figure 11: US: Specialty Generics Market: Breakup by Distribution Channel (in %), 2024

Figure 12: US: Specialty Generics Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 13: US: Specialty Generics Industry: SWOT Analysis

Figure 14: US: Specialty Generics Industry: Value Chain Analysis

Figure 15: US: Specialty Generics Industry: Porter’s Five Forces Analysis

Figure 16: US: Specialty Generics Market (Administration through Injectables): Sales Value (in Million USD), 2019 & 2024

Figure 17: US: Specialty Generics Market (Administration through Injectables) Forecast: Sales Value (in Million USD), 2025-2033

Figure 18: US: Specialty Generics Market (Oral Administration): Sales Value (in Million USD), 2019 & 2024

Figure 19: US: Specialty Generics Market (Oral Administration) Forecast: Sales Value (in Million USD), 2025-2033

Figure 20: US: Specialty Generics Market (Other Routes of Administration): Sales Value (in Million USD), 2019 & 2024

Figure 21: US: Specialty Generics Market (Other Routes of Administration) Forecast: Sales Value (in Million USD), 2025-2033

Figure 22: US: Specialty Generics Market (Oncology): Sales Value (in Million USD), 2019 & 2024

Figure 23: US: Specialty Generics Market (Oncology) Forecast: Sales Value (in Million USD), 2025-2033

Figure 24: US: Specialty Generics Market (Hepatitis): Sales Value (in Million USD), 2019 & 2024

Figure 25: US: Specialty Generics Market (Hepatitis) Forecast: Sales Value (in Million USD), 2025-2033

Figure 26: US: Specialty Generics Market (Multiple Sclerosis): Sales Value (in Million USD), 2019 & 2024

Figure 27: US: Specialty Generics Market (Multiple Sclerosis) Forecast: Sales Value (in Million USD), 2025-2033

Figure 28: US: Specialty Generics Market (HIV): Sales Value (in Million USD), 2019 & 2024

Figure 29: US: Specialty Generics Market (HIV) Forecast: Sales Value (in Million USD), 2025-2033

Figure 30: US: Specialty Generics Market (Other Autoimmune Diseases): Sales Value (in Million USD), 2019 & 2024

Figure 31: US: Specialty Generics Market (Other Autoimmune Diseases) Forecast: Sales Value (in Million USD), 2025-2033

Figure 32: US: Specialty Generics Market (Other Applications): Sales Value (in Million USD), 2019 & 2024

Figure 33: US: Specialty Generics Market (Other Applications) Forecast: Sales Value (in Million USD), 2025-2033

Figure 34: US: Specialty Generics Market: Sales through Retail Pharmacies (in Million USD), 2019 & 2024

Figure 35: US: Specialty Generics Market Forecast: Sales through Retail Pharmacies (in Million USD), 2025-2033

Figure 36: US: Specialty Generics Market: Sales through Specialty Pharmacies (in Million USD), 2019 & 2024

Figure 37: US: Specialty Generics Market Forecast: Sales through Specialty Pharmacies (in Million USD), 2025-2033

Figure 38: US: Specialty Generics Market: Sales through Hospital Pharmacies (in Million USD), 2019 & 2024

Figure 39: US: Specialty Generics Market Forecast: Sales through Hospital Pharmacies (in Million USD), 2025-2033

List of Tables

Table 1: Global: Specialty Generics Market: Key Industry Highlights, 2024 and 2033

Table 2: US: Specialty Generics Market: Key Industry Highlights, 2024 and 2033

Table 3: US: Specialty Generics Market Forecast: Breakup by Route of Administration (in Million USD), 2025-2033

Table 4: US: Specialty Generics Market Forecast: Breakup by Therapeutic Application (in Million USD), 2025-2033

Table 5: US: Specialty Generics Market Forecast: Breakup by Distribution Channel (in Million USD), 2025-2033

Table 6: US: Specialty Generics Market: Competitive Structure

Table 7: US: Specialty Generics Market: Key Players

Companies Mentioned

- Teva Pharmaceuticals

- Sandoz

- Mylan

- Amgen.

Table Information

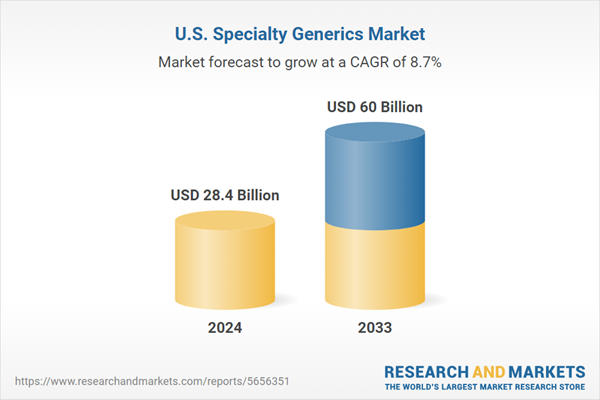

| Report Attribute | Details |

|---|---|

| No. of Pages | 122 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 28.4 Billion |

| Forecasted Market Value ( USD | $ 60 Billion |

| Compound Annual Growth Rate | 8.7% |

| Regions Covered | United States |

| No. of Companies Mentioned | 4 |