Globally, the advanced glass market demand is rising as construction activities increase, leading to a higher need for durable, energy-efficient materials. In addition, the growing focus on sustainability is boosting the adoption of low-emissivity and solar control glass and aiding the market growth. Additionally, the growth in automotive production, especially in the electric vehicle (EV) sector, is boosting the demand for advanced glass in windshields and safety-related applications. Moreover, ongoing technological advancements are enabling the production of lightweight, high-strength glass with enhanced functionality, which is providing an impetus to the market.

For instance, Meta unveiled "Orion," the advanced smart glasses supporting augmented reality (AR), highlighting the integration of advanced glass in consumer electronics, and expanding its applications. Also, the increasing investments in infrastructure projects, especially in developing regions, are fueling the market demand. Furthermore, the rising use of smart glass in electronics and smart buildings is impelling the market growth.

The United States holds an 88.70% market share. The advanced glass market growth in this region is driven by rising government regulations that encourage energy-efficient construction and building retrofits. In line with this, the rise in smart home adoption is fostering the demand for smart glass in windows and doors. Concurrently, the expansion in the aerospace sector is boosting the use of lightweight, impact-resistant glass for aircraft components and significantly contributing to the market expansion. Additionally, the growing healthcare infrastructure is driving the demand for antimicrobial and safety glass in hospitals, supporting the market growth.

Moreover, continuous technological integration in consumer electronics, such as AR devices, is acting as another growth-inducing factor for high-performance glass. For example, Corning received up to USD32 million under the Creating Helpful Incentives to Produce Semiconductors (CHIPS) Act to enhance the production of glass products integral to chip manufacturing, further strengthening the market for advanced glass. Apart from this, the rising investments in renewable energy (RE) projects are creating opportunities for advanced glass in solar panels and energy storage systems, thereby propelling the market forward.

Advanced Glass Market Trends:

Growing Demand in Construction Activities

With the significant expansion in construction activities, there has been increasing demand for effective value-added renovation materials, such as advanced glass, across various commercial and residential complexes, which is primarily influencing the advanced glass market trends. Reports indicate that in 2023, global construction projects accounted for USD 13 trillion in gross annual output, representing 7 percent of the total global gross output. This can be further attributed to the ongoing investments in several infrastructural projects and the rising consumer awareness regarding the multiple benefits associated with the product.Expansion in Automotive Applications

The extensive utilization of advanced glass by original equipment manufacturers (OEMs) and automobile companies to compose easy-to-install vehicle windows is acting as another growth-inducing factor. Advanced glass helps provide optimal comfort to drivers and passengers by inhibiting heat release, reducing air conditioning load, and improving fuel efficiency. This application is driving growth as automakers increasingly turn to advanced glass to meet consumer demands for energy-efficient and comfortable vehicles.Technological Advancements and Electronics Integration

Rapid technological advancements in the manufacturing process and the introduction of varying product types, such as smart, thin, safe crystal, nano canal, and self-cleaning glass, are contributing to the market growth. Other factors, such as the extensive utilization of advanced glass in multiple consumer electronics, including laptops, desktops, and smartphones, and strategic collaborations amongst key players to enhance product performance and efficacy, are creating a positive outlook for the market. As per the India Brand Equity Foundation, foreign direct investment (FDI) in the Appliances and Consumer Electronics (ACE) industry nearly doubled to USD 481 million by June 2022, compared to USD 198 million in 2021.Advanced Glass Industry Segmentation:

The research provides an analysis of the key trends in each segment of the global advanced glass market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, application, and end use industry.Analysis by Product Type:

- Coated Glass

- Laminated Glass

- Toughened Glass

- Ceramic Glass

Laminated glass provides improved safety and sound insulation, making it an ideal choice for applications in the automotive, construction, and aerospace industries. Its durability and UV resistance are driving demand, particularly in premium architecture and protective glazing solutions.

Toughened glass is prized for its exceptional strength and ability to withstand thermal stress. It is extensively utilized in automotive windows, safety barriers, and modern architecture, where robustness and aesthetics are critical.

Ceramic glass is preferred for its heat resistance and dimensional stability. It is prominently used in applications like fireplaces, cooktops, and industrial equipment, addressing high-temperature environments and specialized functional requirements.

Analysis by Application:

- Safety and Security

- Solar Control

- Optics and Lighting

- High Performance

The automotive sector is also contributing to the demand for shatterproof and bullet-resistant glass, particularly in high-end and commercial vehicles. Furthermore, in defense, advanced glass is used for protective armor and surveillance equipment. Additionally, the integration of smart technologies, such as embedded sensors and switchable properties, enhances safety features, driving growth in this segment.

Analysis by End Use Industry:

- Building and Construction

- Aerospace and Defense

- Automotive

- Electronics

- Sports and Leisure

- Optical

- Others

Besides this, the expanding EV market drives advanced glass consumption because designers use these materials to create innovative car shapes while also delivering improved aerodynamic capabilities. Moreover, consumer preferences for premium features including acoustic insulation, ultraviolet (UV) protection, and self-cleaning surfaces encourage automotive manufacturers to integrate these solutions as the market for automotive applications is enhancing the advanced glass market outlook.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Besides this, rising disposable income levels combined with premium product adoption trends have boosted the electronics market for advanced glass applications in smartphones and display technologies. As a result, the Asia Pacific market sustains growth through government programs that support both environmentally friendly and energy-efficient technology adoption.

Key Regional Takeaways:

North America Advanced Glass Market Analysis

North America plays a key role in the advanced glass market, propelled by technological innovations and strong demand from sectors like construction, automotive, and electronics. The region demonstrates robust adoption of energy-efficient materials because it has both building codes and environmental regulations that work to decrease energy usage. Besides this, the construction activities in the region have maintained continuous growth by emphasizing green buildings and sustainable infrastructure leading to increased advanced glass adoption for its insulation properties and longevity benefits.In line with evolving industry dynamics, Orora, a glass manufacturer, announced the potential sale of A$1.775 billion in its North American packaging business to focus on producing high-end liquor bottles, reflecting strategic shifts within the glass sector. Also, the automotive industry uses advanced glass in vehicles because customers need lightweight materials with enhanced safety properties. Furthermore, owing to the electronics industry's substantial contribution, the advanced glass adoption for display panels and consumer devices has significantly increased, which is impelling the market growth.

United States Advanced Glass Market Analysis

Advanced glass adoption is steadily increasing due to expanding infrastructure investment. The growing demand for sustainable and energy-efficient buildings has resulted in a higher adoption of advanced glass in construction projects. According to the U.S. Department of the Treasury, President Biden's signing of the Bipartisan Infrastructure Law allocates USD 1.2 Trillion in federal funding to infrastructure projects, spurring nationwide investment and modernization. Advanced glass offers excellent thermal insulation, noise reduction, and safety features, making it indispensable for modern architectural designs. Innovations in manufacturing technologies have further improved the availability and cost-efficiency of advanced glass products.From skyscrapers to public transportation hubs, these materials are being integrated into designs to enhance energy performance and occupant comfort. Moreover, government incentives for green building initiatives have played a key role in driving the adoption of advanced glass. Residential and commercial developments are increasingly incorporating solutions such as solar control glass and double-glazed panels to align with stringent energy efficiency standards. This trend showcases how technological advancements and regulatory support are shaping the adoption landscape.

Europe Advanced Glass Market Analysis

The aerospace and defense sectors are contributing significantly to the adoption of advanced glass as these industries demand materials capable of meeting rigorous safety, performance, and sustainability standards. According to the Aerospace, Security, and Defense Industries Association of Europe, in 2023, Europe's aerospace and defense industry turnover rose by 10.1% year-on-year to approximately USD 316.5 Billion, building on a 10.5% growth in 2022. This highlights the sustained expansion in the sector. Lightweight glass solutions are essential for reducing the overall weight of aircraft, thereby enhancing fuel efficiency and operational capabilities.Advanced optical and ballistic-resistant glass has become indispensable in the development of cockpit windows, passenger cabin interiors, and surveillance equipment. The increasing focus on safety and innovation in aerospace designs has led to a surge in the integration of high-performance glass in military and commercial aircraft. These materials are also being adopted in defense applications due to their superior durability and ability to withstand harsh environmental conditions. Research and development initiatives within the aerospace industry are further accelerating technological advancements, making advanced glass a cornerstone in meeting both functional and safety requirements.

Asia Pacific Advanced Glass Market Analysis

The automotive sector is driving a notable increase in advanced glass adoption, fueled by evolving consumer preferences and advancements in vehicle design. As per the India Brand Equity Foundation, the automobile sector attracted a cumulative equity FDI inflow of approximately USD 35.65 billion between April 2000 and December 2023. Lightweight and durable glass solutions are becoming a standard for enhancing fuel efficiency and safety in vehicles. Features like solar control, heat resistance, and shatterproof properties are critical in meeting the growing demand for innovative vehicle components.The trend toward electric vehicles has further propelled the need for advanced glass, with automakers incorporating these materials for better energy efficiency and comfort. Increasing production of luxury vehicles and expanding automotive exports have amplified the use of specialty glass in panoramic sunroofs, windshields, and side windows. As manufacturers focus on integrating sustainable and premium features into vehicles, the use of advanced glass solutions aligns seamlessly with these objectives.

Latin America Advanced Glass Market Analysis

Growing demand for consumer electronics is propelling the adoption of advanced glass, driven by increasing disposable income and technological advancements. For instance, total disposable income in Latin America is set to rise by nearly 60% in real terms over 2021-2040. Electronics manufacturers are incorporating ultra-thin, scratch-resistant, and highly durable glass into the design of smartphones, tablets, and wearable devices.The growing preference for sleek, lightweight, and visually appealing gadgets has heightened the need for premium glass solutions that enhance user experience. Additionally, innovations in display technologies have expanded the use of advanced glass in high-resolution screens and foldable devices. The region's evolving market for personal electronics highlights how shifting consumer expectations are driving the development and integration of sophisticated materials.

Middle East and Africa Advanced Glass Market Analysis

The rise in construction activities and real estate projects is fostering significant growth in advanced glass adoption. According to reports, Saudi Arabia is witnessing rapid growth in its construction sector, with over 5,200 projects underway, valued at USD 819 Billion. Advanced glasses are increasingly utilized in modern architectural designs, prioritizing energy efficiency and aesthetic appeal. Advanced glass products, such as low-emissivity and laminated glass, are being incorporated into commercial towers, residential complexes, and urban infrastructure projects.Their ability to reduce heat gain, provide sound insulation, and enhance structural safety makes them a preferred choice in the evolving construction landscape. The focus on sustainable and visually striking designs aligns with the growing demand for high-performance materials, solidifying advanced glass as an integral component in contemporary developments.

Competitive Landscape:

Market participants within the advanced glass industry actively implement multiple strategies to build stronger market positions alongside expanding their product offerings. Industrial players focus their research investments on developing innovative glass solutions that combine lightweight characteristics with switchable features and self-cleaning properties. Additionally, businesses establish partnership alliances to enter new regional markets along with better distribution system access. Moreover, merger and acquisition trends help businesses expand their product lines while they gain access to innovative manufacturing capabilities.The rise of sustainability practices is pushing the development of green production methods that fulfill international environmental requirements. Furthermore, smart glass production by leading participants includes the integration of the Internet of Things (IoT), to address increasing requirements among the construction, automotive, and consumer electronics markets.

The report provides a comprehensive analysis of the competitive landscape in the advanced glass market with detailed profiles of all major companies, including:

- AGC Inc.

- Compagnie de Saint-Gobain S.A.

- Corning Incorporated

- Fuyao Glass Industry Group Co. Ltd.

- Gentex Corporation

- Koch Industries Inc.

- Nippon Sheet Glass Co. Ltd.

- Schott AG

- Sisecam (Türkiye Is Bankasi A.S.)

- Tyneside Safety Glass

- Xinyi Glass Holdings Limite.

Key Questions Answered in This Report

- How big is the advanced glass market?

- What is the future outlook of the advanced glass market?

- What are the key factors driving the advanced glass market?

- Which region accounts for the largest advanced glass market share?

- Which are the leading companies in the global advanced glass market?

Table of Contents

Companies Mentioned

- AGC Inc.

- Compagnie de Saint-Gobain S.A.

- Corning Incorporated

- Fuyao Glass Industry Group Co. Ltd.

- Gentex Corporation

- Koch Industries Inc.

- Nippon Sheet Glass Co. Ltd.

- Schott AG

- Sisecam (Türkiye Is Bankasi A.S.)

- Tyneside Safety Glass

- Xinyi Glass Holdings Limited

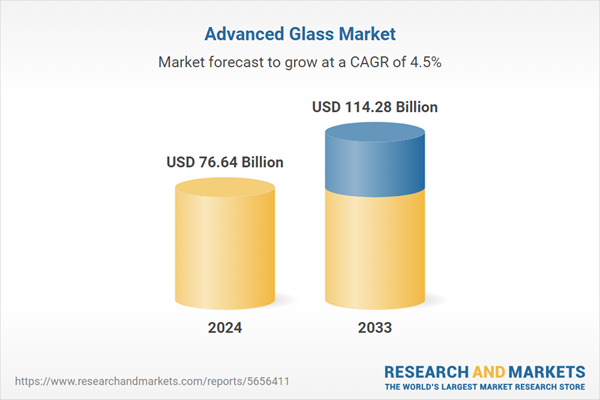

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 145 |

| Published | June 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 76.64 Billion |

| Forecasted Market Value ( USD | $ 114.28 Billion |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |