An anti-lock braking system (ABS) is a safety feature installed in vehicles to prevent wheels from locking up during braking. It is designed to maintain traction and steering control by modulating the braking pressure on individual wheels. It uses sensors to monitor wheel speed and detects a wheel that is about to lock up, and then it rapidly adjusts the brake pressure to that specific wheel. Additionally, ABS allows the driver to retain steering control, even during hard braking or on slippery surfaces, by preventing wheel lock-up. It also helps reduce the risk of skidding and allows the driver to maneuver the vehicle safely, avoiding obstacles or other vehicles.

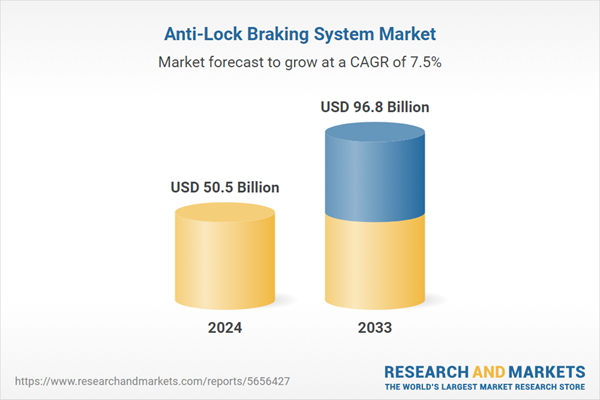

The market is primarily driven by the growing demand for automobile vehicular safety and control systems. Additionally, the rising awareness among consumers regarding their safety, and several benefits offered by ABS, such as shorter braking distances, compatibility with different road surfaces, and reduced wear and tear, is influencing the market growth. Moreover, the introduction of stringent safety regulations and initiatives promoting vehicle safety has further accelerated the market growth. Besides this, several technological advancements, such as improved sensors, faster response times, and enhanced integration with other vehicle systems, made ABS efficient, reliable, and cost-effective, driving its adoption in the market. Along with this, rapid urbanization, the growing population, expanding automotive sector, and increasing vehicle production and sales are propelling market growth. Furthermore, the extensive application of ABS improves stability and shortens braking distances, improving vehicle safety, which is beneficial in emergencies, thus creating a positive market outlook.

Anti-lock Braking System (ABS) Market Trends/Drivers:

Expanding automotive sector

The automotive sector is primarily driven by rising disposable income, urbanization, improving road infrastructure, and changing consumer preferences. In addition, individuals are opting for personal vehicles thus escalating the demand for safer and more advanced braking systems such as ABS is influencing the market growth. It is a critical safety feature in modern vehicles, it prevents wheel lock-up during braking, allowing drivers to maintain steering control and avoid skidding or accidents propelling the market growth. Furthermore, the expansion of the automotive sector is not limited to traditional internal combustion engine (ICE) vehicles. The growing adoption of electric vehicles (EVs) and hybrid vehicles has also contributed to the growth of the ABS market. Additionally, EV manufacturers are incorporating ABS into their models to ensure optimal braking performance and safety in these advanced vehicles creating a positive market outlook.Several technological advancements

The market is also driven by several technological advancements, which are enhancing the performance and capabilities of ABS systems. These advancements are contributing to improved safety, efficiency, and braking performance in vehicles, thus augmenting the market growth. Additionally, the development of electronic ABS systems with the incorporation of electronic sensors, control units, and actuators provides more precise control over braking representing another major growth-inducing factor. This allows for faster response times and improved modulation of brake pressure on individual wheels. Besides this, the integration of advanced sensors that monitor wheel speed, acceleration, and deceleration, provides more accurate and real-time data to the ABS control unit which allows better detection of wheel lock-up and enhances the system's ability to adjust braking pressure accordingly. Furthermore, the integration of ABS with other safety systems, such as electronic stability control (ESC) and traction control systems (TCS) allows for a synergistic operation of multiple safety systems, enhancing vehicle safety and stability thus accelerating the market growth.The growing awareness regarding safety features among individuals

The anti-lock braking system (ABS) market analysis explores the growing awareness regarding safety features among individuals drives the demand for anti-lock braking systems (ABS). In addition, the rising accident rates led individuals to seek vehicles equipped with advanced safety technologies, including ABS, influencing the market growth. Moreover, individuals are now more aware of the potential risks and dangers associated with braking issues, such as wheel lock-up and skidding, especially in emergency braking situations representing another major growth-inducing factor. ABS addresses these concerns by preventing wheel lock-ups and allowing drivers to control their vehicles, reducing the risk of accidents. Besides this, the availability of information and education regarding vehicle safety features has improved significantly. Consumers now have access to a wealth of resources, including safety ratings, crash test results, and expert recommendations, highlighting the importance of ABS as an essential safety component. Furthermore, several governmental initiatives and regulations promoting road safety and awareness programs emphasizing the benefits of ABS are also propelling market growth.Anti-lock Braking System (ABS) Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global anti-lock braking system (ABS) market report, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on component type, vehicle type and end-use.Breakup by Component Type:

- Speed Sensors

- Electronic Control Units (ECU)

- Hydraulic Units

Electronic control units (ECU) dominate the market

The report has provided a detailed breakup and analysis of the market based on the component type. This includes speed sensors, electronic control units (ECU), and hydraulic units. According to the report, electronic control units (ECU), represented the largest segment.ECUs are sophisticated electronic devices that receive data from sensors monitoring wheel speed and other relevant parameters. They analyze this data to determine if wheel lock-up is imminent and, if so, activate the necessary corrective measures to modulate brake pressure and prevent skidding, which is influencing the market growth. Moreover, the advanced capabilities of ECUs, such as fast data processing, complex algorithms, and integration with other vehicle systems, make them essential for efficient and reliable ABS operation, representing another major growth-inducing factor. Besides this, the increasing complexity and sophistication of ABS systems resulted in an escalating demand for advanced ECUs. These ECUs are designed to handle multiple inputs, adapt to various driving conditions, and communicate with other safety systems such as electronic stability control (ESC) or traction control systems (TCS), propelling the market growth.

Breakup by Vehicle Type:

- Two Wheelers

- Passenger Cars

- Commercial Vehicles

Passenger cars represent the most popular vehicle type

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes two wheelers, passenger cars, and commercial vehicles. According to the report, passenger cars represented the largest segment.Passenger cars dominate the market. It encompasses a wide range of vehicles designed for personal transportation, including sedans, hatchbacks, SUVs, and crossover vehicles. In addition, the rising demand for passenger cars in the automotive market is escalating the demand for ABS systems due to the sheer volume of passenger cars on the road, augmenting the market growth. Besides this, safety features are a major consideration for consumers when purchasing passenger cars. ABS is recognized as an essential safety system that enhances braking performance and allows drivers to maintain control during emergency braking situations accelerating the market growth. Along with this, passenger cars are employed for various purposes, including commuting, family transportation, and recreational activities. Their versatility and widespread usage across different demographics contribute to the dominant position of passenger cars in the ABS market.

Breakup by End-Use:

- OEM

- Replacement Demand

OEM demand refers to the installation of ABS systems in vehicles during the manufacturing process. As ABS is recognized as a standard safety feature, OEMs are incorporating ABS in a several vehicles, including passenger cars, commercial vehicles, and motorcycles propelling the market growth. Besides this, replacement demand refers to the installation or retrofitting of ABS systems in vehicles that were initially manufactured without ABS or require ABS system replacements, leading to rising demand from vehicle owners seeking to upgrade their existing vehicles with ABS to enhance safety or comply with regulatory requirements accelerating the market growth. Along with this, the widespread adoption of replacement demand such as increasing awareness of the importance of ABS, government regulations, and consumer preference for enhanced safety features is augmenting the market growth.

Breakup by Region:

- North America

- United States

- Canada

- Others

- Asia Pacific

- China

- Japan

- India

- Australia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Others

- Latin America

- Brazil

- Mexico

- Argentina

- Others

- Middle East and Africa

- Saudi Arabia

- Iran

- United Arab Emirates

- Egypt

- South Africa

- Others

Asia Pacific exhibits a clear dominance in the market

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa (Saudi Arabia, Iran, United Arab Emirates, Egypt, South Africa, and others). According to the report, Asia Pacific accounted for the largest market share.Asia Pacific is dominating the anti-lock braking system (ABS) market, due to the robust automotive industry, increasing vehicle production, and growing emphasis on vehicle safety is contributing to the market growth. In addition, countries such as China, Japan, India, and South Korea are experiencing substantial growth in the automotive sector, driving the demand for ABS. Moreover, the rapid urbanization, increasing disposable income, and a growing middle-class population led to a rise in vehicle ownership and the growing demand for advanced safety features such as ABS represents another major growth-inducing factor across the Asia Pacific region.

Europe is another significant region in the ABS market. European countries, including Germany, France, and the United Kingdom, have a strong automotive presence and are known for their stringent safety regulations, and the early adoption of ABS technology is contributing to its substantial market share in the ABS market.

North America also holds a notable share in the ABS market with their developed automotive industry, technological advancements, and safety standards led to the widespread adoption of ABS systems in vehicles.

Competitive Landscape:

Key players in the market are undertaking various strategies to strengthen their positions and remain competitive. They are investing in research and development (R&D) activities to enhance the performance and efficiency of ABS systems. They are focusing on improving sensor technology, developing advanced algorithms, and exploring new materials to optimize braking performance and responsiveness. Moreover, companies are continuously innovating their ABS offerings by integrating advanced technologies. This includes the incorporation of electronic stability control (ESC), traction control systems (TCS), and other safety features into ABS units to provide comprehensive safety solutions. Besides this, they are forming strategic partnerships and collaborations with automotive manufacturers, suppliers, and technology providers to develop and integrate ABS systems seamlessly, such collaborations help in using each other's strengths, sharing resources and accelerating product development and market penetration.The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Advics Co. Ltd.

- Aisin Seiki

- Continental AG

- Denso Corporation

- Hitachi Automotive System Ltd

- Mando Corporation

- Robert Bosch GmbH

- Wabco Ltd.

Key Questions Answered in This Report

1. How big is the Anti-Lock Braking System (ABS) market?2. What is the expected growth rate of the global Anti-Lock Braking System (ABS) market during 2025-2033?

3. What are the key factors driving the global Anti-Lock Braking System (ABS) market?

4. What has been the impact of COVID-19 on the global Anti-Lock Braking System (ABS) market?

5. What is the breakup of the global Anti-Lock Braking System (ABS) market based on the component type?

6. What is the breakup of the global Anti-Lock Braking System (ABS) market based on the vehicle type?

7. What are the key regions in the global Anti-Lock Braking System (ABS) market?

8. Who are the key players/companies in the global Anti-Lock Braking System (ABS) market?

Table of Contents

Companies Mentioned

- Advics Co. Ltd.

- Aisin Seiki

- Continental AG

- Denso Corporation

- Hitachi Automotive System Ltd

- Mando Corporation

- Robert Bosch GmbH

- Wabco Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 115 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 50.5 Billion |

| Forecasted Market Value ( USD | $ 96.8 Billion |

| Compound Annual Growth Rate | 7.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |