Gas-insulated switchgear (GIS) is a type of electrical substation equipment used to control and distribute electrical power. It is constructed by enclosing circuit breakers, disconnectors, and other components within a sealed metal enclosure, which is then filled with a high dielectric insulating gas, typically sulfur hexafluoride (SF6). This design offers several advantages over traditional air-insulated switchgear. The hermetically sealed enclosure prevents internal contamination and reduces maintenance requirements. The use of SF6 gas as an insulating medium enables compact designs, making GIS suitable for locations with limited space. Additionally, the gas provides superior insulation properties, enhancing the equipment's reliability and operational safety. GIS systems come in various types, including single-phase, two-phase, and three-phase arrangements, each catering to specific voltage levels and applications.

The global gas insulated switchgear market is influenced by the increasing demand for efficient and reliable power distribution systems, which has driven the adoption of gas insulated switchgear due to its compact design and superior performance. Additionally, the emphasis on reducing greenhouse gas emissions propels the market, as gas insulated switchgear offers a more environmentally friendly alternative to traditional switchgear. Furthermore, the expanding renewable energy sector necessitates advanced grid infrastructure, thereby boosting the market growth. Furthermore, the escalating demand to enhance grid stability and minimize power outages drives the market, as these systems offer enhanced insulation and operational reliability. Moreover, stringent regulations pertaining to safety standards in power transmission and distribution contribute to the market's expansion.

Gas Insulated Switchgear Market Trends/Drivers:

Increasing demand for efficient power distribution systems

The global gas insulated switchgear market experiences a significant drive from the increasing demand for efficient power distribution systems. As modern societies depend more on uninterrupted and reliable power supply, the need for advanced technologies that enhance power distribution efficiency becomes paramount. Gas insulated switchgear, with its compact design and remarkable performance capabilities, addresses this requirement effectively. By minimizing space requirements and maximizing operational reliability, gas insulated switchgear facilitates the smooth flow of electricity across grids. This technology ensures reduced transmission losses, leading to energy savings and cost-effectiveness in the long run. As industries and households continue to demand seamless power supply, the adoption of gas insulated switchgear is set to rise, solidifying its position as a critical driver in the global market.Emphasis on greenhouse gas emission reduction

The emphasis on reducing greenhouse gas emissions exerts a pivotal influence on the global gas insulated switchgear market. With growing environmental concerns, industries are actively seeking greener alternatives to traditional technologies. Gas insulated switchgear, by employing insulating gas mixtures with lower global warming potential, presents an eco-friendly solution for power distribution needs. This approach aligns with international climate goals and regulatory mandates aimed at curbing carbon emissions. The use of gas insulated switchgear reduces the environmental impact while maintaining high levels of operational reliability and safety. As governments and industries increasingly prioritize sustainability, the demand for gas insulated switchgear to reduce carbon footprint gains substantial momentum, shaping the market's growth trajectory.Expanding renewable energy sector

The expanding renewable energy sector plays a pivotal role in driving the global gas insulated switchgear market. Renewable energy sources like solar and wind power are gaining prominence as sustainable alternatives to fossil fuels. However, their intermittent nature necessitates efficient energy storage and distribution mechanisms. Gas insulated switchgear, with its advanced insulation properties and robust design, facilitates the integration of renewable energy into existing grids. These systems provide the necessary infrastructure for transferring energy from renewable sources to consumption points while maintaining grid stability. As the world transitions toward cleaner energy options, the demand for gas insulated switchgear rises, given its pivotal role in ensuring a seamless and reliable distribution of power generated from renewable sources.Gas Insulated Switchgear Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on type, installation, technology, voltage and end-use sector.Breakup by Type:

- High Voltage GIS

- Medium Voltage GIS

- Low Voltage GIS

High voltage GIS dominates the market

The report has provided a detailed breakup and analysis of the market based on the type. This includes high voltage GIS, medium voltage GIS, and low voltage GIS. According to the report, high voltage GIS represented the largest segment.The growth of the high voltage gas insulated switchgear (GIS) segment is propelled by the increasing demand for efficient and reliable power transmission and distribution infrastructure. These systems offer compact designs that optimize space utilization while ensuring superior operational performance, making them an ideal choice for densely populated urban areas and industrial complexes. Moreover, the ongoing transition towards renewable energy sources necessitates robust grid solutions capable of handling higher voltage levels to accommodate the integration of renewable power. High voltage GIS, with its advanced insulation properties and capacity to handle elevated voltages, addresses this requirement effectively. Furthermore, the need to enhance grid resilience and reduce power losses contributes to the growth of this segment. High voltage GIS solutions provide enhanced insulation against external factors and minimize transmission losses, resulting in improved grid stability and efficiency. In line with this, stringent environmental regulations and the emphasis on reducing greenhouse gas emissions drive the adoption of high voltage GIS, as these systems utilize environmentally friendly insulating gases with lower global warming potential.

Breakup by Installation:

- Indoor

- Outdoor

Outdoor holds the largest share in the market

A detailed breakup and analysis of the market based on the installation has also been provided in the report. This includes indoor and outdoor. According to the report, outdoor represented the largest segment.The growth of the outdoor segment in the gas insulated switchgear (GIS) market is propelled by several key factors, including the increasing demand for reliable power distribution in outdoor settings, such as substations and power stations. These systems offer robust insulation and operational reliability, ensuring uninterrupted power supply even in challenging environmental conditions. Moreover, the expansion of renewable energy installations, often situated in open-air environments, necessitates efficient and secure grid connections. Outdoor GIS solutions facilitate seamless integration of renewable energy sources into existing grids, contributing to cleaner energy generation and distribution.

Additionally, the need to modernize aging electrical infrastructure in urban areas requires space-efficient solutions, where outdoor GIS's compact design excels. In line with this, the emphasis on grid stability, particularly in regions prone to natural disasters, highlights the value of outdoor GIS in maintaining reliable power transmission. Furthermore, advancements in technology, such as improved weather-resistant materials and enhanced fault detection capabilities, further drive the growth of the outdoor GIS segment by enhancing its suitability for outdoor applications.

Breakup by Technology:

- Hybrid Switchgear

- Integrated Three Phase

- Compact Gas Insulated Switchgear

Hybrid switchgear dominates the market

The report has provided a detailed breakup and analysis of the market based on technology. This includes hybrid switchgear, integrated three phase, and compact gas insulated switchgear. According to the report, hybrid switchgear represented the largest segment.The growth of the hybrid switchgear segment is propelled the increasing demand for reliable and resilient power distribution systems. Its unique combination of both conventional air-insulated and modern gas-insulated technologies enhances operational reliability, ensuring uninterrupted electricity supply even in challenging conditions. Furthermore, the global push towards reducing carbon emissions and transitioning to cleaner energy sources fuels the growth of hybrid switchgear. By incorporating eco-friendly insulation gases, hybrid switchgear contributes to mitigating environmental impact while maintaining superior performance. Apart from this, the integration of renewable energy sources, such as solar and wind, into power grids necessitates adaptable and flexible switchgear solutions. Hybrid switchgear, with its capability to accommodate diverse energy inputs, effectively addresses this need. Additionally, the increasing urbanization and industrialization drive the modernization of power infrastructure, favoring the adoption of hybrid switchgear for its compact design and space-saving attributes. The surging focus on grid resilience against natural disasters and technological advancements further amplifies the demand for hybrid switchgear, ensuring a reliable power distribution network.

Breakup by Voltage:

- < 38 kV

- 38 kV to 72 kV

- 73 kV to 150 kV

- 150 kV

< 38 kV holds the largest share in the market

A detailed breakup and analysis of the market based on the voltage has also been provided in the report. This includes < 38 kV, 38 kV to 72 kV, 73 kV to 150 kV, and > 150 kV. According to the report, < 38 kV represented the largest segment.

The growth of the < 38 kV segment in the gas insulated switchgear market is propelled by the increasing urbanization and industrialization across the globe, which has heightened the demand for reliable power distribution solutions for densely populated areas and industrial complexes. Gas insulated switchgear, with its compact design and high efficiency, addresses this need effectively. Furthermore, the rising integration of renewable energy sources, such as solar and wind power, necessitates efficient grid infrastructure for energy transmission. Gas insulated switchgear offers optimal insulation properties and enhanced grid stability, making it an ideal choice for accommodating fluctuating renewable energy inputs. In line with this, stringent safety regulations in power transmission encourage the adoption of gas insulated switchgear due to its inherent safety features, minimizing risks to both personnel and equipment. Moreover, the need to modernize existing electrical infrastructure further drives the demand for < 38 kV gas insulated switchgear, as it offers advanced technological capabilities to support the evolving energy landscape.

Breakup by End-Use Sector:

- Power Transmission

- Power Distribution

- Power Generation

- Infrastructure and Transportation

- Others

Power generation holds the largest share in the market

A detailed breakup and analysis of the market based on the end-use sector has also been provided in the report. This includes power transmission, power distribution, power generation, infrastructure and transportation, and others. According to the report, power generation represented the largest segment.The growth of the power generation segment is underpinned by the increasing global demand for electricity, driven by population growth, urbanization, and industrialization. Additionally, the growing emphasis on sustainable and renewable energy sources, such as solar, wind, and hydroelectric power, contributes significantly to the segment's growth. As environmental concerns intensify, governments and industries are directing investments towards cleaner energy alternatives, thereby boosting the adoption of renewable power generation technologies. Furthermore, advancements in technology are enhancing the efficiency and reliability of power generation systems. Improved turbine designs, smart grid integration, and digitalization are optimizing power plant operations and maintenance. The transition towards decentralized and distributed power generation, facilitated by innovations like microgrids and off-grid solutions, is also fostering growth in the segment. Moreover, supportive policies and incentives, coupled with international agreements on emissions reduction, are driving the shift towards low-carbon and emission-free power generation methods.

Breakup by Region:

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- North America

- United States

- Canada

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

- Middle East and Africa

- Turkey

- Saudi Arabia

- Iran

- United Arab Emirates

- Others

Asia Pacific exhibits a clear dominance, accounting for the largest gas insulated switchgear market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others); and the Middle East and Africa (Turkey, Saudi Arabia, Iran, United Arab Emirates, and others). According to the report, Asia Pacific represented the largest segment.The Asia Pacific region is experiencing robust growth in the gas insulated switchgear market, driven by the region's rapid urbanization and industrialization, which have escalated the demand for reliable and efficient power distribution systems. The gas insulated switchgear's compact design and enhanced performance meet these requirements effectively. In line with this, the increasing focus on renewable energy sources, such as solar and wind power, prompts the need for advanced grid infrastructure to accommodate their integration. Gas insulated switchgear plays a pivotal role in ensuring seamless energy transfer from these sources to consumption points.

Moreover, governments in the Asia Pacific are placing strong emphasis on environmental sustainability and lowering greenhouse gas emissions. Gas insulated switchgear's environmentally friendly insulating gas mixtures align with these goals. Additionally, the region's inclination towards smart grid technologies and the integration of IoT devices in power networks further propels the adoption of gas insulated switchgear. The growth of urban centers and the expansion of industrial sectors intensify the need for reliable power supply, making gas insulated switchgear a critical component of the region's energy infrastructure development.

Competitive Landscape:

The competitive landscape of the global gas insulated switchgear market is characterized by dynamic factors that influence the industry's direction and growth. As demand for efficient power distribution solutions increases, various players strive to innovate and offer advanced gas insulated switchgear technologies. Market participants focus on research and development, aiming to enhance product performance, reliability, and environmental sustainability. Differentiated product offerings, strategic partnerships, and mergers and acquisitions contribute to market consolidation.Stringent safety and environmental regulations drive players to develop insulating gas mixtures with lower global warming potential, further intensifying competition. With the growing emphasis on grid modernization and the integration of renewable energy sources, companies aim to provide adaptable solutions that ensure seamless energy transmission. Furthermore, the evolving smart grid landscape pushes manufacturers to incorporate IoT capabilities into their offerings, enhancing remote monitoring and control functionalities. The competitive landscape is marked by innovation, technological advancements, and a commitment to meeting the diverse and evolving needs of the global gas insulated switchgear market.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

Some of the key players in the market include:

- ABB

- Alstom

- Benchmarking

- Bharat Heavy Electricals Limited

- Eaton Corporation

- General Electric Company

- Hitachi

- Larsen & Toubro

- Meidensha

- Mitsubishi Electric

- Powell Industries

- Schneider Electric

- Siemens

- Toshiba International Corporation

Key Questions Answered in This Report

- How big is the global gas insulated switchgear market?

- What is the expected growth rate of the global gas insulated switchgear market during 2025-2033?

- What are the key factors driving the global gas insulated switchgear market?

- What has been the impact of COVID-19 on the global gas insulated switchgear market?

- What is the breakup of the global gas insulated switchgear market based on the type?

- What is the breakup of the global gas insulated switchgear market based on the installation?

- What is the breakup of the global gas insulated switchgear market based on the technology?

- What is the breakup of the global gas insulated switchgear market based on the voltage?

- What is the breakup of the global gas insulated switchgear market based on the end-use sector?

- What are the key regions in the global gas insulated switchgear market?

- Who are the key players/companies in the global gas insulated switchgear market?

Table of Contents

Companies Mentioned

- ABB

- Alstom

- Benchmarking

- Bharat Heavy Electricals Limited

- Eaton Corporation

- General Electric Company

- Hitachi

- Larsen & Toubro

- Meidensha

- Mitsubishi Electric

- Powell Industries

- Schneider Electric

- Siemens

- Toshiba International Corporation

Table Information

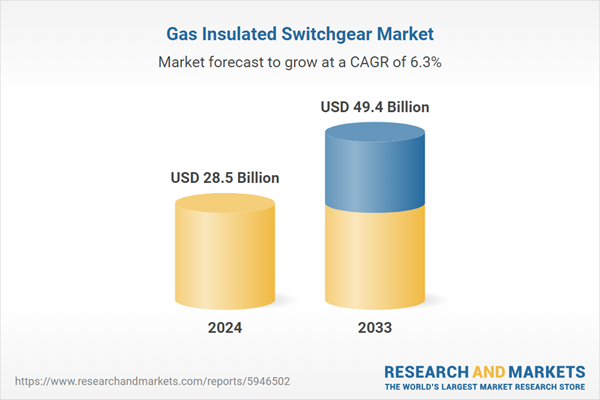

| Report Attribute | Details |

|---|---|

| No. of Pages | 146 |

| Published | March 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 28.5 Billion |

| Forecasted Market Value ( USD | $ 49.4 Billion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 14 |