A medium voltage cable is a specialized electrical conductor designed to transmit energy in the range of 1kV to 35kV. Composed of a conductor, insulation, and protective sheathing, these cables are engineered to offer optimal electrical performance, robustness, and safety. The conductor, typically made of copper or aluminum, serves as the pathway for electrical currents, while the insulation - often of cross-linked polyethylene or ethylene propylene rubber - acts as a barrier against leakage of current and offers resistance to electrical surges. The protective outer sheathing ensures durability and safeguards against mechanical damage and environmental factors.

The global market is primarily driven by the increasing demand for electricity, particularly in emerging economies. In line with this, urbanization is requiring the expansion and upgrade of existing electrical infrastructure, providing an impetus to the market. Moreover, the proliferation of renewable energy projects such as wind and solar farms necessitates robust and reliable electrical transmission solutions, acting as a significant growth-inducing factor. In addition to this, technological advancements in insulation and conductor materials are enhancing cable efficiency and longevity, resulting in higher investment opportunities. The market is further driven by industrial growth, which requires reliable energy transmission systems.

Apart from this, higher disposable income levels have led to greater demand for electrical appliances, thereby elevating the need for effective electrical transmission. Some of the other factors contributing to the market include the digital transformation across various sectors, growing investments in public infrastructure, and an enhanced focus on minimizing electrical transmission losses.

Medium Voltage Cables Market Trends/Drivers:

The rising transition towards cleaner and more sustainable forms of energy

The global transition towards cleaner and more sustainable forms of energy is a compelling factor driving the market for medium voltage cables. As countries aim to reduce their carbon footprints and comply with international climate agreements, there is an accelerated shift towards renewable energy sources such as wind, solar, and hydroelectric power. The integration of these renewables into existing power grids demands advanced electrical infrastructure that can handle fluctuating energy outputs, manage distribution, and ensure efficient energy storage.These imperatives significantly heighten the need for high-quality, durable, and efficient cables. As renewable projects often occupy vast tracts of land far from consumption centers, efficient transmission becomes critical. Medium voltage cables fit this requirement effectively by providing a balance between transmission capacity and the infrastructure costs.

The rapid expansion of infrastructure development activities

Infrastructure development, including the rise of smart cities, large-scale transportation networks, and upgraded public utilities, has an outsized influence on the medium voltage cables market. Large public projects typically necessitate a complex web of electrical systems that must meet high standards of reliability, durability, and efficiency. Such requirements are especially critical for essential services like healthcare, public transportation, and emergency response systems, where electrical failure is not an option.The complexity and scale of these projects create a ripple effect, driving the need for specialized cables that can reliably transmit medium-range voltages. In addition, as countries compete for technological and infrastructural supremacy, significant capital is being allocated to these large-scale projects, creating a sustained market for medium voltage cables that meet stringent quality and performance benchmarks.

An enhanced focus on decentralized energy generation

The growing emphasis on decentralized energy generation, such as microgrids and localized renewable energy projects, is another significant market driver. Traditional energy grids are centralized, but with the move towards localized production, there is a compelling need to redesign electrical transmission structures. This evolution brings about new challenges, including the requirement for flexible and adaptable cabling solutions capable of meeting the demands of intricate, localized systems.Medium voltage cables are apt for these applications, as they offer the right mix of efficiency, durability, and adaptability. Decentralized systems often need to quickly adapt to changing load conditions and integrate various energy sources, both renewable and conventional. Such intricacies necessitate a new breed of medium voltage cables engineered for versatility, thus further heightening market demand on a global level.

Medium Voltage Cables Industry Segmentation:

This report provides an analysis of the key trends in each segment of the global medium voltage cables market report, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on voltage, product, installation and end user.Breakup by Voltage:

- Up to 25kV

- 26kV-50kV

- 51kV-75kV

- 76kV-100kV

26kV-50kV represents the largest market segment

The report has provided a detailed breakup and analysis of the market based on the voltage. This includes Up to 25kV, 26kV-50kV, 51kV-75kV, and 76kV-100kV. According to the report, 26kV-50kV represented the largest segment.The 26kV-50kV segment is primarily driven by the widespread adoption of this voltage range for distribution networks, especially in urban areas. Aging infrastructure and the need for grid modernization also contribute to increased demand for these cables. Governments are increasingly focusing on renewable energy projects, which often utilize cables in this voltage range for efficient energy transmission. Additionally, these cables are popular in commercial applications like shopping centers and large office buildings. The compatibility of this voltage range with a broad spectrum of applications reinforces its major status in the market.

On the other hand, cables in up to 25kV, 51kV-75kV, and 76kV-100kV voltage ranges are generally considered specialty products, often used in specific industrial applications or specialized infrastructure projects. Their limited use in mainstream distribution networks restricts their market reach. Despite the restricted demand, advancements in insulation and conductive materials are making these cables more efficient. Therefore, they continue to find niche applications in the market.

Breakup by Product:

- Termination Cables

- Joints

- XLPE Cables

- Others

Termination cables account for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the product. This includes termination cables, joints, XLPE cables, and others. According to the report, termination cables represented the largest segment.Termination cables are largely used for connecting medium voltage cables to equipment or other segments of a network. They are essential for the seamless functioning of power systems and are seeing rising demand as industries scale and automation increases. Their fire-resistant and robust nature makes them ideal for mission-critical applications like hospitals and data centers. Advanced materials and technology in termination cables are also promoting their use in harsh environmental conditions. Overall, their versatility and importance in connectivity are driving their major share in the market.

On the other hand, joints and XLPE (Cross-Linked Polyethylene) cables play a secondary but essential role in medium voltage systems. They are integral for connecting different cable sections and ensuring seamless transmission. Their market growth is largely dependent on the expansion of the core medium voltage cables market. While they might not represent a major segment, their importance should not be underestimated.

Breakup by Installation:

- Underground

- Submarine

- Overhead

Overhead represents the largest market segment

The report has provided a detailed breakup and analysis of the market based on the installation. This includes underground, submarine, and overhead. According to the report, overhead represented the largest segment.Overhead cables are commonly used for electrical power transmission and distribution over long distances. The comparatively lower installation costs, coupled with easier maintenance compared to underground or submarine cables, make them popular choices for power utilities. However, weather conditions and natural disasters present a challenge for these types of cables, requiring innovative design solutions for resilience. The push towards rural electrification, especially in developing countries, has also bolstered the demand for overhead cables. Their efficiency in power delivery and lower total cost of ownership contribute to their major market segment status.

On the other hand, underground and submarine cables are generally more expensive to install but offer the advantage of being less susceptible to environmental factors. These cables are mostly used in specialized projects like undersea energy transmission or urban underground networks. The high cost of installation and maintenance limits their extensive adoption, but they are crucial for certain applications.

Breakup by End User:

- Industrial

- Commercial

- Utility

Industrial accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the end user. This includes industrial, commercial, and utility. According to the report, industrial represented the largest segment.In the industrial sector, cables with medium voltage are indispensable for operations requiring consistent and reliable power supply. The rise of industrial automation and the Internet of Things (IoT) are boosting the demand for these cables in factories and other industrial settings. In addition, they are vital for powering heavy machinery and large-scale industrial applications. Policies promoting industrialization and manufacturing are also contributing to the growth of this segment. Overall, the industrial sector's complex power needs are a major factor in driving demand for these cables.

On the other hand, the commercial and utility segments are influenced by a combination of factors. The expansion of urban areas necessitates an increase in electricity transmission, thereby fueling the product demand. Initiatives to modernize aging electrical infrastructure have led to increased investment in these sectors. The push for renewable energy sources has given rise to new projects that require dependable transmission lines. Technological advancements, such as the development of high-performance insulating materials, contribute to market growth by providing safer and more efficient solutions.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific exhibits a clear dominance, accounting for the largest medium voltage cables market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share.The Asia-Pacific region, encompassing a range of diverse economies from developed nations such as Japan, China, and Singapore to emerging powerhouses such as India, presents a unique landscape for the global market. One of the most significant drivers in the Asia-Pacific region is the ongoing and upcoming infrastructure development projects. These infrastructure developments inevitably require a robust electrical network, bolstering the demand for medium voltage cables that are crucial for power transmission and distribution.

Additionally, favorable government policies and regulations in the Asia-Pacific countries are increasingly favoring renewable energy projects. The government bodies of several countries have set ambitious targets for renewable energy generation, including solar and wind energy projects, which necessitate extensive cabling for connecting these energy sources to the grid. Regulatory support in the form of incentives, subsidies, and favorable tariff policies is also catalyzing the demand for these cables in renewable energy applications.

Furthermore, continual advancements in cable technology, such as increased durability and conductivity, also drive market growth. Innovations in materials science have led to the development of cables that can withstand harsh environmental conditions and are more efficient in electricity transmission. These technological advancements are attracting investments and adoption across various sectors, including utilities and construction.

Competitive Landscape:

The key players are relentlessly focusing on technological advancements to improve cable quality and energy efficiency. They are also investing in R&D to produce more durable and reliable cables with advanced features. To ensure market growth, these industry leaders are forming strategic partnerships and collaborations with regional companies. They are actively pursuing market expansion through mergers, acquisitions, and establishing new production facilities in untapped markets.These companies are also emphasizing customer-centric approaches and are working to offer tailored solutions. To adhere to global regulations, they are increasingly focusing on sustainable production methods and recycling initiatives. In addition, these key players are involved in rigorous quality testing to meet industry standards and consumer expectations.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

Some of the key players in the market include:

- ABB Ltd

- Brugg Cables (Shanghai) Co. Ltd.

- Eland Cables

- Hellenic Cables S.A.

- LS Cable & System (LS Group)

- Nexans S.A.

- NKT A/S

- Prysmian S.p.A.

- Riyadh Cables

- Southwire Company LLC

- Sumitomo Electric Industries Ltd.

- Synergy Cables

- TPC Wire & Cable

Key Questions Answered in This Report:

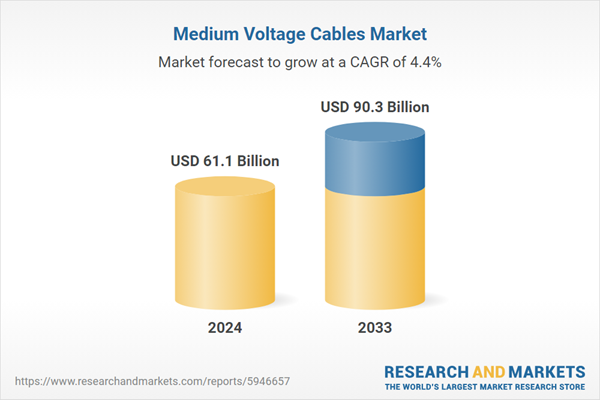

- What was the size of the global medium voltage cables market in 2024?

- What is the expected growth rate of the global medium voltage cables market during 2025-2033?

- What are the key factors driving the global medium voltage cables market?

- What has been the impact of COVID-19 on the global medium voltage cables market?

- What is the breakup of the global medium voltage cables market based on the voltage?

- What is the breakup of the global medium voltage cables market based on the product?

- What is the breakup of the global medium voltage cables market based on the installation?

- What is the breakup of the global medium voltage cables market based on the end user?

- What are the key regions in the global medium voltage cables market?

- Who are the key players/companies in the global medium voltage cables market?

Table of Contents

Companies Mentioned

- ABB Ltd

- Brugg Cables (Shanghai) Co. Ltd.

- Eland Cables

- Hellenic Cables S.A.

- LS Cable & System (LS Group)

- Nexans S.A.

- NKT A/S

- Prysmian S.p.A.

- Riyadh Cables

- Southwire Company LLC

- Sumitomo Electric Industries Ltd.

- Synergy Cables

- TPC Wire & Cable

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 148 |

| Published | April 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 61.1 Billion |

| Forecasted Market Value ( USD | $ 90.3 Billion |

| Compound Annual Growth Rate | 4.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |