Manufacturing execution system is the name of the information system that connects, monitors, and controls complex data flows and manufacturing devices or equipment on shop floors. This system's primary goals are to increase output and ensure that industrial processes are carried out effectively. It aids in maximizing manufacturing operations' efficiency, profitability, compliance, and quality. Consequently, finds use in the management of inventories, analysis of quality, allocation of resources, tracking of production, and other sectors including oil and gas, consumer electronics, food and beverage, and automotive. Automation technology advancements open up the market for more advanced and superior production execution solutions.

There is an increasing need for very complicated items to be supplied in record time for many industries. It is more challenging than ever to balance customer demand with quality and traceability requirements, particularly in sophisticated industries such as aerospace and defence. By recording all as-built data down the whole production tree and providing users with access to a real-time single source of information to implement quality control and reduce risk, MES helps enterprises to fulfil traceability needs.

The MES offers a wide range of capabilities for analyzing business performance and contextualizing data. Executives & supervisors can operate with the same source of data that is upgraded in real-time from the production floor thanks to the consolidation of company data and the availability of dashboards with reporting tools. Monitoring product cycle time, resource use, and scheduling adherence are crucial performance analysis tasks. Supplier data can be incorporated into MES as well, allowing manufacturers to monitor all third parties' performance.

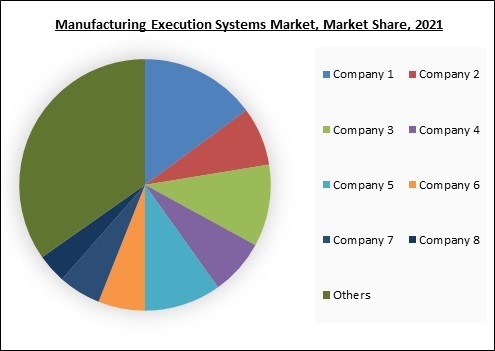

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The below illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Product Launches and Product Expansions.

COVID-19 Impact Analysis

Owing to the COVID-19 outbreak, the market growth for factory execution systems shrank in 2020. Major halts in many industrial operations, such as manufacturing plants not operating and low productivity in manufacturing units, were brought on by this. It had an impact on the earnings of several important market participants. The pandemic also caused a number of manufacturing facilities to close and output to be suspended in a number of different industries worldwide. Several end industry operations, including those in the power generation, oil and gas, and automotive sectors, among others, saw significant transformation during the post-pandemic phase. Manufacturing execution systems market is expected to expand in the coming years owing to the various operations & guidelines that have been established for COVID-19 for smoother operations.Market Growth Factors

Rising Need for Huge Production and Connected Supply Chain

One of the main factors driving the MES industry is the demand for a linked supply chain in industrial industries. An essential component for enabling effective manufacturing activities is efficient data flow throughout the factory. IoT systems could be utilized by factories for supply chain reporting, inventory tracking, and location tracking of manufactured goods. The simple flow of data across the whole supply chain is another benefit of connected manufacturing solution, which enables it simple for businesses to adapt to the shifting market conditions.Increasing Investment in MES to Boost Energy Efficiency and Sustainable Production

Many large companies and SMEs are implementing manufacturing execution systems because they improve manufacturing processes. Production efficiency is aided by these systems' capacity to boost output, cut costs, boost quality, enabling real-time data collection and tracking of products. This aspect is anticipated to promote the adoption of these systems in order to boost revenues. The use of manufacturing execution systems also results in decreases in the amount of waste and energy used throughout the manufacturing process. For instance, putting a MES system on a shop floor eliminates the requirement for paperwork & physical storage space while not requiring additional IT resources.Market Restraining Factors

High Cost of Installation and Maintenance of MES

A company's expenses will rise as a result of the investment cost of MES, which also involves acquisition, consultation, adjustment, installation, and running costs. The capital investments for MES are especially substantial because they contain a number of services linked to this system, whose implementation varies by industry. The costs associated with MES are mostly implementation and operating costs, which consequently raise a company's costs. MES can be fairly pricey due to the intricacy of the programme and other costs like custom integration.Offering Outlook

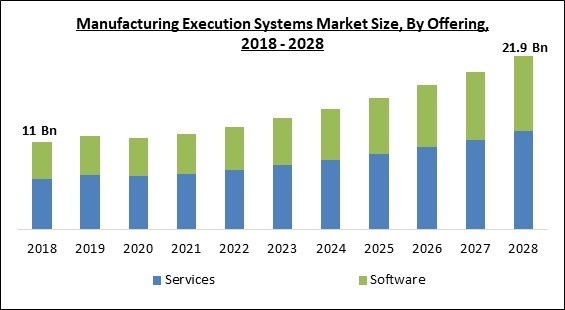

On the basis of offering, the manufacturing execution system market is segmented into Software and Services. Software segment procured a significant revenue share in the manufacturing executing systems market in 2021. Additionally, enterprises can benefit from customized production, a major trend in the development of industrial execution systems, with the use of MES software. A smart factory may go from mass manufacturing to mass personalization and quickly and affordably fulfill the demand for reduced cost, and highly customized items.Deployment Outlook

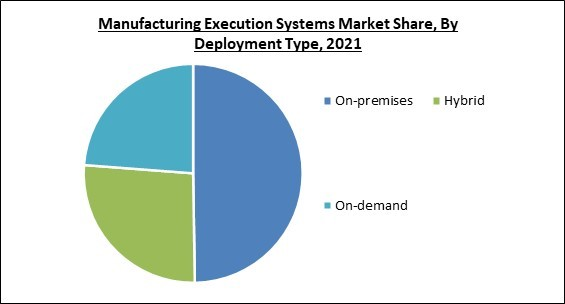

Based on deployment type, the manufacturing execution system market is divided into On-premises, On-demand and Hybrid. Hybrid segment garnered a significant revenue share in the manufacturing execution systems market in 2021. Due to the increasing significance of monitoring real information about the activities in oil and gas fields, the usage of hybrid implementation of manufacturing execution systems has grown in the oil and gas sector. Along with that, a hybrid manufacturing execution system also offers additional storage space, protecting data security.Industry Outlook

By Industry, the manufacturing execution systems market is bifurcated into Process and Discrete. Process industry segment recorded a significant revenue share in the manufacturing execution systems market in 2021. The process of making products like paints, textiles, specialty chemicals, or pharmaceuticals includes combining elements in accordance with precise formulas or recipes. One of several industry modes has always been the focus of traditional manufacturing software.Process Industry type outlook

Based on Process Industry, the market is further bifurcated into Food & Beverages, Oil & Gas, Chemicals, Pulp & Paper, Pharmaceuticals & Life Sciences, Energy & Power, Water & Wastewater Management and Others. Oil & Gas segment procured a promising revenue share in the manufacturing execution systems market in 2021. Refiners can maintain their competitiveness and increase their profitability by continually providing products that satisfy client expectations. MES offers information for real-time, quick, reliable, and transparent data-driven operation optimization. Refiners can have a beneficial impact on the bottom line by making timely, well-informed decisions on production performance with a greater awareness of how their plants are doing in real time.Discrete Industry type outlook

Based on Discrete Industry, the market is further bifurcated into Automotive, Aerospace, Medical devices, Consumer packaged goods and Others. Medical Devices segment registered a substantial revenue share in the manufacturing execution systems market in 2021. Medical device makers place the highest attention possible on regulatory compliance. Records might have to be kept for anything between 20 and 50 years, depending on local laws and the devices being made. MES can assist in all four of these aspects, verification, addressing exceptions, and documentation - to aid in achieving compliance.Regional Outlook

Region-wise, the manufacturing execution systems market is analyzed across North America, Europe, Asia Pacific and LAMEA. Asia Pacific garnered a promising revenue share in the manufacturing execution systems market in 2021. Asia Pacific has a very high need for manufacturing execution systems because of nations like China, South Korea, Japan, and India. It is the manufacturing execution system market that is expanding at the highest rate. Due to their fast industrialization and emphasis on manufacturing operations in sectors like the consumer electronics, automotive, and other industries, China and India have the fastest-growing economies in the world.Cardinal Matrix - Manufacturing Execution Systems Market Competition Analysis

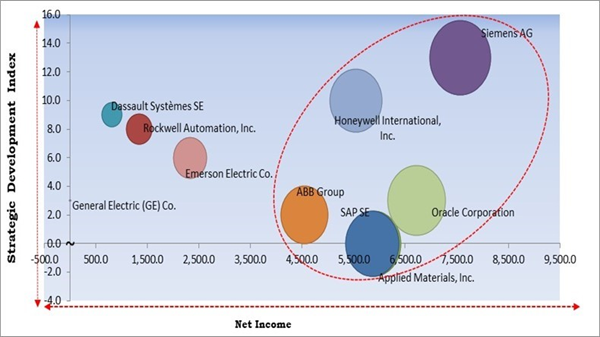

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Siemens AG, Honeywell International, Inc. and Oracle Corporation are the forerunners in the Manufacturing Execution Systems Market. Companies such as Emerson Electric Co., Rockwell Automation, Inc. and Dassault Systèmes SE are some of the key innovators in Manufacturing Execution Systems Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Siemens AG, Honeywell International, Inc., General Electric (GE) Co., Dassault Systèmes SE, SAP SE, ABB Group, Oracle Corporation, Applied Materials, Inc., Emerson Electric Co., Rockwell Automation, Inc.

Strategies deployed in Manufacturing Execution Systems Market

; Partnerships, Collaborations and Agreements:

- Jul-2022: ABB entered into a Memorandum of Understanding (MoU) with SKF, a Swedish bearing and seal manufacturing company. This MoU is expected to explore the chances for collaboration in the automation of manufacturing procedures. Under the partnership, SKF and ABB is expected to detect and analyze solutions to enhance manufacturing production and support clients’ better production efficiency.

- Jun-2022: Emerson signed an agreement with Jotun, a leading manufacturer of decorative paints and marine, protective, and powder coatings. This agreement aimed to automate and digitalize its overall manufacturing facilities. The five-year agreement is expected to allow Jotun to deploy Emerson’s digital technologies to improve all factors of manufacturing automation in factories, and for selected upgrades in certain of its 39 prevailing factories across the globe.

- Feb-2022: Dassault Systèmes came into a partnership with Cadence Design Systems, an American multinational computational software company. This partnership aimed to offer enterprise customers in various vertical markets. Along with that, both the companies is expected to integrate Dassault Systèmes’ 3DEXPERIENCE platform with the Cadence Allegro platform in a joint solution, which is expected to allow clients to master the multidiscipline modeling, simulation, and optimization of complicated, connected electronic systems.

; Product Launches and Product Expansions:

- May-2022: Honeywell released the C300PM, a flexible and cost-effective solution. This solution is developed to offer a unified process control platform. The latest controller is expected to allow effortless technology evolution for consumers looking forward to using the features of the state-of-the-art C300 process controller along with retaining a familiar hardware package.

- May-2022: Honeywell introduced advancements to Honeywell Forge, the leading enterprise performance management software solution. This solution is developed to help consumers to boost their digital transformation journey. Along with that, this class of offerings that involves Honeywell Forge Connected Warehouse is expected to assist enterprises to streamline operations and reduce costs by offering better visibility of data and real-time insights, monitoring, and automation.

- Jul-2021: Dassault Systemes released DELMIAworks. This product is expected to connect the whole design to the manufacturing procedure. In addition, this product involves real-time internet of things (IoT) solution for production and process monitoring aimed at boosting operational efficiency and transparency all over the companies.

- Apr-2021: Siemens expanded its product line by the launch of a new version Opcenter Execution Pharma version 6.2.3. This software is formerly called SIMATIC IT eBR, which provides native integration among the manufacturing execution system (MES) and the distributed control system (DCS) layer.

; Acquisitions and Mergers:

- Sep-2021: Rockwell Automation took over Plex Systems, the leading cloud-native smart manufacturing platform. This acquisition aimed to boost Rockwell's strategy to transform the Connected Enterprise, fueling faster time to value for consumers as they constantly adopt cloud solutions to enhance agility, resilience, and sustainability in their operations.

- Sep-2021: Honeywell acquired Performix, a provider of manufacturing execution system (MES) software. This acquisition aimed to develop the world's top integrated software platform for consumers across the life sciences industry who are looking forward to getting quick compliance, better reliability, and enhanced production throughput at the highest levels of quality.

- Mar-2021: Siemens took over C&S Electric Limited, a leading manufacturer of electrical and electronic equipment. This acquisition aimed to focus on the regions of intelligent infrastructure for buildings & distributed energy systems, power generation & distribution, and automation & digitalization in the procedure and manufacturing sectors.

Scope of the Study

Market Segments Covered in the Report:

By Offering

- Services

- Software

By Deployment Type

- On-premises

- Hybrid

- On-demand

By Industry

- Discrete

- Automotive

- Aerospace

- Medical Devices

- Consumer Packaged Goods

- Others

- Process

- Pharmaceuticals & Life Sciences

- Food & Beverages

- Oil & Gas

- Chemicals

- Pulp & Paper

- Energy & Power

- Water & Wastewater Management

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Siemens AG

- Honeywell International, Inc.

- General Electric (GE) Co.

- Dassault Systèmes SE

- SAP SE

- ABB Group

- Oracle Corporation

- Applied Materials, Inc.

- Emerson Electric Co.

- Rockwell Automation, Inc.

Unique Offerings from the Publisher

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Siemens AG

- Honeywell International, Inc.

- General Electric (GE) Co.

- Dassault Systèmes SE

- SAP SE

- ABB Group

- Oracle Corporation

- Applied Materials, Inc.

- Emerson Electric Co.

- Rockwell Automation, Inc.