Speak directly to the analyst to clarify any post sales queries you may have.

KEY HIGHLIGHTS

- Earthmoving equipment accounted for the largest Kuwait construction equipment market share in 2022. Excavators in the earthmoving segment accounted for the largest share in 2022. Rising investment in housing, warehouse expansion, and public infrastructure projects is expected to drive the demand for excavators in the market.

- In Dec 2022, the Kuwaiti government planned constructing eight bridges on the Al-Nawaseeb Road. In Kuwait, Al-Nawaseeb Road is one of the country’s main roads from the Kuwaiti capital to Saudi Arabia. The total length of the bridges will be 1,736 meters. The construction of this superstructure started in 2020.

- In 2022, Kuwait’s Council of Ministers General Secretariat (CMGS) awarded the license for developing four sites on the 36 km Sheikh Jaber Al Ahmad Al-Sabah Causeway. The commercial aspects of the project will include retail, hospitality, health, wellness, food and beverage, and serviced apartments. The project is estimated to be completed by the end of 2026 and is estimated to contribute to the Kuwait construction equipment market growth.

Increased Investment in Public Infrastructure Projects

- In February 2023, Kuwait approved nearly USD 2.76 billion for 110 projects planned during fiscal year 2023-2024. The projects mainly include the airport's expansion, the Silk City's development, and the railway network across the country.

- Construction of the Jaber Al Ahmad New City is in progress, which, once completed, will respond to the needs of Kuwait’s rapidly growing population. The city is located 25 km west of Kuwait City. It is designed to include a new self-supporting community and accommodate around 80,000 people on a plot of over 12.4 million square meters.

MARKET TRENDS & DRIVERS

Kuwait’s National Development Plan and Investments in Public Infrastructure to Propel the Kuwait Construction Equipment Market

- The Vision has established high importance to Kuwait’s national infrastructure, with investments hitting as high as USD 27 billion in the bidding stage. New Kuwait will build on the recent urban development and housing momentum by introducing new master plan developments and cities.

- Plan also aims to develop the country’s tourism sector to yield surplus revenue and create a new employment pool and plans to further enhance the country’s transportation and power sectors by building on the recent success of the Independent Water and Power Plant (IWPP) and Public-Private Partnership (PPP) projects.

Increased Renewable Energy Projects in the Country Will Propel the Demand for Material Handling Equipment

- As of February 2022, a 30 MW solar PV plant was planned in Al Jahra, Kuwait, named Subiya Water Storage Solar PV Plant. The plant is expected to be built in one step. Construction is expected to start in 2023, and the plant should be ready for business in 2025.

- The government planned to build a 5GW solar power complex in the country's north. In addition, solar capacity is planned installed capacity at Shagaya by 2030 with an investment of USD 20 million.

Robust Growth in the Development of Ports to Boost the Sales of Overhead Cranes in the Kuwait Construction Equipment Market

- Kout Food Group (KGF), in 2021, inaugurated its 16,000-square-metre warehouse for a storage, distribution center, and truck park at the Agility Logistics Park (ALP) in Sulaibiya. Moreover, in March 2023, Ad Ports Group announced the launch of a new shipping service that will improve commercial and logistic connectivity to Qatar and Kuwait.

- In addition to it, Kuwait also planned to launch a global auction to develop and operate a brand-new cargo village next to the Kuwait International Airport (KWI). The new cargo village set to be built west of KWI is part of a three-stage long-term master plan stretching to 2050 to expand air traffic and shipping operations in the Gulf state.

MARKET RESTRAINTS

Housing Crises in the Region Hamper the Sales of Construction Equipment in the Region

- The lack of available housing has increased housing costs, making privately owned homes less affordable. One of the government’s reports also mentioned that the price-to-income ratio of affording a house in Kuwait is the worst among GCC countries. Therefore, the residential price-to-income ratio in Kuwait is higher than that of cities such as London or New York and approximately three times that of Dubai and Abu Dhabi.

- Another reason that can be mapped out that stimulated the crises is that the government owns 90% of the land in Kuwait and regulates residential real estate development through parceling and allocation of land plots.

The Skilled Labour Shortage in the Country Hampers the Pace of Construction Projects

- Many Kuwaitis prefer to work in the public sector, leading to a shortage of skilled workers in the construction, healthcare, and IT industries. The lack of government projects also prompted many Kuwaiti companies to flee to more active and lively neighboring markets, which harmed the Kuwait construction equipment market.

- Around 205,000 expatriates working in the private sector left Kuwait in 2021, which has also hampered local businesses. One of the government reports pointed out that in 2021, about 41,200 domestic workers left Kuwait permanently. Domestic workers currently constitute around 22.8% of the workforce in Kuwait, of 2.7 million.

SEGMENTATION ANALYSIS

Segmentation by Type

- Earthmoving Equipment

- Excavator

- Backhoe Loaders

- Wheeled Loaders

- Other Earthmoving Equipment (Other loaders, Bulldozers, Trenchers)

- Road Construction Equipment

- Road Rollers

- Asphalt Pavers

- Material Handling Equipment

- Crane

- Forklift & Telescopic Handlers

- Aerial Platforms (Articulated Boom Lifts, Telescopic Boom lifts, Scissor lifts)

- Other Construction Equipment

- Dumper

- Tipper

- Concrete Mixture

- Concrete Pump Truck

- End Users

- Construction

- Mining

- Manufacturing

- Others (Power Generation, Utilities Municipal Corporations, Oil & Gas, Cargo Handling, Power Generation Plants, Waste Management)

VENDOR LANDSCAPE

- Caterpillar, Volvo CE, Komatsu, Liebherr, Hitachi Construction Equipment, XCMG, and Zoomlion are leaders in the Kuwait construction equipment market. These companies have a strong market share and offer diverse sets of equipment.

- In 2020, Kuwait International Airport received eight cranes (T285-120V) from Zoomlion. These cranes marked the highest tonnage tower cranes exported by China.

Prominent Vendors

- Caterpillar

- Komatsu

- Xuzhou Construction Machinery Group Co. Ltd. (XCMG)

- Liebherr

- Volvo Construction Equipment

- Hitachi Construction Machinery

- Zoomlion Heavy Industry Science & Technology Co. Ltd

- JCB

- SANY

Other Prominent Vendors

- Hyundai Construction Equipment

- Kobelco

- Liu Gong

- Tadano

- CNH Industrial

- Terex Corporation

- SDLG

- MERLO Group

Distributor Profiles

- Alghanim Equipment

- Emdad Equipment &Oil Field Supplier

- Arab Group for Equipment and Construction (AGECO)

- Mohamed Abdulrahman Al-Bahar

- EQUIP

- RIHAM

- Boodai Trading Company Ltd. W.L.L.

KEY QUESTIONS ANSWERED:

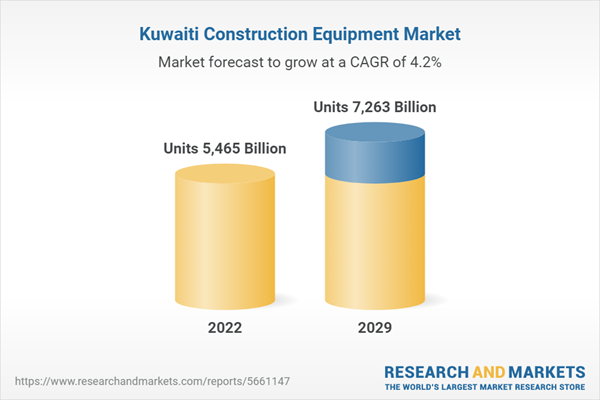

- How big is the Kuwait construction equipment market?

- What is the growth rate of the Kuwait construction equipment market?

- Who are the key players in the Kuwait construction equipment market?

- What are the trends in the Kuwait construction equipment industry?

- Which are the major distributor companies in the Kuwait construction equipment market?

Table of Contents

Companies Mentioned

- Caterpillar

- Komatsu

- Xuzhou Construction Machinery Group Co. Ltd. (XCMG)

- Liebherr

- Volvo Construction Equipment

- Hitachi Construction Machinery

- Zoomlion Heavy Industry Science & Technology Co. Ltd

- JCB

- SANY

- Hyundai Construction Equipment

- Kobelco

- Liu Gong

- Tadano

- CNH Industrial

- Terex Corporation

- SDLG

- MERLO Group

- Alghanim Equipment

- Emdad Equipment &Oil Field Supplier

- Arab Group for Equipment and Construction (AGECO)

- Mohamed Abdulrahman Al-Bahar

- EQUIP

- RIHAM

- Boodai Trading Company Ltd. W.L.L.

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | August 2023 |

| Forecast Period | 2022 - 2029 |

| Estimated Market Value ( Units | Units 5465 Billion |

| Forecasted Market Value ( Units | Units 7263 Billion |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Kuwait |

| No. of Companies Mentioned | 24 |