Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, future market expansion faces significant hurdles due to a global policy pivot favoring Battery Electric Vehicles (BEVs). Governments are increasingly implementing strict zero-emission mandates that often exclude standard hybrids from the lucrative financial incentives available to plug-in technologies. This regulatory landscape, combined with the automotive sector's long-term dedication to total electrification, threatens to limit the potential of the HEV market as manufacturers reallocate capital toward fully electric architectures to ensure future compliance standards are met.

Market Drivers

A key catalyst for market growth is the strategic expansion of hybrid portfolios by major automotive OEMs, reflecting a pragmatic industry shift that balances immediate carbon reduction with profitability. Manufacturers are increasingly treating hybrid architectures as a long-term bridge rather than a temporary stopgap, responding to slowing demand for fully electric models. By enhancing hybrid production capacities and diversifying lineups, automakers leverage the technology's lower manufacturing costs and higher profit margins compared to battery-electric counterparts; for instance, Toyota Motor Corporation reported in January 2025 that its global hybrid sales for the full year 2024 rose by 21 percent to 4.14 million units, highlighting the commercial success of this strategy.Furthermore, the ability of hybrids to mitigate range anxiety significantly influences consumer adoption, positioning them as the preferred low-emission choice for buyers wary of charging logistics. By eliminating reliance on underdeveloped public charging infrastructure while offering superior fuel economy, hybrids effectively address the concerns that hinder pure electric vehicle uptake. This preference has secured a strong market position globally; the European Automobile Manufacturers’ Association noted in January 2025 that hybrids claimed a 30.9 percent share of the 2024 EU car market, ranking second only to petrol, while Ford Motor Company reported a 38 percent surge in U.S. hybrid sales during the third quarter of 2024, confirming robust demand.

Market Challenges

The aggressive global policy shift favoring Battery Electric Vehicles (BEVs) poses a major obstacle to the growth of the Global Hybrid Electric Vehicle (HEV) Market. Governments are increasingly enforcing zero-emission mandates that exclude standard hybrids from financial incentives, thereby distorting market dynamics. This regulatory framework compels automotive manufacturers to divert substantial capital away from hybrid powertrains to meet stringent compliance targets for fully electric architectures, consequently constraining the availability and competitiveness of new hybrid models as the industry prioritizes long-term legislative goals over immediate transitional benefits.This policy-induced disparity is particularly visible in markets with strict electrification quotas. For example, the Society of Motor Manufacturers and Traders reported that in September 2024, Battery Electric Vehicle registrations in the United Kingdom surged by 24.4 percent due largely to fleet mandates, whereas the Hybrid Electric Vehicle segment saw only modest growth of 2.6 percent. Such data demonstrates how regulatory mechanisms effectively channel supply and demand toward fully electric options, impeding the organic growth potential of the hybrid market despite continuing consumer interest in the technology.

Market Trends

The resurgence of Plug-in Hybrid Electric Vehicles (PHEVs) in key markets indicates a shift where the technology is being viewed as a primary growth engine rather than merely a transitional phase. In regions like China, renewed engineering focus is enhancing PHEVs to offer extended electric-only ranges that comply with zero-emission zones while maintaining long-distance utility, positioning them as a superior alternative to battery electric vehicles where infrastructure is developing. This trend is validated by data from the China Association of Automobile Manufacturers, which reported in January 2025 that plug-in hybrid sales in China surged by 70.9 percent year-on-year in December 2024, reaching 622,000 units.Concurrently, the integration of hybrid powertrains into SUV and pickup truck segments marks a strategic move to decarbonize the industry’s heaviest and most profitable vehicle categories. Automakers are deploying high-torque hybrid systems in large trucks to meet strict fuel economy standards without compromising the towing capacity and payload performance essential for commercial users, thereby ensuring the viability of large-displacement models under regulatory pressure. This segment-specific growth is highlighted by Ford Motor Company’s January 2025 report, which announced that its U.S. hybrid truck sales increased by 40 percent in 2024 to total 187,426 units.

Key Players Profiled in the Hybrid Electric Vehicle (HEV) Market

- Toyota Motor

- Honda Motor

- Hyundai Motor

- Kia Corporation

- Ford Motor

- General Motors

- Nissan Motor

- BMW AG

- Mercedes-Benz Group

- Stellantis NV

Report Scope

In this report, the Global Hybrid Electric Vehicle (HEV) Market has been segmented into the following categories:Hybrid Electric Vehicle (HEV) Market, by Hybridization Type:

- MHEV

- FHEV

Hybrid Electric Vehicle (HEV) Market, by Vehicle Type:

- PC

- LCV

- M&HCV

Hybrid Electric Vehicle (HEV) Market, by Powertrain:

- Parallel Hybrid

- Series-Parallel Hybrid

- Series Hybrid

Hybrid Electric Vehicle (HEV) Market, by Propulsion:

- Diesel Hybrid

- Petrol Hybrid

Hybrid Electric Vehicle (HEV) Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Hybrid Electric Vehicle (HEV) Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Hybrid Electric Vehicle market report include:- Toyota Motor

- Honda Motor

- Hyundai Motor

- Kia Corporation

- Ford Motor

- General Motors

- Nissan Motor

- BMW AG

- Mercedes-Benz Group

- Stellantis NV

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

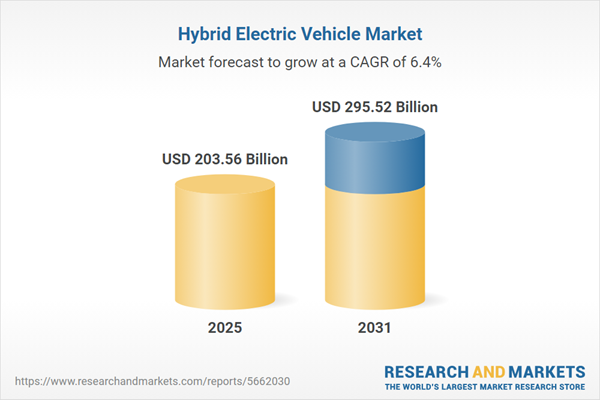

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 203.56 Billion |

| Forecasted Market Value ( USD | $ 295.52 Billion |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |