Speak directly to the analyst to clarify any post sales queries you may have.

An authoritative orientation to the forces reshaping the surface water sports equipment ecosystem that sets the strategic context for product, channel, and regulatory decisions

This introduction frames the contemporary surface water sports equipment environment by identifying the driving forces reshaping product development, distribution pathways, and end-user expectations. Over recent years, steady innovation in materials and manufacturing techniques has intersected with evolving consumer behaviors-heightened environmental awareness, demand for experiential recreation, and digital-first purchasing habits-creating a landscape where agility and differentiation are now prerequisites for competitive resilience.

Consequently, stakeholders from designers to retailers are adapting their value propositions to reflect faster product cycles, modular equipment offerings, and increased emphasis on safety certification and performance validation. Furthermore, the compression of global supply chains into more regionally concentrated networks has influenced lead times and cost structures, prompting firms to rethink inventory strategies and supplier partnerships. Through this lens, the introduction sets up the remainder of the analysis by underscoring three foundational themes that recur across subsequent sections: the centrality of product segmentation and how it governs go-to-market choices, the systemic effects of trade measures and regulatory shifts on sourcing and pricing, and the strategic imperatives for companies to align innovation with distribution and end-user needs.

Taken together, these themes establish a pragmatic starting point for executives and managers who must balance near-term operational adjustments with longer-term investments in brand, technology, and channel capabilities. The introduction therefore functions as both orientation and call to prioritize integrated strategies that bridge product, channel, and regulatory considerations.

A comprehensive assessment of transformative technological, behavioral, and distributional shifts altering competitive dynamics and strategic priorities across the sector

The landscape for surface water sports equipment is undergoing transformative shifts driven by converging technological, behavioral, and regulatory trends that reshape competitive dynamics and value chains. Advances in composite materials, lighter fabrics, and digital design tools are enabling product differentiation across categories from boards to safety equipment, while parallel developments in sensor integration and digital services are opening post-sale engagement opportunities that extend revenue beyond the physical product.

At the same time, consumer preferences have migrated toward experiential and sustainable offerings, with a growing segment of buyers prioritizing eco-conscious materials and traceable supply chains. As a result, manufacturers are accelerating investments in circular design, recyclable materials, and certification programs that can be leveraged as a marketable attribute. Furthermore, distribution is being reconfigured by accelerated e-commerce adoption and omnichannel models that blend direct sales, online retail, and specialty retailer experiences to capture both convenience-driven consumers and performance-oriented buyers.

Finally, competitive landscapes are shifting as smaller agile brands disrupt incumbents with niche positioning while larger firms consolidate distribution and channel partnerships to secure shelf space and online visibility. Together, these forces make agility, supply chain transparency, and integrated product-service propositions the most effective levers for capturing growth and insulating margins amid rising input and logistics pressures.

An evidence-based analysis of how tariff measures through 2025 have reshaped sourcing, pricing, and supply chain strategies with long-term implications for competitive positioning

The cumulative impact of tariff actions enacted through 2025 has materially influenced sourcing strategies, pricing behavior, and supply chain design within the surface water sports equipment sector, and firms have responded with a mix of tactical and structural adjustments. Initially, tariff pressure prompted immediate cost pass-through attempts, operational rebalancing, and renegotiations with suppliers to preserve price competitiveness. Over time, these pressures catalyzed more strategic responses, including supplier diversification, increased use of regional manufacturing hubs, and a renewed focus on value engineering to maintain product attributes while limiting input cost exposure.

Moreover, tariffs have amplified the importance of total landed cost analysis rather than unit price alone, encouraging procurement teams to reassess freight routing, inventory buffers, and currency hedging practices. As firms pursued nearshoring and regionalization to mitigate tariff risk, they also encountered trade-offs in labor costs, production capacity, and technical capability availability, which in turn drove selective investment in automation and process optimization. In regulated product categories-such as safety equipment where compliance is non-negotiable-companies prioritized maintaining certification continuity even when shifting production footprints, which required additional coordination and validation efforts.

In addition, tariffs have precipitated competitive repositioning where brands with stronger direct-to-consumer channels were better able to absorb and explain price adjustments, while those reliant on multi-tiered distribution networks faced higher friction. Consequently, strategic choices around channel mix, contract terms, and inventory management became critical to preserving market access and customer loyalty as policy-driven cost volatility persisted through 2025.

Granular segmentation analysis revealing how product, sport, distribution, end-user, and price dimensions intersect to shape distinct strategic priorities and commercial models

Key segmentation insights reveal how product, sport, distribution, end-user, and price dimensions interact to create differentiated commercial dynamics across the surface water sports equipment space. Based on product type, categories such as Accessories, Apparel, Boards, Safety Equipment, and Watercraft exhibit distinct innovation cycles and margin profiles, with Boards further subdivided into Kiteboard, Stand Up Paddleboard, Surfboard, and Wakeboard each catering to specific performance expectations and manufacturing techniques. Transitioning to sport type, the market encompasses Canoeing, Diving, Kayaking, Kiteboarding, Stand Up Paddleboarding, Surfing, and Wakeboarding; within these, Canoeing's subcategories of Recreational Canoe, Touring Canoe, and Whitewater Canoe, Diving's split into Scuba Gear and Snorkeling Gear, and Kayaking's classification into Inflatable Kayak, Sit In Kayak, and Sit On Top Kayak reflect varying durability, certification, and accessory requirements that dictate both product design and aftercare services.

When viewed through distribution channels, differences emerge between Direct Sales, Online Retail, Specialty Retailer, and Sporting Goods Store strategies, with each channel exhibiting unique customer engagement models and margin structures that influence pricing, promotion, and inventory decisions. End-user segmentation across Educational Institution, Professional, Recreational, and Rental Company highlights demand drivers that range from institutional procurement cycles and certification standards to recreational buyers’ preference for convenience and rental firms’ need for rugged, serviceable equipment. Finally, price range segmentation among Economy, Mid Segment, and Premium underscores how perceived value, brand positioning, and feature sets determine willingness to pay and influence go-to-market tactics. Integrating these segmentation lenses enables manufacturers and distributors to tailor product portfolios, channel investments, and service offerings to maximize relevance across customer cohorts.

A regional assessment of how demand patterns, manufacturing capabilities, and regulatory environments across key geographies shape differentiated go-to-market strategies

Regional dynamics present differentiated opportunities and constraints that influence product design, distribution strategy, and regulatory compliance across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, demand patterns often reflect a mature mix of recreational and performance-driven users, with well-established specialty retail networks and growing direct-to-consumer channels that emphasize experiential marketing and localized product assortments. By contrast, Europe, Middle East & Africa combines high regulatory scrutiny and strong sustainability expectations in parts of Europe with rapidly developing leisure markets in other regions, requiring flexible go-to-market approaches and region-specific certification strategies.

Asia-Pacific functions as both a major manufacturing base and a fast-evolving consumer market, presenting dual considerations: on one hand, proximity to key suppliers and cost-effective manufacturing capabilities; on the other, rising domestic consumption and a growing premium segment that increasingly seeks higher-specification boards and safety gear. Across these regions, seasonal demand patterns, logistical corridor constraints, and differing import regimes necessitate nuanced inventory strategies and localized marketing. Consequently, companies that align product assortments, channel priorities, and compliance processes with regional consumer behavior and regulatory frameworks will be better positioned to capture durable value. In addition, cross-regional coordination in product launches and supply planning can mitigate the risk of stock imbalances and optimize global revenue capture.

An insight-driven look at corporate strategies that differentiate leaders through innovation, channel orchestration, and operational resilience across the industry

Key company insights emphasize the strategic moves that differentiate market leaders from challengers in product innovation, channel orchestration, and operational resilience. Market-leading firms typically demonstrate an integrated approach that combines sustained investment in product engineering, a disciplined distribution strategy blending direct sales with selective retail partnerships, and robust supply chain governance that anticipates trade and regulatory shifts. These capabilities enable premium tier offerings to command higher margins while allowing midsegment and economy brands to focus on scale, cost optimization, and broad channel reach.

Conversely, emerging brands often compete through niche specialization-whether by mastering a specific sport segment such as kiteboarding, offering superior rental-friendly durability for institutional partners, or delivering digitally enabled services that deepen post-sale engagement. Strategic partnerships, licensing deals for technology or materials, and targeted acquisitions are common tactics used to fill capability gaps quickly. Operationally, leading companies invest in demand sensing, flexible manufacturing arrangements, and lifecycle services such as maintenance programs to extend customer relationships and create recurring revenue flows. Ultimately, companies that balance long-term R&D commitments with pragmatic channel execution and supply chain adaptability will be best equipped to sustain competitive differentiation as external pressures evolve.

Practical, actionable recommendations that align product modularity, channel optimization, diversified sourcing, and sustainability commitments to mitigate risk and drive growth

Actionable recommendations for industry leaders focus on practical levers to strengthen competitiveness while managing exposure to trade, supply chain, and channel disruptions. First, firms should prioritize modular product architectures and material standardization to enable rapid cost and performance trade-offs without compromising certification or safety standards. This approach supports faster iteration and smoother production transitions across alternative manufacturing partners. Second, firms must recalibrate distribution strategies to balance direct-to-consumer investments with enduring retail partnerships, ensuring that premium experiences and aftermarket services remain accessible while maintaining scale through broader retail presence.

Third, procurement and sourcing teams should institutionalize total landed cost frameworks and diversify supplier portfolios across multiple regions to reduce concentration risk; where tariffs or trade policy create cost pressure, selectively nearshoring critical components may preserve lead times and improve responsiveness. Fourth, companies should invest in data-driven demand planning and digital customer engagement tools to optimize inventory turns and enhance lifetime customer value. Fifth, sustainability and certification should be integrated into product roadmaps as differentiators rather than compliance burdens, with transparent messaging that resonates with eco-conscious consumers. Lastly, executive leadership should formalize scenario planning and rapid-response playbooks to navigate policy changes and logistics disruptions, including contractual terms with distributors that allow for dynamic pricing, promotions, and inventory reallocation. Implementing these recommendations in a coordinated manner will help organizations convert disruption into strategic opportunity.

A transparent, practitioner-grounded research methodology combining interviews, regulatory and technical review, cross-segmentation mapping, and scenario analysis for robust strategic insight

The research methodology underpinning this analysis combined qualitative and quantitative techniques to construct a rigorous, replicable understanding of the surface water sports equipment landscape. Primary insights were gathered through structured interviews with industry practitioners spanning product development, procurement, retail management, and institutional procurement to capture firsthand perspectives on supply chain dynamics, channel behavior, and end-user needs. Secondary inputs included regulatory guidance, technical standards for safety equipment, and publicly available company disclosures to contextualize firm-level strategies and compliance obligations.

Analytical methods included cross-segmentation mapping to understand how product categories interact with sport types, distribution channels, end-user needs, and price tiers, along with scenario analysis to assess the operational implications of tariff and trade-policy changes. Validation steps involved triangulating interview findings with observable market behaviors-such as retail assortments, product specifications, and distribution footprints-to ensure consistency and to surface practical trade-offs faced by decision-makers. Where appropriate, sensitivity testing was applied to examine the resilience of key strategic options under different cost and logistics scenarios. The resulting methodology yields actionable insights that are grounded in practitioner experience and corroborated by public-domain evidence, thereby supporting robust strategic decision-making.

A concluding synthesis highlighting the strategic intersection of innovation, segmentation, distribution, and policy as the blueprint for sustained competitiveness and resilience

In conclusion, the surface water sports equipment sector is at an inflection point where product innovation, distribution evolution, and policy shifts are jointly redefining strategic imperatives for manufacturers, distributors, and service providers. The interplay between material and design advances, rising consumer expectations for sustainability and experience, and the operational impacts of trade measures requires organizations to be both nimble and deliberate. Companies that adopt modular product strategies, diversify sourcing footprints, and strengthen channel integration will be better positioned to capture value and navigate episodic disruptions.

Moreover, aligning product development with distinct segmentation needs-across product type and sport type, through nuanced channel strategies, and by addressing end-user-specific requirements-will be critical to driving relevance and loyalty. Regional nuances across the Americas, Europe, Middle East & Africa, and Asia-Pacific further underscore the need for localized approaches that harmonize global standards with market-level consumer behaviors. Ultimately, sustained competitiveness will rely on the capacity to integrate operational excellence with strategic foresight, enabling firms to turn uncertainty into an impetus for disciplined innovation and enduring customer value.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China Surface Water Sports Equipment Market

Companies Mentioned

The key companies profiled in this Surface Water Sports Equipment market report include:- AIRE Inc.

- Airhead by Aqua-Leisure Recreation, LLC

- Akona Adventure Gear

- Allen Brothers

- Aqua Marina

- BeachBox

- BELASSI GmbH

- Bhawna Engineering Works

- Blue Wave Products, Inc.

- Body Glove

- BomBoard

- Cyclops Marine Limited

- HO Sports

- Imagine Surf

- O'Brien Watersports

- Rave Sports by Escalade Inc.

- Solstice Sports

- SRR Aqua

- ThunderMonkey

- Vanguard Inflatables

- Wing Inflatables

- WOW Watersports

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 195 |

| Published | January 2026 |

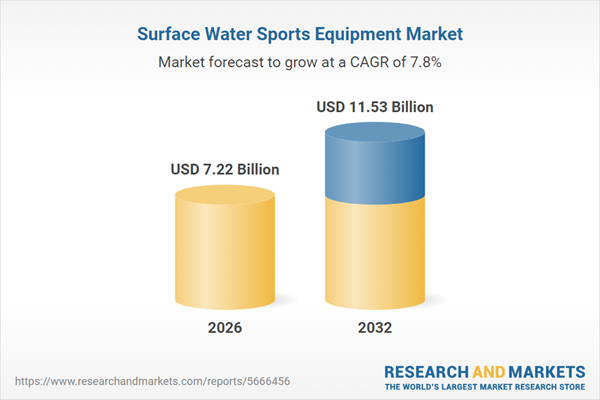

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 7.22 Billion |

| Forecasted Market Value ( USD | $ 11.53 Billion |

| Compound Annual Growth Rate | 7.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 23 |