Increasing Popularity of Personalized Medicine Bolsters Middle East & Africa Genotyping Market

According to the National Health Service of England, personalized medicine is the medical treatment tailored to the unique traits of each patient. The method is based on scientific advancements that provide an understanding of a person's unique genetic and molecular profile that contributes to their susceptibility to diseases as well as helps determine the safest and most effective medical treatments. Genomic medicine, guided by each person's unique genetic, clinical, and environmental information, is a fundamental component of personalized medicine. The fundamentals of personalized medicine involve the standardization, development, and integration of various essential tools into health systems and clinical workflows for the whole-genome studies of transcription, sequence variation, proteins, and metabolites. Health risk assessment, family health history, and clinical decision assistance for complex risk and predictive information are combined with genomic data to detect individual risks and guide clinical treatment, laying the groundwork for a more informed and effective patient care approach.DNA-based risk assessment for common complex diseases, genome-guided therapy, dose selection, and molecular signatures for cancer diagnosis and prognosis are examples of genome information has already enabled personalized health care. The integration of personalized medicine with healthcare can aid in more precise diagnoses, enable the prediction of disease risk before the occurrence of symptoms and provide individualized treatment plans with maximum safety and efficiency. Genotype data can be utilized as a guideline to determine the correct warfarin dose. The Clinical Pharmacogenetics Implementation Consortium has developed genotype-based drug guidelines to assist physicians in optimizing pharmacological therapies based on genetic test results. Genomic analysis of tumors can help tailor therapeutic approaches for treating individuals with hereditary cancer.

Although scientific discoveries related to personalized medicine are making their way from labs to clinics, the widespread acceptance of personalized medicine necessitates significant changes in regulatory, reimbursement procedures, and legislative privacy laws for rapid adoption of these medicines. Thus, increasing awareness and popularity of personalized medicine due to ongoing research and use of genome editing techniques is expected to act as a trend for growth of the genotyping market.

Middle East & Africa Genotyping Market Overview

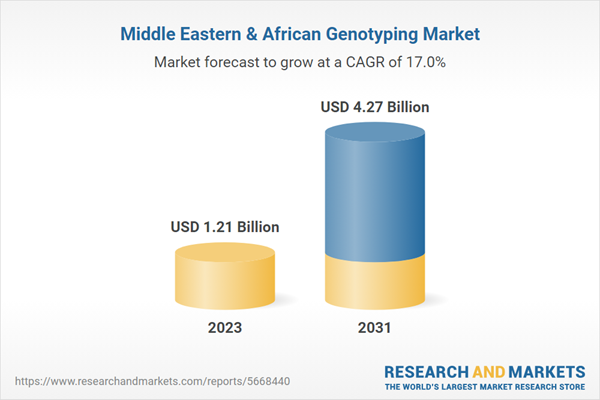

The genotyping market growth in the Middle East & Africa is attributed to factors such as significant advancements in healthcare facilities, the high adoption rate of robotics in therapy, and geographic expansion efforts by market players. Moreover, the rising incidence of cancer, growing investments in the healthcare sector from several private and government institutions and increasing collaborations with hospitals from developed regions are expected to boost the genotyping market growth in the Middle East & Africa during the forecast period.Middle East & Africa Genotyping Market Revenue and Forecast to 2031 (US$ Million)

Middle East & Africa Genotyping Market Segmentation

The Middle East & Africa genotyping market is categorized into product type, technology, application, end user, and country.Based on product type, the Middle East & Africa genotyping market is segmented into instruments, reagents and kits, bioinformatics, and genotyping services. The reagents and kits segment held the largest market share in 2023.

By technology, the Middle East & Africa genotyping market is segmented into microarrays, capillary electrophoresis, sequencing, polymerase chain reaction (PCR), matrix-assisted laser desorption / MALDI-TOF, and other technologies. The polymerase chain reaction (PCR) segment held the largest market share in 2023.

Based on application, the Middle East & Africa genotyping market is bifurcated into pharmacogenomics, diagnostics and personalized medicine, animal genetics, agricultural biotechnology, and other applications. The diagnostics and personalized medicine segment held the largest market share in 2023.

In terms of end user, the Middle East & Africa genotyping market is bifurcated into pharmaceutical and biopharmaceutical companies, diagnostic and research laboratories, academic institutes, and other end users. The pharmaceutical and biopharmaceutical companies segment held the largest market share in 2023.

By country, the Middle East & Africa genotyping market is segmented into Saudi Arabia, South Africa, the UAE, and the Rest of Middle East & Africa. Saudi Arabia dominated the Middle East & Africa genotyping market share in 2023.

Hoffmann-La Roche Ltd, QIAGEN NV, Merck KGaA, Thermo Fisher Scientific Inc, BioTek Instruments Inc, Illumina Inc, Danaher Corp, Bio-Rad Laboratories Inc, GE HealthCare Technologies Inc, Standard BioTools Inc, Laboratory Corp of America Holdings, Beckman Coulter Inc, BGI, Takara Bio Inc, and DiaSorin SpA. are among the leading companies operating in the Middle East & Africa genotyping market.

Reasons to Buy

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the Middle East & Africa genotyping market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the Middle East & Africa genotyping market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth Middle East & Africa market trends and outlook coupled with the factors driving the Middle East & Africa genotyping market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution.

Table of Contents

Companies Mentioned

- Hoffmann-La Roche Ltd.

- QIAGEN NV.

- Merck KGaA.

- Thermo Fisher Scientific Inc.

- BioTek Instruments, Inc.

- Illumina Inc.

- Danaher Corp.

- Bio-Rad Laboratories Inc.

- GE HealthCare Technologies Inc.

- Standard BioTools Inc.

- Laboratory Corp of America Holdings.

- Beckman Coulter Inc.

- BGI.

- Takara Bio Inc.

- DiaSorin SpA.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 151 |

| Published | December 2024 |

| Forecast Period | 2023 - 2031 |

| Estimated Market Value ( USD | $ 1.21 Billion |

| Forecasted Market Value ( USD | $ 4.27 Billion |

| Compound Annual Growth Rate | 17.0% |

| Regions Covered | Africa, Middle East |

| No. of Companies Mentioned | 15 |