Technological Advancements and Rising R&D Investments in Biotechnology and Pharmaceutical Industry Drives Europe Genotyping Market

Genotyping market players are focusing on increasing their investments in projects aimed at advancements in biotechnology to come up with better alternatives to conventional techniques.In January 2024, Thermo Fisher Scientific launched Axiom PangenomiX Array, offering optimal genetic coverage for pharmacogenomic research and population-scale disease studies. This array is currently the only research solution that can run four assays in one test: SNP genotyping, complete genome copies number variant detection, fixed copy number discovery, and blood and HLA typing. In September 2023, Bio-Rad launched new PTC Tempo 48/48 and PTC Tempo 384 thermal cyclers for sequencing, cloning, and genotyping. The PTC Tempo thermal cyclers are built with an intuitive user interface and flexible connectivity features to streamline protocol management, along with monitoring capabilities on the cloud platform. In January 2023, Qiagen acquired Verogen, a company that uses next-generation sequencing (NGS) techniques to drive the future of forensic investigation and human identification (HID). QIAGEN and Verogen together are expected to create opportunities to help researchers advance forensic science, thereby aiding accurate suspect identification, finding missing persons, and exonerating innocent individuals. In June 2022, NRGene launched Soy SNPro, a product covered under predesigned SNP sets for genotyping (DNA tests) of various crops. SNPro is an off-the-shelf complete genotyping solution that combines low-density genotyping with high-density imputation. In May 2022, NEOGEN Corporation and Gencove announced the launch of InfiniSEEK, an innovative and cost-effective solution for addressing difficulties involved in whole-genome sequencing and targeted SNP analyses. Such technological breakthroughs have the potential to enable miniaturization, automation, and cost reduction. They can also aid in operational flexibility and multiparameter testing. All these benefits add to the uses and convenience of DNA sequencing, allowing clinicians to concentrate on higher-level decisions such as selecting and prioritizing therapeutic targets through various genotyping studies. Further, technological advancements in DNA sequencing, such as NGS, have enabled speedy, accurate sequencing, allowing for great productivity. Thus, the growing research and development activities, along with increasing government funding for genome-based projects, contribute to the genotyping market progress.

Europe Genotyping Market Overview

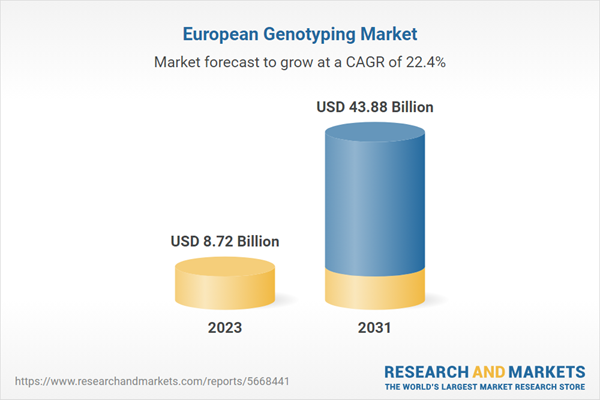

The Europe genotyping market is segmented into Germany, the UK, France, Italy, Spain, and the Rest of Europe. The region holds the second-largest share of the global genotyping market and is expected to register a notable CAGR during the forecast period. Factors such as technological advancements, reducing prices of DNA sequencing procedures, increasing incidence of genetic diseases, and rising awareness of personalized medicine are among the factors aiding the growth of the Europe genotyping market.Europe Genotyping Market Revenue and Forecast to 2031 (US$ Million)

Europe Genotyping Market Segmentation

The Europe genotyping market is categorized into product type, technology, application, end user, and country.Based on product type, the Europe genotyping market is segmented into instruments, reagents and kits, bioinformatics, and genotyping services. The reagents and kits segment held the largest market share in 2023.

By technology, the Europe genotyping market is segmented into microarrays, capillary electrophoresis, sequencing, polymerase chain reaction (PCR), matrix-assisted laser desorption / MALDI-TOF, and other technologies. The polymerase chain reaction (PCR) segment held the largest market share in 2023.

Based on application, the Europe genotyping market is bifurcated into pharmacogenomics, diagnostics and personalized medicine, animal genetics, agricultural biotechnology, and other applications. The diagnostics and personalized medicine segment held the largest market share in 2023.

In terms of end user, the Europe genotyping market is bifurcated into pharmaceutical and biopharmaceutical companies, diagnostic and research laboratories, academic institutes, and other end users. The pharmaceutical and biopharmaceutical companies segment held the largest market share in 2023.

By country, the Europe genotyping market is segmented into the UK, Germany, France, Spain, Italy, and the Rest of Europe. Germany dominated the Europe genotyping market share in 2023.

Hoffmann-La Roche Ltd, QIAGEN NV, Merck KGaA, EUROFINS GENOMICS, Thermo Fisher Scientific Inc, BioTek Instruments Inc, Illumina Inc, Danaher Corp, Bio-Rad Laboratories Inc, GE HealthCare Technologies Inc, Standard BioTools Inc, Laboratory Corp of America Holdings, Beckman Coulter Inc, BGI, Takara Bio Inc, and DiaSorin SpA. are some of the leading companies operating in the Europe genotyping market.

Reasons to Buy

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the Europe genotyping market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the Europe genotyping market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth Europe market trends and outlook coupled with the factors driving the Europe genotyping market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution.

Table of Contents

Companies Mentioned

- Hoffmann-La Roche Ltd.

- QIAGEN NV.

- Merck KGaA.

- EUROFINS GENOMICS.

- Thermo Fisher Scientific Inc.

- BioTek Instruments, Inc.

- Illumina Inc.

- Danaher Corp.

- Bio-Rad Laboratories Inc.

- GE HealthCare Technologies Inc.

- Standard BioTools Inc.

- Laboratory Corp of America Holdings.

- Beckman Coulter Inc.

- BGI.

- Takara Bio Inc.

- DiaSorin SpA.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 156 |

| Published | December 2024 |

| Forecast Period | 2023 - 2031 |

| Estimated Market Value ( USD | $ 8.72 Billion |

| Forecasted Market Value ( USD | $ 43.88 Billion |

| Compound Annual Growth Rate | 22.4% |

| Regions Covered | Europe |

| No. of Companies Mentioned | 16 |