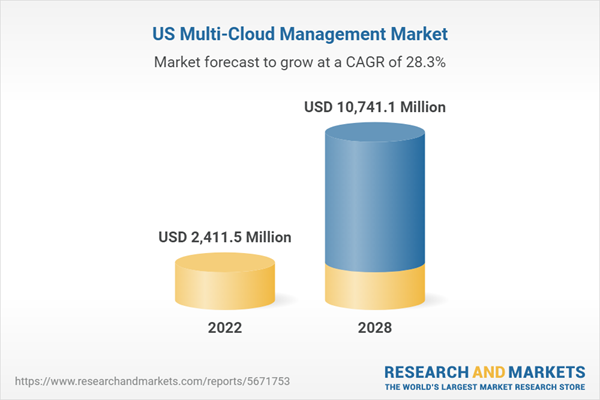

The US multi-cloud management market size is expected to grow from US$ 2,411.5 million in 2022 to US$ 10,741.1 million by 2028. The US multi-cloud management market size is expected to grow at a CAGR of 28.3% from 2022 to 2028.

According to most big data experts, the amount of data generated in the US is expected to increase dramatically during the forecast period. Seagate's Data Age 2025 report estimates that the amount of data generated globally will reach 175 zettabytes by 2025. The massive rise in people working, studying, and spending time at home is responsible for the mounting data. Since data-driven business models will be widely used in the future, the companies' main goal will be to secure this data. To store, compute, and analyze the data generated will require a large storage space which can be fulfilled by deploying the data on the cloud. Therefore, the transition by the companies to store data from on-premises servers to the cloud infrastructure will open profitable opportunities for the providers of multi-cloud management systems.

Furthermore, introducing new platforms, business apps, trends, such as bring-your-own-device (BYOD) and choose-your-own-device (CYOD), and other technologies are likely to make the IT infrastructure more complex and heterogeneous in the coming years. Due to quick advancements in mobile computing, BYOD and CYOD trends are spreading throughout business settings. Hence, employees may now access organizational data via mobile devices anytime, increasing productivity, and ensuring that organizational data is secured and kept confidential.

In 2022, according to statistics from World Backup Day, 10% of computers are infected by viruses each month, and 30% of people never back up their data. Moreover, mishaps, such as staff members erasing data that was not backup elsewhere, account for 29% of disasters. Ransomware is another problem that has grown over the past few years. Getting crucial operating data locked up can be disastrous if one cannot access recent backups kept in a different location. According to the 2019 threats report from McAfee Labs, there were 118% more ransomware assaults in the first 3 months of that year compared to the same period in 2018.

New malware are continuously being identified. The risk of cyberattacks exists for all businesses, including large, small, and medium-sized ones. Data breaches in the first half of 2018 were 140% more frequent than they were at the same time in 2017, according to Gemalto (a digital security business). After a service outage, disaster recovery is an organization's procedure to restart regular operations. Multiple clouds might be used by companies that offer disaster recovery services. A strategy to lower the risk of service availability failures, data loss, and compromised privacy is to use at least two clouds or more. Using several clouds at once might reduce the risk when using a public cloud for apps and data.

Cost, security, and control loss are the most frequent obstacles to cloud adoption. A business can choose which workloads to run and where to run them by utilizing a multi-cloud infrastructure, which gives it more flexibility and control. Thus, the disaster recovery flexibility offered by multi-cloud management is contributing to the multi-cloud management market.

The multi-cloud management market is segmented by component, deployment, application, verticals, and geography. US multi-cloud management market analysis by component, the multi-cloud management market is segmented into solution and service. The solution segment led the multi-cloud management market with a larger multi-cloud management market share in 2021. In terms of deployment, the multi-cloud management market is bifurcated into public cloud and private cloud. The public cloud segment led the market with a larger multi-cloud management market share in 2021. US multi-cloud management market analysis by application, the market is segmented into infrastructure and resource management, identity and policy management, compliance management, metering and billing, and provisioning and lifecycle management. The infrastructure and resource management segment led the market with the largest multi-cloud management market share in 2021. Based on verticals, the market is segmented into IT & Telecom, BFSI, government, retail & consumer goods, travel & hospitality, healthcare & life science, and others.

The US multi-cloud management market has been derived using primary and secondary sources. Exhaustive secondary research has been conducted using internal and external sources to obtain qualitative and quantitative information related to the market. The process also obtains an overview and forecast for the US multi-cloud management market concerning all the segments. Also, primary interviews were conducted with industry participants and commentators to validate data and gain more analytical insights into the topic. This process includes industry experts, such as VPs, business development managers, market intelligence managers, national sales managers, external consultants, valuation experts, research analysts, and key opinion leaders specializing in the US market.

A few leading players operating in the US multi-cloud management market are BMC Software, Inc.; Cisco Systems, Inc.; Flexera; International Business Machines Corporation; Micro Focus International plc; Zerto Ltd.; VMware, Inc.; Snow Software, Inc.; UnityOneCloud; and Dynatrace, Inc.

According to most big data experts, the amount of data generated in the US is expected to increase dramatically during the forecast period. Seagate's Data Age 2025 report estimates that the amount of data generated globally will reach 175 zettabytes by 2025. The massive rise in people working, studying, and spending time at home is responsible for the mounting data. Since data-driven business models will be widely used in the future, the companies' main goal will be to secure this data. To store, compute, and analyze the data generated will require a large storage space which can be fulfilled by deploying the data on the cloud. Therefore, the transition by the companies to store data from on-premises servers to the cloud infrastructure will open profitable opportunities for the providers of multi-cloud management systems.

Furthermore, introducing new platforms, business apps, trends, such as bring-your-own-device (BYOD) and choose-your-own-device (CYOD), and other technologies are likely to make the IT infrastructure more complex and heterogeneous in the coming years. Due to quick advancements in mobile computing, BYOD and CYOD trends are spreading throughout business settings. Hence, employees may now access organizational data via mobile devices anytime, increasing productivity, and ensuring that organizational data is secured and kept confidential.

In 2022, according to statistics from World Backup Day, 10% of computers are infected by viruses each month, and 30% of people never back up their data. Moreover, mishaps, such as staff members erasing data that was not backup elsewhere, account for 29% of disasters. Ransomware is another problem that has grown over the past few years. Getting crucial operating data locked up can be disastrous if one cannot access recent backups kept in a different location. According to the 2019 threats report from McAfee Labs, there were 118% more ransomware assaults in the first 3 months of that year compared to the same period in 2018.

New malware are continuously being identified. The risk of cyberattacks exists for all businesses, including large, small, and medium-sized ones. Data breaches in the first half of 2018 were 140% more frequent than they were at the same time in 2017, according to Gemalto (a digital security business). After a service outage, disaster recovery is an organization's procedure to restart regular operations. Multiple clouds might be used by companies that offer disaster recovery services. A strategy to lower the risk of service availability failures, data loss, and compromised privacy is to use at least two clouds or more. Using several clouds at once might reduce the risk when using a public cloud for apps and data.

Cost, security, and control loss are the most frequent obstacles to cloud adoption. A business can choose which workloads to run and where to run them by utilizing a multi-cloud infrastructure, which gives it more flexibility and control. Thus, the disaster recovery flexibility offered by multi-cloud management is contributing to the multi-cloud management market.

The multi-cloud management market is segmented by component, deployment, application, verticals, and geography. US multi-cloud management market analysis by component, the multi-cloud management market is segmented into solution and service. The solution segment led the multi-cloud management market with a larger multi-cloud management market share in 2021. In terms of deployment, the multi-cloud management market is bifurcated into public cloud and private cloud. The public cloud segment led the market with a larger multi-cloud management market share in 2021. US multi-cloud management market analysis by application, the market is segmented into infrastructure and resource management, identity and policy management, compliance management, metering and billing, and provisioning and lifecycle management. The infrastructure and resource management segment led the market with the largest multi-cloud management market share in 2021. Based on verticals, the market is segmented into IT & Telecom, BFSI, government, retail & consumer goods, travel & hospitality, healthcare & life science, and others.

The US multi-cloud management market has been derived using primary and secondary sources. Exhaustive secondary research has been conducted using internal and external sources to obtain qualitative and quantitative information related to the market. The process also obtains an overview and forecast for the US multi-cloud management market concerning all the segments. Also, primary interviews were conducted with industry participants and commentators to validate data and gain more analytical insights into the topic. This process includes industry experts, such as VPs, business development managers, market intelligence managers, national sales managers, external consultants, valuation experts, research analysts, and key opinion leaders specializing in the US market.

A few leading players operating in the US multi-cloud management market are BMC Software, Inc.; Cisco Systems, Inc.; Flexera; International Business Machines Corporation; Micro Focus International plc; Zerto Ltd.; VMware, Inc.; Snow Software, Inc.; UnityOneCloud; and Dynatrace, Inc.

Table of Contents

1. Introduction

3. Research Methodology

4. US Multi-Cloud Management Market Landscape

5. US Multi-Cloud Management Market - Key Industry Dynamics

6. US Multi-Cloud Management Market Overview

7. Multi-Cloud Management Market Analysis - By Component

8. Multi-Cloud Management Market Analysis - By Deployment

9. Multi-Cloud Management Market Analysis - By Application

10. Multi-Cloud Management Market Analysis - By Verticals

11. Impact of COVID-19 Pandemic on Multi-Cloud Management Market

12. Industry Landscape

13. Company Profiles

14. Appendix

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- BMC Software, Inc.

- Cisco Systems, Inc.

- Flexera

- International Business Machines Corporation

- Micro Focus International plc

- Zerto Ltd.

- VMware, Inc.

- Snow Software, Inc.

- UnityOneCloud

- Dynatrace, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 131 |

| Published | September 2022 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 2411.5 Million |

| Forecasted Market Value ( USD | $ 10741.1 Million |

| Compound Annual Growth Rate | 28.3% |

| Regions Covered | United States |